Briefly:In our opinion speculative long positions in gold, silver and mining stocks are justified from the risk/reward perspective.

Yesterday, we finally saw some strength in the precious metals sector. Moreover, we saw it without a decline in the USD Index, which is a positive sign. Will gold, silver, and mining stocks soar once the USD finally declines? When could this happen? Actually, very soon, but – as we have written previously, the coming rally is not likely to be the start of the next big move, but rather a corrective upswing.

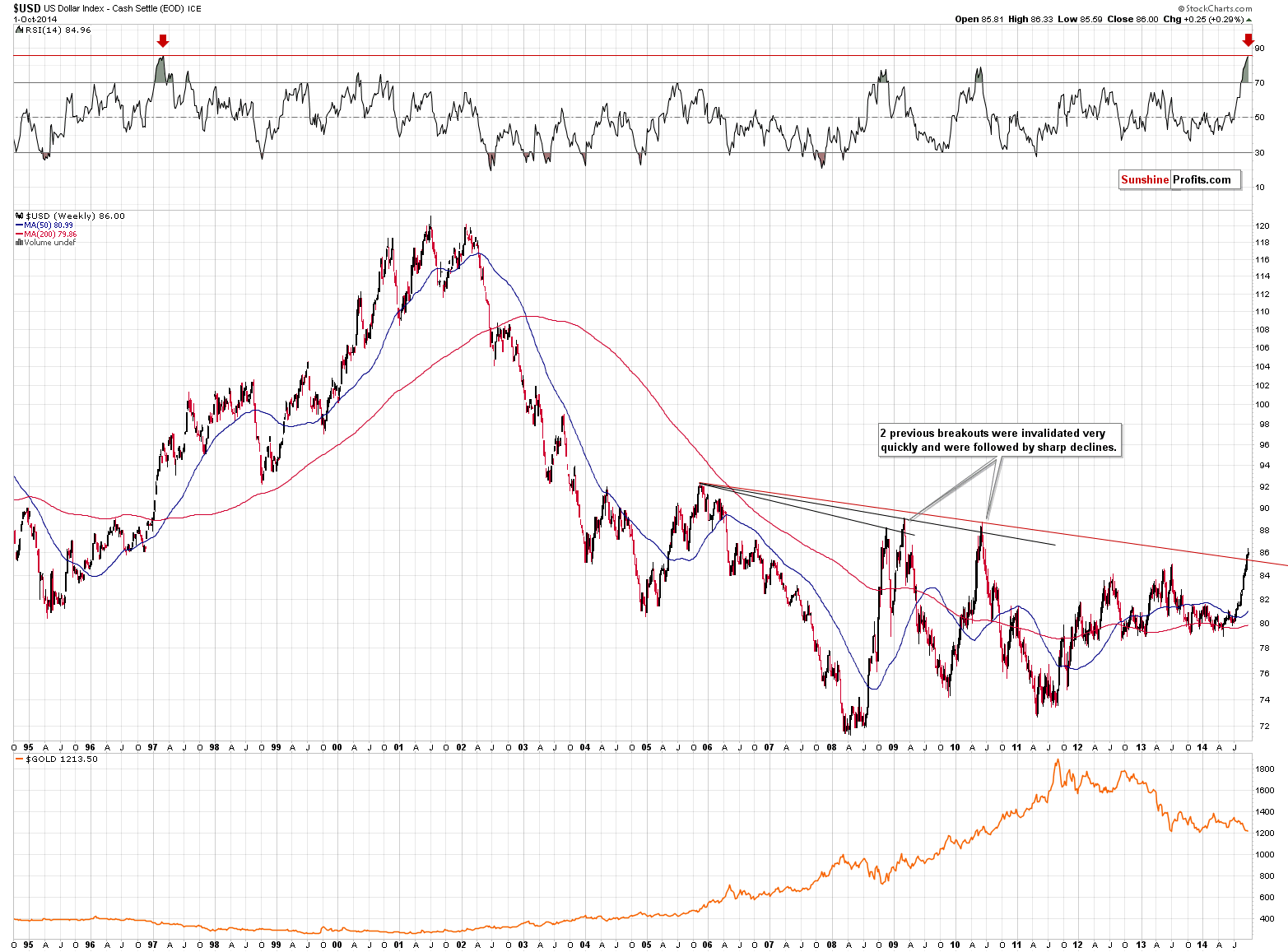

Let’s start today’s alert with the USD Index (charts courtesy of http://stockcharts.com). First of all, we think that it’s important to keep the long-term perspective in mind.

Our previous comments remain up-to-date and the implications remain in place:

From the monthly perspective (and when you take a look at the above chart without enlarging it), the breakout is rather small. Enlarging the above chart, however, reveals that the breakout is indeed visible and similar to the previous 2 “breakouts.” The key thing here is that both previous breakouts above lines based on the 2005 high were followed by invalidations and sharp declines. That’s quite a good reason not to be bullish at this time or excited about the breakout.

There’s also another – perhaps even more important – interesting fact about the above perspective. The RSI indicator is at its 20+-year high. In other words, the sharpness of the most recent rally and absence of corrections have caused the USD Index to be extremely overbought from the medium-term perspective. We have been expecting the rally in the USD Index to be significant and we wrote on multiple occasions that given the long-term breakout that we saw over a year ago, the surprises would be to the upside, but no market could move in only one direction without periodical corrections. The RSI indicator tells us that such a correction is likely just around the corner.

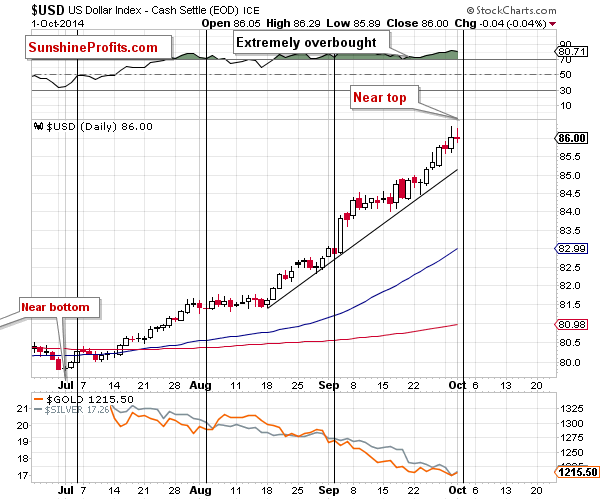

From the short-term perspective, we see that the USD Index didn’t move higher yesterday (except for the intra-day attempt) and the move was rather small. The cyclical turning point is today, so it’s highly likely that we will see a turnaround today or very soon.

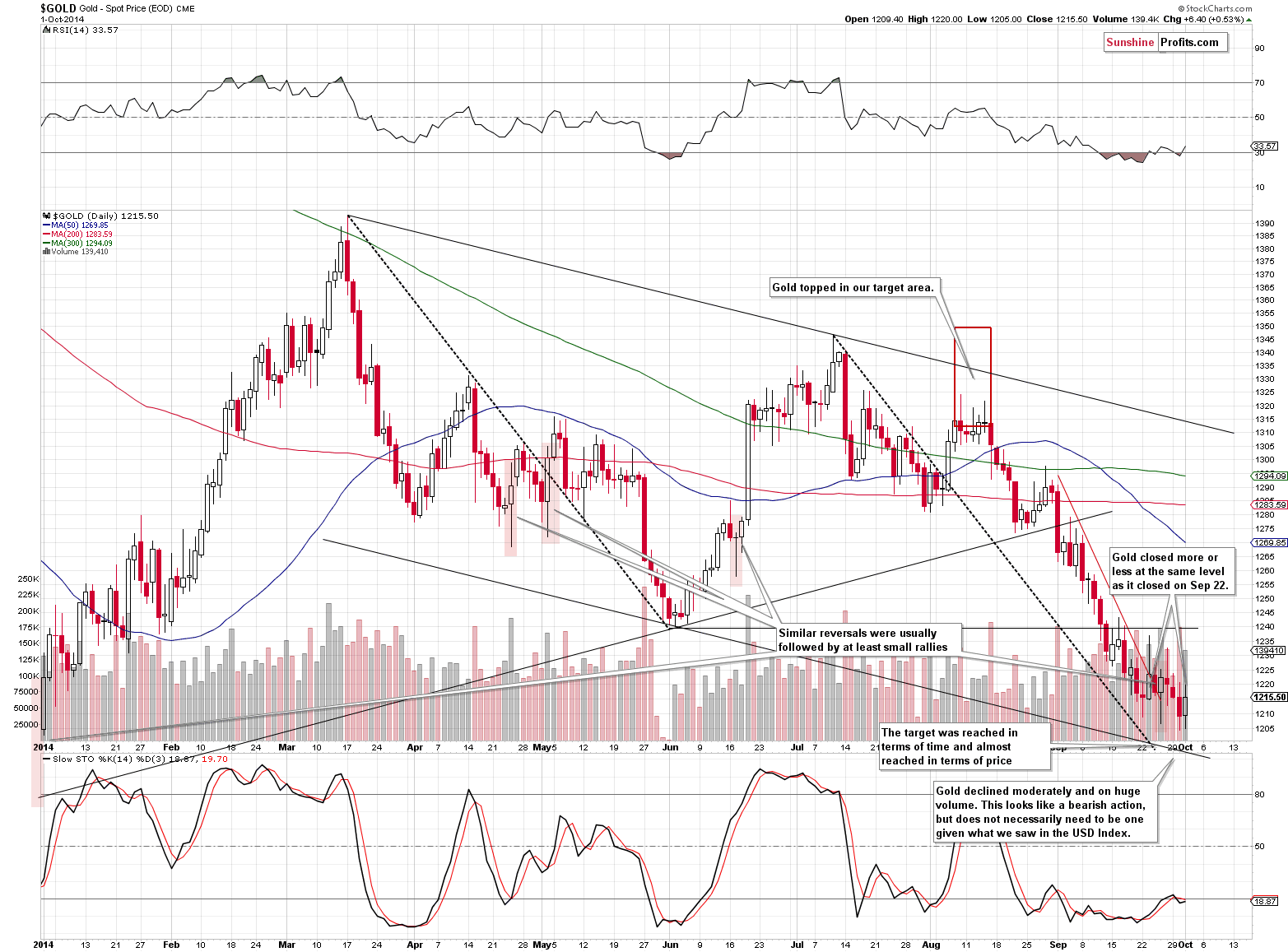

What has gold done given the lack of movement in the USD Index yesterday? The same thing that it’s been doing in the past several days – it showed strength. Gold moved higher. The situation in which gold either moves higher (if the USD doesn’t rally) or moves a little lower, but not significantly lower (if the USD rallies) creates a bullish outlook. The odds are that gold will rally significantly as soon as the USD finally declines.

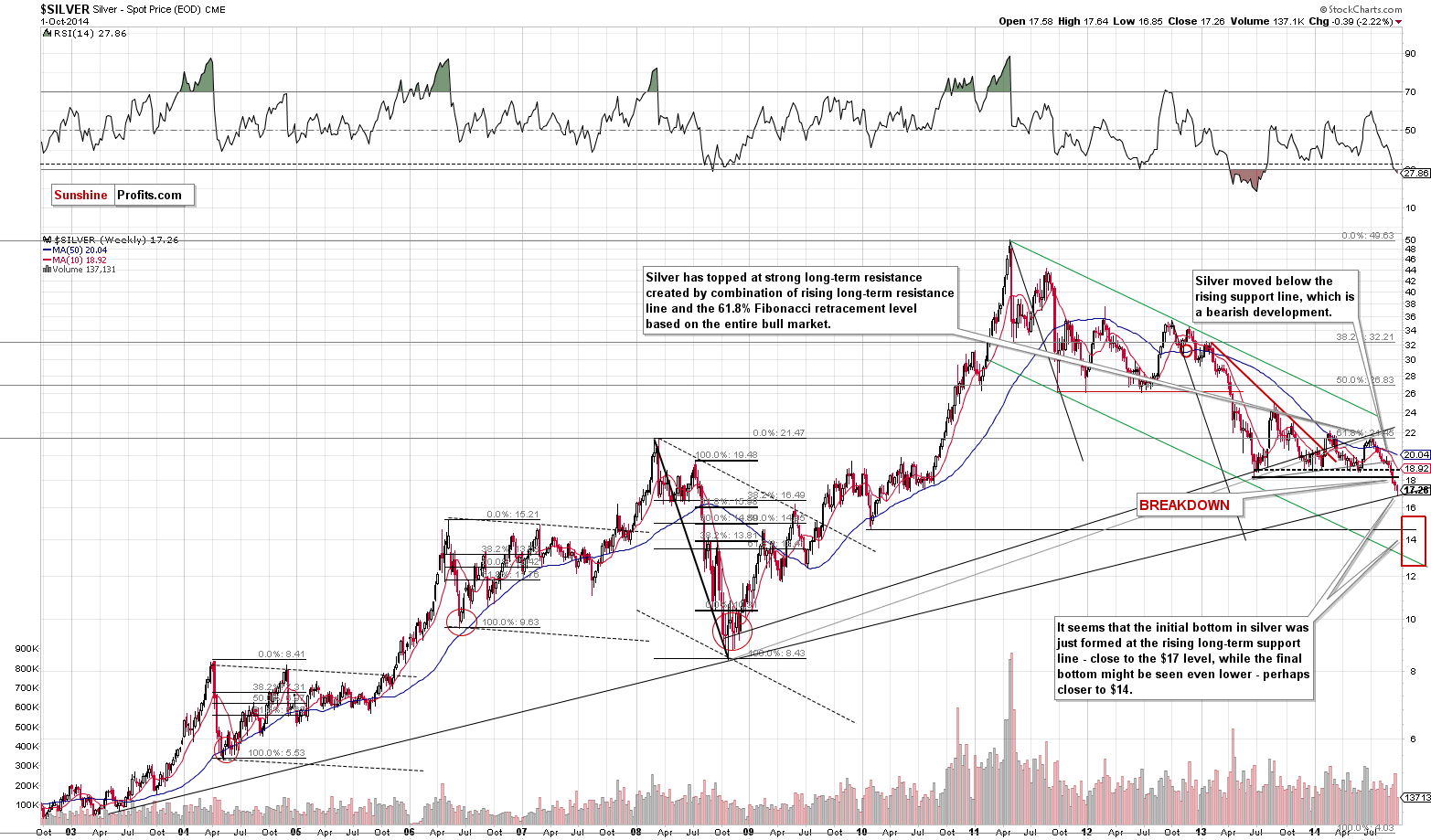

Silver moved a bit higher, which was something that we had expected based on the long-term support line being reached. Naturally, it doesn’t seem that the short-term rally is over at this time.

[As a reminder,] silver declined to the very long-term and very strong support line (the one based on the 2003 and 2008 lows). That’s the last of the strong support levels that prevents silver from truly plunging – perhaps below $15.

Since silver is oversold on a short- and medium-term basis, it seems that a corrective upswing here is very likely.

Please note that the RSI indicator is at the level that marked a major bottom in 2008 and in 2012 – a move higher seems justified also from this perspective.

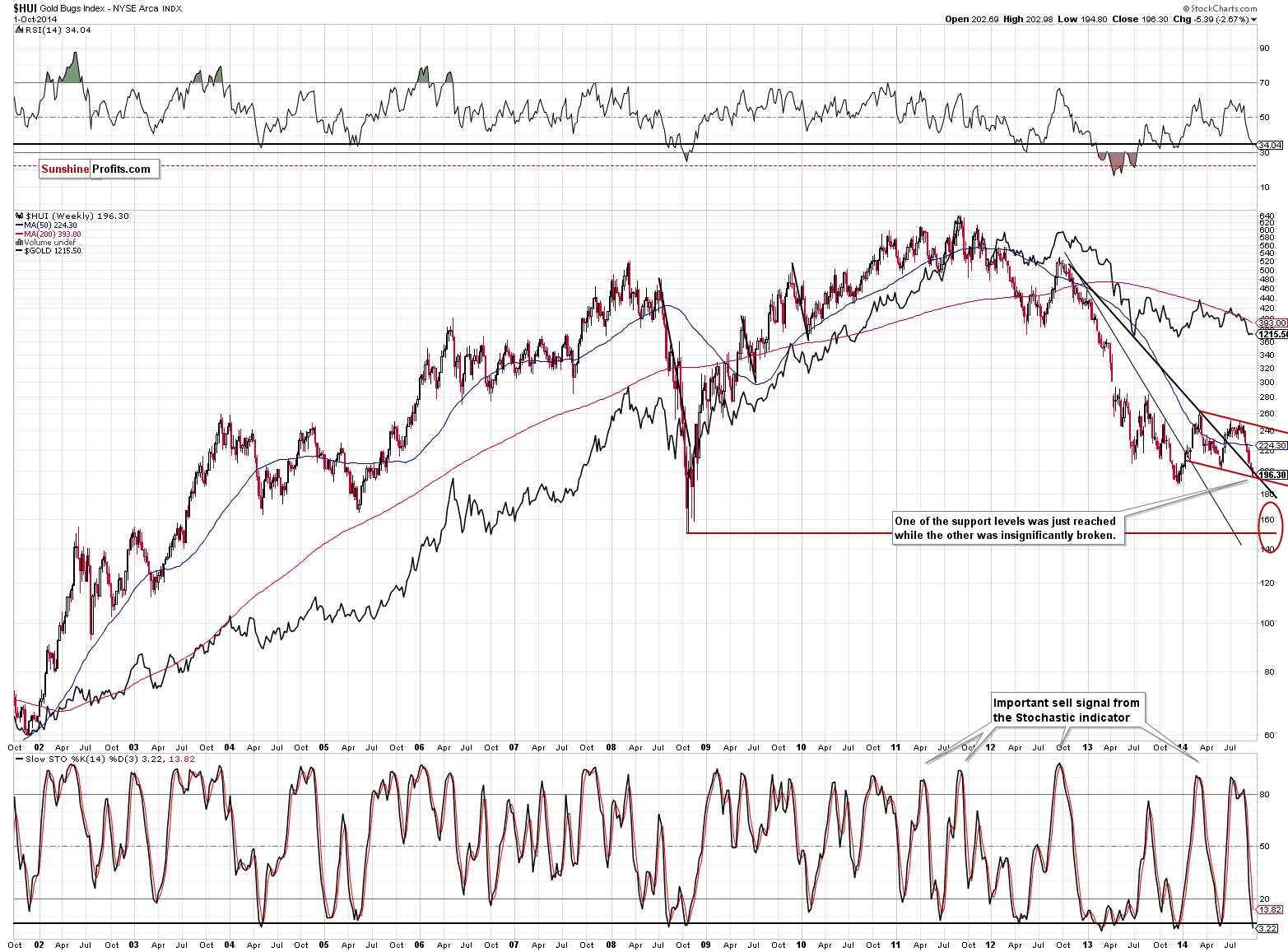

The situation in gold stocks hasn’t changed much either, but it also seems that quoting yesterday’s comments is useful at this time.

The HUI Index moved to the declining red support line, which is created as a parallel line to the declining resistance (based on this year’s highs). Gold stocks tend to form zigzags and it seems that we are seeing the final days of the big 2014 zigzag pattern. The declining black support line was insignificantly broken, but unless we see a weekly close below this level, it doesn’t seem that this breakdown should be treated as meaningful.

Moreover, the RSI indicator based on the HUI Index provides us with a similar signal as it does in the case of silver. The RSI moved to the level that corresponded to local bottoms many times in the past, including the final bottoms in 2004 and 2005. Gold stocks are quite likely to move higher at least temporarily.

Summing up, while the situation has been extremely overbought (USD) and oversold (gold, silver, mining stocks) from the short-term perspective for some time, we have now seen some important medium-term reversal signs as well. The cyclical turning point in the USD Index suggests that a turnaround is just around the corner and the RSI levels in the USD, silver and gold stocks point to a bigger corrective upswing. Additionally, gold has been showing strength in the previous several days by refusing to decline significantly even though the USD Index rallied significantly. The above is a bullish combination for the precious metals sector for the next several days or weeks, and a rally seems to be in the cards even if it doesn’t start right away.

To summarize:

Trading capital (our opinion):

It seems that having speculative long positions in gold, silver and mining stocks is a good idea:

- Gold: stop-loss: $1,187, initial target price: $1,249

- Silver: stop-loss: $16.57, initial target price: $18.07

- Mining stocks (price levels for the GDX ETF): stop-loss: $20.94, initial target price: $23.37

In case one wants to bet on higher junior mining stock ETFs, here are the stop-loss details and initial target prices:

- GDXJ stop-loss: $32.80, initial target price: $37.14

- JNUG stop-loss: $10.94, initial target price: $16.34

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts