Briefly: In our opinion a small (half of the regular size) speculative short position in gold and silver is justified from the risk/reward perspective.

Gold rallied yesterday and so did mining stocks. The move higher was less visible in the case of silver, but is this really less significant? As it is usually the case, the context provides the details necessary to interpret the situation in the most profitable way. Let’s take a closer look (charts courtesy of http://stockcharts.com.)

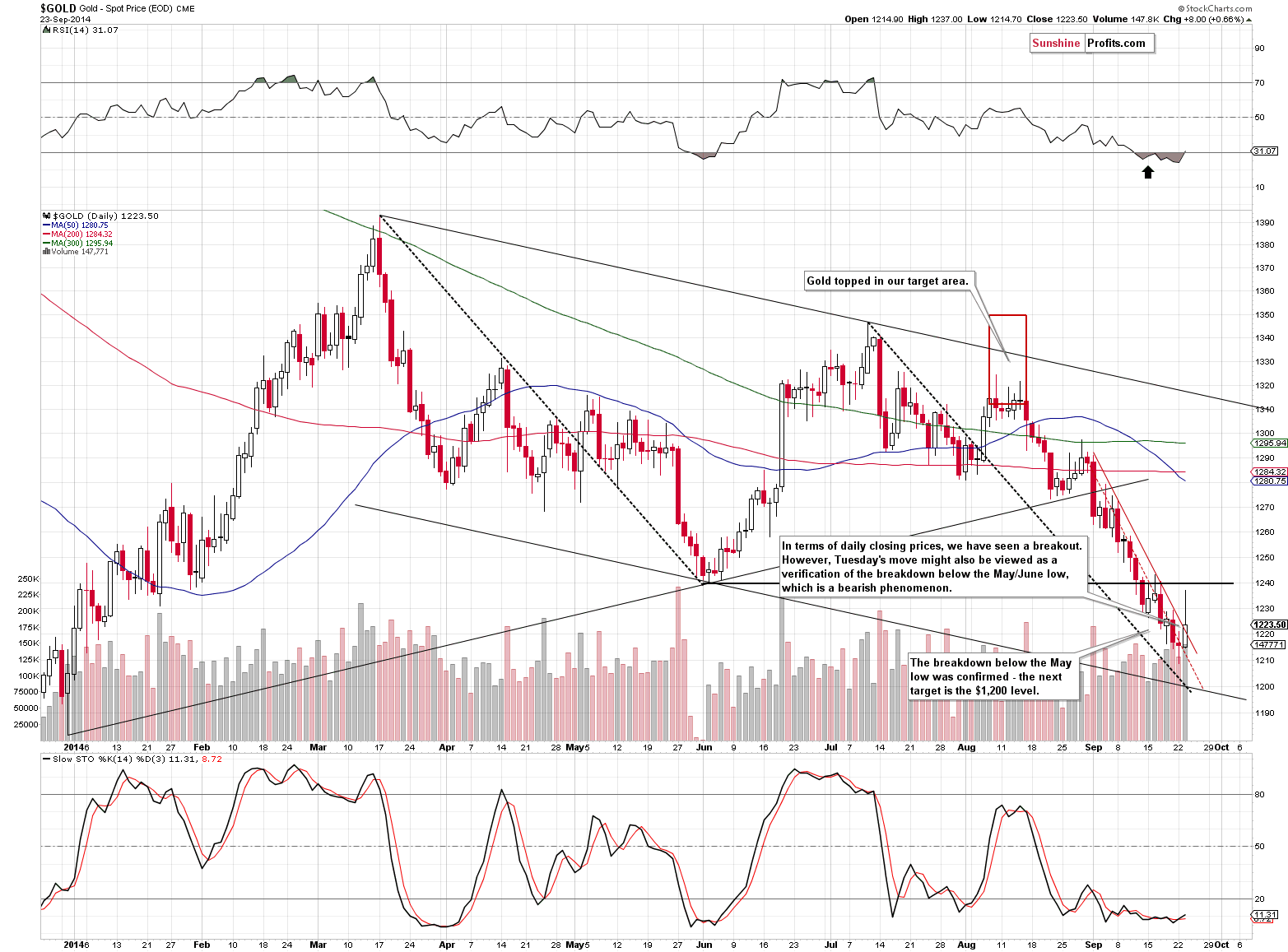

Yesterday, we saw a significant rally before the markets opened in the U.S., but not much more afterwards. Gold moved higher (probably based on the U.S. airstrikes in Syria) but gave away most of the gains before the session was over.

Still, gold managed to move above the declining short-term resistance line in terms of both intra-day highs and daily closing prices. This seems to be a bullish development, but is it really? Not quite. The only thing that the intra-day move higher seems to have accomplished was to verify the breakdown below the May / June low. Gold moved very close to this level and then moved back down. Consequently, it’s hard to draw excessively bullish conclusions from the above chart.

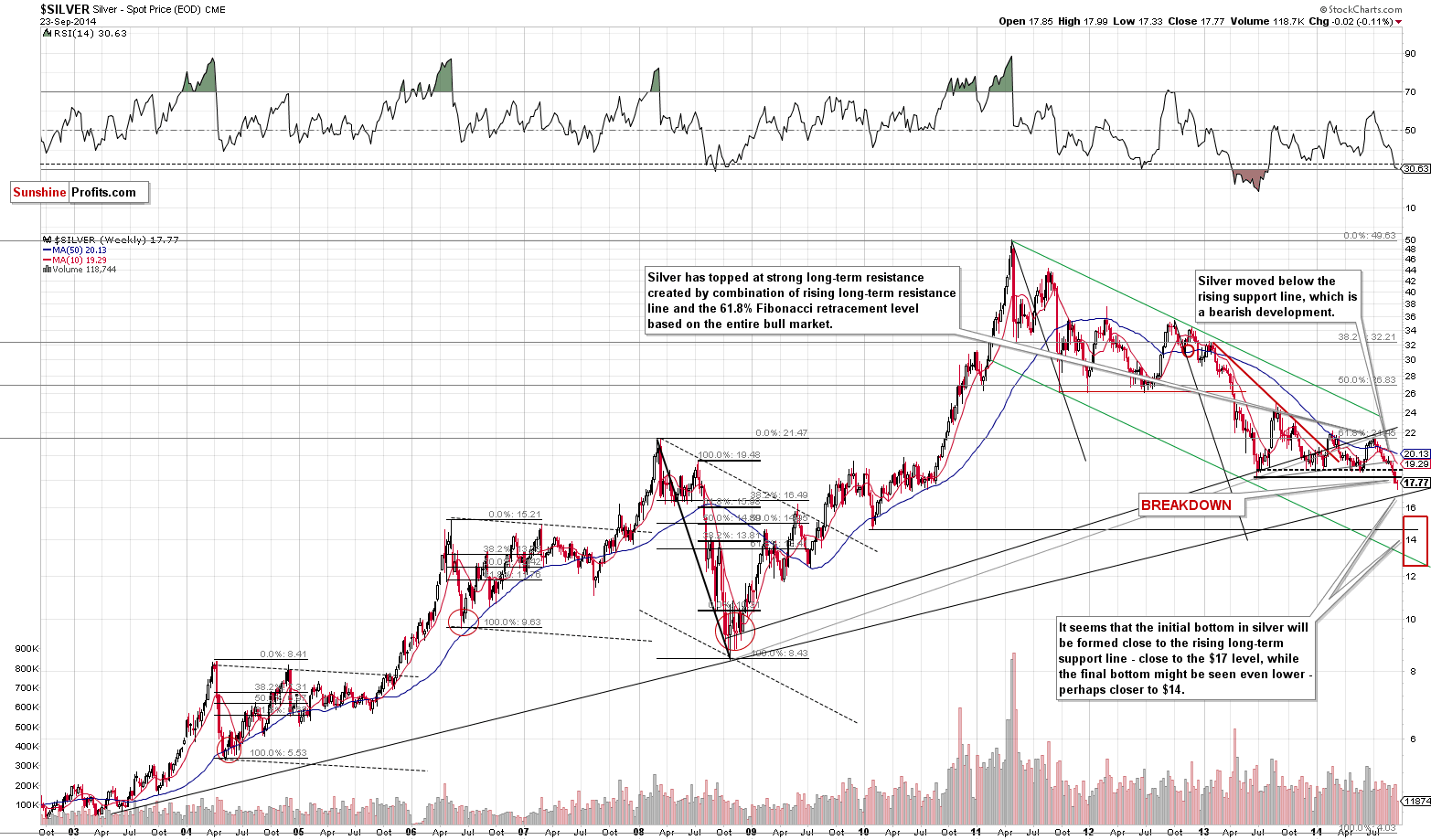

The situation in the silver market remains very tense and unchanged from yesterday (the white metal moved higher by only a few cents). Consequently, our yesterday’s comments remain up-to-date:

Silver’s breakdown is so significant not only because silver moved below the 2013 low. It’s so significant because we have not only seen a daily close below this important level, but also a weekly close. Silver didn’t end the week just a little below the 2013 low – it closed much lower. The move below the 2013 low was big enough to see it from the very long-term perspective.

With momentum this strong, will silver correct shortly? It certainly could, as its oversold on a short-term basis, but it now seems more likely that it will decline until it reaches support strong enough to stop the move, or – more likely – cause a corrective upswing within the decline. The closest support that could do it is in our opinion the rising long-term support line (based on 2000 and 2008 lows), which is currently slightly below the $17 level.

The RSI indicator is now slightly above the 30 level and with a move to the $17 level or slightly below it, it’s likely to reach the same level that triggered significant rallies in mid-2012 and mid-2008. Perhaps the corrective upswing would take silver back to the 2013 low and the decline would resume after this move.

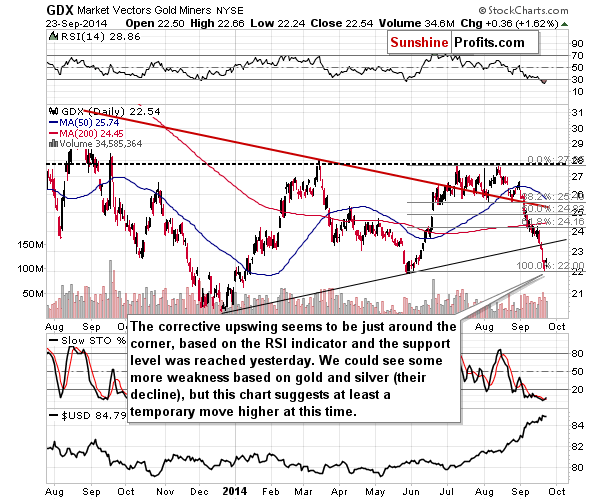

In yesterday’s alert we mentioned NOT opening new short positions in mining stocks, and it seems that we were cautious not without a reason – miners moved higher by more than 1.6%. What’s next? Our yesterday’s comments remain up-to-date:

Miners could certainly move lower once again if we see weakness in gold and silver, but it doesn’t seem that they would confirm the breakdown below the May lows at this time before correcting. They are more oversold on a short-term basis than they’ve been in over a year, so re-entering short positions here seems too risky at this time. It seems that we will have another profitable (with favorable risk/reward ratio) opportunity shortly, but it’s not here just yet.

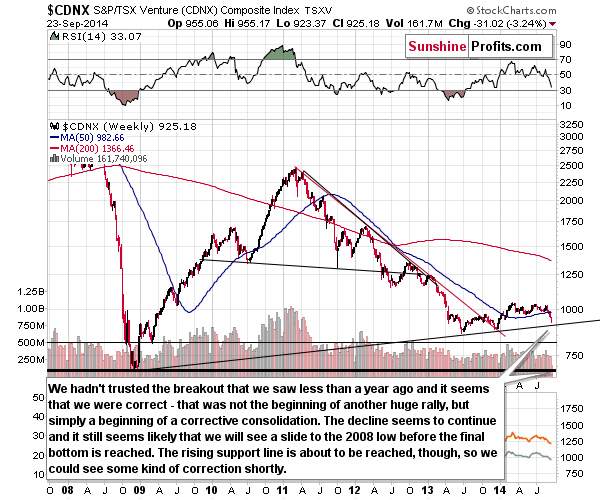

Junior mining stocks moved sharply lower yesterday. This was not surprising to those who had followed our analysis for many months. We have been skeptical toward the strength that we saw in the juniors sector in the first part of 2014 and we called this upswing “temporary”. It seems that we were correct as the juniors sector has been declining in the most recent past. The short-term trend is definitely down.

Please note that juniors are about to reach a support line and we are quite likely to see some kind of a move higher (consolidation?) before the decline continues. Once it does, it’s likely to take juniors to their 2008 low. This is in tune with what we expect of the mining stocks sector in general.

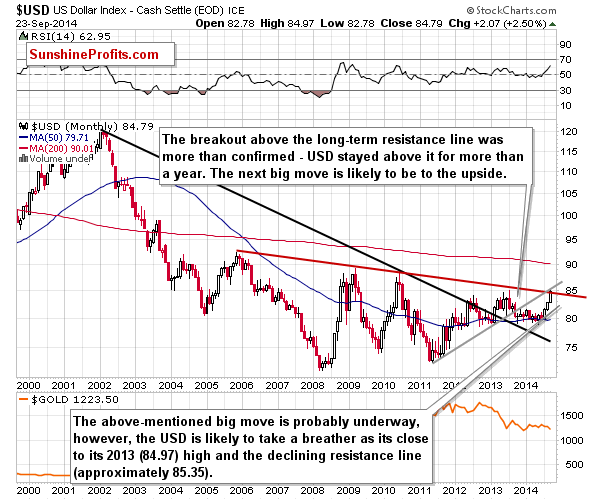

Before we summarize, let’s take a look at the USD Index.

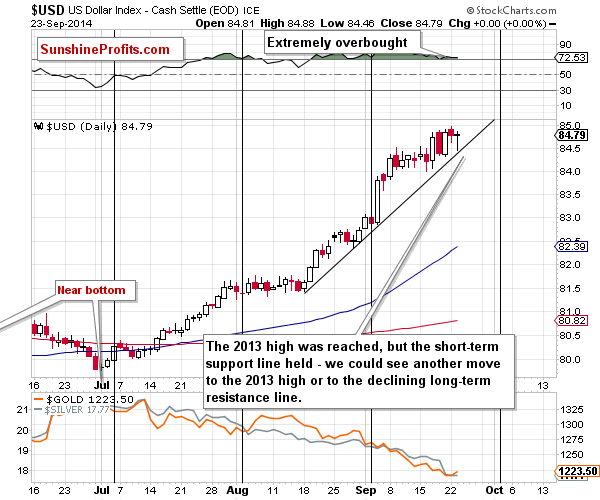

The USD Index moved temporarily lower yesterday, but ended the session rather unchanged. Even though the USD Index is significantly overbought on a short-term basis, this week’s move to the 2013 high might not be the final top just yet. What we wrote in Friday’s alert remains up-to-date:

The USD Index rallied but it hasn’t moved above the resistance line based on 2005 and 2010 highs (the line is currently at approximately 85.35). (…)

At this time we can’t rule out some more strength, but it’s not likely to be significant before the USD Index finally corrects.

Please note that the space between the 2013 and the upcoming high is a huge U-shaped bottoming pattern, something that could be the base for the cup-and-handle pattern. After the USD corrects we could see some sideways movement (the handle would be formed), which could correspond to a sideways trading in the precious metals sector very close to its 2013 lows – perhaps verifying the breakdown below them.

(…) it doesn’t seem likely to us that this was the final top for this rally. Why not? Because individual currency pairs (most of them) (…) have not yet reached their support/resistance level yet. Consequently, the 85.35 target seems to be a more likely target than the 84.97. In other words, the rally in the USD Index and the decline in the precious metals sector (even the short-term one) are likely not over yet.

Basically, the most important action in the USD Index yesterday happened before we published yesterday’s alert and was covered by us. A large part of it remains up-to-date:

(…) we can see that the nearest support is at approximately 84.40 and this is where the USD Index moved today. Since there was no breakdown – even below the short-term support line – it seems that the rally could continue for several days (before the declining long-term resistance line is reached).

Summing up, while the USD Index and the precious metals sector are still likely to correct their most recent moves, it now seems likely that they will move “just a little” before they do indeed correct. Silver’s breakdown was clearly visible and this kind of sign of momentum is likely to be followed by further weakness before we see a turnaround. The short positions in the mining stocks were already closed and profits were taken off the table and it seems to be a good idea to stay out of this sector at this time as the short-term situation seems rather unclear. It does seem to us, however, that gold and silver will move even lower before the current decline ends and a corrective upswing begins.

To summarize:

Trading capital (our opinion):

Short position (half of the regular size of the position) in gold with a stop-loss at $1,246 and the target price at $1,204 (it seems that having an exit order at this time at this level is a good idea in most cases).

Short position (half of the regular size of the position) in silver with a stop-loss at $18.33 and the target price at $17.06 (it seems that having an exit order at this time at this level is a good idea in most cases).

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts