Briefly: In our opinion no speculative short positions in gold, silver and mining stocks are currently justified from the risk/reward perspective.

Gold tried to rally yesterday, based on the dollar’s decline, but failed to hold these gains and ended up barely higher. That’s another day of gold’s underperformance relative to the USD Index – another bearish sign. If that wasn’t enough, we have just seen another significant move lower in mining stocks.

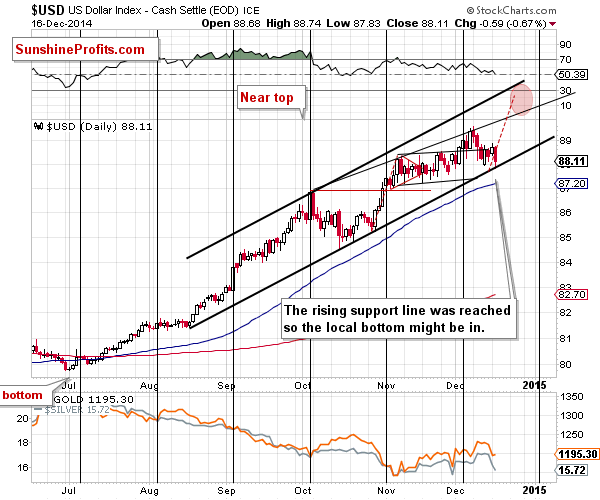

Let’s see what happened, starting with the USD Index (charts courtesy of http://stockcharts.com).

In short, the USD Index reached the rising support line, which means that a local bottom is likely in and we will see another move higher relatively soon. That’s bearish information for gold.

Quoting the previous alert:

In the recent alerts we wrote that one of the things that could make the outlook for gold much more bearish was its ability to decline regardless of what was going on in the USD Index.

The price action that we have been seeing in both markets in the last few days indicates that this might indeed be the case. The last 2 days in particular showed that gold could decline without the dollar’s help. Will this kind of relationship continue? It seems rather likely but not (yet) very likely. We still remain cautious, but more and more leaning toward the bearish outlook for the short term.

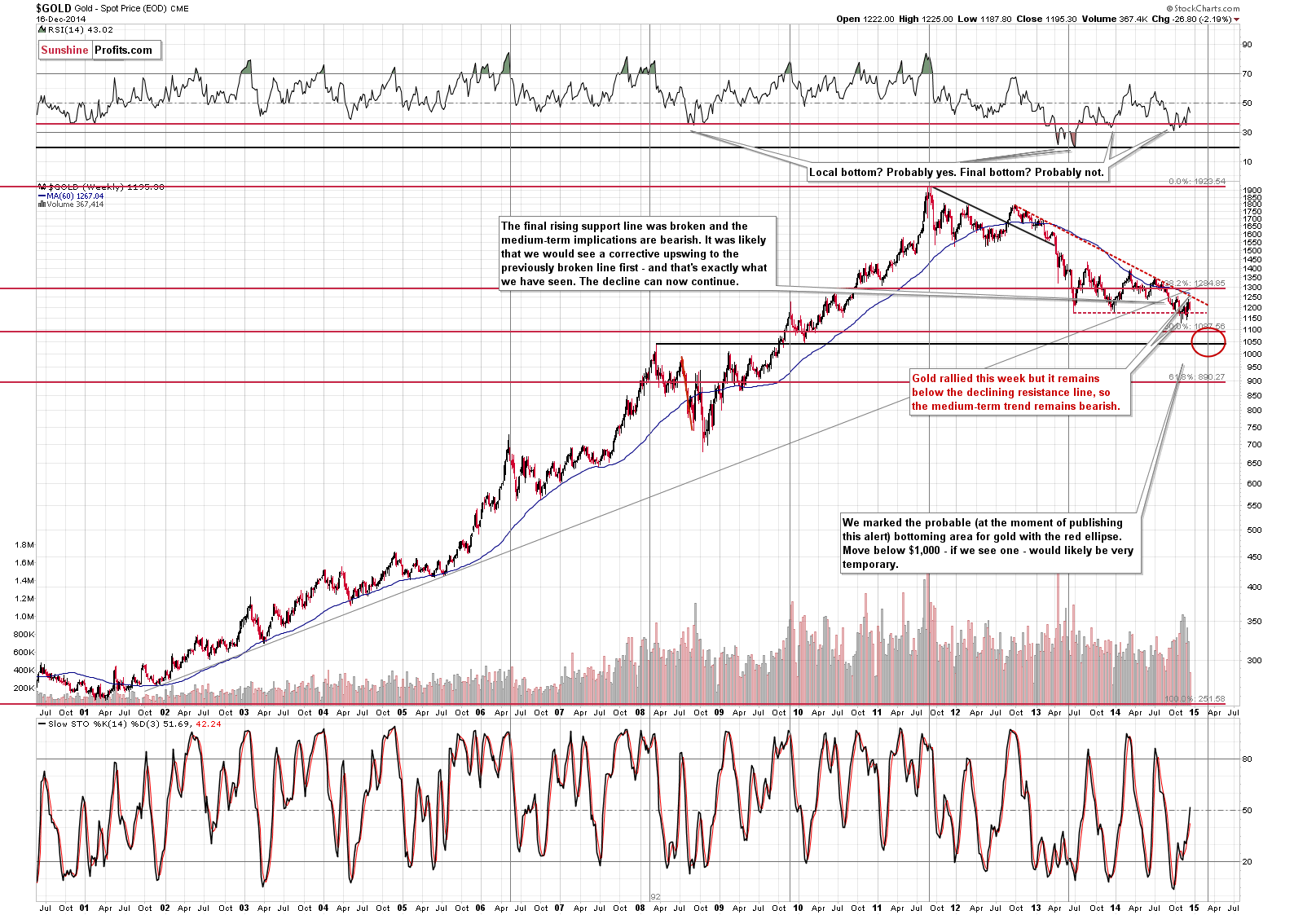

Meanwhile, nothing changed from the medium-term perspective, so our previous comments remain up-to-date:

Let’s keep in mind that gold remains in a medium-term downtrend and could move even higher in the short term (to $1,250 or so) and still remain in it. In other words, another short-term rally here would not invalidate the bearish medium-term outlook.

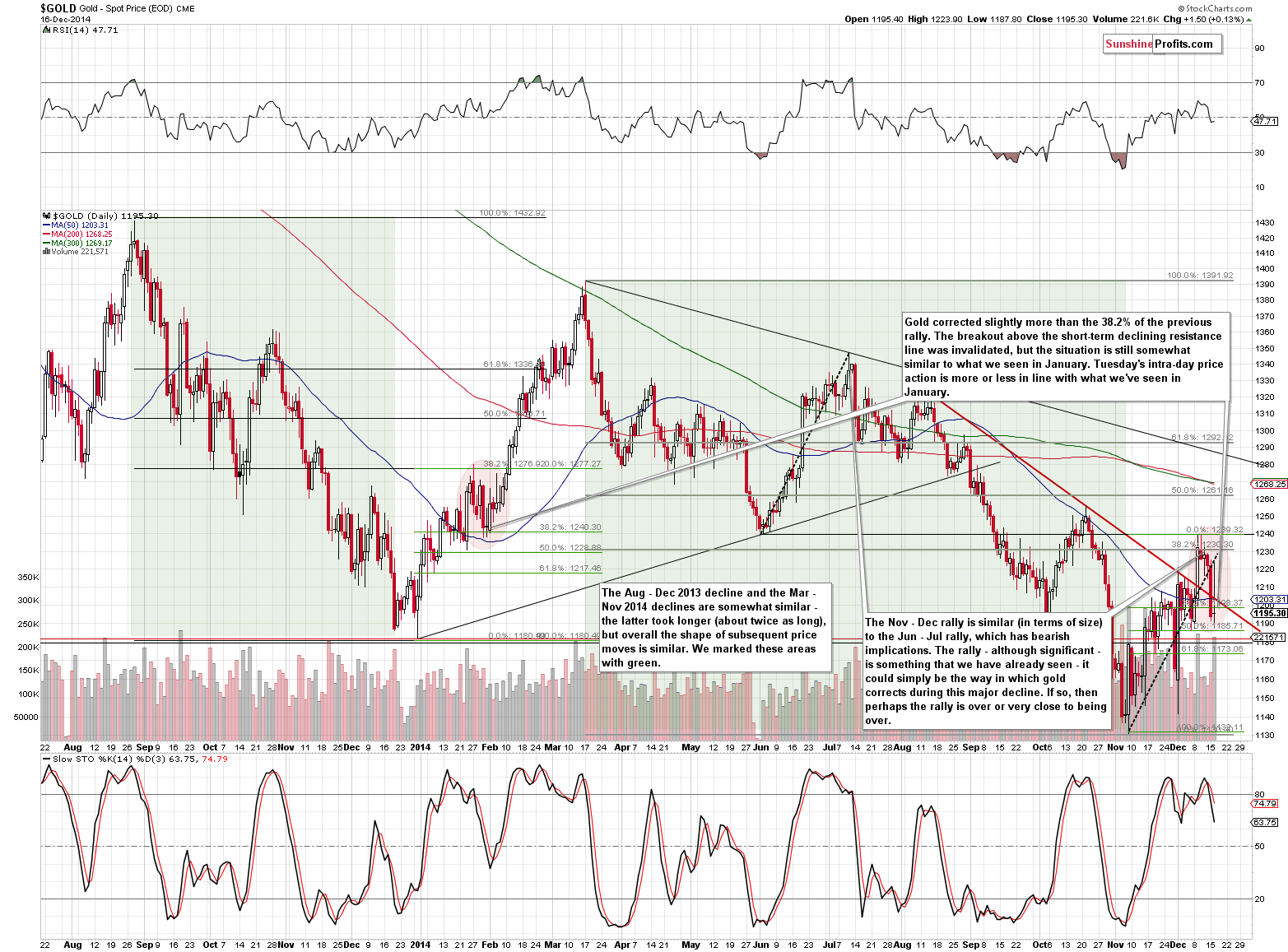

The short-term picture still features a self-similar pattern that we described yesterday in the following way:

The price of the yellow metal declined slightly below the 38.2% Fibonacci retracement level based on the short-term rally. This is more or less where gold corrected in late January 2014 before rallying quite sharply. Since the previous declines (marked with green) were similar in terms of shape, we could see a similar rally also here, if this self-similarity pattern continues.

Today’s rally in gold seems to confirm that the above pattern remains in place and the implications remain bullish.

Gold declined after we wrote the above, but since it’s not below the previous lows, the shape of the price moves is still similar to what we saw in January. Consequently, we could still see a rally in the coming days / weeks based on the above alone.

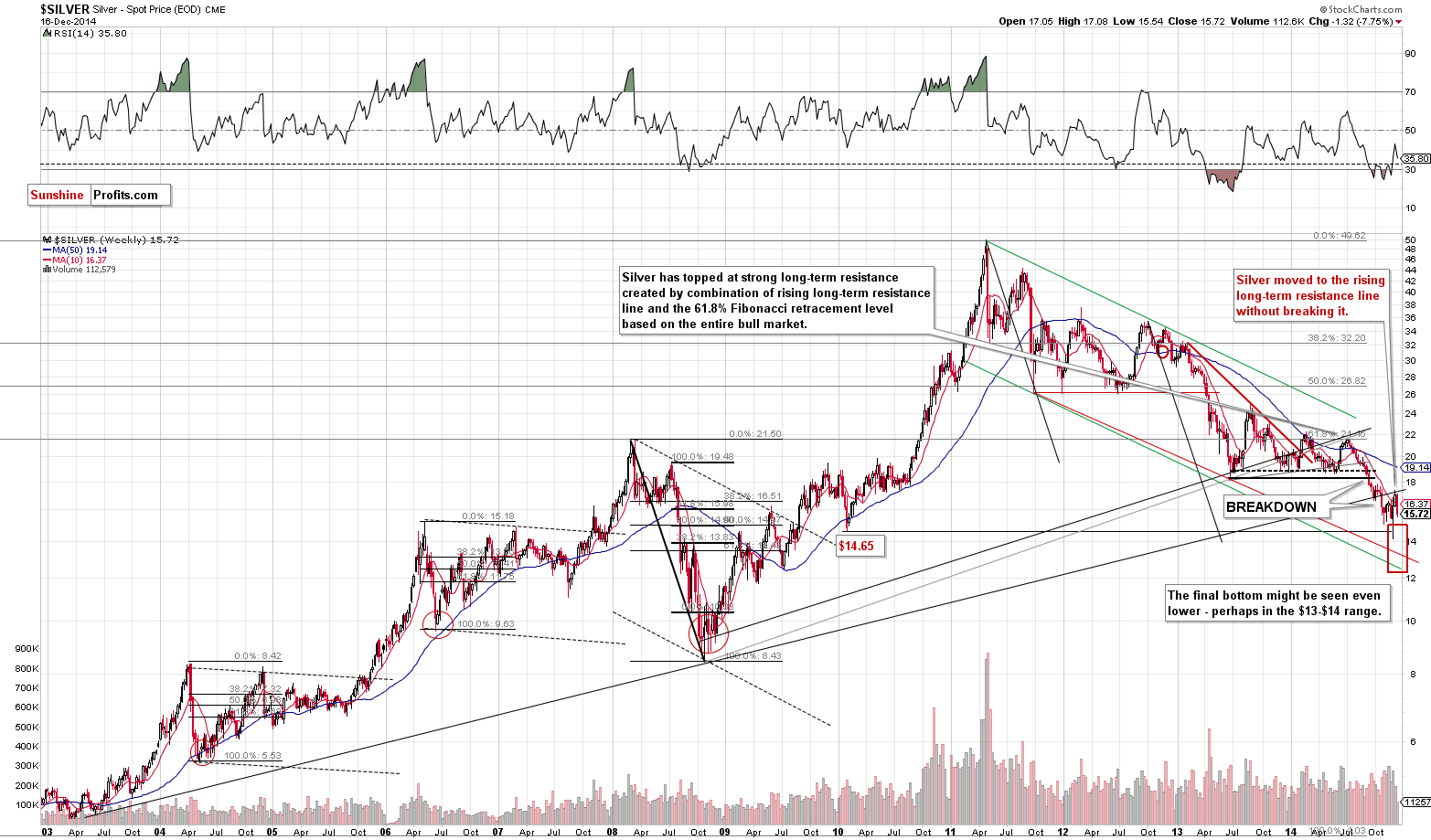

Let’s move to silver.

The situation in silver is clearly bearish from the long-term point of view and staying out of the silver market with the long-term capital seems justified.

The only thing that silver did in its previous run-up was correcting the breakdown below the rising long-term support line and verifying it as resistance. The implications remain bearish.

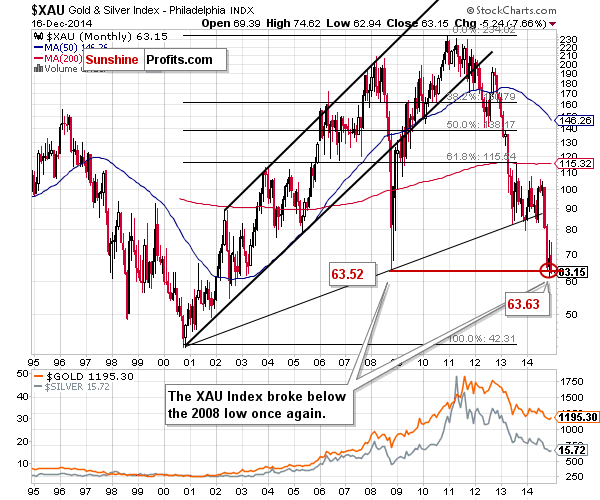

Gold stocks declined significantly and so did silver stocks. In today’s article we’ll take a look at the XAU Index as it includes both gold and silver stocks.

The XAU Index declined significantly this month and is already below the 2008 low. The previous move higher – just like in silver – seems to have been nothing more than a correction – just as we had expected it to be.

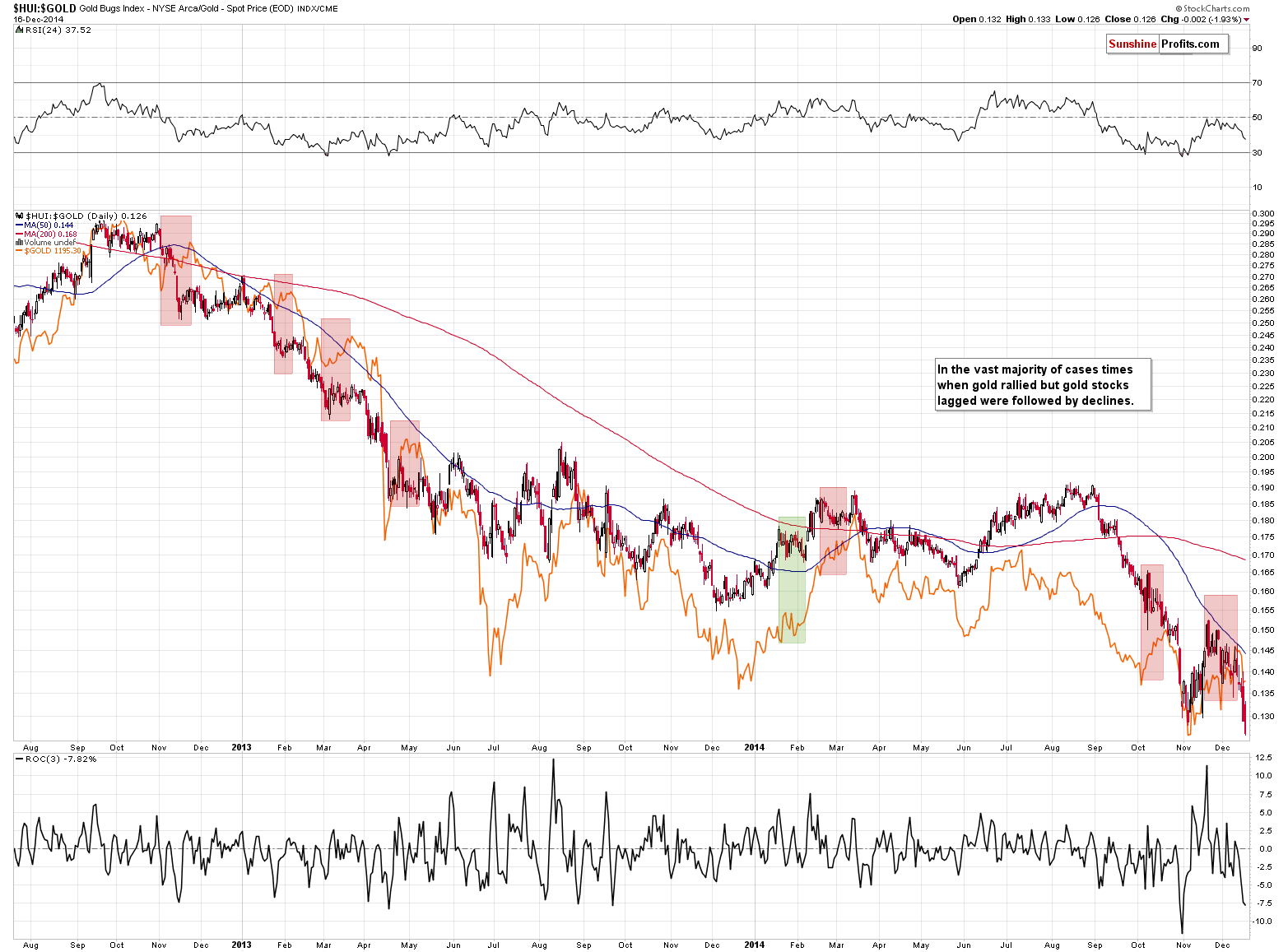

More importantly, the gold stocks to gold ratio declined once again on Tuesday and the bearish implications are now even stronger - the breakdown in the ratio is now almost confirmed.

Summing up, the situation is very tense and while most factors point to lower gold prices in the short run (even more based on yesterday’s price action), there is one factor that prevents us from re-opening short positions in the precious metals sector at this point – the similarity of the recent decline-and-correction pattern to what we’ve seen previously. At this time the scenario in which we’ll see another short-term move up, like in February and early March this year, still can’t be ruled out. If gold stocks continue to disappoint and gold continues to perform poorly given signals from the USD Index, we will most likely see the short positions as justified (we’re very close to this point) – but that is not the case just yet.

With gold stocks being very close to their 2008 and 2014 lows and silver close to $15, it’s certainly good to be out of the market with the long-term investments in this sector – something that we have been writing about for many months now. It seems that we will see much lower prices for precious metals in the coming weeks or months regardless of the short-term developments.

We’ll keep you – our subscribers - informed.

To summarize:

Trading capital (our opinion): No positions

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the sings pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

The price of crude oil declined yesterday once again – was the bottom reached yet?

Oil Trading Alert: Crude Oil – The Doji-generated Reversal?

We saw a day of increased volume yesterday. This was accompanied by depreciation. The most visible change, however, was a close below $350 on BitStamp, a first in four days. Does this mean that we're seeing the beginning of a move down?

Bitcoin Trading Alert: Move down Might Have Already Begun

Earlier today, the data showed that the euro zone’s preliminary manufacturing PMI climbed to a four-month high of 50.8 this month (beating expectations for a rise to 50.5), while the preliminary reading of the services PMI rose to 51.9 in December (also above the forecast of an increase to 51.5). Additionally, the ZEW Centre for Economic Research reported that its index of German economic sentiment climbed to 34.9 from 11.5 in November, well above the forecast of 20.8. These bullish numbers supported the common currency against the greenback and pushed EUR/USD above the barrier of 1.2500. Will we see further rally?

Forex Trading Alert: Positive Sign For EUR/USD

=====

Hand-picked precious-metals-related links:

Traders Betting Russia’s Next Move Will Be to Sell Gold

Fed Won’t Stop Gold’s Recovery in ‘15, ANZ Says as Asia Buys

Commodity Trading Giant Exits Physical Gold Due To "Lack Of Physical With A Documented Origin"

Harsh words on Barrick Gold prospects

Stop Worrying and Love the Gold

=====

In other news:

Gross Backs Krugman View of Fed on Hold in Weak Inflation World

This could be Putin's surprise move: Former ambassador

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts