Briefly: In our opinion speculative short positions (half) in gold, silver and mining stocks are justified from the risk/reward perspective.

That’s exactly what happened yesterday. Does it tell us something? It definitely does. It is usually a sign of weakness in the precious metals market, but is it significant enough to make the situation in gold very bearish in light of this month’s rally?

In short, the situation became a bit more bearish based on yesterday’s price moves (gold’s underperformance of the USD Index) and short positions that we had mentioned yesterday are already profitable, but the USD Index could still move more visibly lower in the short term so adding to the short positions in gold, silver in mining stocks doesn’t seem justified yet.

Let’s take a look at the charts (charts courtesy of http://stockcharts.com).

Large part of what we wrote previously remains up-to-date:

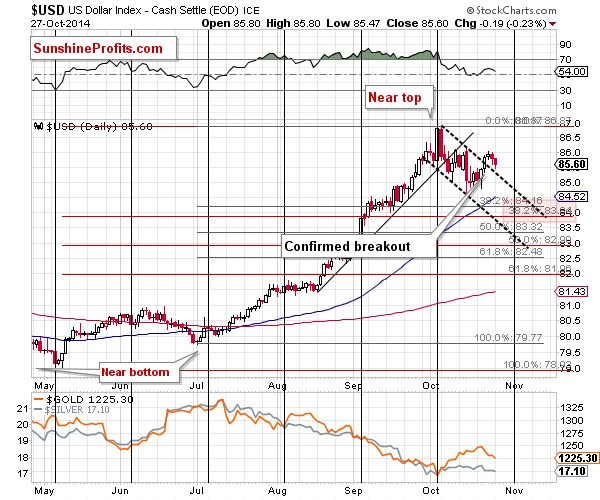

The breakout above the declining resistance line is now confirmed by more than 3 consecutive closes above the resistance line, so it is definitely meaningful. As always, this does not guarantee a move higher, but it made it much more probable. In fact, a move higher in the very short term is now more probable than a move lower. It now seems likely that the USD Index will move higher at least until the next cyclical turning point – meaning for another week or so.

Actually, the USD Index moved slightly lower yesterday, but the breakout was not invalidated, so the move didn’t change anything in the outlook for the index.

The implications for gold and the rest of the precious metals sector are bearish.

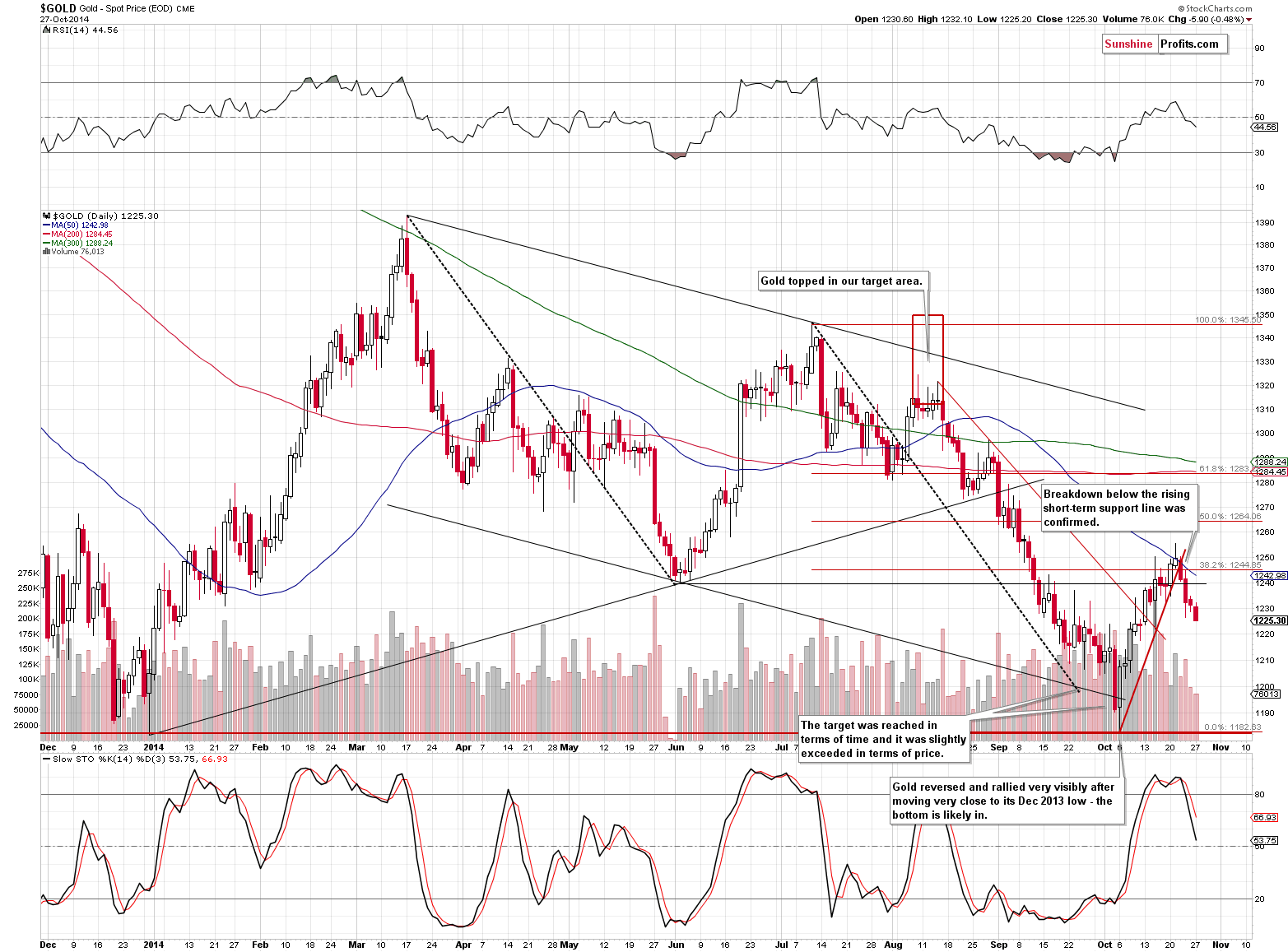

Just as the breakout above the declining short-term resistance line was more than confirmed in the case of the USD Index, the breakdown below the rising support line was more than confirmed in the case of gold. Consequently, the outlook for the short-term remains bearish.

As mentioned earlier, gold declined even though the USD Index declined as well, which serves as a bearish confirmation. Gold didn’t decline on increasing volume, though, so not all bearish signs are in place. It seems that only small short positions are justified at this time from the risk/reward perspective.

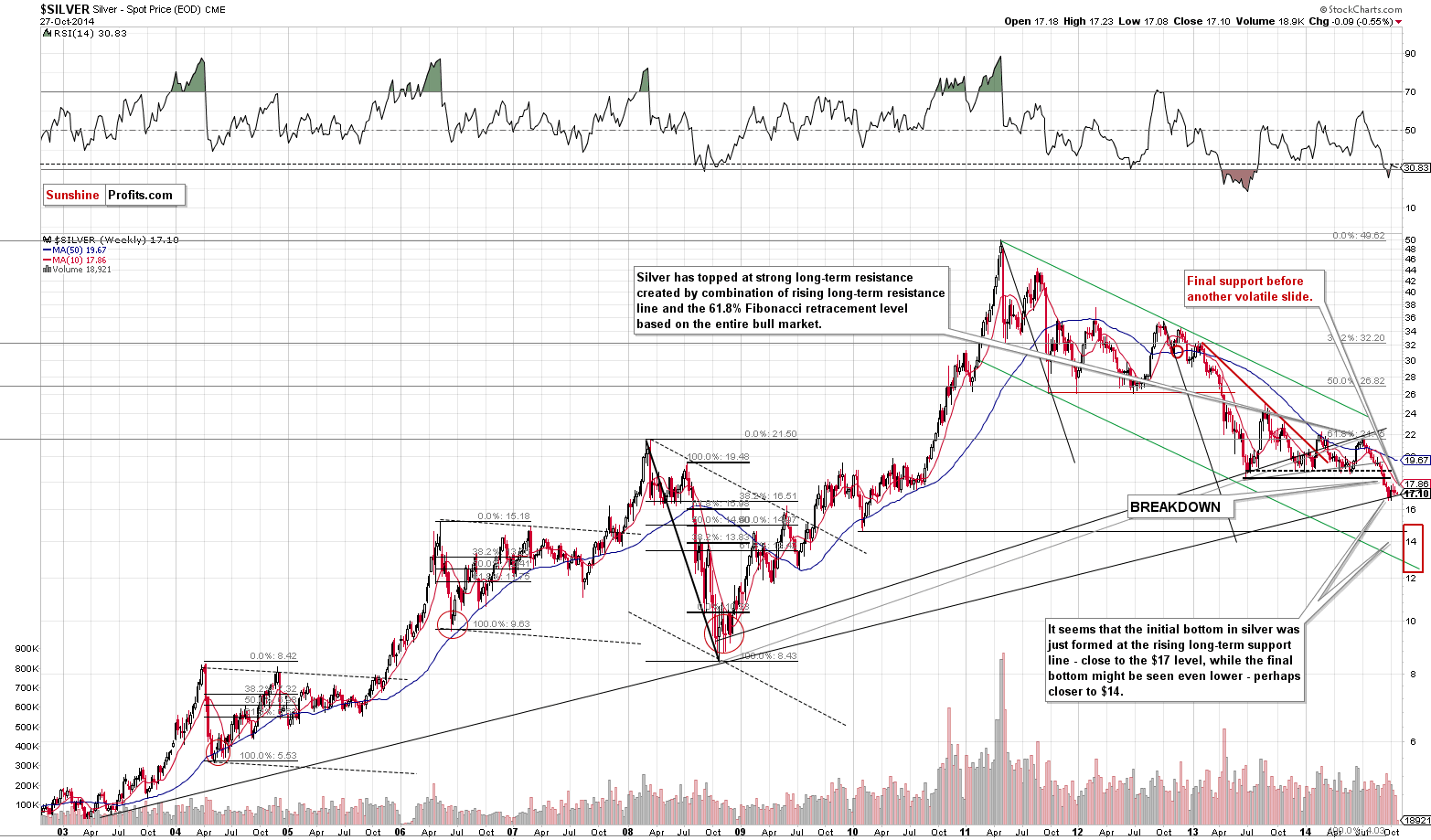

The situation in silver is quite specific at this time. The white metal is not acting strongly even though it reached an important, long-term support level and the general stock market moved visibly higher in the last several days (silver tends to take the stock market’s medium-term moves “into account”). This tells us that the final bottom had not yet been reached, only a temporary one.

Another specific issue is that there is no strong support below the current one all the way to the 2010 low – below the $15 level. This means that once silver breaks down, it’s likely to fall down in a rather sharp manner.

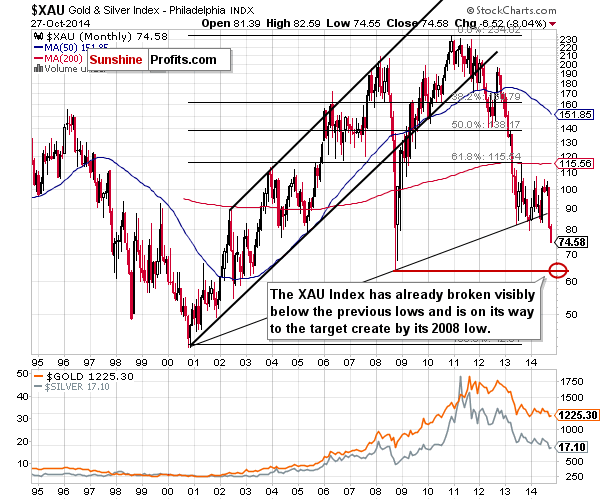

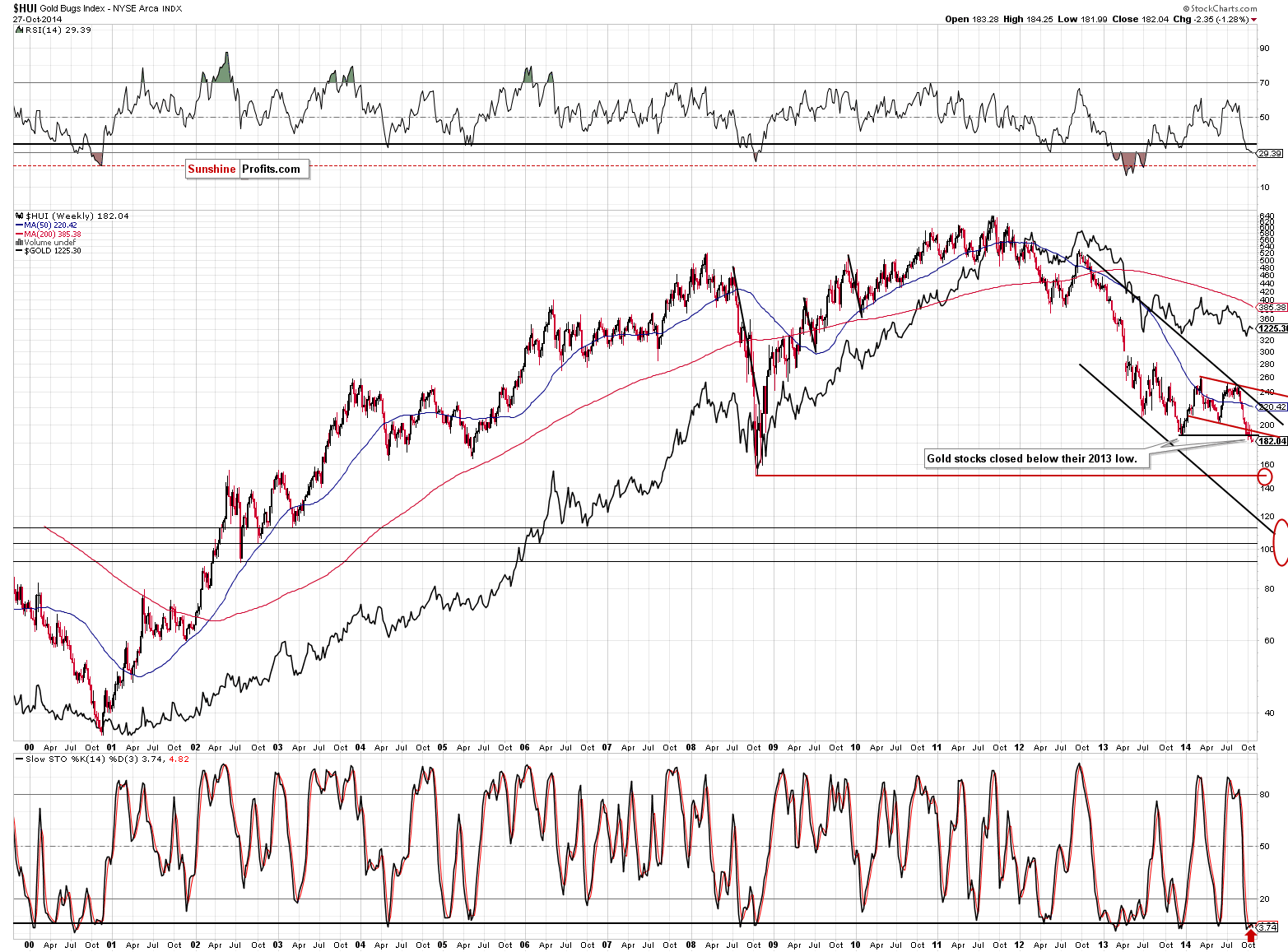

What else tells us that the decline in the precious metals market is not over? Mining stocks.

Both key indices: the HUI and XAU have broken visibly below their previous lows and seem to be ready to move much lower. We have already discussed mining stocks’ underperformance many times in the past so today we would like to emphasize the fact that the breakdown is visible from both perspectives, which increases the strength of the signal.

All in all, we can summarize the situation just as we did yesterday:

Summing up, the situation deteriorated further based on Monday’s price action and it seems that opening small short positions in the precious metals sector was a good idea (they were justified from the risk/reward perspective, and at this time remain profitable). Please note that the USD Index could still move lower – thus correcting 38.2% of the previous move up and gold could move to the support lines – more or less to the $1,260 level (even if it does, it will not invalidate the bearish outlook). However, at this time, the odds no longer favor this outcome in our opinion.

A word of caution – we are after several months of winning trades (taking all sectors into account at the same time) in a row, so it might seem that the next trade can’t go wrong. It could, as there are no sure bets in any market – at this time the situation is not crystal clear and we think that opening a position that is only half the size of the regular position is justified at this time.

We will continue to monitor the situation and report to you – our subscribers - accordingly.

To summarize:

Trading capital (our opinion):

It seems that having speculative (half) short positions in gold, silver and mining stocks is a good idea:

- Gold: stop-loss: $1,268, initial target price: $1,192 stop loss for the DGLD ETF $65.35, initial target price for the DGLD ETF $78.65

- Silver: stop-loss: $17.87, initial target price: $15.11 stop loss for DSLV ETF $57.69, initial target price for the DSLV ETF $89.22

- Mining stocks (price levels for the GDX ETF): stop-loss: $22.33, initial target price: $17.11, stop loss for the DUST ETF $21.33, initial target price for the DUST ETF $43.77

In case one wants to bet on lower junior mining stocks' prices, here are the stop-loss details and initial target prices:

- GDXJ: stop-loss: $36.23, initial target price: $25.13

- JDST: stop-loss: $9.54, initial target price: $30.56

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alert:

On Friday, crude oil lost 0.68% as concerns over a global oversupply continued to weigh. Additionally, soft U.S. housing data pushed the commodity below $82 per barrel. Will we see another test of the strength of the psychologically important level of $80?

Oil Trading Alert: Crude Oil - Sinking Or Rebounding?

=====

Hand-picked precious-metals-related links:

Barclays bullish on gold fundamentals, maintains $1,220 Q4 forecast

The next big market shock can come from 'Save Swiss gold' movement

Gold price: ETF investors cash out

=====

In other news:

First, Europe stress tests… Next, full QE?

Fears grow over QE’s toxic legacy

If oil drops to $70, what will gas cost?

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts