Briefly: In our opinion speculative long positions (full) in gold, silver and mining stocks are justified from the risk/reward perspective.

Gold, silver and mining stocks moved higher yesterday as the USD Index declined. The price action was not unexpected, but since gold reached its May/June high on high volume (and reversed), it’s natural to ask oneself if the top is now finally in.

In our view, the answer to this question is: almost. Today’s alert will be rather short, but it seems that the 2 points that we make in it are the key issues that one has to take currently into account (charts courtesy of http://stockcharts.com).

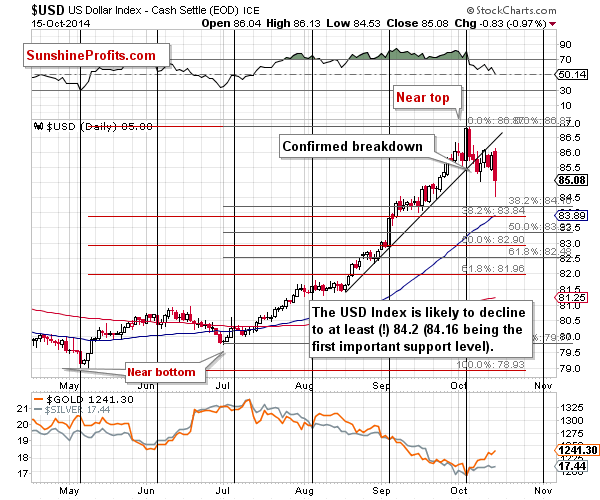

Firstly, the USD Index moved lower but not low enough. It would still need to move lower in order to reach even the highest of the short-term Fibonacci support levels. Consequently, it seems likely that it will decline further – at least to 84.2 or so.

As far as targets are concerned, our previous comments on the USD Index remain up-to-date:

How low can the USD Index move during the corrective downswing? It could decline to 82 (81.96 is the 61.8% Fibonacci retracement based on the May - October rally), but the decline could end as soon as the USD reaches 84.2 or so (84.16 is the 38.2% Fibonacci retracement based on the July – October rally). Either way, the USD Index is quite likely to decline at least by additional 1.4 index points, which is quite a lot. Even if the USD declines to 84.2 and bottoms, this decline would still be likely to trigger a bigger upswing in the precious metals sector.

Why? Because gold, silver, and mining stocks are negatively correlated with the dollar in the short term.

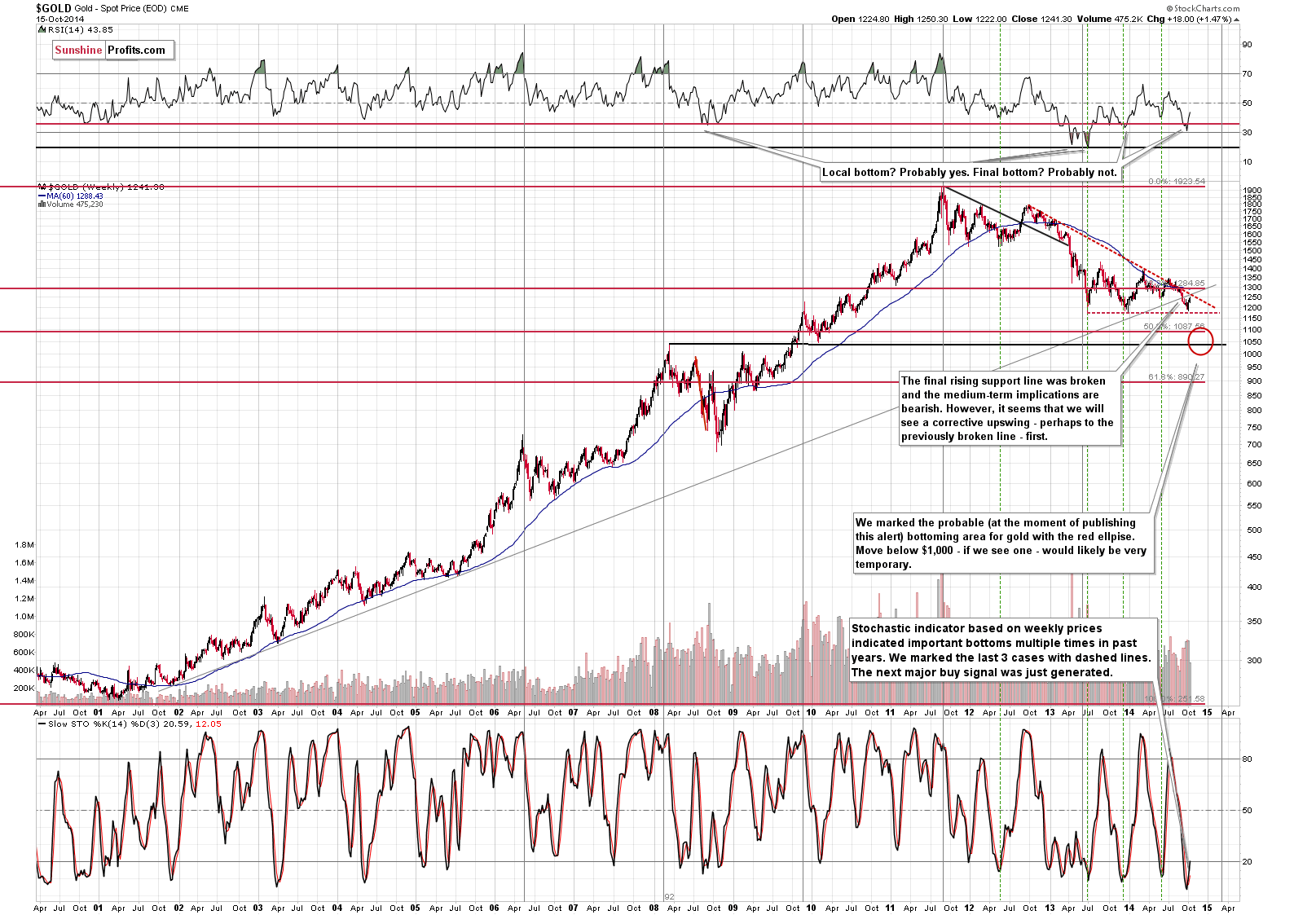

Secondly, gold moved to our initial target at $1,250, but since the USD likely hasn’t bottomed yet, we can expect gold to move higher, at least until it reaches the combination of resistance lines. The lines intersect at approximately $1,260, and we can’t rule out a temporary move above this level (just like it was the case in the first week of July). At this time it seems likely that most of the rally is behind us but that it’s not completely over just yet.

In our opinion, it’s justified, from the risk/reward point of view, to place exit orders for the speculative long positions at the previously-mentioned initial target levels for silver and mining stocks, and place an exit order for gold at $1,257 (in other words, we aim to make the current profits from this trade even bigger).

Now, in the case gold moves to $1,257, it would seem a good idea to exit long positions in silver and mining stocks regardless of what levels they are at. The reason is that from that perspective betting on higher prices would simply seem too risky given the smaller upside potential (in the short term).

As always, we will keep you – our subscribers – updated and informed.

To summarize:

Trading capital (our opinion):

It seems that having speculative (full) long positions in gold, silver and mining stocks is a good idea:

- Gold: stop-loss: $1,172, exit order: $1,257, stop loss for the UGLD ETF $11.29, initial target price for the UGLD ETF $13.75

- Silver: stop-loss: $16.47, exit order: $18.07, stop loss for USLV ETF $23.94, initial target price for the USLV ETF $31.73

- Mining stocks (price levels for the GDX ETF): stop-loss: $19.94, exit order: $23.37, stop loss for the NUGT ETF $18.25, initial target price for the NUGT ETF $28.99,

In case one wants to bet on higher junior mining stock ETFs, here are the stop-loss details and initial target prices:

- GDXJ stop-loss: $28.40, exit order: $37.14

- JNUG stop-loss: $6.19, exit order: $16.34

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts