tools spotlight

-

Countdown Started - the Golden Clock is Ticking

November 12, 2021, 5:41 AMAvailable to premium subscribers only.

-

Gold and the USD Index Both Break Out. Who’s Lying?

November 11, 2021, 4:52 AMAvailable to premium subscribers only.

-

Gold: Don’t Fret the Small Stuff

November 10, 2021, 8:06 AMDo small upswings really matter if one has medium-term goals in mind? A slight increase in price doesn’t mean the bulls are coming home.

The medium-term back and forth movement in gold continues. If I could make the markets move in a certain direction sooner, and end the prolonged consolidation, I would. However, I can’t, and the only thing that I can do is to report to you what I see on the markets and describe what my course of action will be.

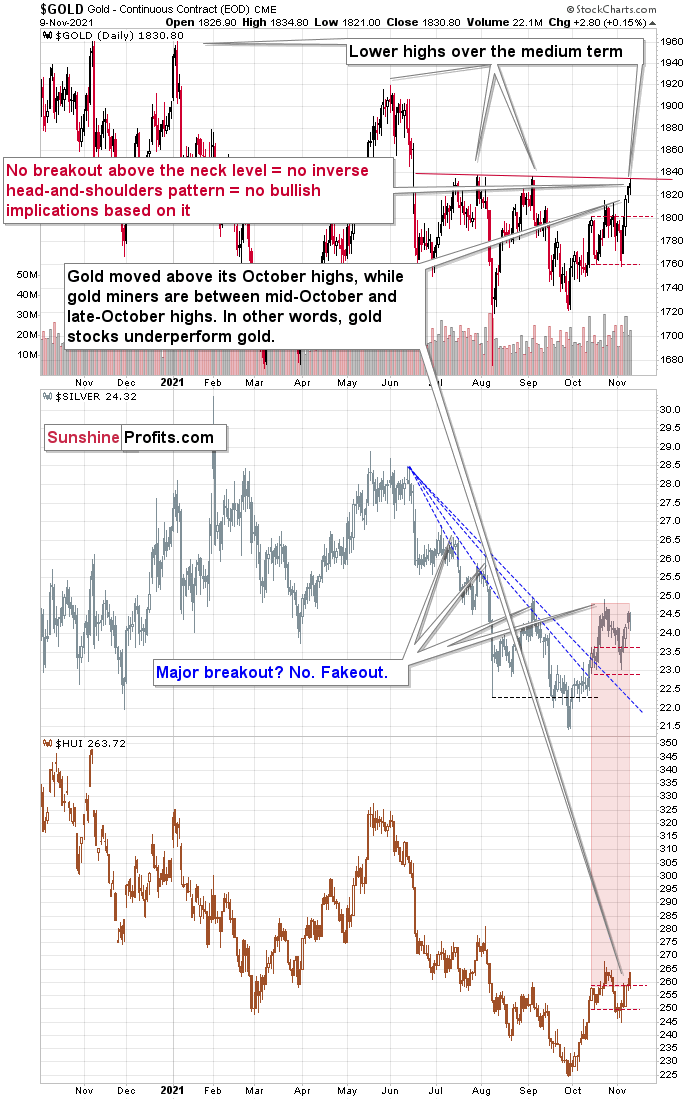

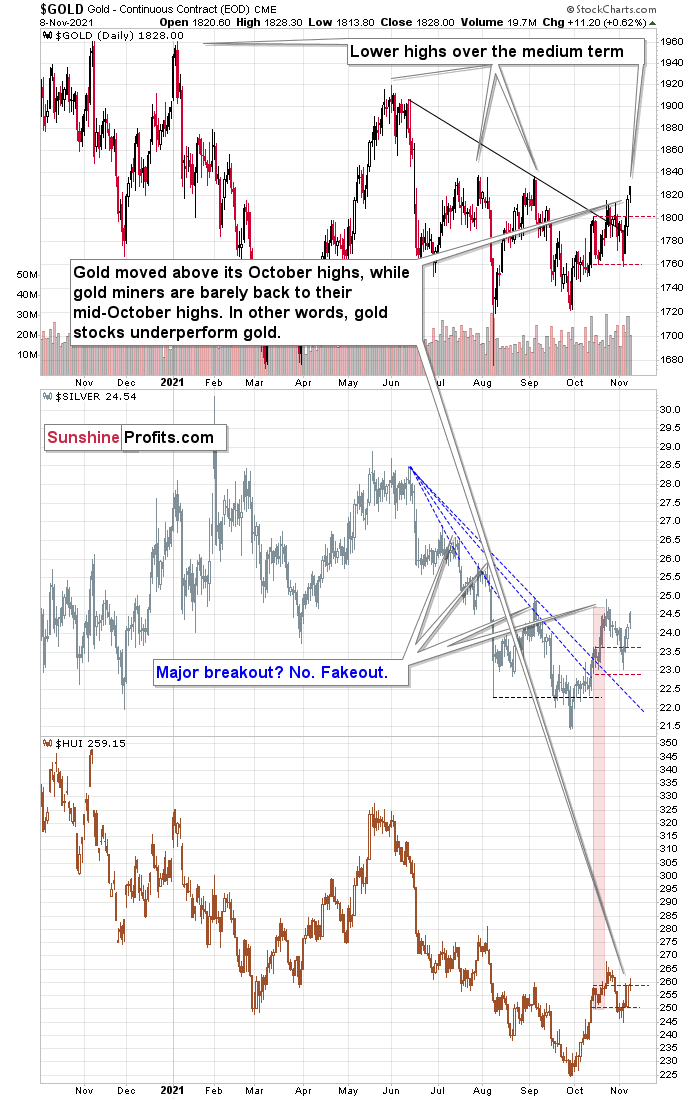

During yesterday’s session we saw more of what we’ve been seeing in the previous days. Gold moved higher, and gold stocks moved higher (but in a weak manner), and even though gold moved to new monthly highs, the HUI Index is not even back to its late-October highs. It’s boring, discouraging, and demotivating. But the only thing that we can do is to react to what the market is willing to provide us with. What do yesterday’s and today’s pre-market price moves tell us?

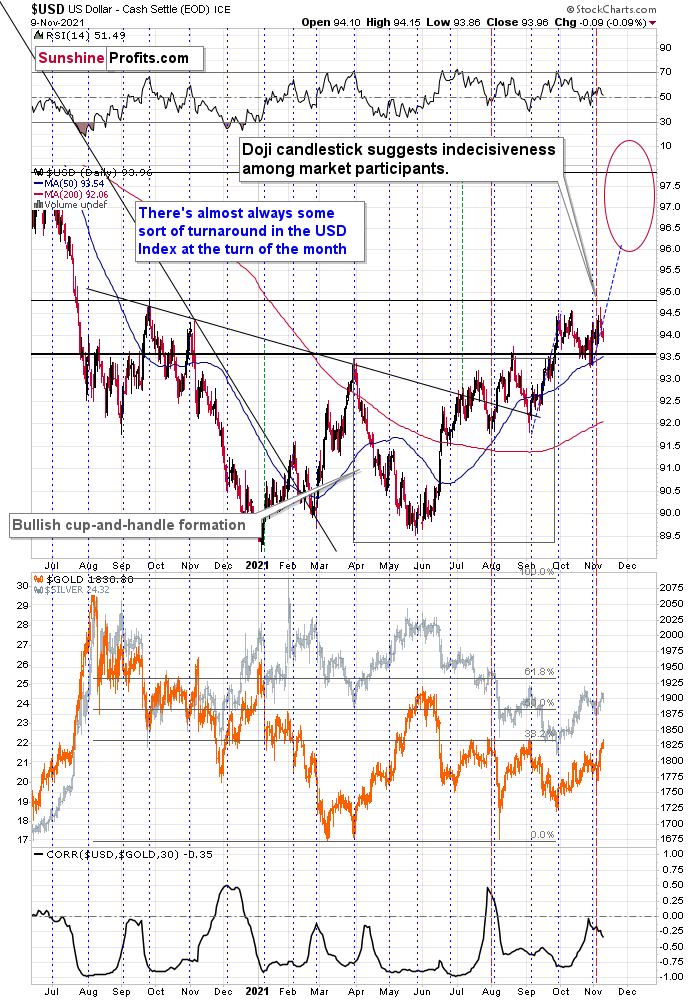

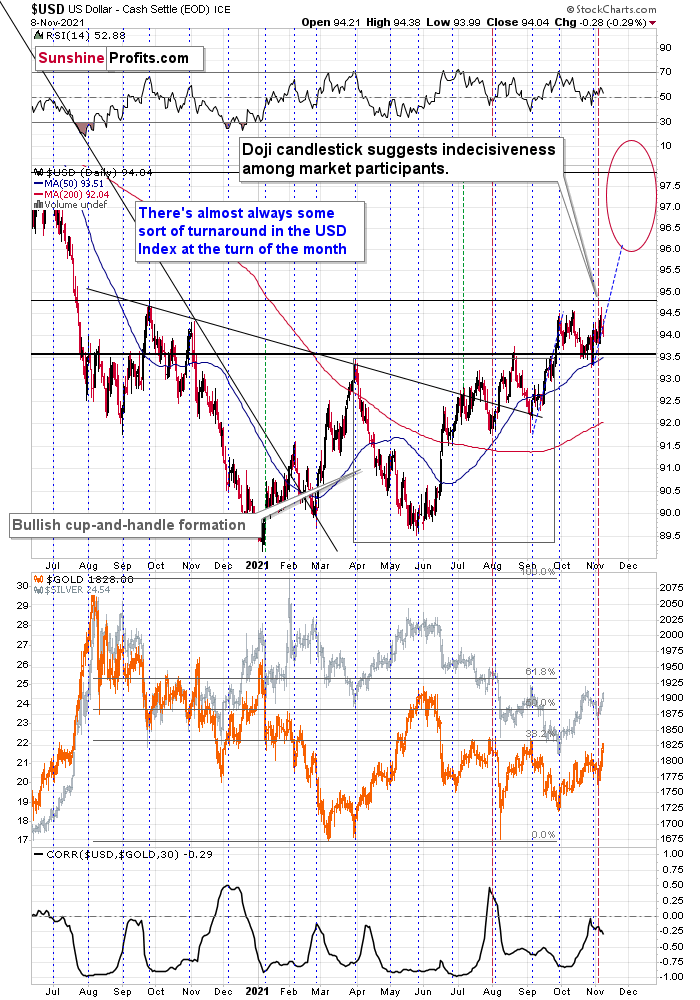

First of all, the market tells us that the breakout to new highs in the USD Index is not being invalidated. I know that I’ve written this tens of times, but this factor remains intact and it continues to have very important implications going forward. These are bullish for the USD Index and bearish for the precious metals sector.

Second, as I had already written earlier today, gold stocks are not showing strength relative to gold.

The gold price just made new monthly highs and is now visibly above its October highs, but the silver price and – most importantly - gold stocks are not. In fact, they are just a little above their mid-October highs.

Consequently, the thing that one tends to see in the final parts of a short-term rally remains in place.

So, when will the decline in PMs finally continue? Based on what I wrote on Monday – in particular about gold’s reversal points, it’s likely to start soon – perhaps as early as this week.

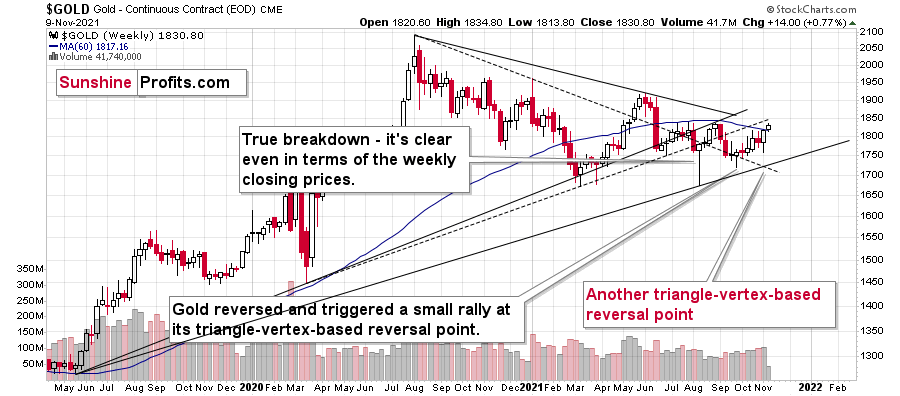

As a quick reminder, you can see gold’s triangle-vertex-based reversal on the chart below:

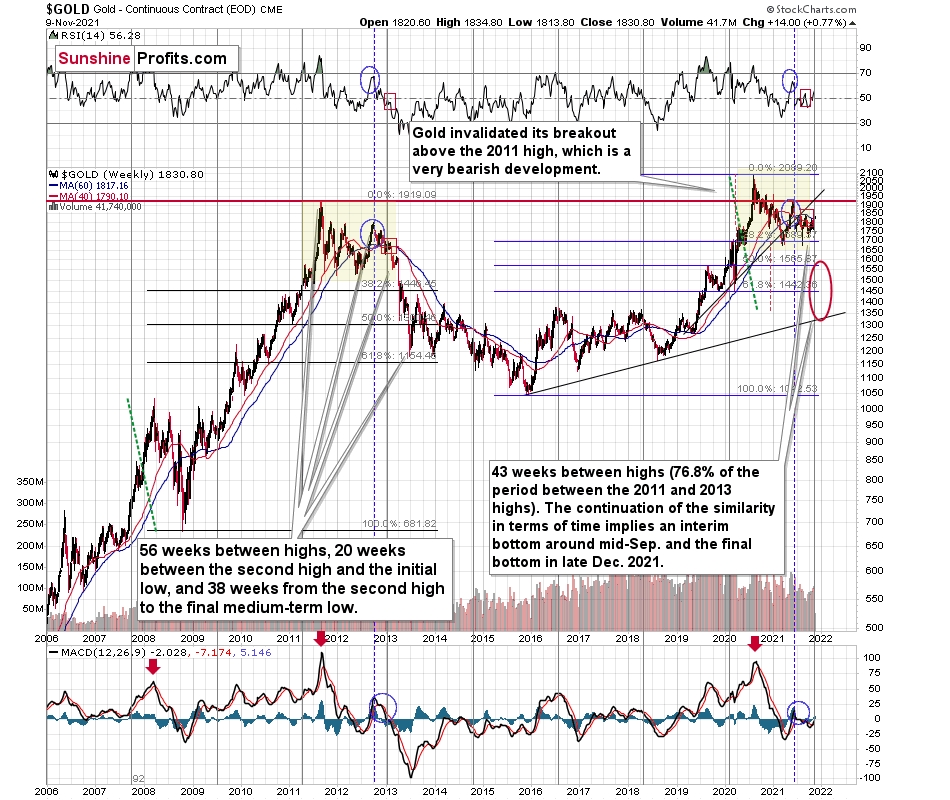

And you can see gold’s long-term cyclical turning point on the chart below:

The fact that gold moved to its recent medium-term highs is also a factor here. Resistance provided by those highs is quite likely to trigger a reversal in gold, and based on today’s pre-market action, it’s what we might already be seeing right now.

The move lower is small so far, but all bigger moves have small beginnings, and given the reversal points and the resistance that gold just encountered, this could be “it”.

Also, speaking of resistance levels, on today’s second chart I placed a red resistance line based on the previous highs. It might be tempting to view the price action below it as an inverse head and shoulders pattern, which could have bullish implications. However, let’s keep in mind that without a breakout above the neck level (approximately the previous highs), the formation is not yet complete, and as such it has NO bullish implications whatsoever, as it simply doesn’t exist yet.

All in all, the outlook for the precious metals market is not bullish, even though the last several days / weeks might make one feel otherwise. Before viewing the recent move higher as something significant and/or bullish, please consider how tiny this upswing is compared to the decline in gold stocks between May and October. No market moves in a straight line, and periodic corrections are inevitable. It doesn’t make them a start of a new powerful upswing in each case, though. And if the part of the precious metals market that is supposed to rally the most at the start of a major upswing is so weak right now, then why should one expect the current upswing to be anything more than a corrective upswing within a bigger downtrend?

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

Bearish Outlook: Mining Stocks Don't Mind Gold’s Rally

November 9, 2021, 8:51 AMLet’s start today’s analysis with a question I just received. It was about whether I felt that GLD and GDX were forming a W-shaped bottom, and whether I would consider going long if the price kept moving up, at least for a short term.

Starting with the last part, it’s a definite “yes”. I would definitely “consider” going long. In fact, I consider going long each day (and I featured long positions in the precious metals sector earlier this year). My aim is to look at the charts as if I didn’t have any investment or trading position open, and to determine IF and what kind of position I would like to open on a given day based on what I see in the charts. This approach helps to avoid the so-called “conservatism bias”, which emerges when one sticks to a belief, outlook, opinion (or trading position in this case) just because they had them previously. People with strong conservatism bias might even not want to read / listen to anything that might challenge their original views.

Anyway, as soon as the bearish indications are either nullified or overwhelmed by bullish factors, I’ll be happy to go long the precious metals and/or mining stocks. However, most likely, the situation will have turned neutral before that happens or not bearish enough to justify keeping the short position intact.

At this time, I continue to think that the outlook remains bearish and the short position in the mining stocks remains justified. It’s not a feeling, it’s an analysis-based opinion.

Is gold or GDX forming a W-shaped bottom? I don’t think so.

Ultimately, whether something was a W-shaped bottom or a horizontal consolidation becomes clear only after a breakdown below the previous lows, or after a sizable rally that is accompanied by other bullish confirmations.

We haven’t seen a breakdown to new lows recently, but we haven’t seen meaningful bullish confirmations either.

The key bullish ingredient that is missing, and something that provides us with clear bearish indications instead, is mining stocks’ relative strength.

The above charts clearly show how weak mining stocks are compared to gold, and it is particularly bearish given the support that miners have been receiving recently from the general stock market. The latter moved to new highs, helping the miners move up. And what did they do? They did move up indeed, but in a very weak manner.

From the short-term point of view, gold stocks are weak because they barely got back to their mid-October highs, let alone the October highs. Gold moved visibly above its recent highs, but the HUI Index – the flagship proxy for gold stocks – was barely affected. This is very bearish, and there’s no other way to call it.

Miners’ weakness doesn’t end there. Looking from a broader point of view, we see that miners are currently trading close to their March lows. Gold is now about $150 above its March low, so miners more or less ignored that move over the medium term. That’s not a small move, and the importance of this indication is not to be ignored.

Besides, let’s keep in mind that the USD Index remains above its previous 2021 highs, and the breakout above them was more than confirmed. This means that it’s likely to move to much higher values, even though it may seem that it will continue to hesitate and trade sideways “forever”.

There’s a technical rule of thumb that says that the longer the base is, the bigger the following move is going to be. The post-breakout consolidation has been taking place for over a month, so it’s likely preparing the USD Index to move much higher. The implications for the precious metals sector are bearish.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold Investment News

Delivered To Your Inbox

Free Of Charge

Bonus: A week of free access to Gold & Silver StockPickers.

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM