Briefly: In our opinion speculative short positions (full) in gold, silver and mining stocks are justified from the risk/reward perspective.

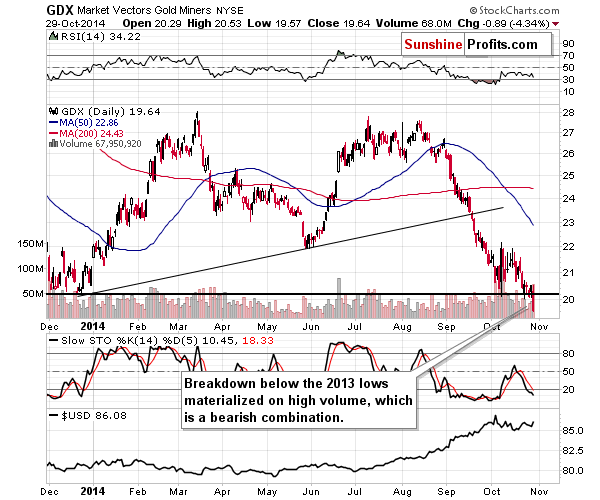

Gold and mining stocks declined yesterday in a rather profound way. The GDX ETF finally broke below its 2013 lows and the volume that corresponded to this action was high. However, silver almost didn’t react – why didn’t it? Will we see a rally shortly?

In short, not likely. There was a good reason for silver to hold up strongly at this time. However, before we move to this situation, let’s take a look at the “background info” – the changes in the USD Index (charts courtesy of http://stockcharts.com).

In yesterday’s alert we wrote the following:

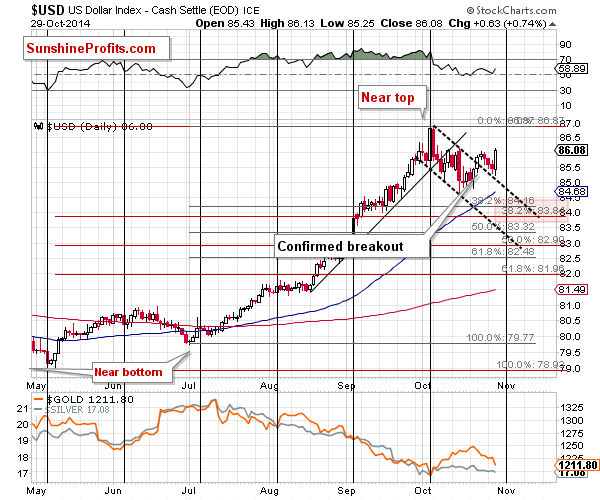

The breakout above the declining resistance line is now confirmed by more than 3 consecutive closes above the resistance line, so it is definitely meaningful. As always, this does not guarantee a move higher, but it made it much more probable. In fact, a move higher in the very short term is now more probable than a move lower. It now seems likely that the USD Index will move higher at least until the next cyclical turning point – meaning for another week or so.

Actually, the USD Index moved slightly lower yesterday and on Monday, but the breakout was not invalidated, so the move didn’t change anything in the outlook for the index.

The implications for gold and the rest of the precious metals sector are bearish.

It turns out that the USD Index rallied and gold declined – after a confirmed breakout and breakdown, respectively. The situation developed as we had expected it to. What’s next? The cyclical turning point is at hand, so we might not see many more daily upswings in the near future. The closest resistance is at the previous October high, about an index point above Wednesday’s close. Consequently, we are quite likely to see another sharp upswing, but it also seems likely that the USD Index will at least pause after reaching its previous high, at or close to the turning point.

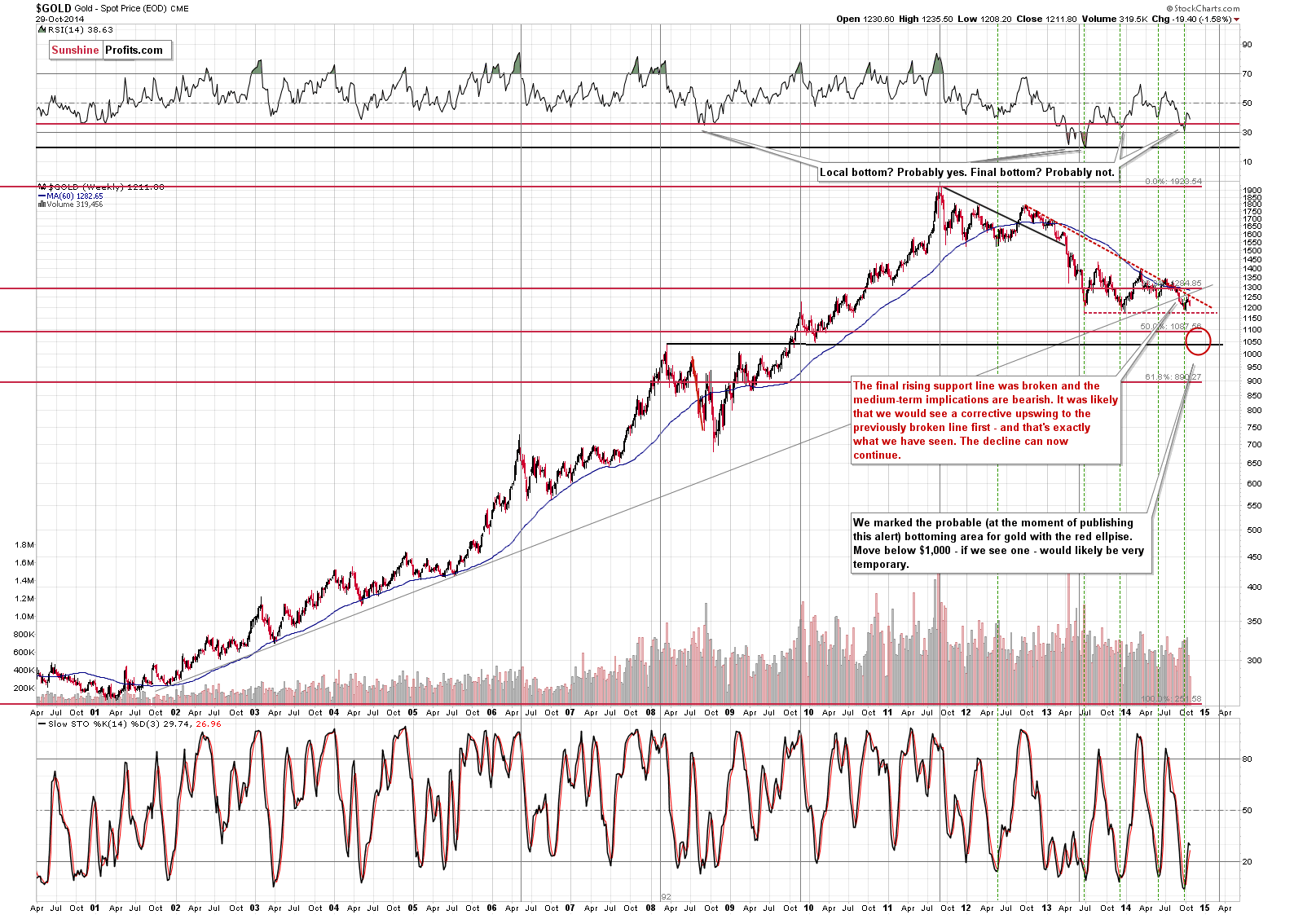

From the long-term perspective we see that this month’s rally was in fact a corrective upswing that took gold to combination of strong resistance lines. It was a breather that we expected to see and as it’s already been seen, so we can now expect the decline to continue. Perhaps the next big slide is already underway.

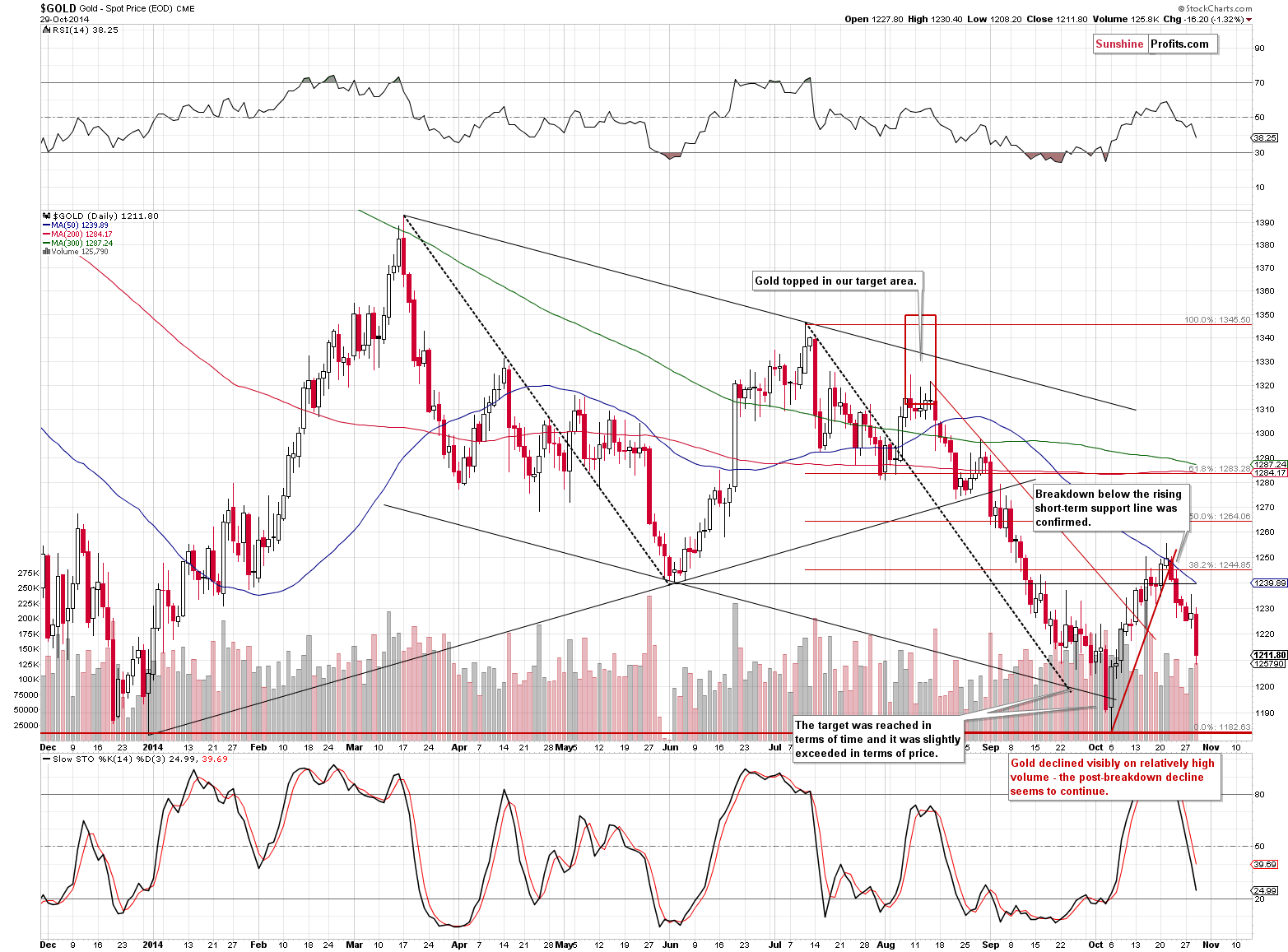

The short-term gold chart shows that the decline is indeed underway. That’s another expected development. Gold confirmed the breakdown below the short-term rising support line just a few days ago and based on this action, i.a., we decided to open short positions and they are already profitable. The decline that accompanied yesterday’s decline was significant, which serves as a bearish confirmation.

Please note that the RSI indicator is not oversold, so gold can very well fall further. How low can gold go initially? At least to the previous October low, but we think that the final bottom will be much lower.

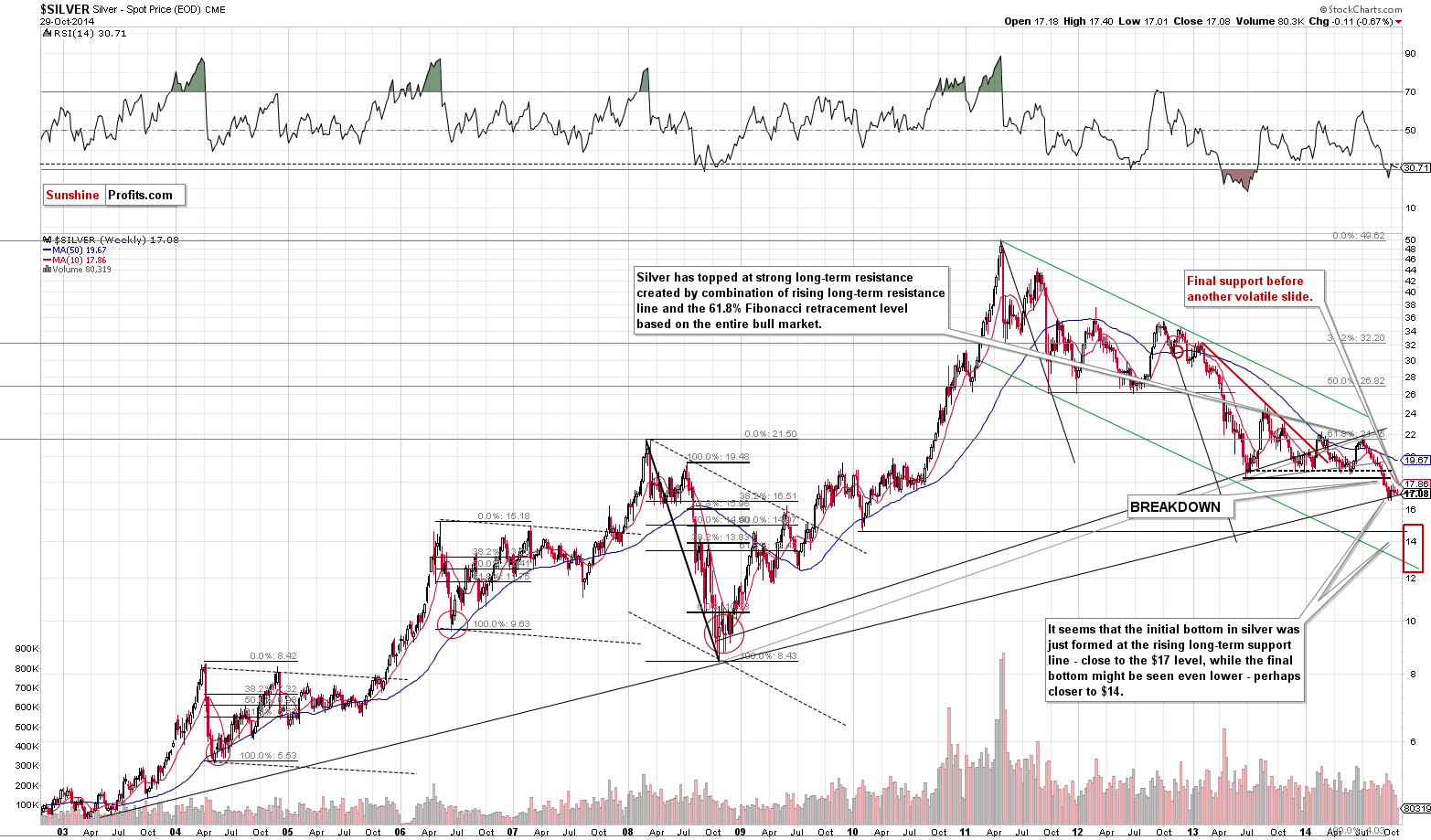

Earlier today we mentioned silver by saying that it was no wonder that it hadn’t declined much yesterday. The reason is the proximity of the rising long-term support line.

Silver remains “strong” as it’s right at this line. We don’t think this is a real sign of strength of the white metal. When silver finally gives in and breaks this level, it’s likely to catch up with gold and miners and decline sharply. Please note that once this support is taken out there will be no other support to stop the decline until the white metal moves below $15.

Is silver still a great investment when one takes a few years into account? We think so.

Can silver plunge very low before it starts another powerful rally regardless of its favorable fundamental situation? Yes, it can.

As mentioned previously, the GDX ETF moved to new lows and it happened on huge volume. That was a very bearish development, especially that the HUI and XAU indices had already broken below their respective lows.

Summing up, the situation in the precious metals market was bearish but based on yesterday’s price action it has now become even more bearish (taking the short term into account). While we wrote that it was justified to open small short positions in the sector a few days ago (which are already profitable), it seems that doubling them at this time is also justified (as always, just our opinion).

Still, please note that it is generally not a good idea to use all or most of ones capital for a given trade. One should not trade more than they can afford to lose. We are after several months of winning trades (taking all sectors into account at the same time) in a row, so it might seem that the next trade can’t go wrong. It could, as there are no sure bets in any market - so caution is still suggested.

We will continue to monitor the situation and report to you – our subscribers - accordingly.

To summarize:

Trading capital (our opinion):

It seems that having speculative (full) short positions in gold, silver and mining stocks is a good idea:

- Gold: stop-loss: $1,268, initial target price: $1,192 stop loss for the DGLD ETF $65.35, initial target price for the DGLD ETF $78.65

- Silver: stop-loss: $17.87, initial target price: $15.11 stop loss for DSLV ETF $57.69, initial target price for the DSLV ETF $89.22

- Mining stocks (price levels for the GDX ETF): stop-loss: $22.33, initial target price: $17.11, stop loss for the DUST ETF $21.33, initial target price for the DUST ETF $43.77

In case one wants to bet on lower junior mining stocks' prices, here are the stop-loss details and initial target prices:

- GDXJ: stop-loss: $36.23, initial target price: $25.13

- JDST: stop-loss: $9.54, initial target price: $30.56

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

On Tuesday, crude oil gained 1.13% as weaker U.S. dollar supported the price. In this way, the commodity bounced off a multi-month low and closed the day above $81. Did this upswing changed the very short-term outlook?

Oil Trading Alert: Crude Oil – Has Anything Changed?

=====

Hand-picked precious-metals-related links:

Swiss gold referendum likely to pass and send prices higher says Julius Baer’s Burkhard Varnholt

Will there be a buyer of 1700 tons of gold after November?

TIMELINE: The gold price and the Fed's rocky relationship

Alan Greenspan: Gold Standard Not Possible In Welfare State

Gold Equals 15 Barrels of Oil in Bearish Sign for Bullion

Gold miner Agnico earnings miss but raises output forecasts

Centerra Gold loss widens as prices, sales drop

Barrick Gold earnings beat market; cuts cost forecast

Gold premiums soar on import restrictions buzz

Russia buys most gold for reserves since ’98

=====

In other news:

Why Asia stocks will rally into year-end: Goldman

As Fed leaves bond market, here's who will step in

America's biggest financial fears

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts