Briefly: In our opinion speculative short positions (half) in gold, silver and mining stocks are justified from the risk/reward perspective.

To say that not much happened on Friday is still an exaggeration – basically all markets that we usually cover closed very close to the levels at which they had closed on Thursday. However, yesterday was this kind of day when even though nothing seemed to happen, something actually changed. Something important for gold traders.

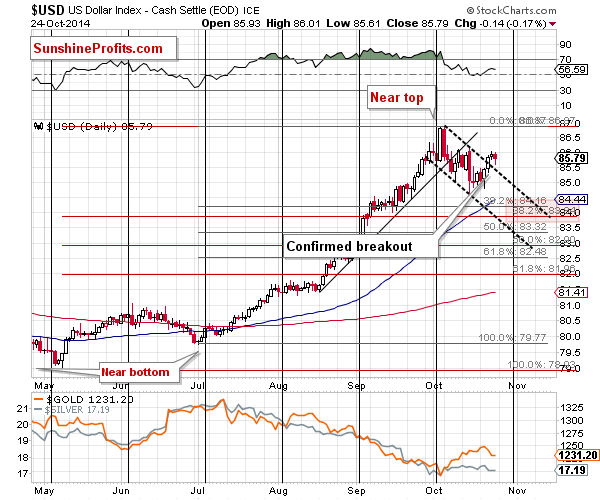

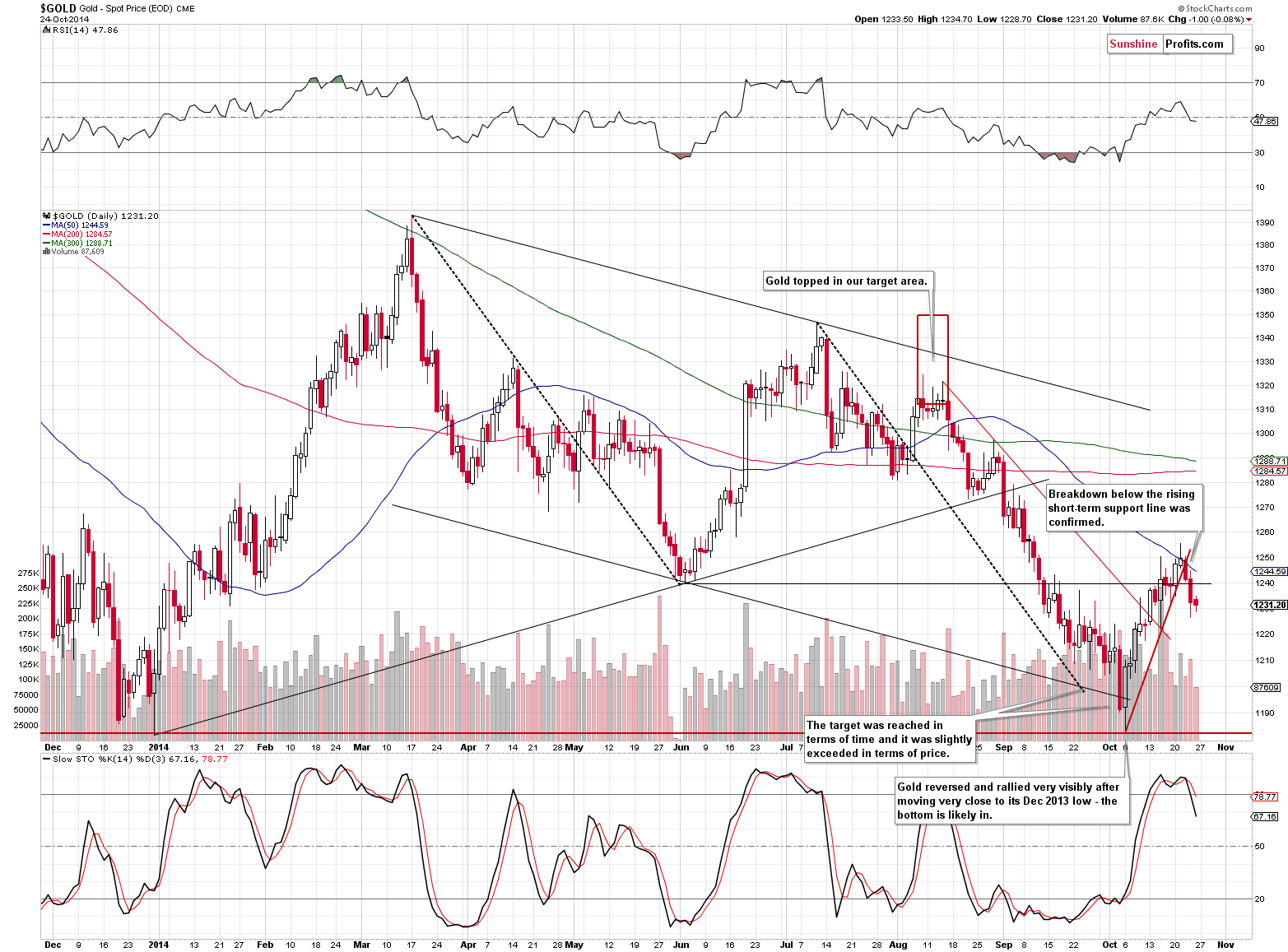

The breakdown in gold and the breakout in the USD Index were confirmed. Even though the prices didn’t change much, it was the time (the additional day) that changed the situation. By changed, we mean more bearish for gold. In today’s alert we will comment on the USD Index and gold charts as the situation on the other ones remains just as we described in Friday’s alert. We will also discuss silver’s cyclical turning point. Let’s start with the USD Index chart (charts courtesy of http://stockcharts.com).

Large part of what we wrote previously remains up-to-date:

On Wednesday we saw a small, unconfirmed breakout above the short-term declining trend channel. The USD Index stayed there on Thursday, so some traders already view this move as confirmed. However, we prefer to take the careful approach and wait for a third confirmation before saying that the breakout is really meaningful. It is more meaningful today than it was yesterday, though.

The breakout is now confirmed by 3 consecutive closes above the resistance line, so it is definitely meaningful. As always, this does not guarantee a move higher, but it made it much more probable. In fact, a move higher in the very short term is now more probable than a move lower. It now seems likely that the USD Index will move higher at least until the next cyclical turning point – meaning for another week or so.

The implications for gold and the rest of the precious metals sector are bearish.

Just as the breakout above the declining short-term resistance line was confirmed in the case of the USD Index, the breakdown below the rising support line was confirmed in the case of gold. Consequently, the outlook for the short-term is now bearish.

The situation was too unclear a few days ago to keep the long positions intact and now we see that closing the long positions early on Wednesday was definitely a good and profitable idea. The question – since the situation in gold deteriorated - is if the situation is bearish enough to open short positions.

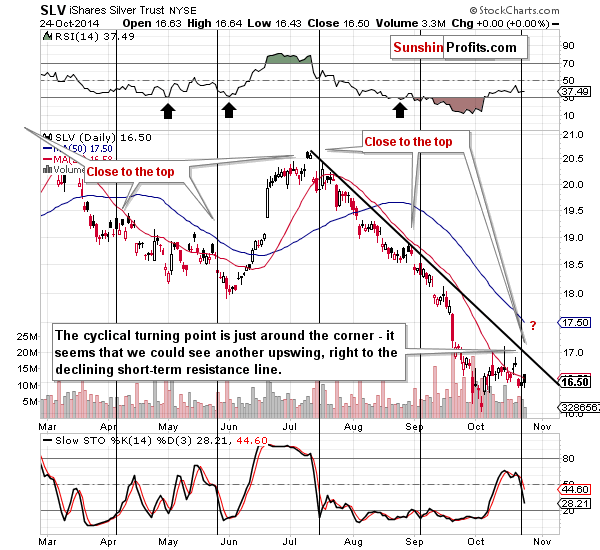

Mining stocks have not rallied, even though other stocks have, so in a way, miners are still underperforming, which confirms the bearish outlook. Silver could still rally to the declining resistance line, but given gold’s breakdown it could (it’s more likely based on gold’s confirmed breakdown) also be the case the cyclical turning point has already worked and silver’s decline last week was partially based on it.

Please note that at the previous 3 turning points local tops were seen slightly before the turning point. Consequently, the odds are that the local top is already behind us also at this time.

Summing up, the situation deteriorated further based on Friday’s price action and it seems that opening short positions in the precious metals sector might be a good idea (only small ones for now, though). The USD Index could still move lower – thus correcting 38.2% of the previous move up and gold could move to the support lines – more or less to the $1,260 level (even if it does, it will not invalidate the bearish outlook). However, at this time, the odds no longer favor this outcome in our opinion.

A word of caution – we are after several months of winning trades (taking all sectors into account at the same time) in a row, so it might seem that the next trade can’t go wrong. It could, as there are no sure bets in any market – at this time the situation is not crystal clear and we think that opening a position that is only half the size of the regular position is justified at this time.

We will continue to monitor the situation and report to you – our subscribers - accordingly.

To summarize:

Trading capital (our opinion):

It seems that having speculative (half) short positions in gold, silver and mining stocks is a good idea:

- Gold: stop-loss: $1,268, initial target price: $1,192 stop loss for the DGLD ETF $65.35, initial target price for the DGLD ETF $78.65

- Silver: stop-loss: $17.87, initial target price: $15.11 stop loss for DSLV ETF $57.69, initial target price for the DSLV ETF $89.22

- Mining stocks (price levels for the GDX ETF): stop-loss: $22.33, initial target price: $17.11, stop loss for the DUST ETF $21.33, initial target price for the DUST ETF $43.77

In case one wants to bet on lower junior mining stocks' prices, here are the stop-loss details and initial target prices:

- GDXJ: stop-loss: $36.23, initial target price: $25.13

- JDST: stop-loss: $9.54, initial target price: $30.56

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts