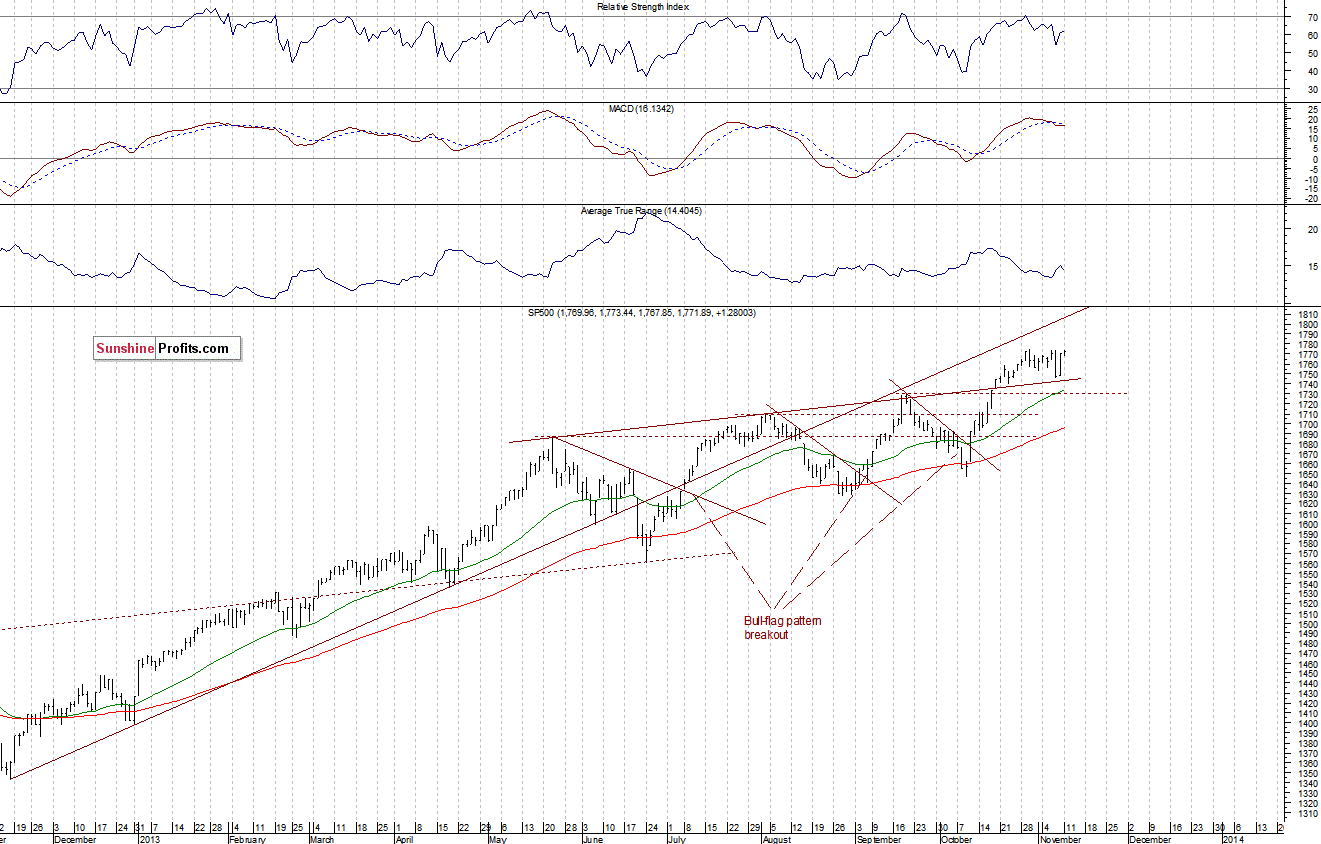

The major U.S. stock market indexes were mixed yesterday, as investors hesitated after the recent volatile trade. Overall, it was a quiet session, with the U.S. bond market closed for Veteran’s Day. The S&P 500 gained 0.1%, as it fluctuated near the resistance at around 1,770-1,775, marked by the October 30 all-time high of 1,775.22. Still with no clear short-term direction, however, close to long-term highs, as we can see on the daily chart:

Expectations before the opening of today’s session are slightly negative, with index futures currently down between 0.1% and 0.2%. The European stock market indexes have lost 0.2-0.3% so far. The S&P 500 futures contract (CFD) trades near the resistance of around 1,770, as market quickly retraced its recent decline. On the other hand, the support is at 1,750, marked by some of the recent lows, as the 15-minute chart shows:

Our intraday outlook remains bearish, and our short-term outlook is bearish:

Intraday outlook: bearish

Short-term outlook: bearish

Medium-term outlook: neutral

Long-term outlook: bullish

The above analysis is the first of today's 2+ Stock Trading Alerts. Stay as updated as possible on the current events and trends on the

stock market by choosing our Stock Trading Alert subscription service

Thank you,

Paul Rejczak