Briefly: In our opinion no speculative short positions in gold, silver and mining stocks are currently justified from the risk/reward perspective.

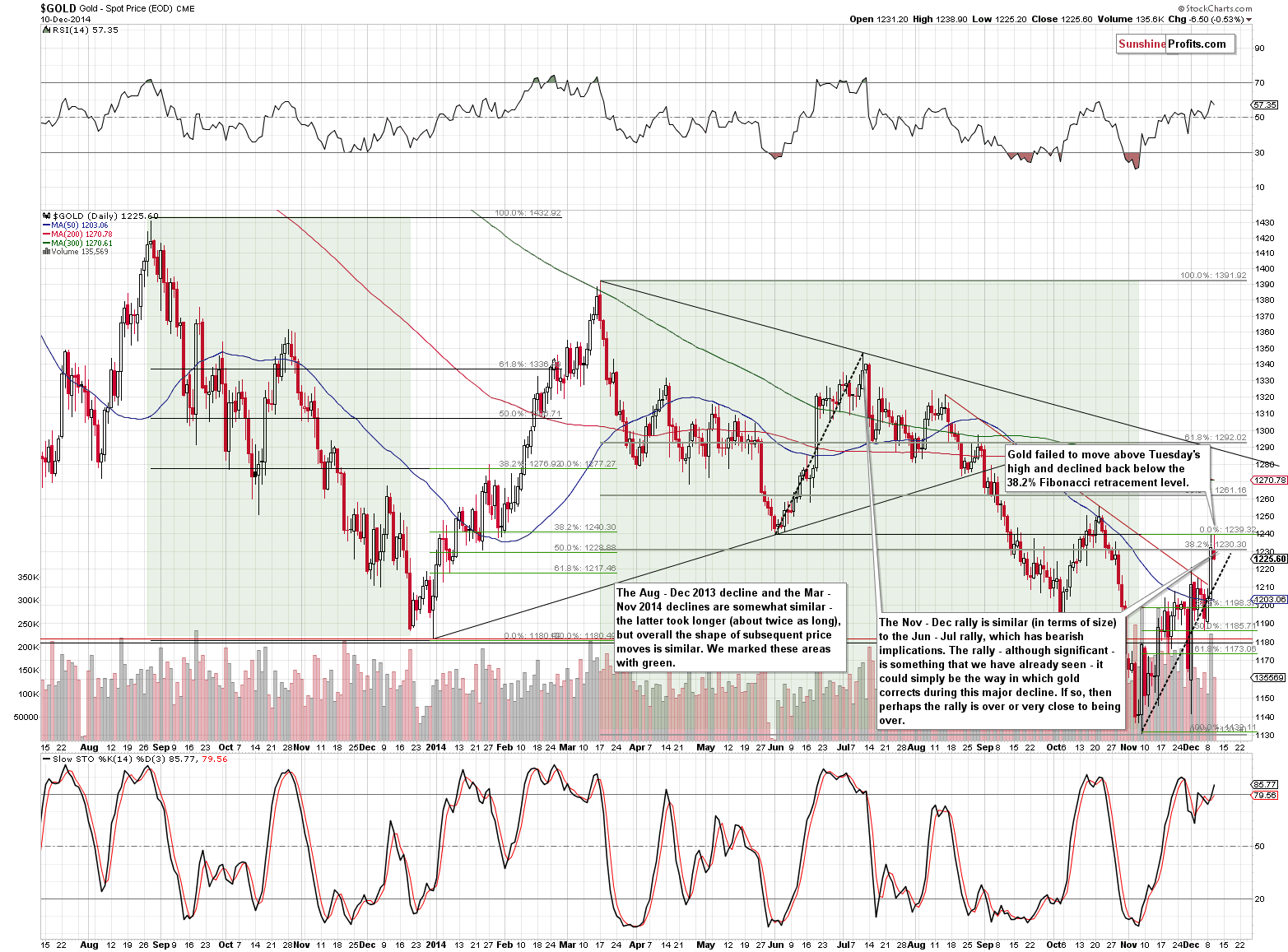

The USD Index declined yesterday, but gold didn’t rally. In fact, it moved a bit lower, back below the 38.2% Fibonacci retracement level. Is this a confirmation that the next big move will be to the downside and that shorts should be opened?

In short, while the situation deteriorated a bit yesterday, it’s still too unclear to open any speculative position in our view. In general, not much changed yesterday and points made in yesterday’s big alert remain up-to-date. If you haven’t had the chance to read it, we suggest doing it today. Today’s alert will be much shorter and we will focus on the small changes that were indeed seen. The only change that was not small is the juniors’ breakdown.

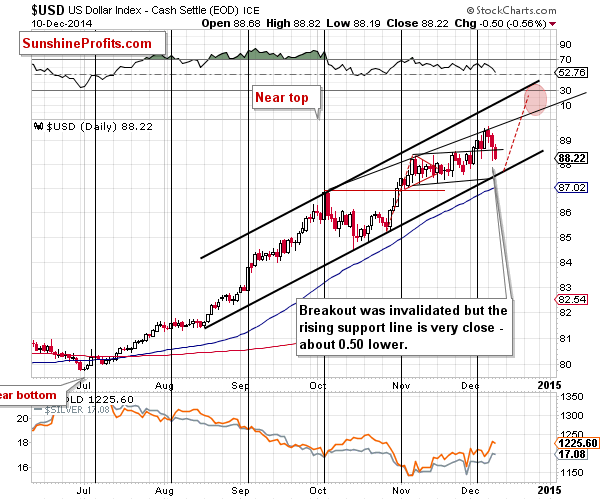

Let’s start with the USD Index (charts courtesy of http://stockcharts.com).

The USD Index declined once again and moved below the upper border of the previous flag pattern. With the breakout being invalidated, we could see some short-term weakness, but the next significant support is very close – about 0.50 lower – at the rising medium-term support line.

Yesterday we wrote that one of the things that could make the outlook for gold much more bearish was its ability to decline regardless of what was going on in the USD Index. Gold indeed declined along with the USD Index yesterday, but it doesn’t seem that this was significant enough to indicate a new tendency. That was just daily price action, and since gold’s previous upswing was very sharp and significant, a daily pause is something natural – it doesn’t have to imply anything more.

Consequently, at this time, we are skeptical toward gold’s ability to decline regardless of the U.S. dollar’s price swings.

Gold moved back below the 38.2% Fibonacci retracement level, which suggests that the most recent upswing was indeed just a correction within a bigger decline. Let’s keep in mind that even if gold moves higher from here – to $1,250 or so, it will still remain in a medium-term downtrend as in this case there would be no breakout above the declining medium-term resistance line.

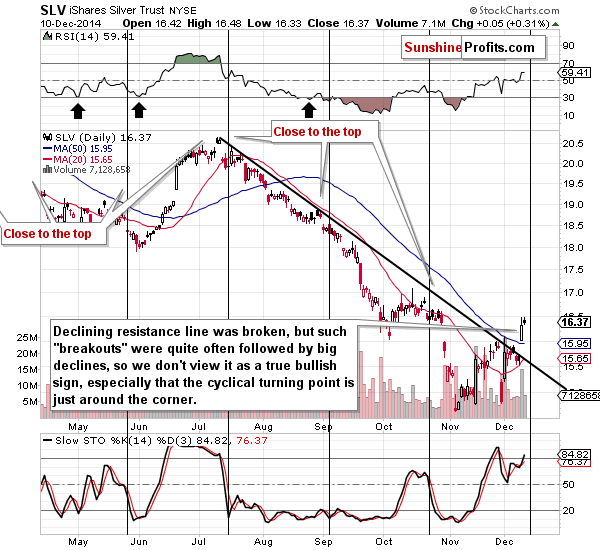

Let’s move to silver.

As far as the short term is concerned, comments from yesterday’s alert remain up-to-date:

Silver moved above its declining short-term resistance line just before its cyclical turning point. This is actually a bearish combination. Silver is known to flash fake buy signals (often in forms of various breakouts) just before taking another dive. This could be the case also this time.

In other words, viewing silver’s breakout as bullish might be premature at this point.

The situation didn’t change, but since we moved 1 day closer to the turning point without a decline, the latter becomes even more probable.

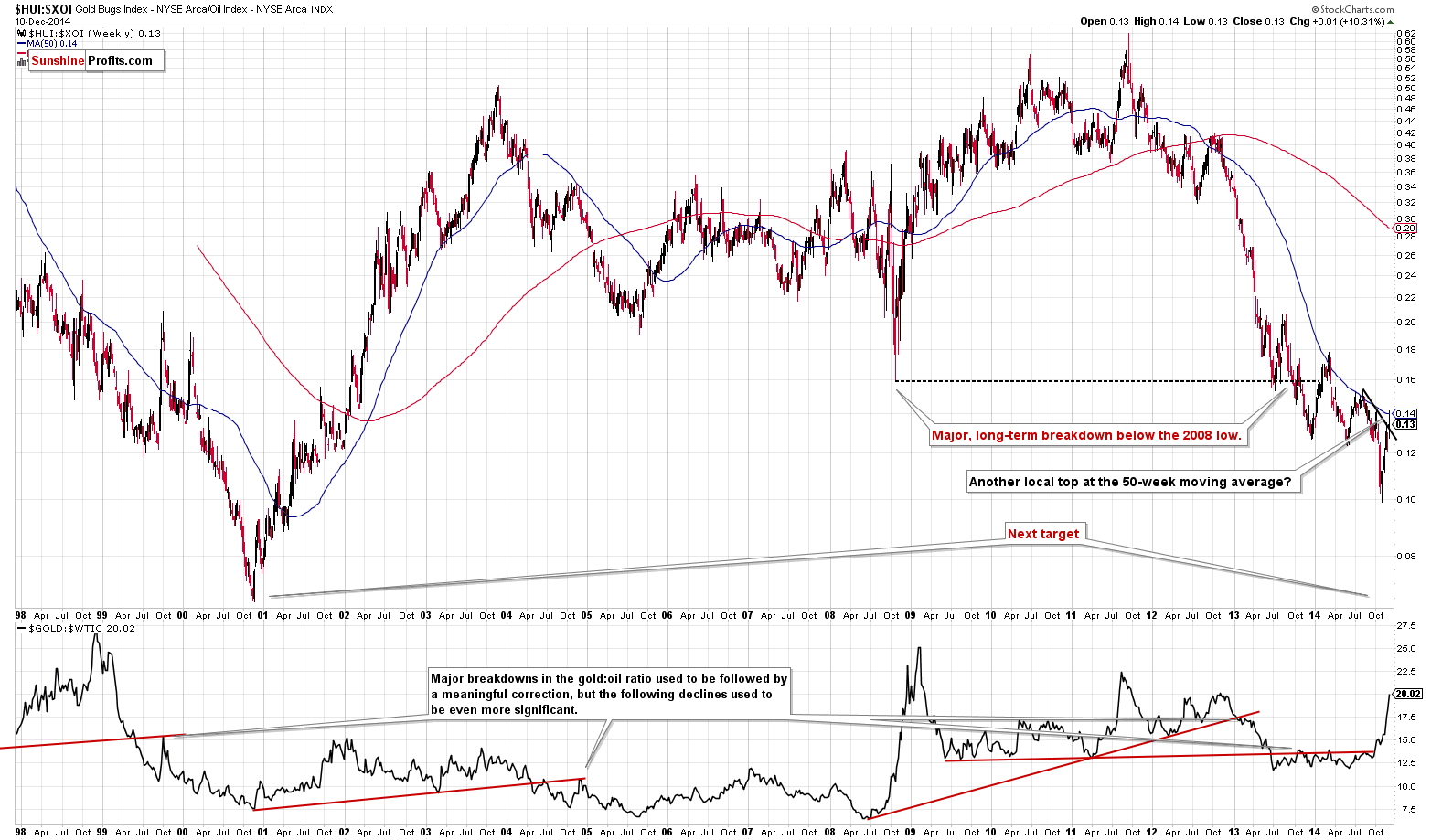

In yesterday’s alert we wrote the following regarding the gold stocks to oil stocks ratio:

Meanwhile, the gold stocks to oil stocks ratio continues to suggest that we might see a little more short-term strength before the decline continues. At the same time we see that the rally is yet another correction.

In the previous cases the ratio topped at or slightly above the 50-week moving average. That’s something we haven’t seen so far.

Interestingly, this is exactly what we’ve seen during yesterday’s session. The ratio moved slightly above the 50-week moving average and then declined once again. This serves as a bearish confirmation for the precious metals market.

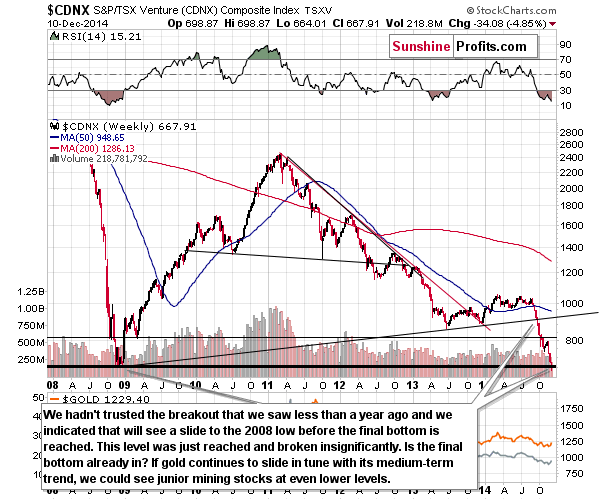

Finally, let’s take a look at the juniors. As stated in the title, we’ll use the Toronto Stock Exchange Venture Index as a proxy for juniors as so many of them are included in it.

The thing that we emphasized over and over again this year was that the juniors’ breakout was not necessarily something very bullish and that we had likely not seen the final bottom in this sector. The reason was that the previous breakouts had often been invalidated and followed by significant declines. It turned out that it was the case also this time – juniors took their time – holding up relatively well for most of the year – but ultimately they pierced through the rising long-term support line.

Our next target for juniors was the 2008 low, but… it was just (b)reached. Juniors declined insignificantly below their 2008 low. Even though the move itself was rather small and the breakdown is not confirmed at this time, it is still significant as juniors have actually managed to break below an major low when 2 of the key markets that influence them (gold and the general stock market) are not moving below their previous lows (stocks are declining, though). On a side note, please note that the SP Junior Long Term Indicator suggested staying out of the juniors sector for more than a year.

The above serves as a bearish indication for the entire precious metals market. The implications are of medium-term importance, this breakdown doesn’t imply a move lower or higher in the coming days.

Overall, we can summarize the situation in the precious metals market as we did it in yesterday’s alert:

Summing up, there are many factors that are currently in play that have contradictory implications, which makes the short-term outlook rather unclear, even though the medium-term one remains bearish.

We have not seen silver’s huge underperformance and gold is not hated in the financial media (at least not very significantly) and long-term charts are showing declining trends. We could see some short-term strength in gold based on various factors, but at this time it’s too early to say that the next big upswing is underway. Most sings point [based on yesterday’s prices we have 2 more: resistance was reached in the gold stocks to oil stocks ratio and TSXV broke below its 2008 low] out that the current rally in gold is simply a correction within a downtrend.

The thing that could generate a bigger upswing in gold is a big decline in the USD Index, and the latter could actually happen based on the resistance level being reached and that might happen relatively soon. However, the USD could move even higher – to the rising green support line – and we could also see gold’s move lower take place regardless of the situation in the USD. Perhaps gold is rallying not because of its inner strength (weak performance of mining stocks suggests that the sector is not really strong), but because it got too low too fast and simply had to correct. Gold’s small decline on Wednesday is not enough to prove that this is the new tendency.

It our view, the best approach is to continue to monitor the situation and take action once it clarifies. Gold’s ability to decline regardless of what’s going on in the USD Index would be a perfect bearish confirmation, but we have not seen it so far. If USD Index moves above the 90 level and holds it, then we would likely see an even greater rally and another big downswing in gold, anyway.

We’ll keep you – our subscribers - informed.

To summarize:

Trading capital (our opinion): No positions

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the sings pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

Although crude oil hit a fresh multi-year low after the market’s open, the commodity rebounded in the following hours supported by a weaker greenback. In this way, light crude gained 0.40%, but still remains under the previous lows. What’s next?

Oil Trading Alert: Where Are Oil Bulls?

=====

Hand-picked precious-metals-related links:

Yesterday's top story: Gold forecasts for 2015 - Scotiabank mining panel

Russia lifts gold reserves by 18.9 tns as rouble slump continues

=====

In other news:

ECB lending meets estimates; euro falls

Is Tomorrow Too Late for Greece?

Greece Reruns Doomsday Scenario as Politics Rocks Markets

Norway’s Shock Rate Cut Drives Krone to Lowest Since 2009

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts