Briefly: In our opinion speculative long positions (half of the regular size) in gold, silver and mining stocks are justified from the risk/reward perspective.

Gold, silver and mining stocks declined yesterday. This action might seem odd given Thursday’s high-volume reversal (Why aren’t metals rallying yet? Won’t they rally at all?), but once one knows one tiny – yet very important – detail, the situation becomes much clearer.

Volume.

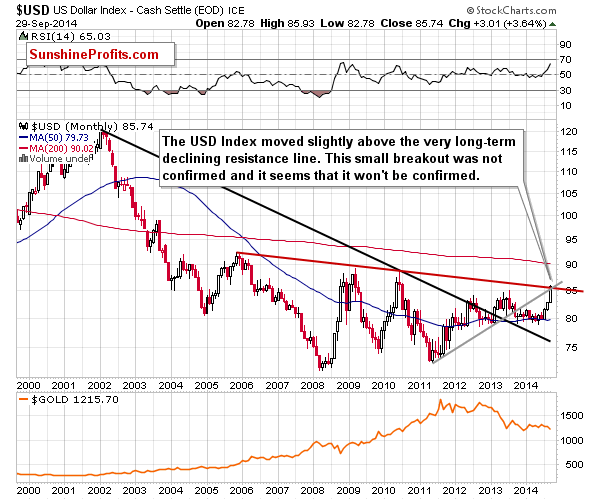

Before we analyze volume for gold and mining stocks, let’s take a look at the USD Index (charts courtesy of http://stockcharts.com).

Generally, not much changed on the above chart and our previous comments remain up-to-date, but the chart is so important in light of the situation in the currency and precious metals markets that we decided to include it once again.

The resistance level that was just reached is very significant and that’s the most important thing that the above chart tells us.

The resistance line was insignificantly broken on Friday. The move is not confirmed, and we doubt that it will be confirmed given the strength of the resistance that was encountered.

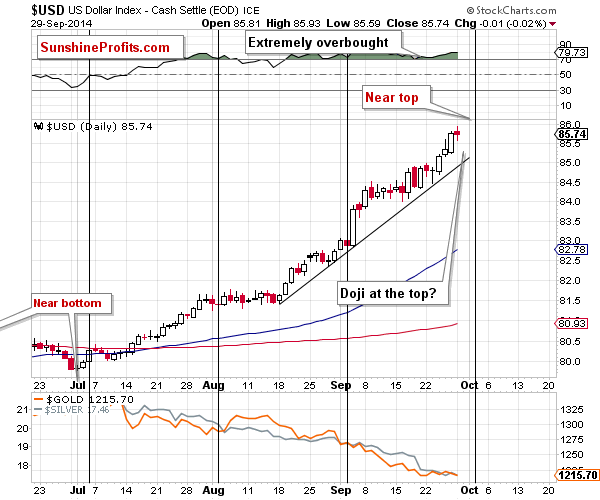

The above is especially true given the proximity of the cyclical turning point.

The USD Index is now close to the turning point, which means that it’s particularly vulnerable to a turnaround. The previous move has been definitely up, so the odds for a decline are now even higher than they were in the previous days. The RSI indicator is extremely overbought and we have just seen a “doji candlestick,” which is a daily formation that signals a reversal (much like a “shooting star”).

All in all, even if we didn’t see a local top yesterday, it’s very likely not far away.

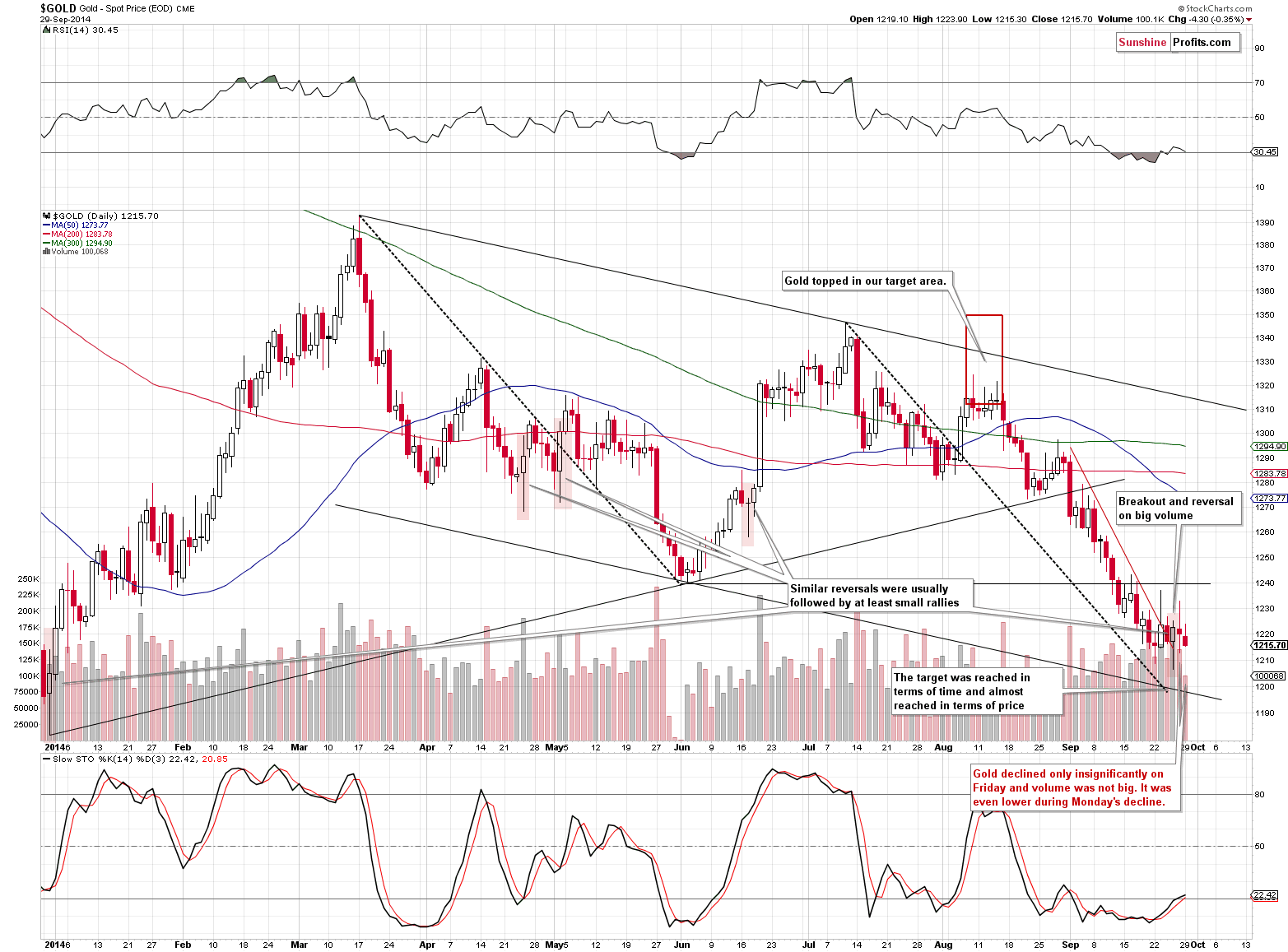

Given an intra-day move higher (followed by a decline, but still), did gold move to new lows? It didn’t.

The gold-USD link continues to provide bullish signs for the precious metals sector.

Moreover, even without paying attention to the above, the short-term outlook for gold remains bullish despite yesterday’s tiny move lower. Thursday’s move higher (reversal) took place on huge volume and Friday’s small downswing took place on relatively low volume. Yesterday’s decline took place on volume that was even lower. The moves lower simply appear to be counter-trend ones (countering the short-term upswing that is) and not the main ones.

There was basically nothing new in the silver market yesterday, so we’ll move right to gold and silver mining stocks.

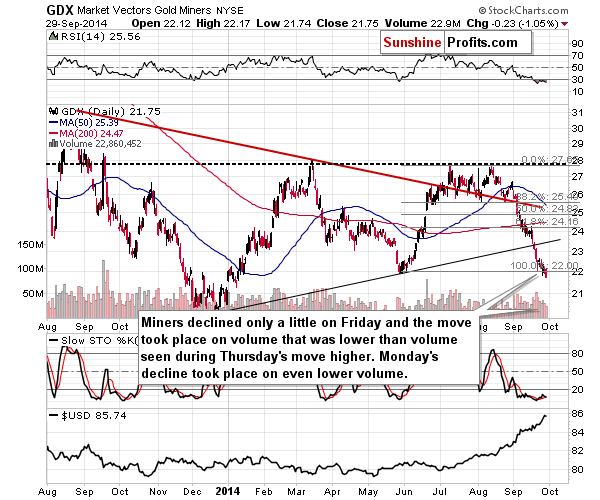

The most important thing that we can comment on is analogous to what we wrote about gold earlier today. Miners moved a bit lower on Friday, but they did so on relatively low volume and their move below the previous lows was very small. The volume that accompanied Monday’s decline was even lower. Consequently, we don’t think this is the true direction in which the market is heading.

Summing up, it seems that the corrective upswing in the precious metals sector is underway or is about to start in the next few days. In our opinion, it’s not the beginning of another big rally in the precious metals just yet, but a counter-trend move, which will be followed by further declines. [We described the scenario that we view as most likely to materialize in the gold market in yesterday’s alert so if you haven’t had the chance to read it, we encourage you to do so now.] At this time it seems likely that we are just ahead (in terms of weeks) of a big slide in the prices of metals and the final bottom for this prolonged decline. We’ll keep you updated.

// ADDED RIGHT BEFORE SENDING THE ALERT: Gold and silver moved lower today, but they are not close to reaching our stop-loss levels. There’s a good reason for which we placed them at these levels – simply put, unless metals move that low, the outlook will not change. There was a possibility that silver would move closer to the $17 level before moving higher and we discussed it just a few days ago. On Sep 24 we wrote the following:

With momentum this strong, will silver correct shortly? It certainly could, as its oversold on a short-term basis, but it now seems more likely that it will decline until it reaches support strong enough to stop the move, or – more likely – cause a corrective upswing within the decline. The closest support that could do it is in our opinion the rising long-term support line (based on 2000 and 2008 lows), which is currently slightly below the $17 level.

On Sep 25 we wrote the following:

Silver didn’t move to the very long-term resistance line, but it moved to the low that was formed in the pre-market trading on Monday/Sunday depending on one’s time zone. Gold was only a few dollars above our entry price. Given the strength that we have just seen on the market, waiting for the previously mentioned “entry levels” in gold and silver might be too risky (meaning risking missing the corrective upswing).

In other words, the outlook has not changed based on today’s pre-market action. Moreover, it will not change even if metals move slightly lower again. The odds strongly favor a corrective upswing and it seems to us that keeping long positions intact is a good idea at this time.

Given the situation on the USD Index and also in gold and silver, it seems that lowering the stop-loss level for mining stocks is a good idea now (in order to keep the long position intact). You will find details below.

To summarize:

Trading capital (our opinion):

It seems that having small (half of the regular position) long positions in gold, silver and mining stocks is a good idea:

- Gold: stop-loss: $1,187, initial target price: $1,249

- Silver: stop-loss: $16.89, initial target price: $18.07

- Mining stocks (price levels for the GDX ETF): stop-loss: $20.94, initial target price: $23.37

In case one wants to bet on higher junior mining stock ETFs, here are the stop-loss details and initial target prices:

- GDXJ stop-loss: $33.80, initial target price: $37.14

- JNUG stop-loss: $12.37, initial target price: $16.34

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts