Let’s start today’s Stock Trading Alert with an important administrative announcement.

As you may know, we have recently launched a survey (thank you for participating) in which we asked about the amount of trading alerts per day that you require. The answer that (decisively) won, was 1 alert per day + extra alerts whenever the situation changes and an additional alert is necessary. Additional alerts didn't seem to change much from your point of view.

Consequently, starting next week, we will change the way we provide you with our Stock Trading Alerts. Instead of 3 smaller trading alerts (1 posted before the market open and 2 posted during the session), we will be posting 1 slightly bigger trading alert (before the opening bell) along with a promise to keep you updated via another trading alert, should anything change in our outlook.

In this way, you will be better prepared before the markets open, and at the same time you will remain up-to-date virtually at all times.

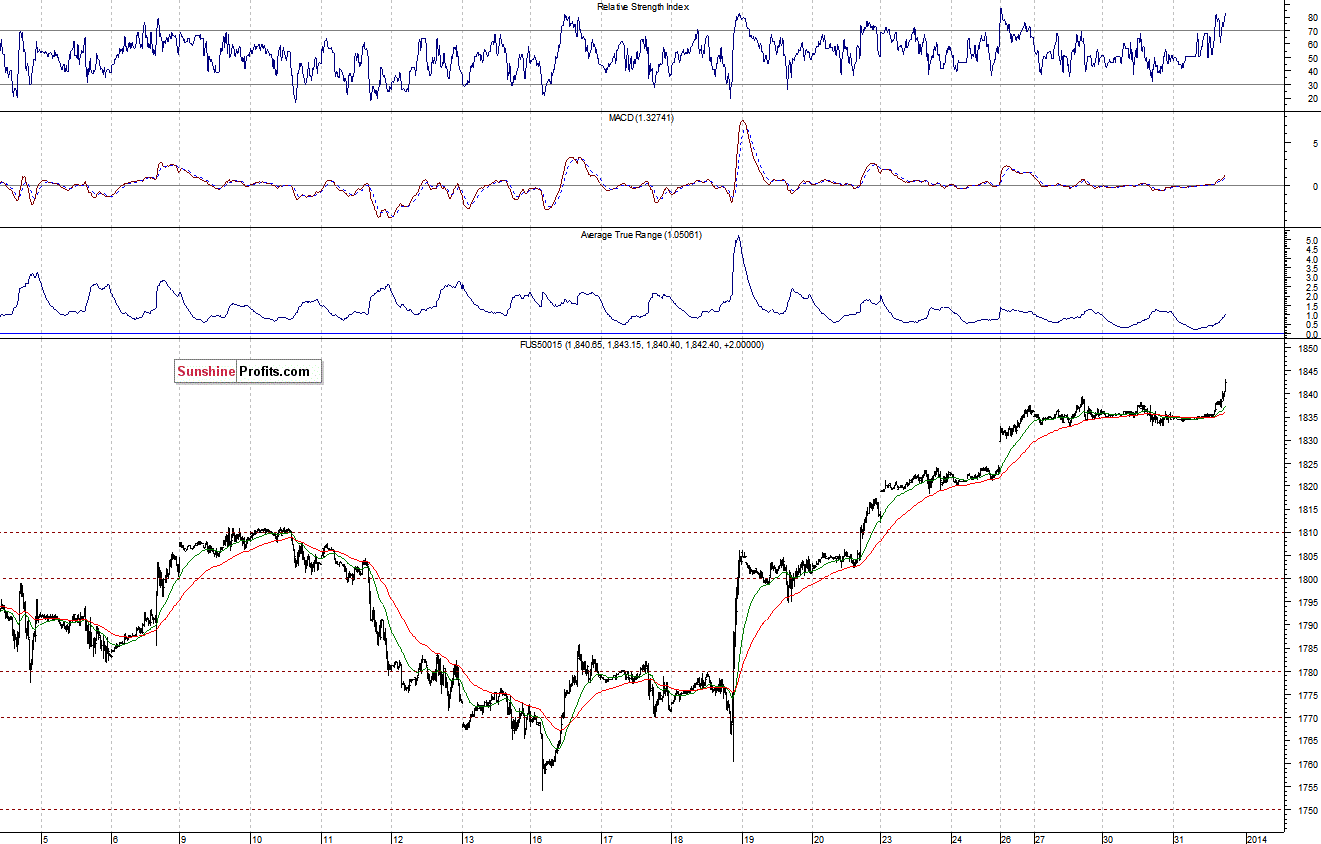

The U.S. stock market indexes are currently up between +0.3% and +0.6%, as investors keep buying stocks in year’s final trading session. The S&P 500 index managed to reach a new intraday all-time high at 1,848.64. The support remains at 1,829.75-1,834.96, marked by Thursday’s daily gap up. The S&P 500 futures contract (CFD) trades slightly higher, as the support remains at around 1,830:

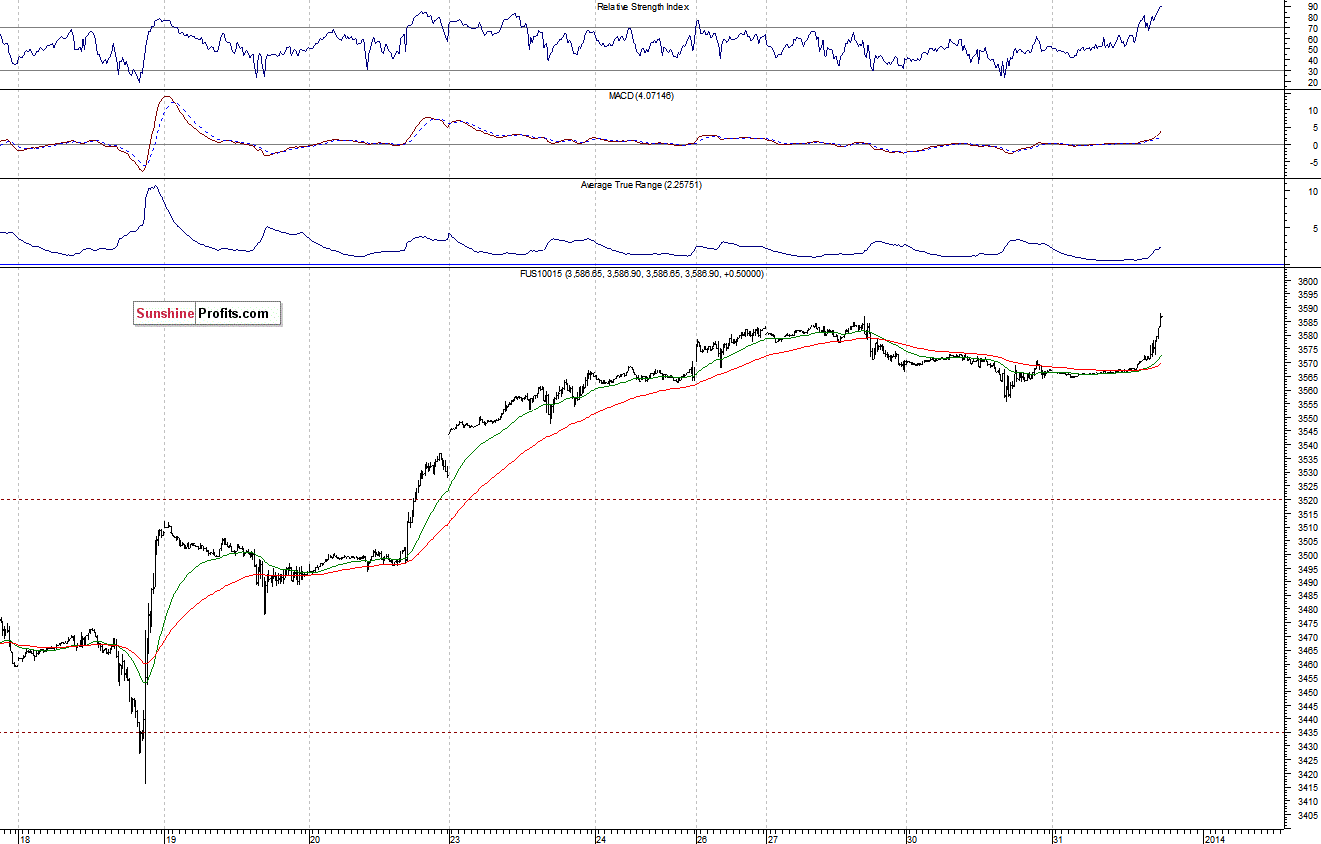

The technology sector Nasdaq 100 futures contract (CFD) trades slightly below the level of a potential resistance at around 3,600. However, it still looks like a flat correction within the recent advance, as we can see on the 15-minute chart:

Our intraday outlook is neutral, and our short-term outlook is bullish:

Intraday (next 24 hours) outlook: neutral

Short-term (next 1-2 weeks) outlook: bullish

Medium-term (next 1-3 months) outlook: neutral

Long-term outlook (next year): bullish

Thank you,

Paul Rejczak