Briefly: In our opinion speculative short positions (half) in gold, silver and mining stocks are justified from the risk/reward perspective.

That’s exactly what happened yesterday and in general this week. Gold is a bit lower than it closed on Friday, but the HUI Index is at higher levels. Is the miners’ strength telling us that the decline is already over?

Not likely. The situation hasn’t really changed since yesterday and miners’ outperformance is not meaningful. Before providing more detailed explanation, let’s take a look at the situation in the USD Index (charts courtesy of http://stockcharts.com).

In short, our yesterday’s comments remain up-to-date:

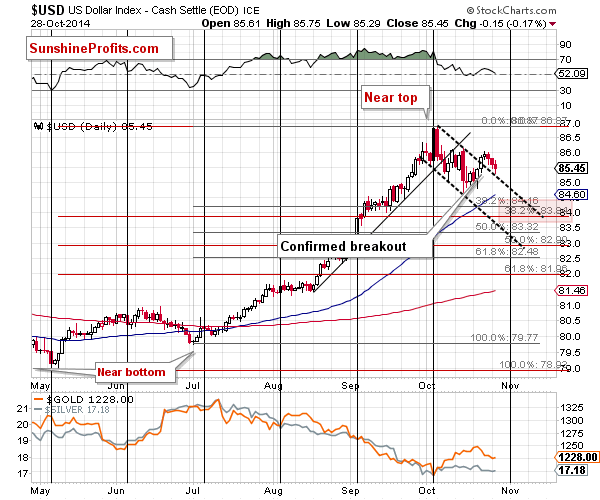

The breakout above the declining resistance line is now confirmed by more than 3 consecutive closes above the resistance line, so it is definitely meaningful. As always, this does not guarantee a move higher, but it made it much more probable. In fact, a move higher in the very short term is now more probable than a move lower. It now seems likely that the USD Index will move higher at least until the next cyclical turning point – meaning for another week or so.

Actually, the USD Index moved slightly lower yesterday and on Monday, but the breakout was not invalidated, so the move didn’t change anything in the outlook for the index.

The implications for gold and the rest of the precious metals sector are bearish.

As it is the case with the USD – our comments on gold remain up-to-date:

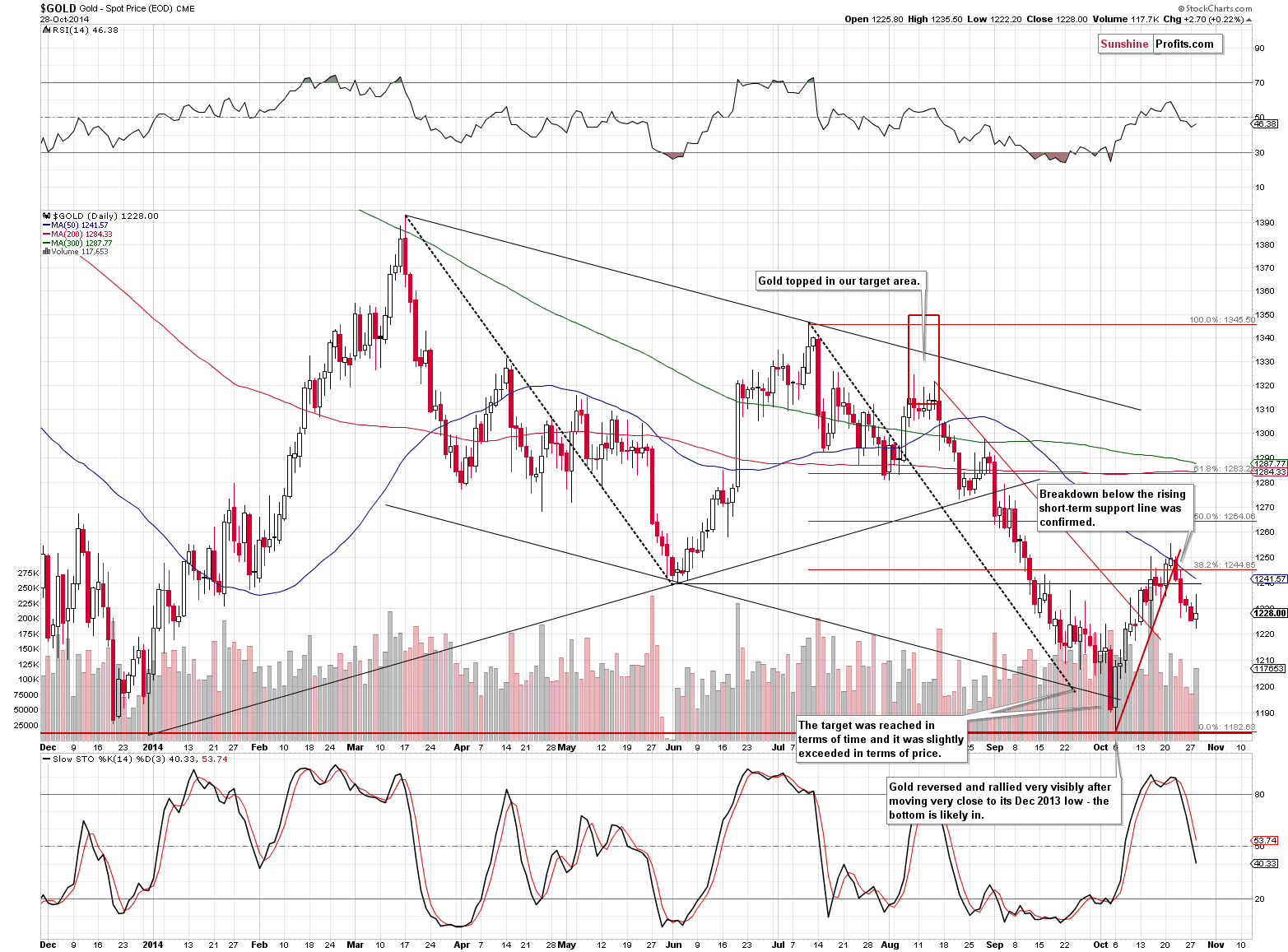

Just as the breakout above the declining short-term resistance line was more than confirmed in the case of the USD Index, the breakdown below the rising support line was more than confirmed in the case of gold. Consequently, the outlook for the short-term remains bearish.

As mentioned earlier, gold declined even though the USD Index declined as well, which serves as a bearish confirmation. Gold didn’t decline on increasing volume, though, so not all bearish signs are in place. It seems that only small short positions are justified at this time from the risk/reward perspective.

On Tuesday gold paused by rallying sharply but then giving up almost all the gains. The volume was relatively high. This, by itself, is neither bullish nor bearish, but the corresponding action in miners is somewhat bullish.

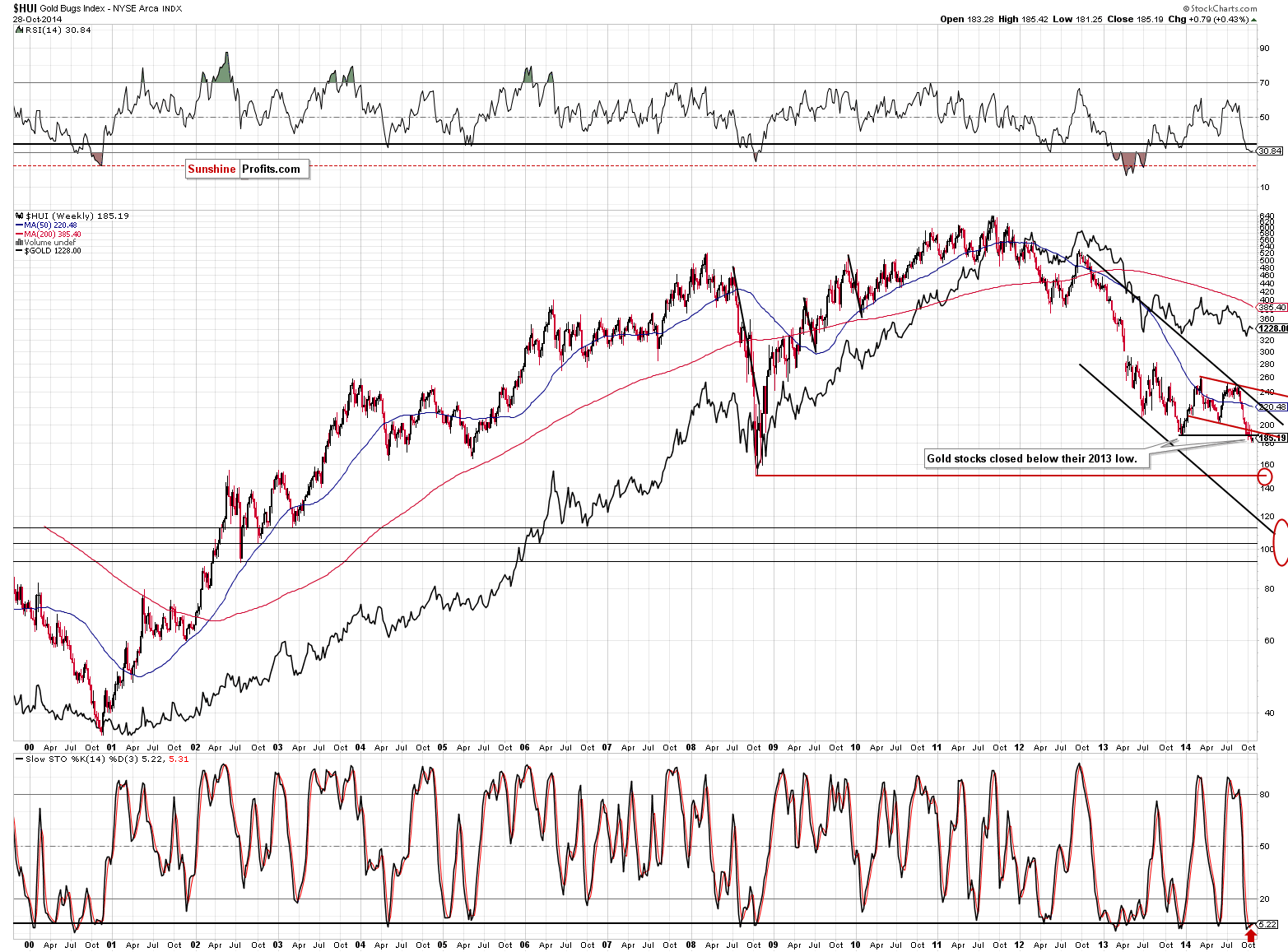

Gold stocks have moved a bit higher this week even though gold has moved a bit lower. Some could view this as a sign of true strength, but we don’t and there are two reasons for it.

Firstly, the size of moves is rather small, and secondly, there was a good reason for miners to move a bit higher as the general stock market rallied. In fact miners haven’t rallied as significantly as other stocks.

Overall, the above is bullish but just a little – it’s not a buy sign in our opinion.

Other than the above, there is little to comment on today. What we have written in the previous several alerts remains up-to-date and we can summarize the situation just as we did yesterday:

Summing up, the situation deteriorated further based on Monday’s price action and it seems that opening small short positions in the precious metals sector was a good idea (they were justified from the risk/reward perspective, and at this time remain profitable). Please note that the USD Index could still move lower – thus correcting 38.2% of the previous move up and gold could move to the support lines – more or less to the $1,260 level (even if it does, it will not invalidate the bearish outlook). However, at this time, the odds no longer favor this outcome in our opinion.

A word of caution – we are after several months of winning trades (taking all sectors into account at the same time) in a row, so it might seem that the next trade can’t go wrong. It could, as there are no sure bets in any market – at this time the situation is not crystal clear and we think that opening a position that is only half the size of the regular position is justified at this time.

We will continue to monitor the situation and report to you – our subscribers - accordingly.

To summarize:

Trading capital (our opinion):

It seems that having speculative (half) short positions in gold, silver and mining stocks is a good idea:

- Gold: stop-loss: $1,268, initial target price: $1,192 stop loss for the DGLD ETF $65.35, initial target price for the DGLD ETF $78.65

- Silver: stop-loss: $17.87, initial target price: $15.11 stop loss for DSLV ETF $57.69, initial target price for the DSLV ETF $89.22

- Mining stocks (price levels for the GDX ETF): stop-loss: $22.33, initial target price: $17.11, stop loss for the DUST ETF $21.33, initial target price for the DUST ETF $43.77

In case one wants to bet on lower junior mining stocks' prices, here are the stop-loss details and initial target prices:

- GDXJ: stop-loss: $36.23, initial target price: $25.13

- JDST: stop-loss: $9.54, initial target price: $30.56

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

We continue to see the pattern of small moves around $350. Yesterday was a classic case of such a development with the price range relatively narrow and the volume still relatively weak. Today, we've seen more of that. But will these conditions last?

Bitcoin Trading Alert: Bitcoin in Narrow Range, Might Not Be for Long

Earlier today, the Commerce Department showed that durable goods orders fell 1.3% in the previous month, missing expectations for a 0.5% increase. Core durable goods orders (without volatile transportation items) dropped 0.2% in September, which was the largest decline in eight months. Thanks to these bearish numbers, the USD/CAD pair declined sharply, slipping below the last week’s low. Where could currency bulls find solid support?

Forex Trading Alert: How Low Could USD/CAD Go?

=====

Hand-picked precious-metals-related links:

Sibanye 2014 gold target could be difficult

How the central bank squandered Switzerland's gold reserves

Things That Make You Go Hmmm... Like The Swiss Gold Status Quo Showdown

Strike-hit Impala’s platinum output down 25%, unit costs up 62%

US Mint's Eagle gold coin October sales are highest since Januaryf

The not so great debate – Is gold manipulated or not?

Hong Kong gold exports to China pick up strongly but...

=====

In other news:

Fed will go out of its way to be dovish

Quantitative easing is finally over. Here’s what it accomplished...

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts