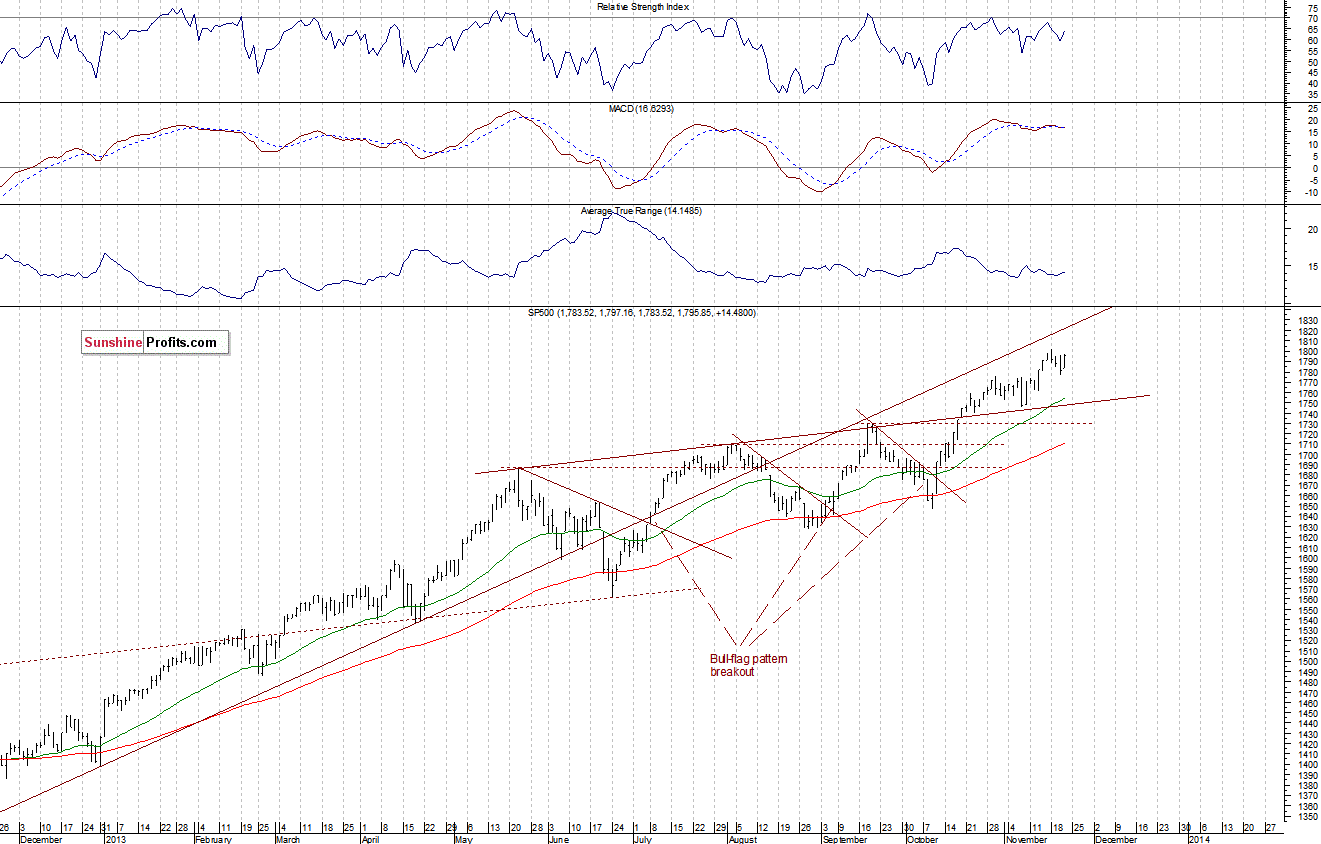

The main U.S. stock market indexes gained between 0.7% and 1.1% yesterday, as investors bet on continuation of the long-term uptrend. The S&P 500 index approached the level of 1,800 once again. It is the nearest important resistance, marked by Monday’s all-time high of 1,802.33. On the other hand, the support remains at around 1,770-1,775. For now, there are no confirmed uptrend reversal signals, as we can see on the daily chart:

Expectations before the opening of today’s session are virtually flat, with index futures currently between 0.0% and +0.1%. The European stock market indexes have been mixed so far. Investors will now wait for the JOLTS – Job Openings report announcement at 10:00 a.m. The S&P 500 futures contract (CFD) trades near Monday’s high, slightly below the level of 1,800. The support remains at around 1,775-1,780, as the 15-minute chart shows:

Our intraday outlook remains bearish, and our short-term outlook is bearish:

Intraday (next 24 hours) outlook: bearish

Short-term (next 1-2 weeks) outlook: bearish

Medium-term (next 1-3 months) outlook: neutral

Long-term outlook (next year): bullish

The above analysis is the first of today's 2+ Stock Trading Alerts. Stay as updated as possible on the current events and trends on the

stock market by choosing our Stock Trading Alert subscription service

Thank you,

Paul Rejczak