tools spotlight

-

Dollar Remains Strong and Rushes Further. Gold in Pain?

October 12, 2021, 9:26 AMThe old saying goes: in the case of gold and the dollar, the latter’s uprising is the former’s downsizing. Will we see this materializing once again?

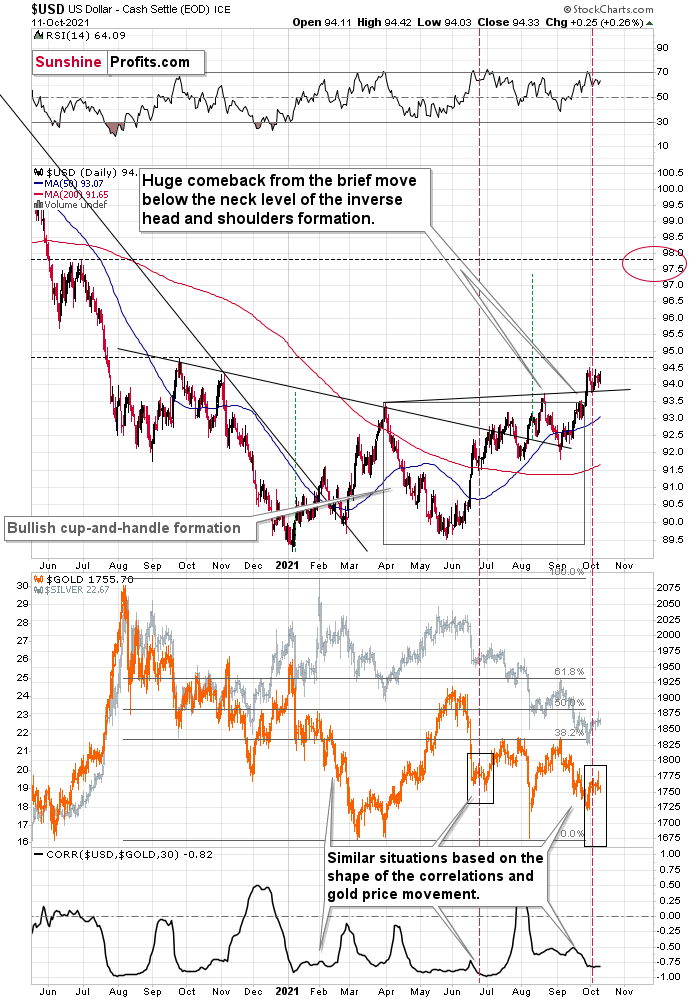

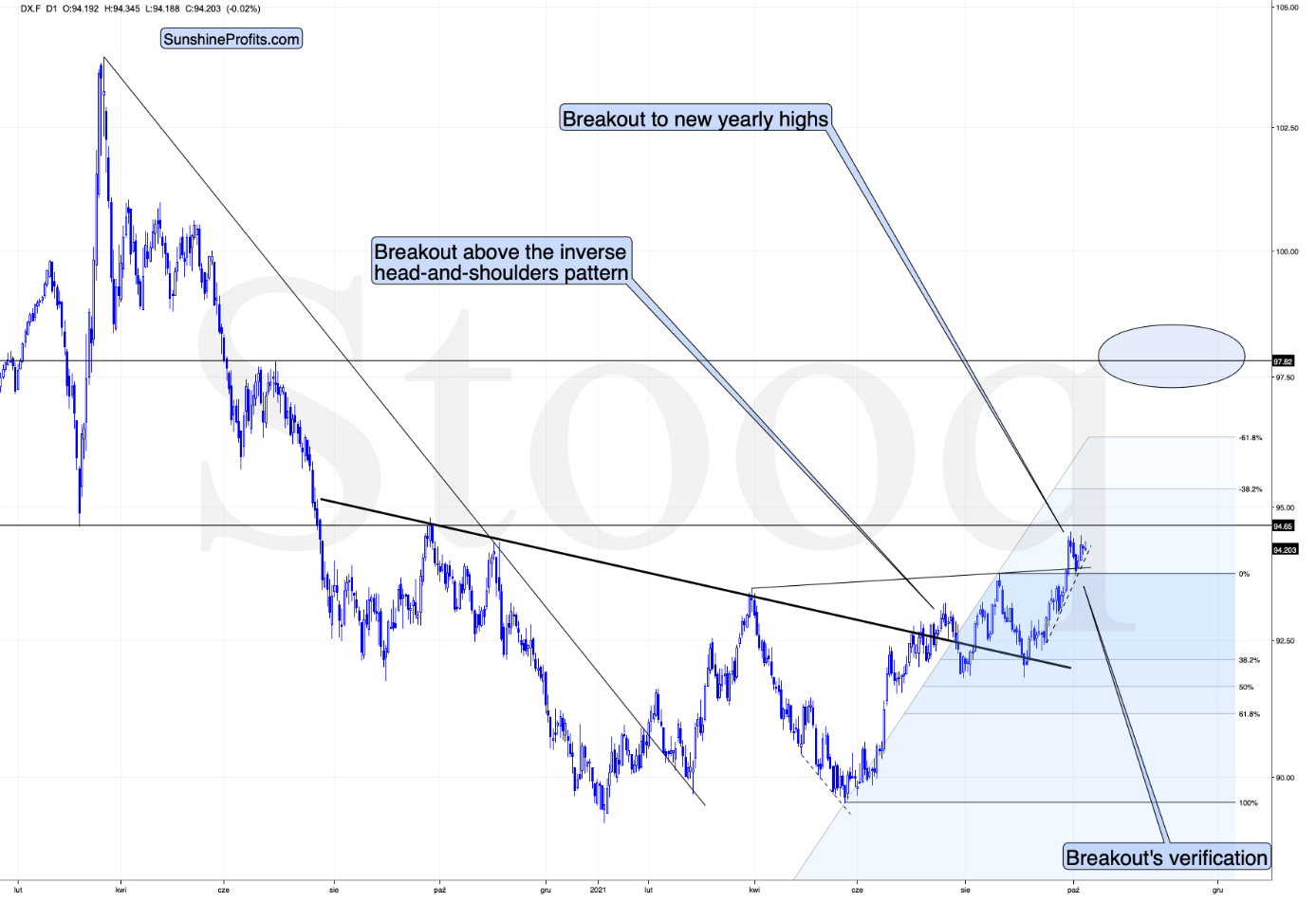

With the USD Index shrugging off the weak U.S. nonfarm payrolls print on Oct. 8 and demonstrating more and more resiliency as the months progress, the dollar basket has not only verified the breakout above the neckline of its inverse (bullish) head & shoulders pattern, but it’s also finding higher levels of support.

To explain, after bursting through its rising resistance line (which is now support), the recent consolidation is perfectly normal within a medium-term uptrend. Moreover, mirroring the behavior that we witnessed in June, the USD Index’s small correction after its RSI (Relative Strength Index) hit 70 was followed by another sharp move higher. As a result, the greenback’s technical foundation remains robust.

For context, I wrote on Oct. 4:

While a short-term consolidation could ensue following the USD Index’s ferocious rally, a similar development occurred in late June. After a short-term corrective downswing proceeded the USD Index’s sharp rally, the USD Index continued its medium-term ascent soon after. And while gold demonstrated the opposite price action in late June – recording a short-term rally and following that up with a medium-term drop to lower lows – the 2021 theme of ‘USD Index up, PMs down’ should continue to play out over the next few months.

To that point, with gold, silver and mining stocks often moving inversely to the U.S. dollar, the greenback’s likely uprising could sink the precious metals over the medium term.

Please see below:

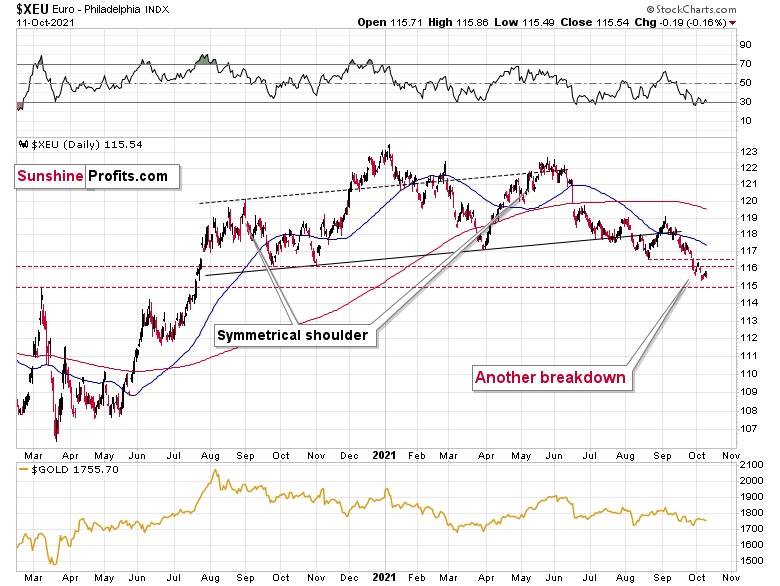

Equally bullish for the greenback, with the USD Index’s technical strength signaling an ominous ending for the Euro Index, the latter has struggled immensely in recent weeks.

And while the Euro Index bounced on Oct. 8 following the weak U.S. nonfarm payrolls print, the European currency closed at another 2021 low on Oct. 7 and has continued its freefall below the neckline of its bearish head & shoulders pattern. As a result, the next stop could be ~1.1500 (the March 2020 highs, then likely lower). For context, the EUR/USD accounts for nearly 58% of the movement of the USD Index, and that’s why the euro’s behavior is so important.

Please see below:

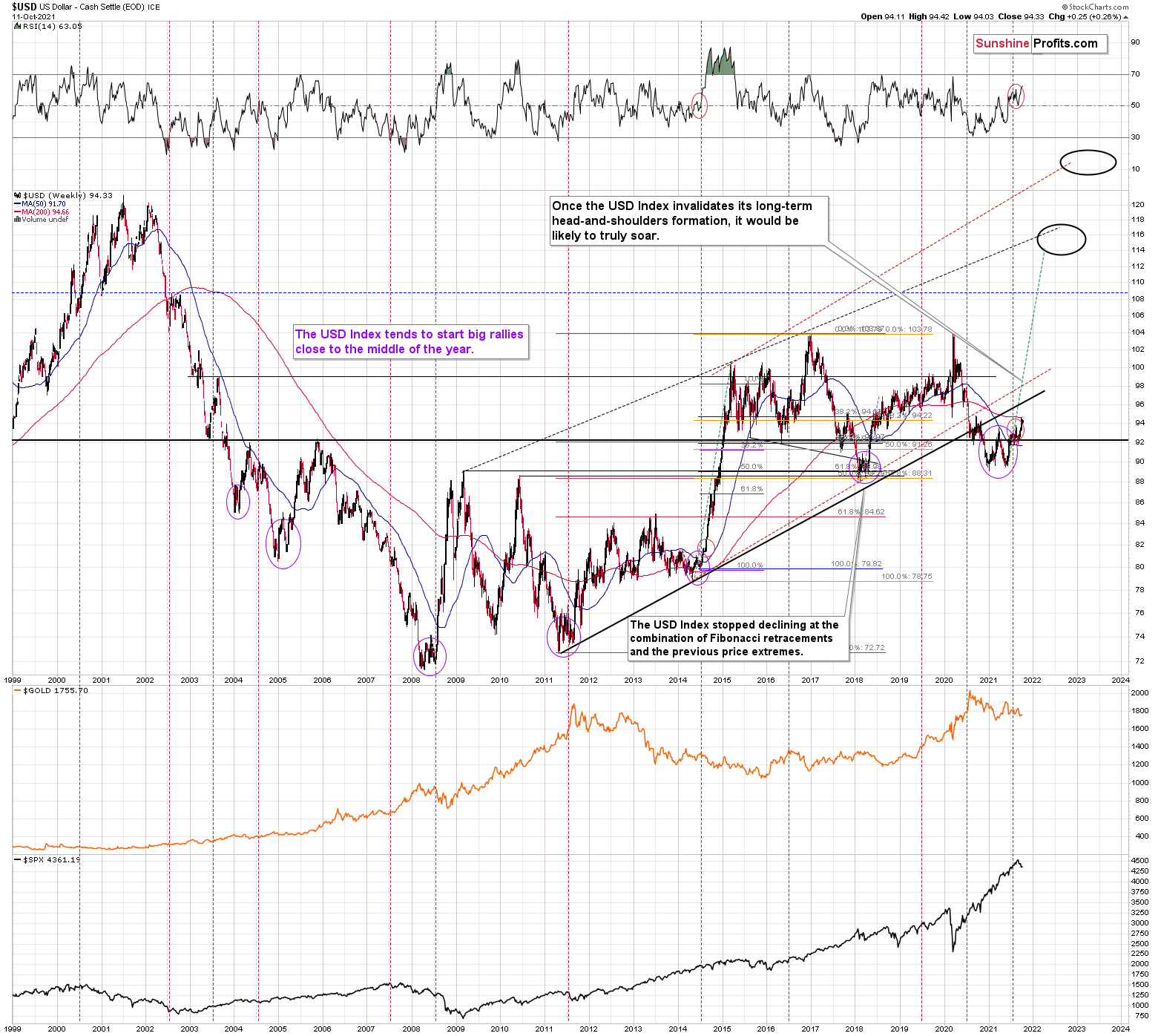

Adding to our confidence (don’t get me wrong, there are no certainties in any market; it’s just that the bullish narrative for the USDX is even more bullish in my view), the USD Index often sizzles in the summer sun and major USDX rallies often start during the middle of the year. Summertime spikes have been mainstays on the USD Index’s historical record and in 2004, 2005, 2008, 2011, 2014 and 2018 a retest of the lows (or close to them) occurred before the USD Index began its upward flights (which is exactly what’s happened this time around).

Furthermore, profound rallies (marked by the red vertical dashed lines below) followed in 2008, 2011 and 2014. With the current situation mirroring the latter, a small consolidation on the long-term chart is exactly what occurred before the USD Index surged in 2014. Likewise, the USD Index recently bottomed near its 50-week moving average; an identical development occurred in 2014. More importantly, though, with bottoms in the precious metals market often occurring when gold trades in unison with the USD Index (after ceasing to respond to the USD’s rallies with declines), we’re still far away from that milestone in terms of both price and duration.

Moreover, as the journey unfolds, the bullish signals from 2014 have resurfaced once again. For example, the USD Index’s RSI is hovering near a similar level (marked with red ellipses), and back then, a corrective downswing also occurred at the previous highs. More importantly, though, the short-term weakness was followed by a profound rally in 2014, and many technical and fundamental indicators signal that another reenactment could be forthcoming.

Please see below:

Just as the USD Index took a breather before its massive rally in 2014, it seems that we saw the same recently. This means that predicting higher gold prices (or the ones of silver) here is likely not a good idea.

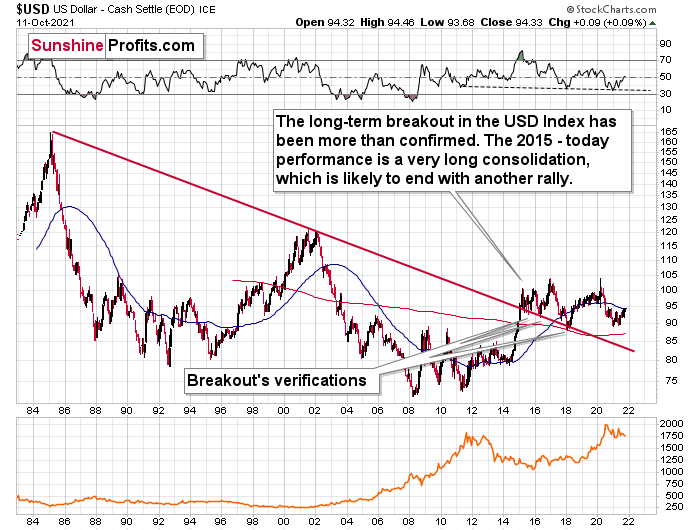

Continuing the theme, the eye in the sky doesn’t lie. And with the USDX’s long-term breakout clearly visible, the wind still remains at the dollar’s back.

Please see below:

The bottom line?

As the drama unfolds, the ~98 target is likely to be reached over the medium term, and the USDX will likely exceed 100 at some point over the medium or long term. Keep in mind though: we’re not bullish on the greenback because of the U.S.’ absolute outperformance. It’s because the region is fundamentally outperforming the Eurozone, the EUR/USD accounts for nearly 58% of the movement of the USD Index, and the relative performance is what really matters.

In conclusion, the USD Index remains ripe for an upward re-rating and the greenback’s ability to shrug off bad fundamental news has cemented its bullish foundation. Moreover, with the EUR/USD holding on by a thread, the currency pair’s pain is the USD Index’s gain. In addition, with the U.S. 10-Year Treasury yield closing the Oct. 8 session at its highest level since Jun. 3 and the Fed poised to announce its taper timeline in the coming months, plenty of reinforcements support a stronger U.S. dollar over the medium term. And since gold, silver and mining stocks have strong negative correlations with the U.S. dollar, the latter’s uprising could lead to the former’s downsizing.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

Early (Video) Heads-up before the Next Week

October 9, 2021, 10:54 AMBased on last week’s events, I recorded two videos:

- Publicly available video featuring signals from the SLV to GLD ratio and from the HUI (gold stocks) to XOI (oil stocks) ratio.

- Premium video available to subscribers to my Gold & Silver Trading Alerts - it includes details regarding changes in our trading positions (and comments on the useful change that we made recently).

You will find the first video over here:

-

Intraday Video Alert

October 8, 2021, 1:08 PMI just recorded a video about today’s moves in the precious metals sector and you can access it below:

.Bullion Bears Are Not Going Anywhere

October 8, 2021, 9:17 AMNot to beat around the bush: everything remains bearish. However, let’s take a look at what happened yesterday in the precious metals sector.

The most notable – and interesting – action took place in the mining stocks.

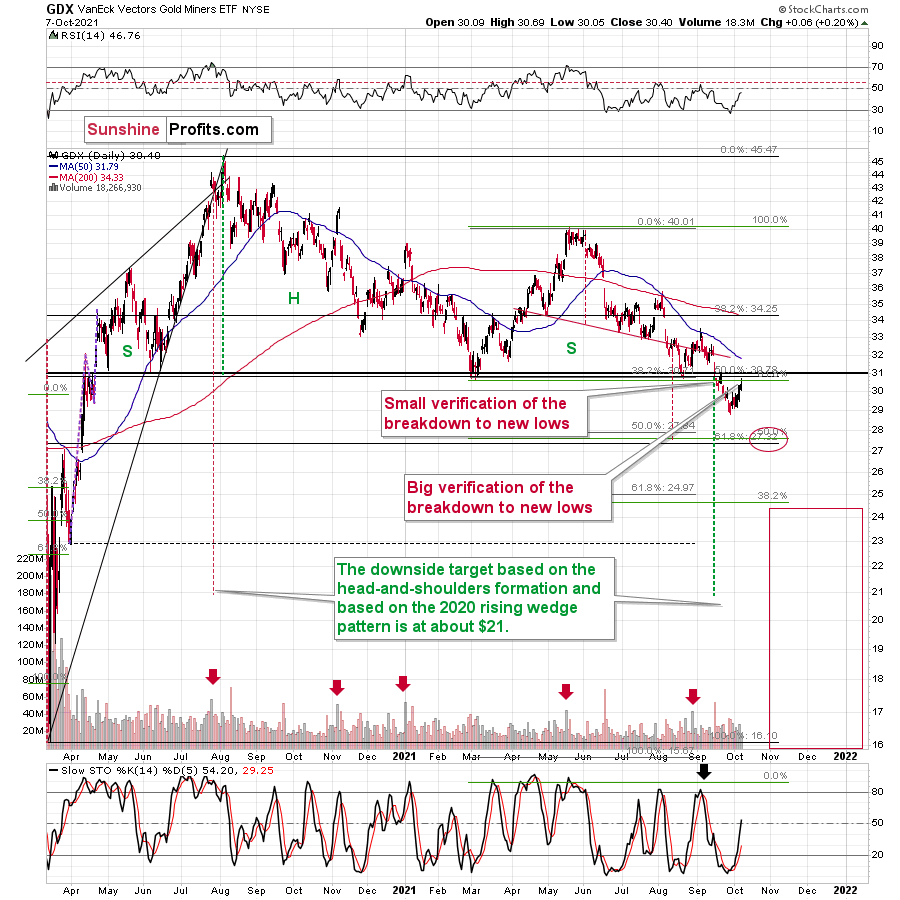

The GDX ETF rallied on an intraday basis, but erased almost all of its previous gains before the end of the session, closing only 6 cents higher. This tells us two things:

- That was an intraday reversal (it was not accompanied by huge volume, but still)

- Gold miners failed to rally back above their previous lows – they just touched the previous support and verified it as resistance.

Consequently, yesterday’s price action was nothing bullish – it was probably the final part of a corrective upswing.

In mid-September, we saw a tiny verification of the breakdown, and this time, the verification took a form that’s clearly visible even from the medium-term point of view. Does it change anything? Actually, yes, it does. Breakdown’s verification tells us that miners are even more ready to decline to new lows in a powerful manner.

The GDX ETF ended the day above the $30 level, but this level is not the key support / resistance level – the previous lows are. If the $30 level was critical, previous bottoms would have formed at it, and they didn’t.

But miners outperformed gold! Isn’t that a bullish sign?

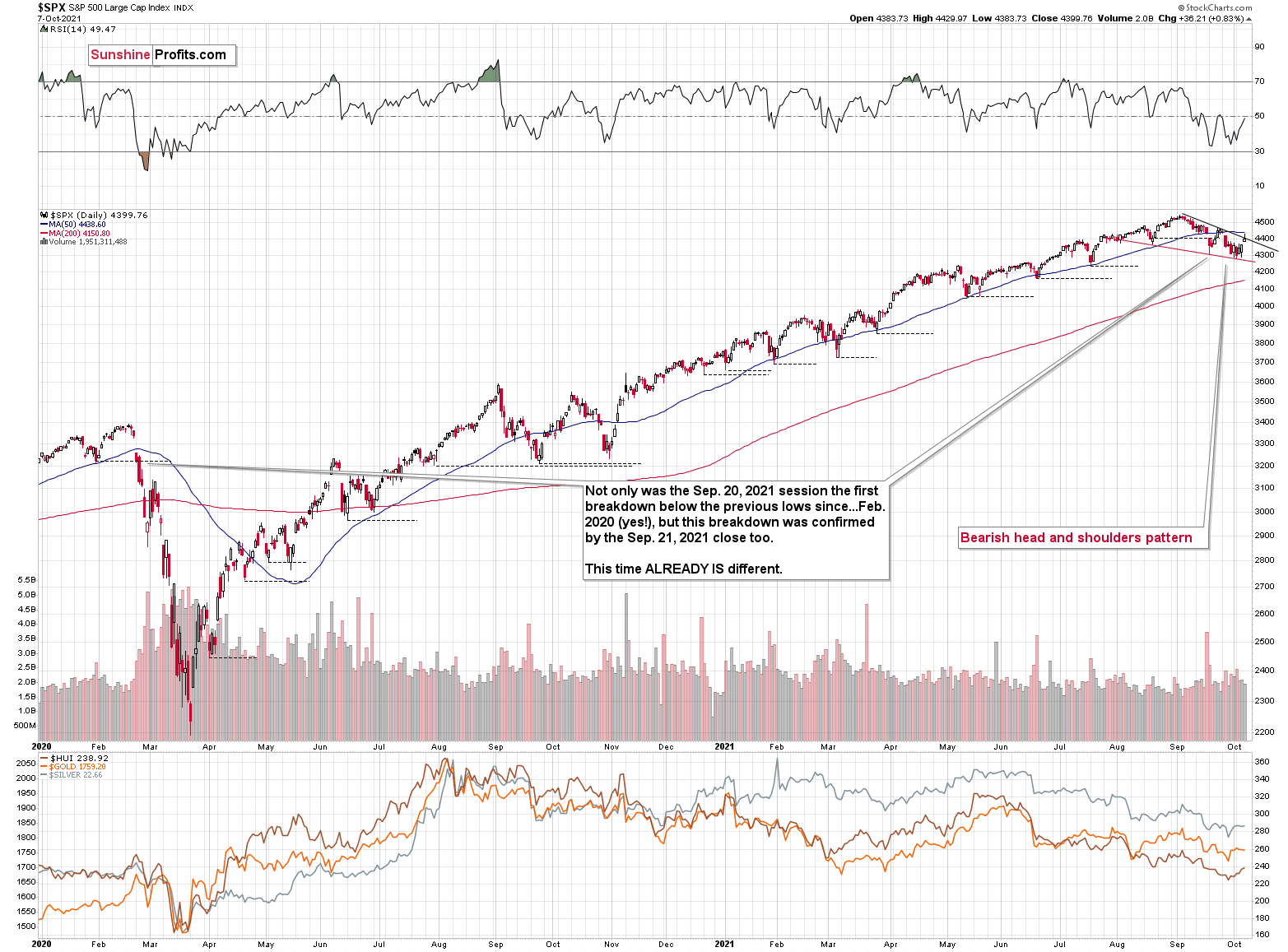

If this persists, it might indeed become a bullish sign, but for now, it seems to have just been a necessary technical development (verification of the breakdown) that was likely influenced by what’s happening in the general stock market.

Every now and then miners follow stocks closely, but this link is usually short-lived. And so, as the general stock market rallied (and reversed), so did miners. I don’t think that stocks would be able to trigger a bigger rally in the miners, even if they rallied significantly from here.

And based on stocks’ yesterday’s inability to rally above their declining black resistance line based on previous lows, it seems that they are ready to head south any day or hour now.

Gold and the USDX

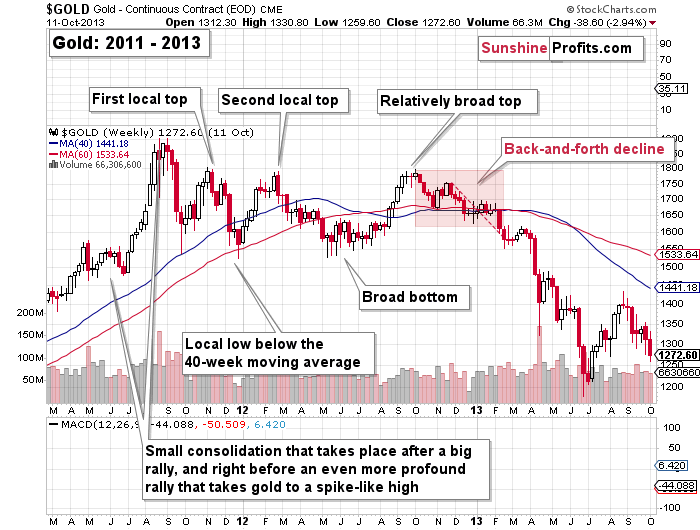

Gold is moving back and forth, and it’s doing so in tune with what happened in early 2013.

The implications of this analogy remain bearish.

Gold moved higher along with the USD Index recently, but that’s likely just a temporary effect of the debt-ceiling discussion, nothing more. Besides, the size of gold’s “strength” is not significant. So, all in all, I don’t view it as a true bullish sign.

And speaking of the USD Index, please note how well it managed to verify the breakout to new highs and above the rising support/resistance line. It’s also above the rising dashed support line, so even the very short-term trend remains up.

Once the USD Index soars once again, PMs are likely to respond with much lower prices, and it seems that we won’t have to wait too long for it.

On a final note, before we move to more fundamental discussions, please note that the politicians might provide some more smoke and mirrors about the debt ceiling so that it looks like they hadn’t decided to keep raising it a long time ago. That’s just pretending to really care about fiscal responsibility and not about the S&P’s returns and votes. It might look like a “real, fierce fight” after which the politicians will be “forced” to raise the debt ceiling for “the good of the people”. The real reason will likely be that nobody wants to be directly responsible for the short-term economic turmoil that would follow otherwise. I don’t mean to be cynical here, and I’m not saying that all politicians are like that, but assuming that politicians and semi-politicians (monetary authorities, etc.) want votes and S&P returns while avoiding the personal blame usually allowed me to make quite accurate forecasts…

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and silver that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold Investment News

Delivered To Your Inbox

Free Of Charge

Bonus: A week of free access to Gold & Silver StockPickers.

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM