Briefly: In our opinion speculative long positions (full) in gold, silver and mining stocks are justified from the risk/reward perspective.

Gold didn’t do much yesterday (gold stocks even rallied), but the yellow metal declined in today’s pre-market trading before rallying just before the open. Was it nothing more than just a pause or are there more declines on the horizon?

In short, in our opinion, we have likely seen a very local top but likely not the final top for the current short-term upswing. Generally, the situation hasn’t changed in any of the markets that we featured yesterday, so today’s alert will to a big extent be a repeat of the yesterday’s one. Here’s why (charts courtesy of http://stockcharts.com).

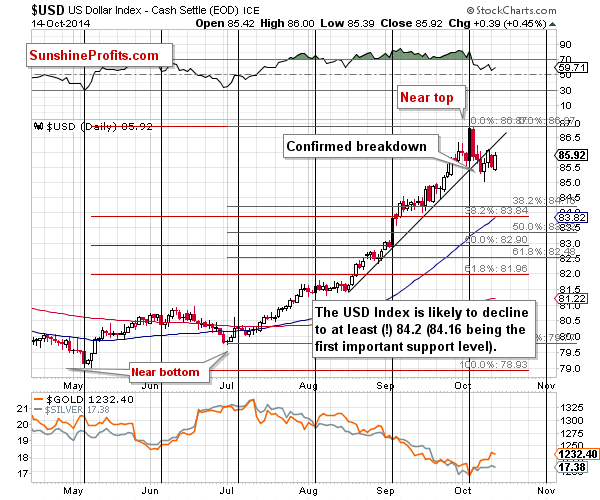

The USD Index moved to the rising support/resistance line, but not above it. The breakdown, therefore, was not invalidated and we can expect the USD Index to move lower in the near future (not necessarily immediately, though).

As far as targets are concerned, our previous comments on the USD Index remain up-to-date:

How low can the USD Index move during the corrective downswing? It could decline to 82 (81.96 is the 61.8% Fibonacci retracement based on the May - October rally), but the decline could end as soon as the USD reaches 84.2 or so (84.16 is the 38.2% Fibonacci retracement based on the July – October rally). Either way, the USD Index is quite likely to decline at least by additional 1.4 index points, which is quite a lot. Even if the USD declines to 84.2 and bottoms, this decline would still be likely to trigger a bigger upswing in the precious metals sector.

Why? Because gold, silver, and mining stocks are negatively correlated with the dollar in the short term.

Please note that USD has still not moved to even the highest of these target levels, so the bottom in the USD Index is likely not yet in.

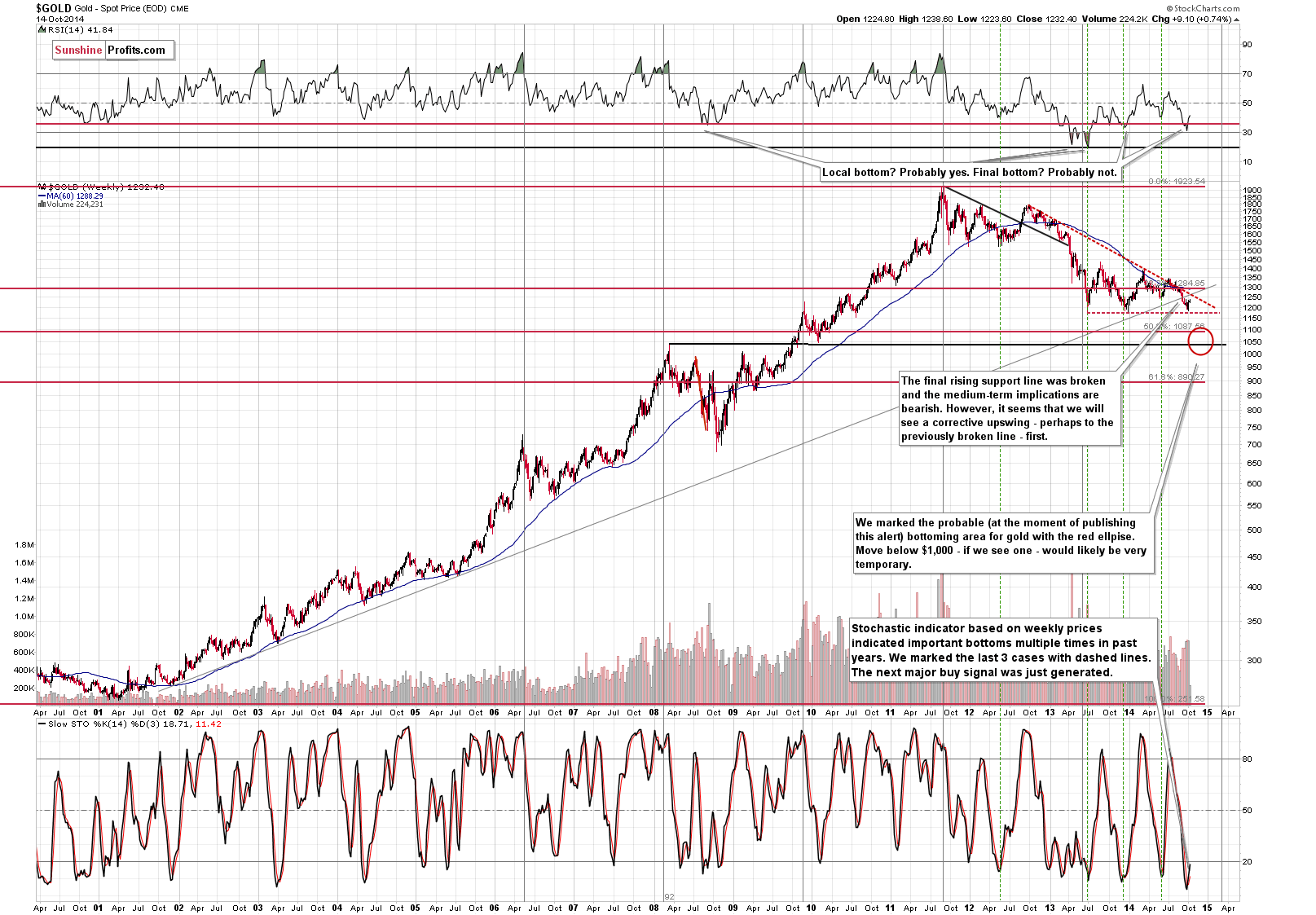

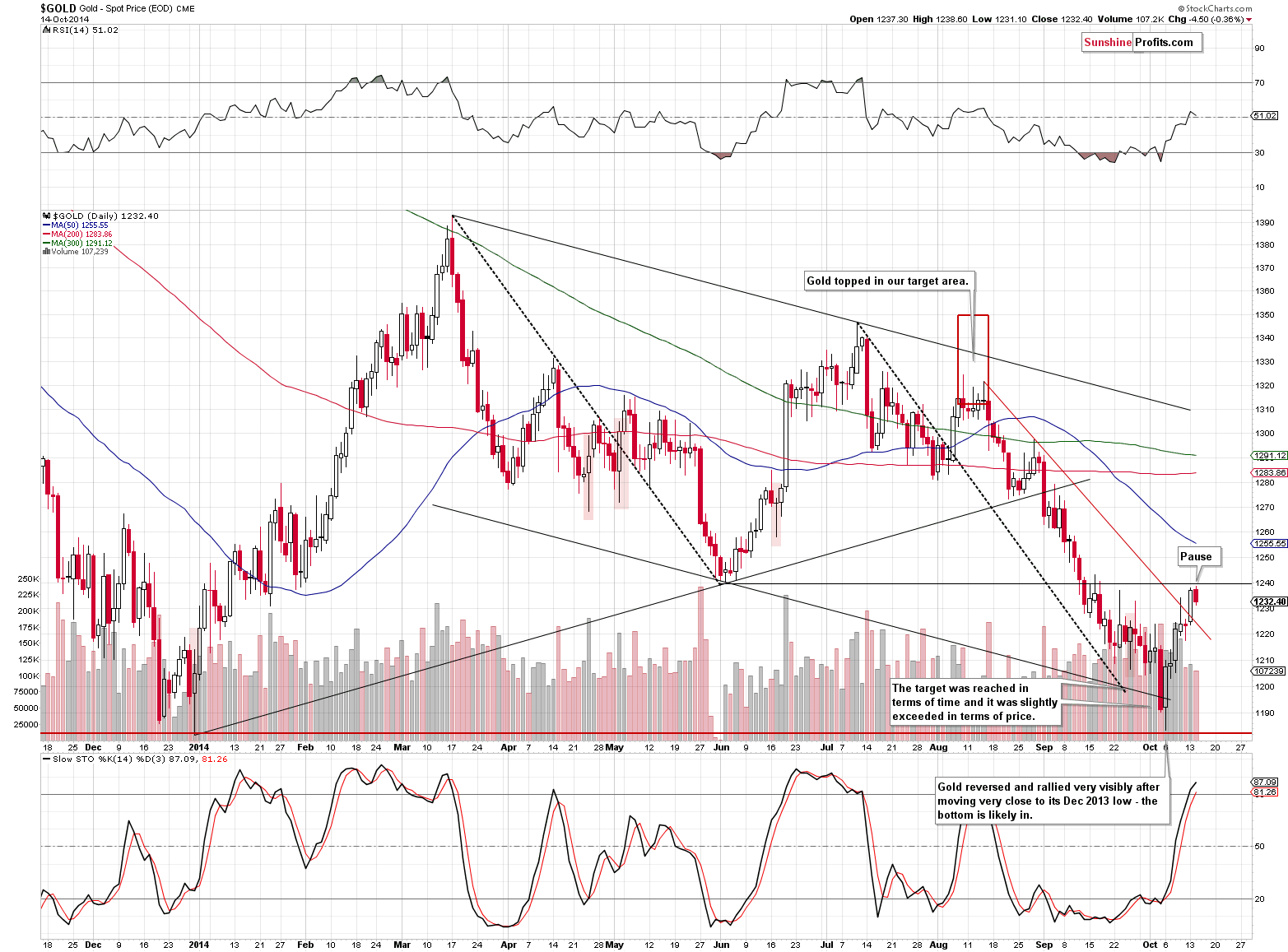

Having said that, let’s take a look at the yellow metal. Again, our previous comments remain up-to-date, as gold moved higher yesterday, but not high enough to reach our price target:

In our opinion, it’s quite likely to rally to the combination of resistance levels: the long-term rising (grey) line and the declining red dashed line. These lines intersect just a little above the $1,250 level, so it seems to makes sense to expect the next local top to form there. Please note that this is based on the information that we have available today. It will be crucial to monitor the USD Index and its link with gold to determine whether a top is indeed being formed or not. If we don’t see bottoming action in the USD Index, but gold reaches the above-mentioned resistance levels, it might not be the final top for gold. We will keep our eyes opened and report to you accordingly.

On a short-term basis, we shouldn’t be surprised that we are seeing a small pause – gold moved very close to its May/June lows. The long-term picture and resistance levels are more important and more likely to stop the rally, than the May/June low. Let’s keep in mind that the USD Index is probably not done declining, so there should be some upside pressure in the near future.

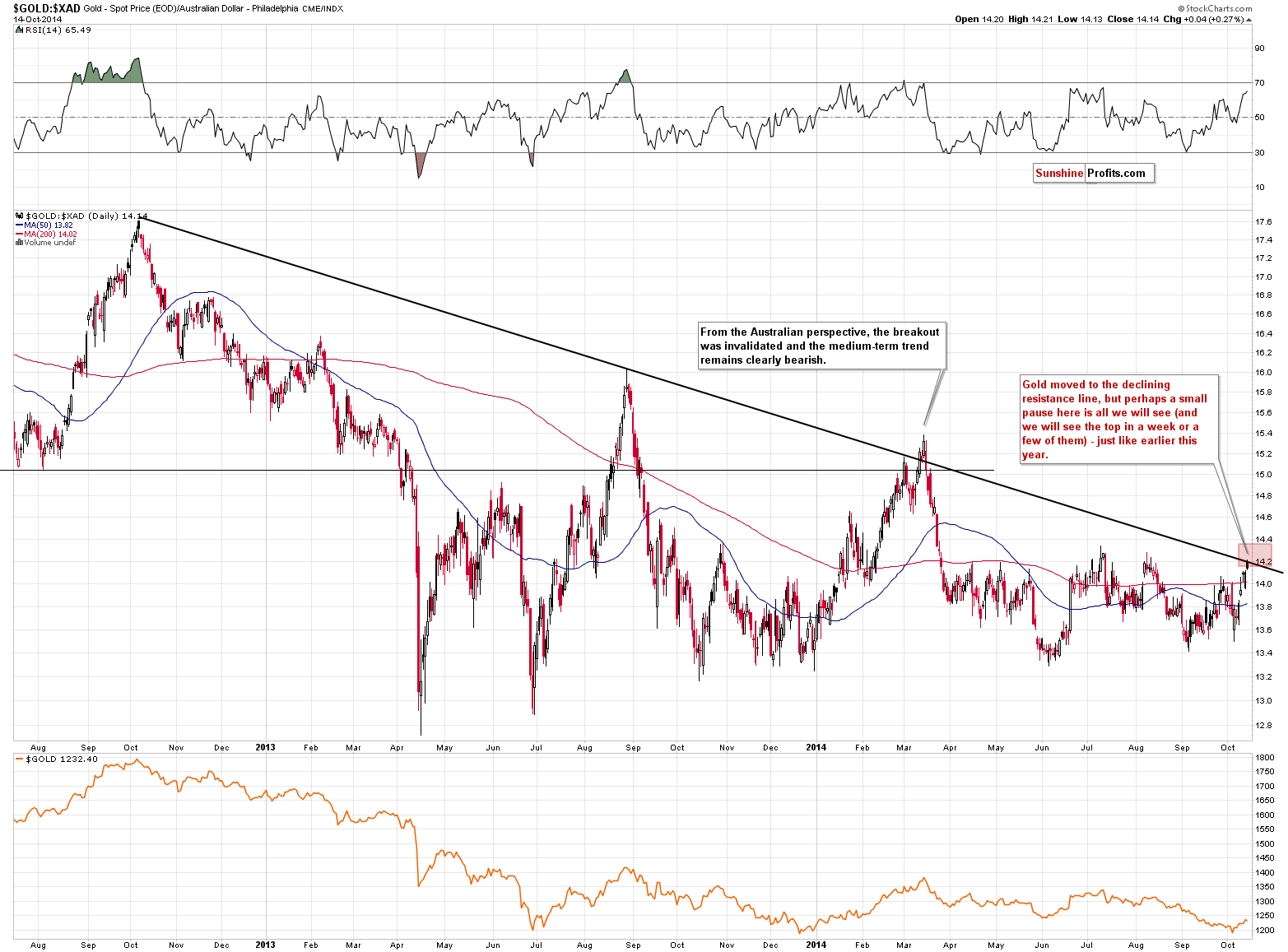

In Friday’s alert (we suggest that you read it in case you haven’t had the chance to do so yet) and in the following alerts, we commented on gold’s price seen from the Australian perspective.

We wrote the following:

When we take a look at gold priced in the Australian dollar, we see a rather straightforward picture. There is a big declining resistance line that might stop or delay any rallies. At least, that’s been the case so far this year. To be precise – in March, gold moved slightly above this line, but it plunged shortly thereafter. In case history rhymes also this time, we drew the target area at and slightly above the declining resistance line. Either way, it’s rather close, so we are quite likely to see a pause or top rather soon.

Gold moved to the declining resistance line, but it doesn’t seem that the rally is over because the USD Index has not declined enough so far. Please note that the earlier in 2013 this line was also reached, but all it generated was a small pause before the final top – it seems likely that we are seeing this type of action once again.

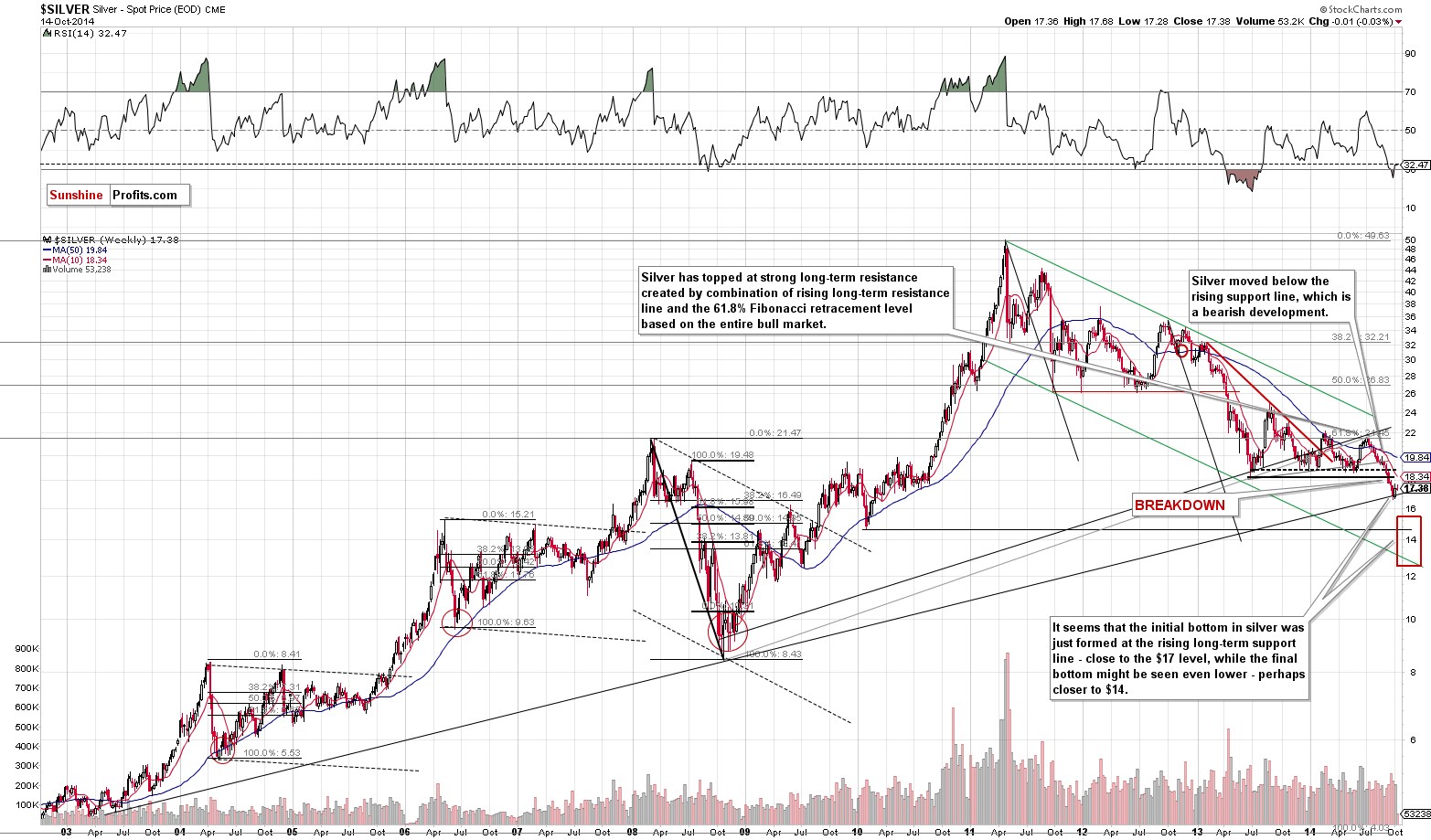

The situation in silver is also unchanged from what we saw and wrote previously and our previous comments remain up-to-date:

As you can see on the above chart, the situation in silver hasn’t changed much recently. The white metal seems to have bottomed at the long-term rising support line and the correction seems to be under-way. How high is silver likely to move before it declines once again? It’s a particularly tough call in case of this part of the precious metals sector as it can be, and is, very volatile at times, however, it seems that it could move to its 2013 low or the previous 2014 lows. Consequently, $18 - $18.50 is our target area based on the information that we have available today. Just as it is the case with gold, it will be crucial to consider the situation in the USD, before making trading / investment decisions regarding silver.

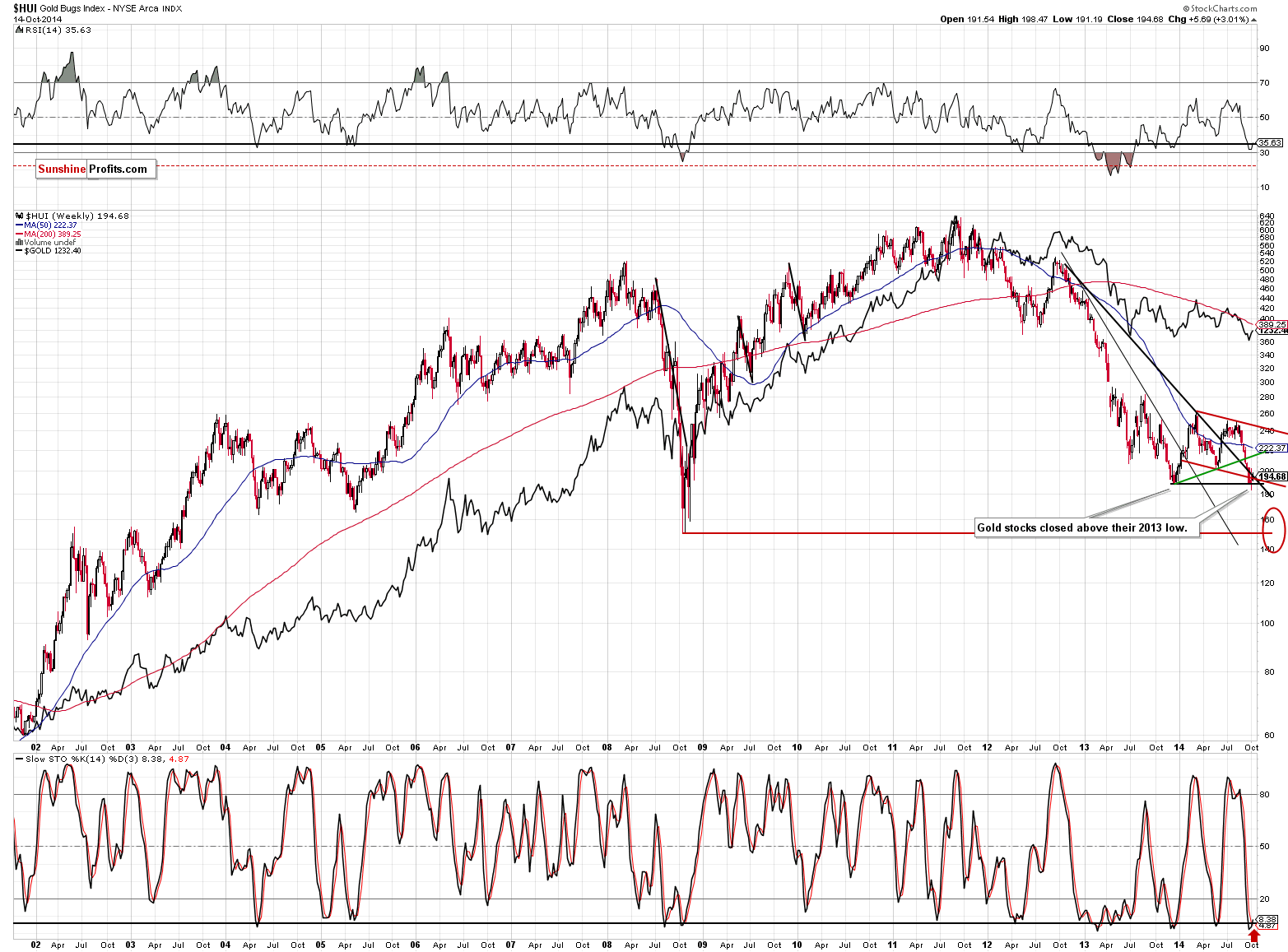

Gold stocks moved higher yesterday even though gold didn’t. The likely reason is the link between the general stock market and gold stocks on which we commented recently. Yesterday, the main stock indices closed more or less where they had closed on the previous day – without an additional daily decline. Without the stocks’ “help” gold stocks managed to catch up with gold (to a small extent, but still). It seems likely that the “catch-up effect” will be even stronger when stocks rally visibly.

How high can the HUI Index go (before moving lower again) based on the information that we have today? To approximately 213-215, in our opinion. That’s where the rising, green support line is. Again, the above could change and we will keep you – our subscribers – informed.

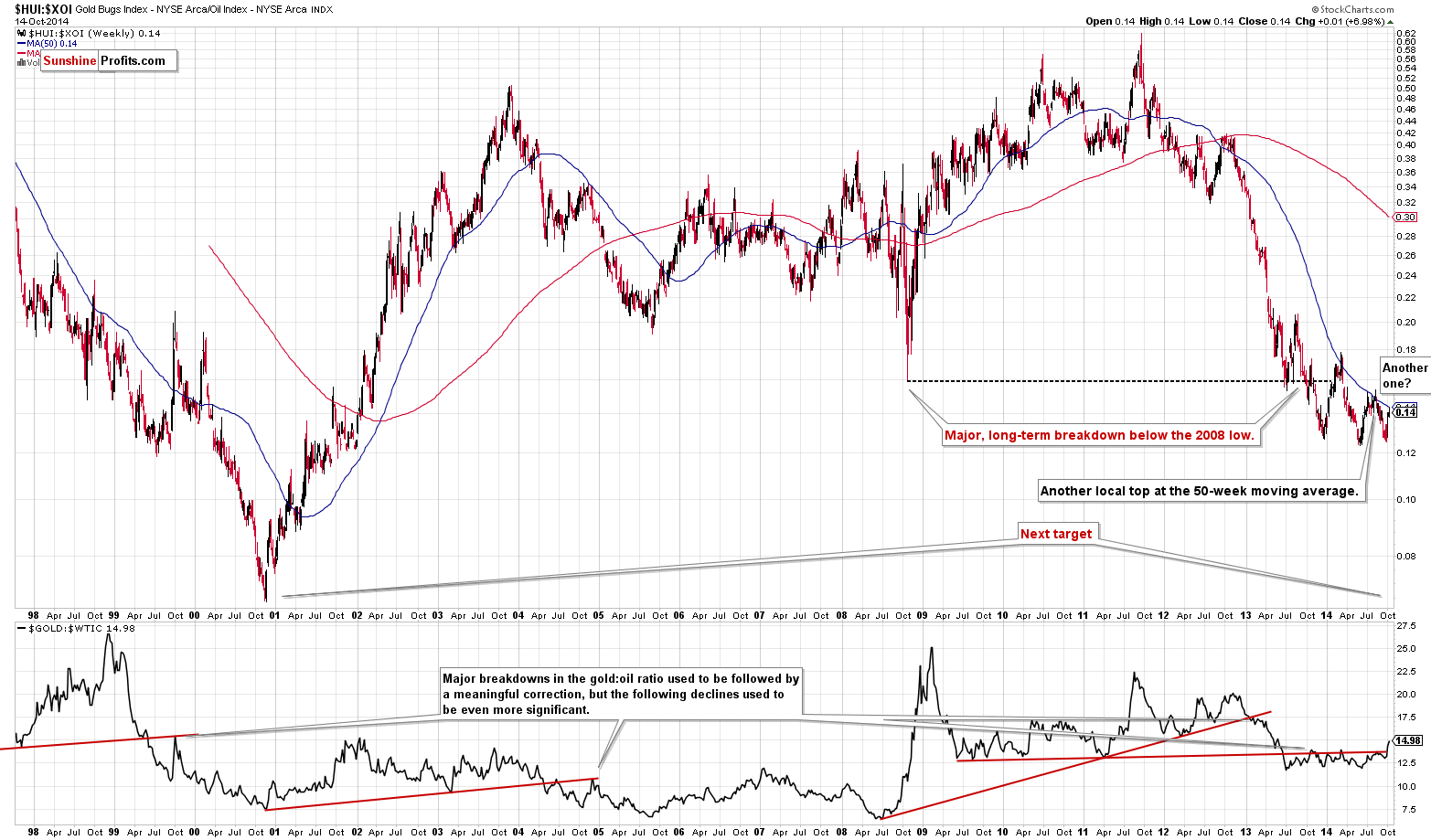

Before summarizing, we would like to show you one additional chart – the one featuring the ratio between gold stocks and oil stocks.

The ratio has one again moved to its 50-week average, which suggests that a local top is close. The last 2 major tops of 2014 in the ratio were formed when it moved a bit above the moving average. In both cases there were also initial tops that were not the final ones. We might have just seen the “initial top” in the ratio and a “very local one” in the precious metals sector. In other words, based on the above chart, we could see a very small decline (perhaps we have already seen it in today’s pre-market trading), but it doesn’t seem that the short-term upswing is already over.

Overall, we can summarize the situation in the precious metals market in the same way as we previously did:

Summing up, it seems that the corrective downswing in the USD Index and the corrective upswing in the precious metals market are underway. In our opinion, it seems to be a good idea to use speculative capital to profit from these moves. Today’s alert features our estimations of where the next local tops might be in gold, silver and mining stocks, but there are still quite a few unknowns, especially in the case of the USD Index. The price targets that we provide below are “initial” meaning that they are based on our estimations at this time. We will monitor the situation and will let you – our subscribers – know (we will send a confirmation) when we think it’s a good idea to exit the current long position and take profits off the table.

A lot of money had been saved by staying out of the precious metals market in the past months with one’s long-term investments (that is if one followed our suggestions; details below), and additional gains have been made on the recent speculative short positions. The corrective upswing that we are already seeing will likely provide additional profits from the trading capital.

As always, we will keep you – our subscribers – updated and informed.

To summarize:

Trading capital (our opinion):

It seems that having speculative (full) long positions in gold, silver and mining stocks is a good idea:

- Gold: stop-loss: $1,172, initial target price: $1,249, stop loss for the UGLD ETF $11.29, initial target price for the UGLD ETF $13.56

- Silver: stop-loss: $16.47, initial target price: $18.07, stop loss for USLV ETF $23.94, initial target price for the USLV ETF $31.73

- Mining stocks (price levels for the GDX ETF): stop-loss: $19.94, initial target price: $23.37, stop loss for the NUGT ETF $18.25, initial target price for the NUGT ETF $28.99,

In case one wants to bet on higher junior mining stock ETFs, here are the stop-loss details and initial target prices:

- GDXJ stop-loss: $28.40, initial target price: $37.14

- JNUG stop-loss: $6.19, initial target price: $16.34

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts