Briefly: In our opinion a small (half of the regular size) speculative short position in gold is justified from the risk/reward perspective.

The central bank left interest rates unchanged and continued to cut the quantitative easing program, by another $10 billion a month, as was expected (all in all, nothing really surprising happened). In response, gold and mining stocks plunged and silver declined a little. Taking profits off the table and closing the very short-term long positions turned out to be a good idea as the sector declined visibly in the final part of the session. With the breakdown below the May lows being confirmed, will we see further weakness?

Let’s jump right into charts (charts courtesy of http://stockcharts.com.)

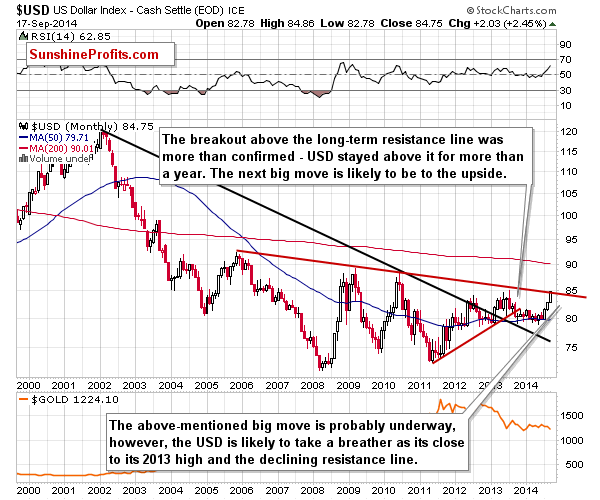

First of all, let’s keep in mind the major thing that has not really changed. The USD Index rallied but it hasn’t moved above the resistance line based on 2005 and 2010 highs (the line is currently at approximately 85.35). The 2013 high is at 84.97 - only a bit higher than we see the USD Index today.

At this time we can’t rule out some more strength, but it’s not likely to be significant before the USD Index finally corrects.

Please note that the space between the 2013 and the upcoming high is a huge U-shaped bottoming pattern, something that could be the base for the cup-and-handle pattern. After the USD corrects we could see some sideways movement (the handle would be formed), which could correspond to a sideways trading in the precious metals sector very close to its 2013 lows – perhaps verifying the breakdown below them.

Either way, the odds are that the situation will finally clarify and that we will have another great risk/reward case for entering new speculative positions.

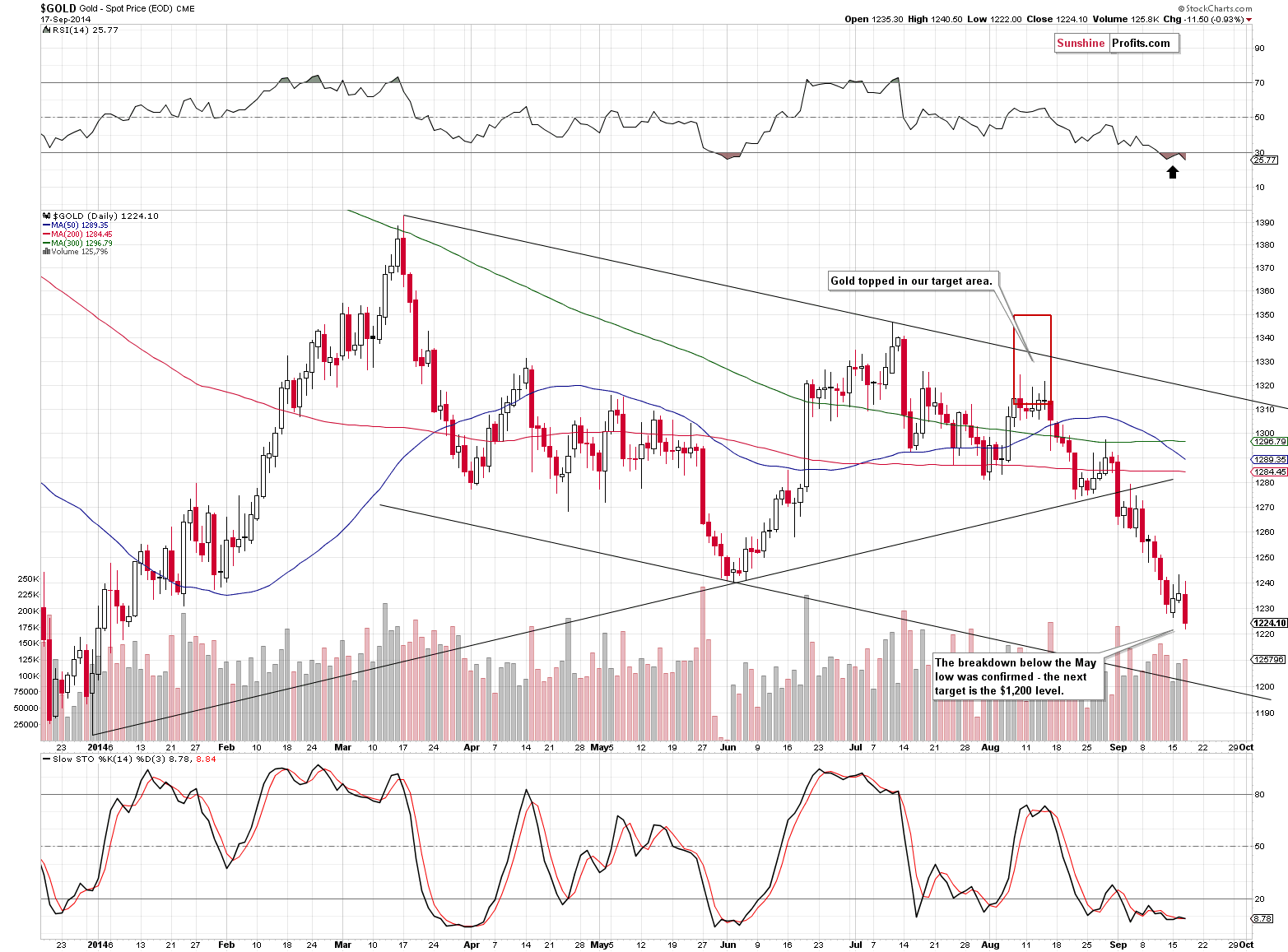

The gold chart shows that the breakdown below the May low was confirmed and followed by a daily decline, but it also shows that the next strong support for gold is at the $1,200 level – at the lower border of the declining trend channel.

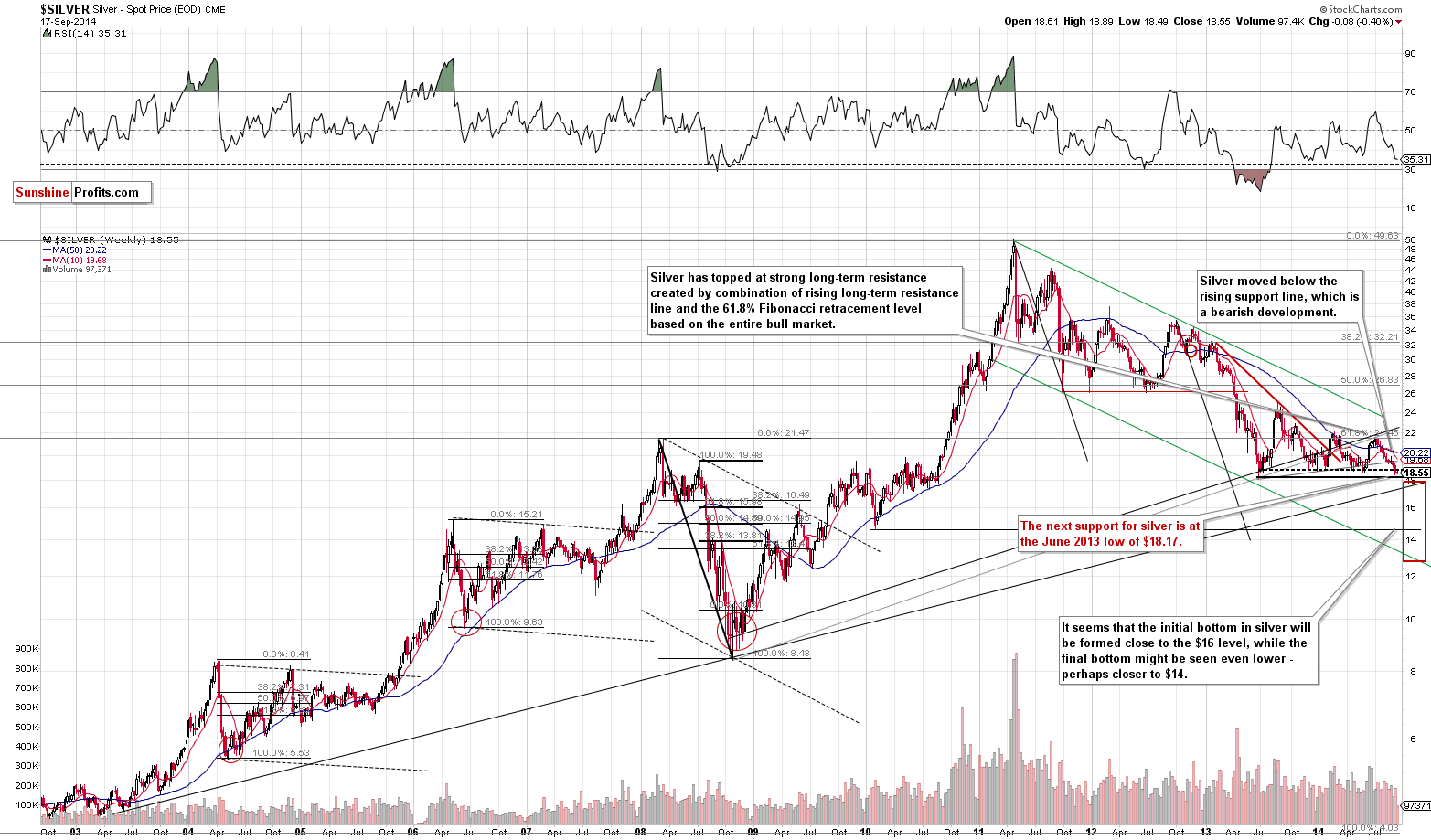

The silver market confirmed the breakdown below the May low as well and the next support – a very strong one – is at the 2013 low: $18.17. At the moment of writing these words silver is at $18.42, so it’s just 25 cents above the 2013 lows.

We would not be surprised to see silver moving to this level even today (tomorrow or the following week seem more probable, though) and then moving back up or stopping the decline for some time (a week or a few of them).

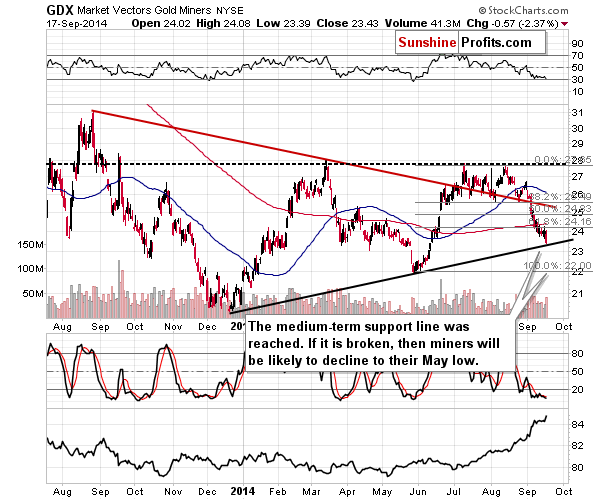

The mining stocks have just reached an important medium-term support – the rising support line base on the Dec 2013 and May 2014 lows.

The RSI has been close to 30, so it’s quite likely that we will see a corrective upswing sooner or later, and the proximity of the rising support line suggests that it will be very soon. If not, then we would be likely to see miners move to the May low and then move back up once again.

Summing up, while the USD Index and the precious metals sector are still likely to correct their most recent moves, it now seems likely that they will move “just a little” before they do indeed correct. The move lower in silver is likely to be very small, so it doesn’t seem worth betting on (keeping the risk/reward perspective in mind). The mining stocks are at a support so in their case, the move lower could also not be that significant (we could see a breakdown followed by more declines, but we have not seen it so far). Gold, however, seems quite likely to move even a bit lower before it corrects. Consequently, it seems that opening a small speculative short position in gold could be a good idea along with a defined target price. You’ll find details below.

To summarize:

Trading capital (our opinion): Short position (half of the regular size of the position) in gold with stop-loss at $1,246 and the target price at $1,204 (it seems that placing an exit order at this time at this level is a good idea in most cases)

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts