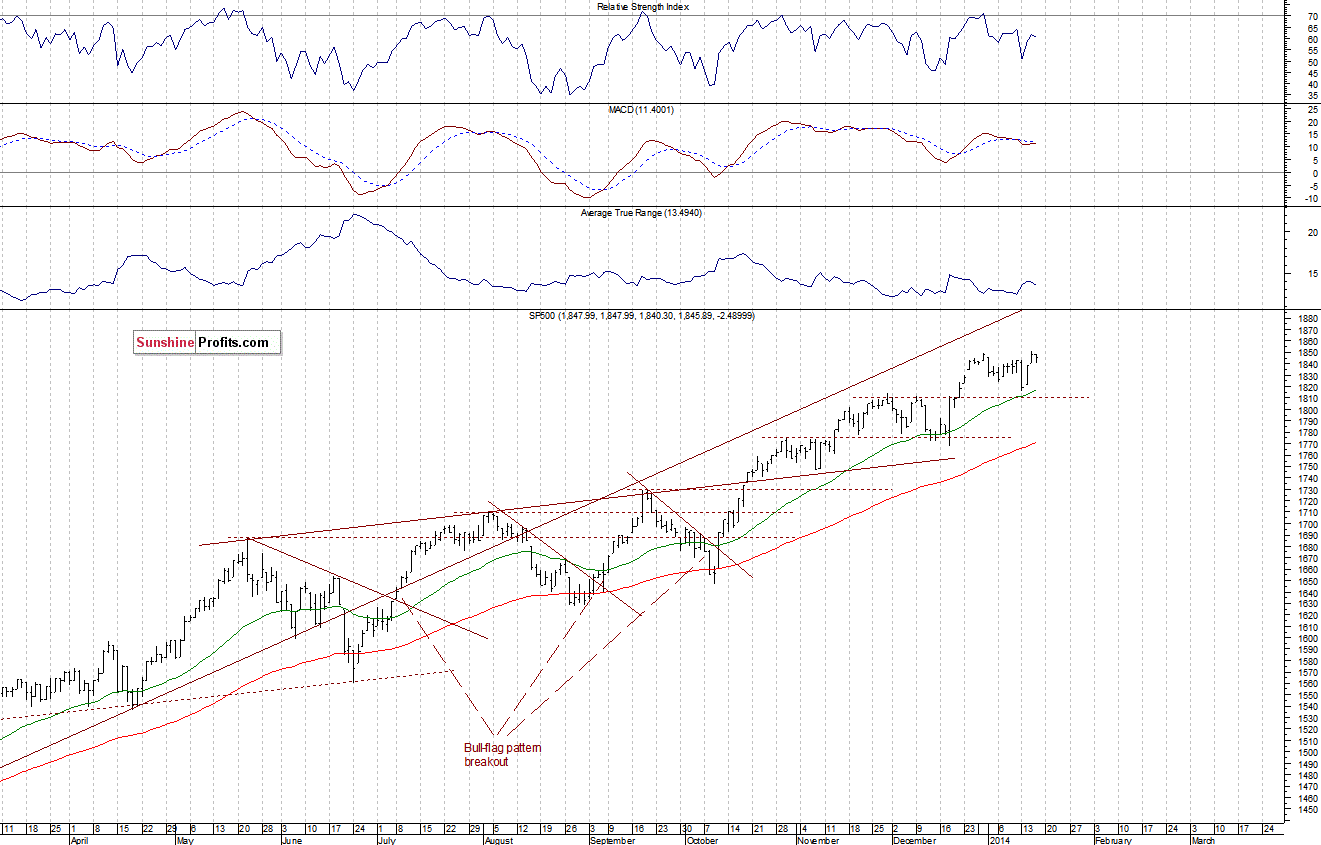

The main U.S. stock market indexes were mixed between -0.4% and 0.0% yesterday, as investors hesitated following recent advance. The S&P 500 index remained near its new intraday all-time high of 1,850.84. The nearest important support is at around 1,840, marked by Wednesday’s daily gap up of 1,839.17-1,840.52. On the other hand, the support remains at 1,850.For now, it looks like a short-term correction within an uptrend, however, a double top pattern cannot be excluded here, as we can see on the daily chart:

Expectations before the opening of today’s session are positive, with index futures currently up 0.3%. The European stock market indexes have gained 0.2-0.5% so far. Investors will now wait for some economic data announcements: Housing Stars and Building Permits at 8:30 a.m., Industrial Production and Capacity Utilization at 9:15 a.m., Michigan Sentiment report at 9:55 a.m., and finally, JOLTS – Job Openings number at 10:00 a.m. Investors will also wait for some further quarterly corporate earnings releases today, including one from GE. The S&P 500 futures contract (CFD) trades close to its long-term high, extending short-term consolidation. The nearest resistance is at around 1,840-1,845. On the other hand, the support remains at around 1,825-1,830, as the 15-minute chart shows:

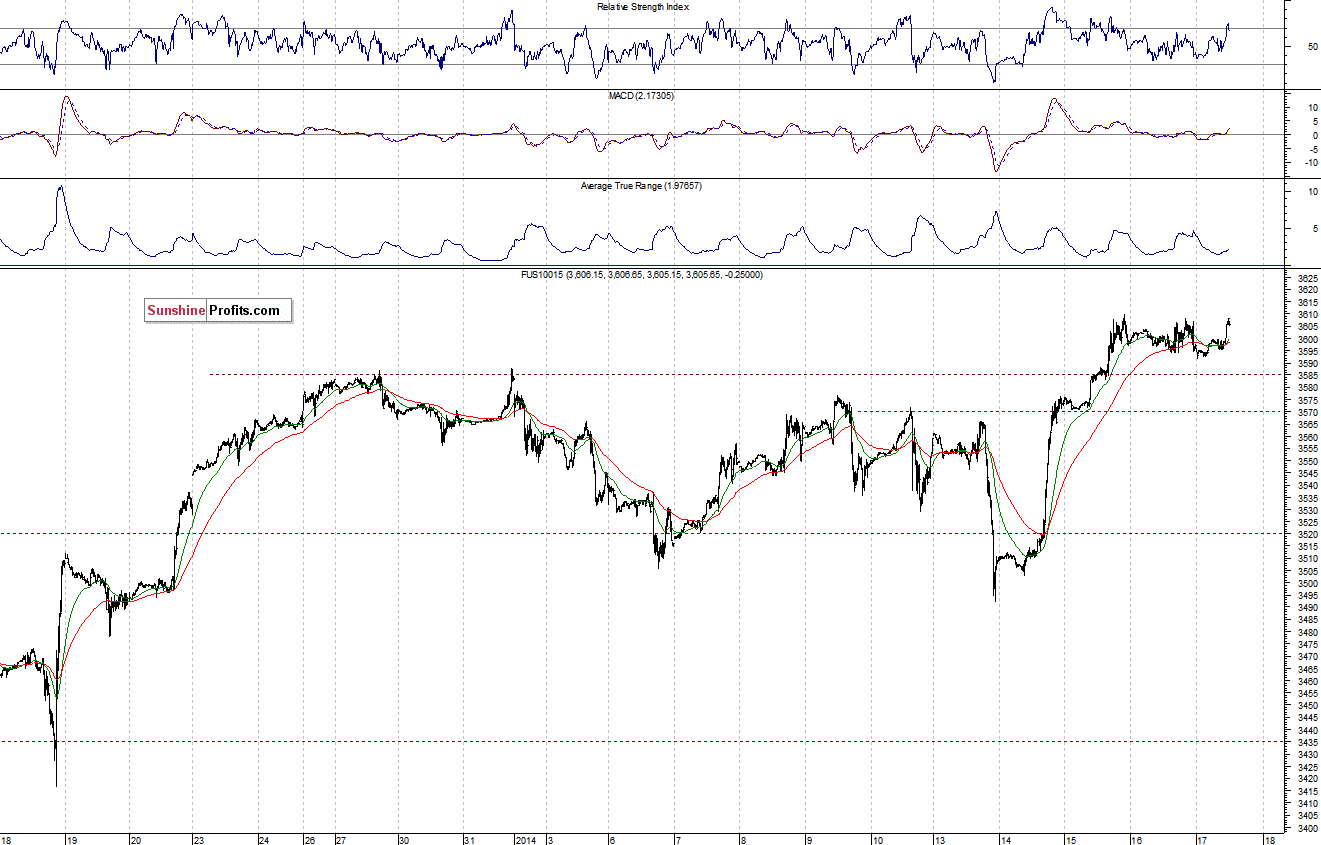

Analogously, the Nasdaq 100 futures contract (CFD) extends its short-term fluctuations following recent advance. It looks like a flat correction within an uptrend. The nearest important support is at around 3,585, marked by the late December consolidation:

Our intraday outlook is neutral, and our short-term outlook is neutral:

Intraday (next 24 hours) outlook: neutral

Short-term (next 1-2 weeks) outlook: neutral

Medium-term (next 1-3 months) outlook: neutral

Long-term outlook (next year): bullish

Thank you,

Paul Rejczak