Briefly: In our opinion no speculative positions in gold, silver and mining stocks are justified from the risk/reward perspective. In other words, it seems that taking profits off the table is a good idea now for most investors.

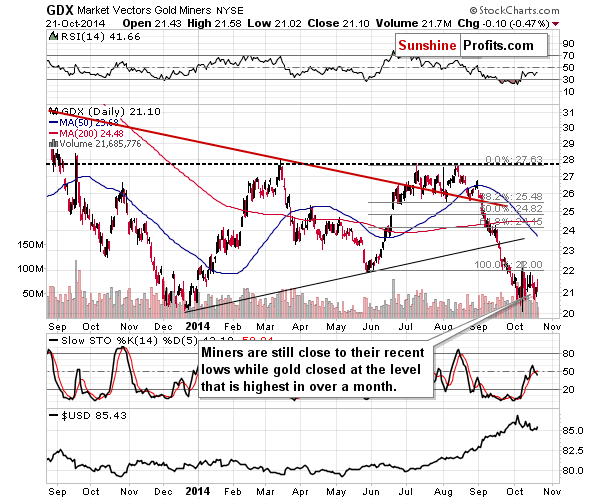

Yesterday, gold once again closed higher than it had in the previous several weeks, which seems like a very bullish development for the entire precious metals market until one realizes that miners are still close to their most recent lows. Plus, gold didn’t manage to hold well above the 50-day moving average – it declined before the market closed and ended the session more or less at it.

In short, the situation developed as we had expected it to and is similar to what we described in yesterday’s alert. We are one step closer to the local top, but most likely still not behind it.

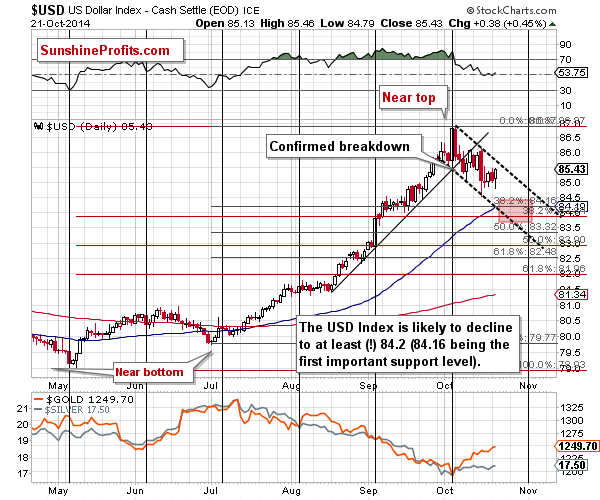

Why? The USD Index is likely not done declining and the long-term resistance lines in gold have not been reached. What we wrote about these markets yesterday, on Monday and on Friday remains up-to-date. Let’s see what happened on the short-term USD chart(charts courtesy of http://stockcharts.com).

The USD Index moved higher, but it remains in the short-term declining trend channel. Consequently, the outlook hasn’t changed and it remains bearish for the short term. The target area remains up-to-date.

The target area is relatively close in terms of both time and price. Most of the decline is probably behind us. We have previously written that we expect the USD Index to correct to the 38.2% Fibonacci retracement level and the biggest unknown is what the retracement should be based on – the May-Oct. or Jul.-Oct. rally. The former seems a bit more likely because the 38.2% based on the May-Oct. rally coincides with the 50-day moving average (blue line on the above chart).

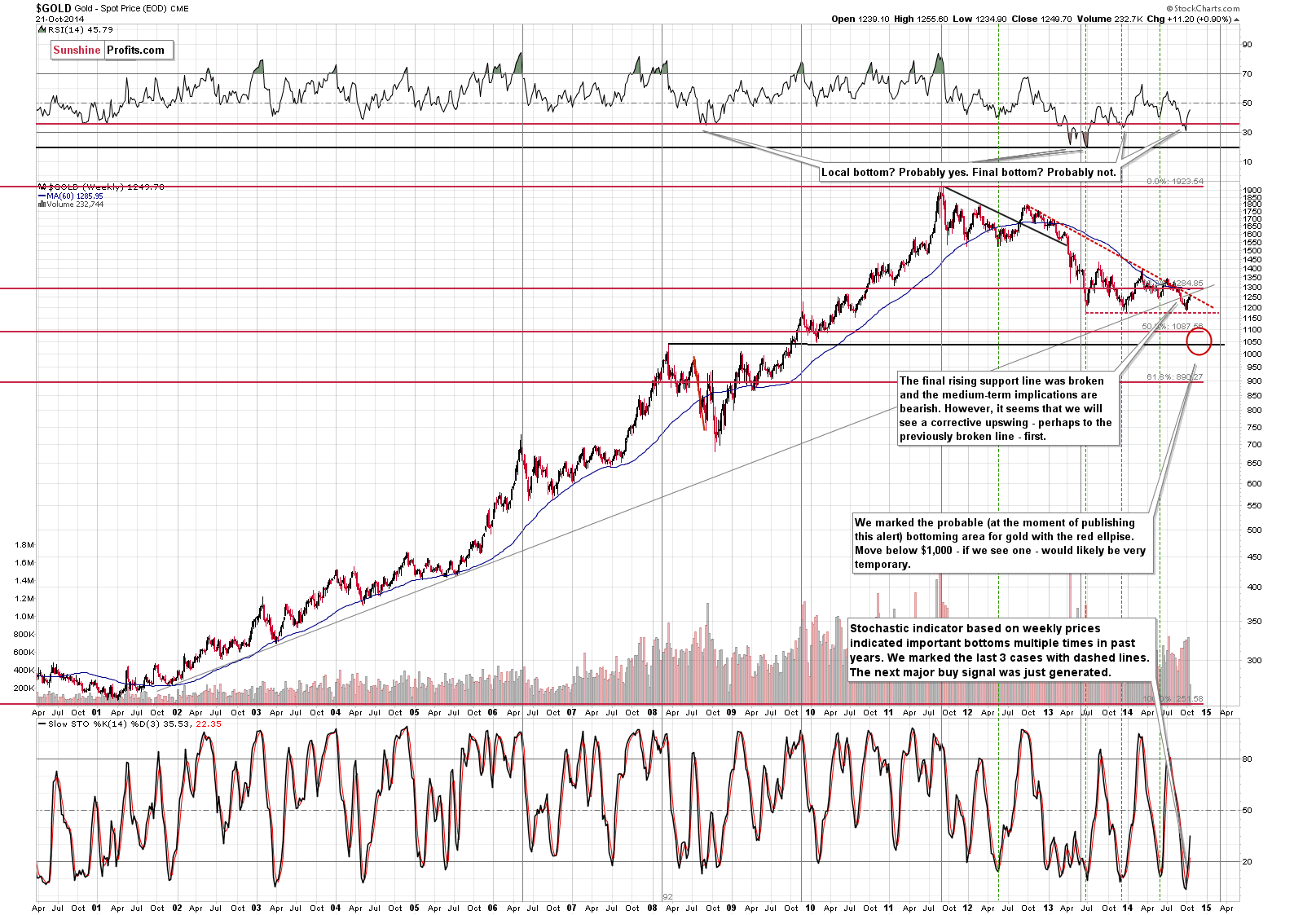

Gold moved higher yesterday and as you see on the above chat it’s very close to the resistance lines. It hasn’t reached them yet, though, so the rally is likely not over yet, but close to being over. The 50-day moving average was broken yesterday (gold closed only slightly above it, though), but this average is not as significant a resistance level as the resistance lines drawn on the above chart and definitely not as strong as their combination.

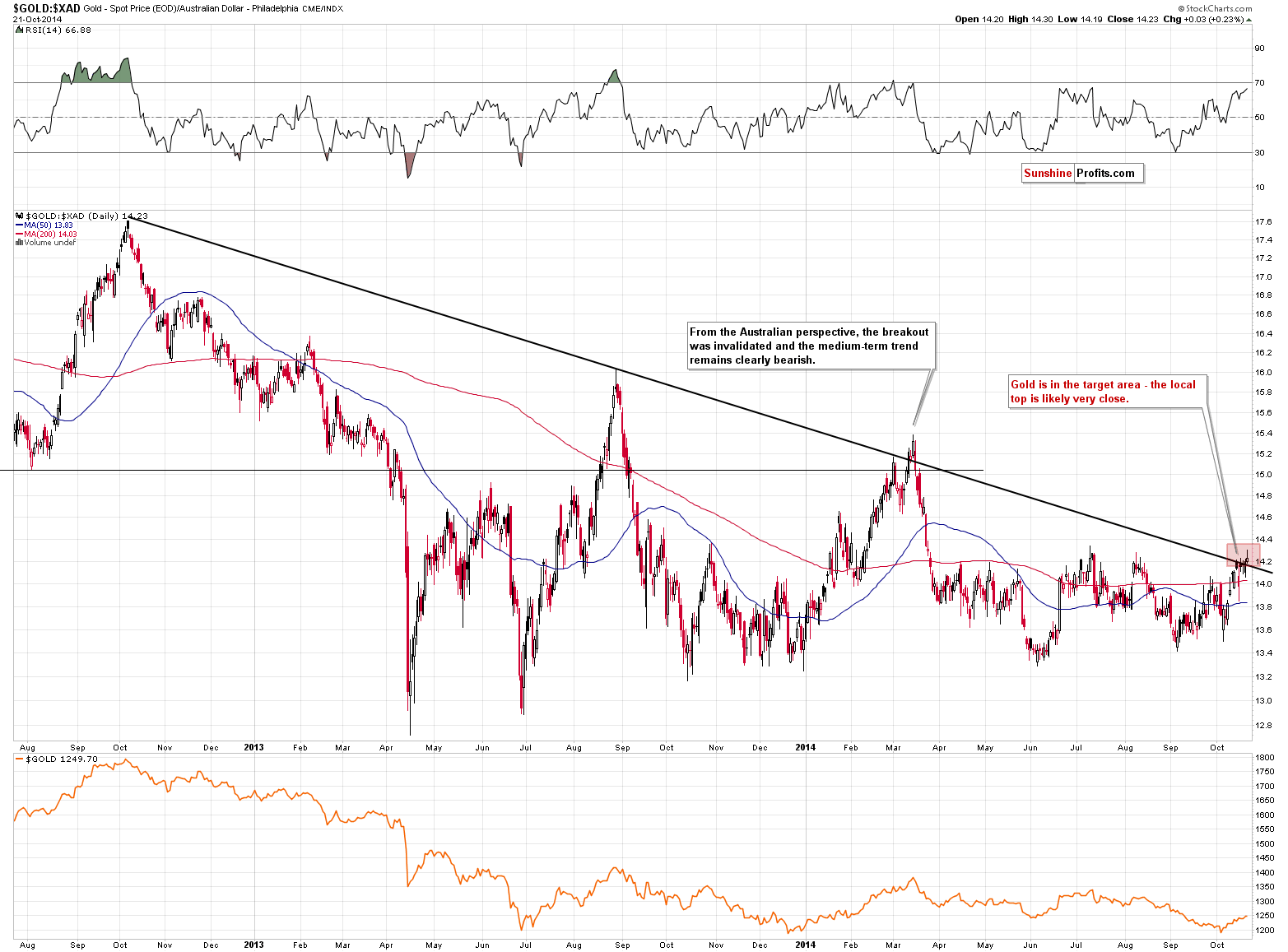

Gold seen from the Australian perspective is now above the declining resistance line, which is something that we have been expecting to accompany the next local top. Earlier this year, gold moved even higher above it before topping, so yesterday’s breakout is not a clear and immediate sell signal, but a strong suggestion that we should prepare to exit the long positions relatively soon.

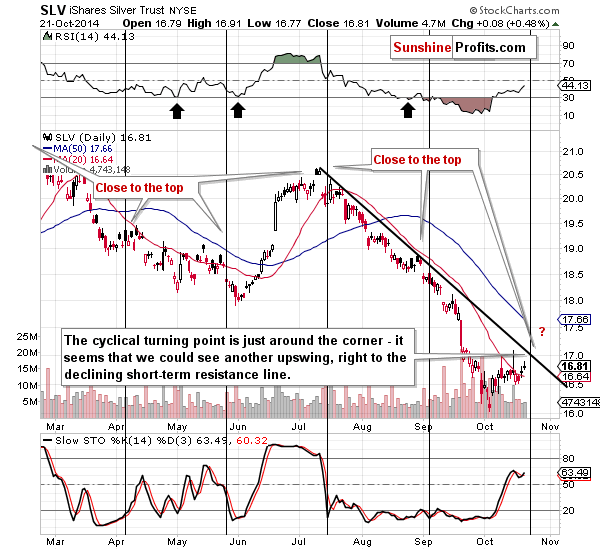

We get the same message from the short-term SLV ETF chart.

Yesterday we wrote the following:

The USD Index is not the only thing that moves in cycles. The silver market has a cyclical nature as well. The white metal is likely to turn around in the next several days, and the most recent short-term move has been up. Consequently, we are quite likely to see a local top relatively soon.

The declining resistance line is now relatively close – about $0.27 away and more or less at the previous intra-day Oct high. Consequently, we could see the local top more or less at this price level. It seems that it would quite likely coincide with gold moving to its target price.

Silver is now one day closer to the turning point and a few cents closer to the resistance line. The next local top appears to be just around the corner.

The mining stocks have once again provided us with a bearish signal. They have not only refused to rally, but they actually declined despite rising gold and a rallying stock market. This is particularly bearish given that we have seen the same signal for 3 days in a row. Friday’s lack of performance, therefore, was not an accident or a temporary phenomenon. The mining stocks’ weakness can no longer be explained by a declining general stock market (it’s not declining anymore and miners are not catching up with gold). This tells us that the miners’ weakness is the lack of strength of the precious metals sector – at least at this time and as far as short term is concerned (again, we would like to re-emphasize that we expect to see gold, silver and miners at much higher prices in the coming years).

Summing up, the situation in the precious metals market is rather complicated at this time. The USD Index “suggests” that the metals will move at least a little higher before forming a top. Gold “says” that we are very close to the top and we were just a few dollars away from it yesterday. Silver confirms the above. However, mining stocks “strongly suggest” considering short positions – not long ones. What’s a prudent way to approach this situation? It’s tempting to try to ride this rally until it’s definitely over and exit very close to the top, but let’s forget about this for a minute and consider if we would open a long position today if we hadn’t had one already, the answer is “no”. It’s too risky given the proximity of the resistance levels in gold and silver (not to mention silver’s turning point) and the underperforming mining stock sector. The potential rally that the decline in USD Index could generate doesn’t seem “certain enough” to justify betting on higher precious metals prices at this time. Consequently, it seems that closing all speculative long positions in the precious metals sector and taking profits (miners haven’t performed well recently, but thanks to diversification into longs in gold and silver, the entire trade has been profitable) off the table is a good idea now. Overall, we are getting even better prices than we got when we closed the first half of the positions.

What’s most likely to happen (our best guesstimate) is that we would see a very temporary but sharp upswing in silver (temporary move above the declining resistance line that would be followed by an even bigger decline) while gold would move toward the $1,260 level. However, betting on this taking place seems too risky at this time. If that happens, we will most likely take advantage of it by opening short positions. Still, at this time we are not 100% certain that we will do so. It seems that we will be opening the next positions relatively soon, though. As always, we will keep monitoring the situation and report to you accordingly.

To summarize:

Trading capital (our opinion): No positions

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts