Our intraday outlook remains bearish, and our short-term outlook is neutral:

Intraday (next 24 hours) outlook: bearish

Short-term (next 1-2 weeks) outlook: neutral

Medium-term (next 1-3 months) outlook: neutral

Long-term outlook (next year): bullish

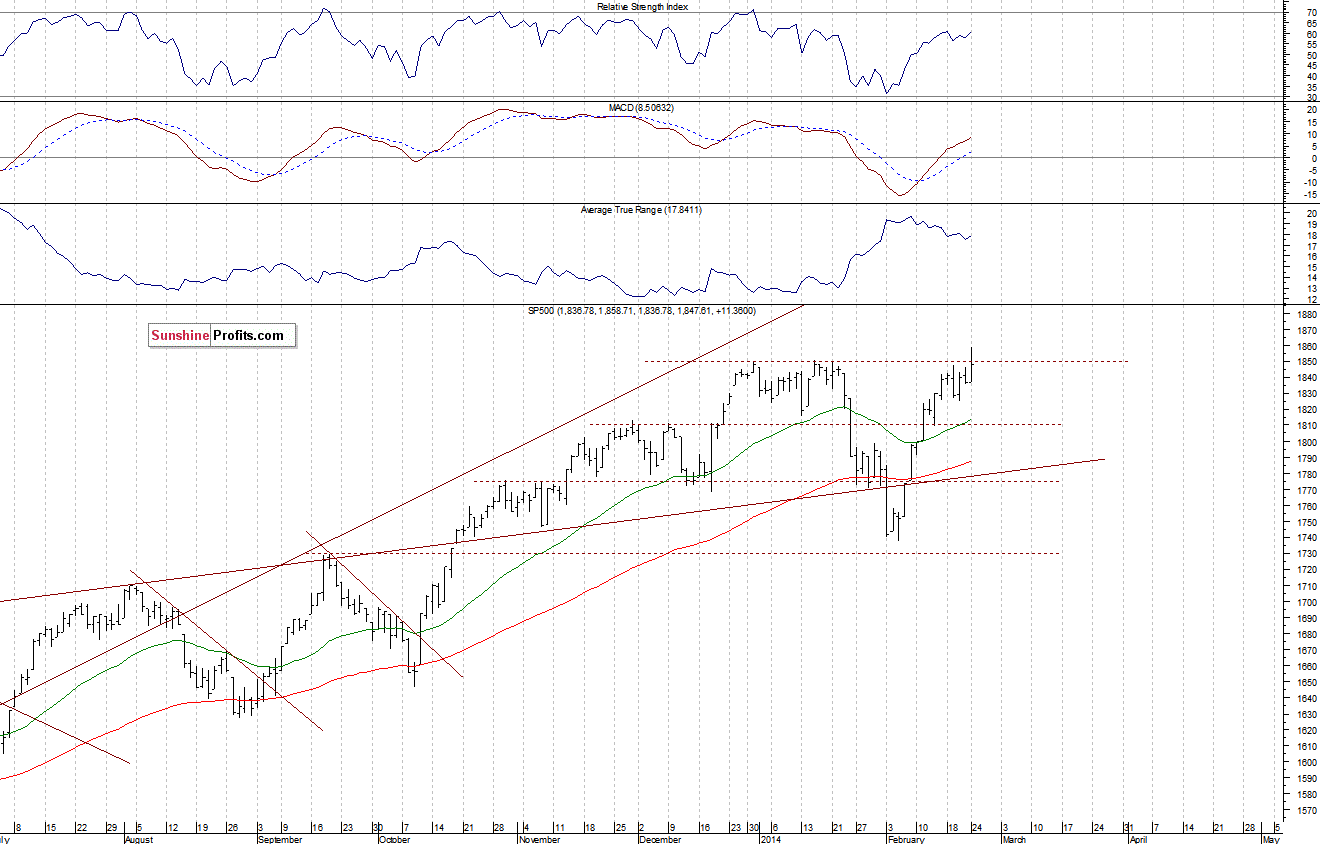

The main U.S. stock market indexes gained 0.6-0.7% yesterday, extending their long-term uptrend, as investors kept buying stocks, hoping for more gains. The S&P 500 index has reached a new all-time high of 1,858.71, however, it closing slightly below the level of 1,850. The resistance is at around 1,850-1,860. On the other hand, the support is at around 1,825, marked by the recent local low, and the next support remains at 1,800-1,810, as we can see on the daily chart:

Expectations before the opening of today’s session are slightly negative, with index futures currently down between 0.1% and 0.2%. The European stock market indexes have lost 0.4-0.7% so far. Investors will now wait for some economic data announcements: Case-Shiller 20-city Index and FHFA Housing Price Index at 9:00 a.m., Consumer Confidence number at 10:00 a.m. The S&P 500 futures contract (CFD) has retraced some of its recent advance, after breaking above the short-term consolidation. The resistance is at around 1,855, and the nearest support is at 1,830-1,840:

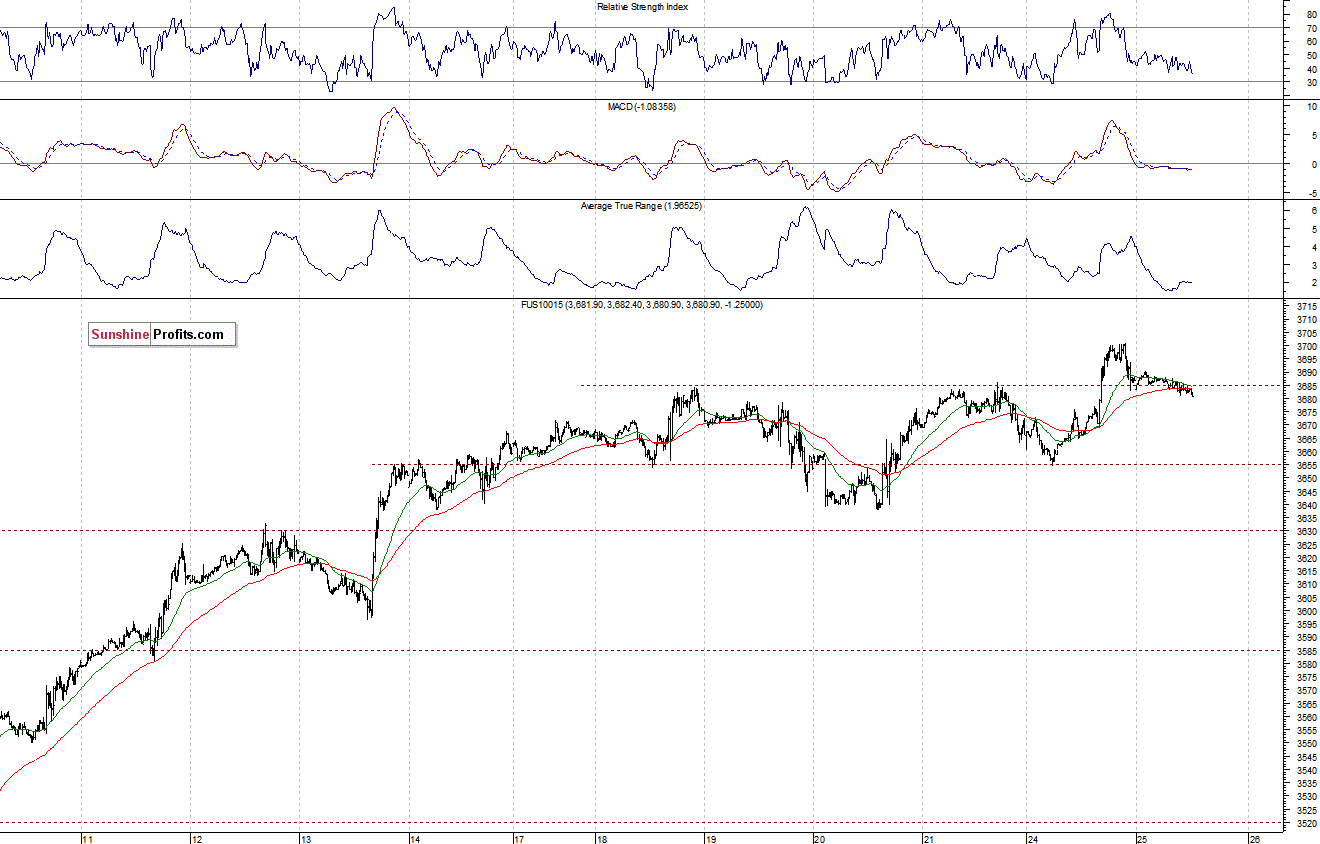

The technology Nasdaq 100 futures contract (CFD) bounced off the psychological resistance at 3,700. The support is at 3,655, among others. For now, it looks like another downward correction within an uptrend, as the 15-minute chart shows:

Thank you.

Paul Rejczak

Stock Trading Strategist

Stock Trading Alerts