Briefly: In our opinion small (half of the regular position) long positions in gold, silver and mining stocks are justified from the risk/reward perspective.

The previous week was extremely important for gold & silver traders and investors. Gold moved visibly below its final rising support line and silver broke below the $19. Miners moved below their 61.8% Fibonacci retracement. Will the precious metals sector really plunge shortly?

In our opinion the answer is yes or no depending on how one defines “shortly”. “Not likely” in terms of days, but “likely” in terms of weeks. Let’s move to charts (charts courtesy of http://stockcharts.com.)

The situation in the USD Index is as critical and the index is as likely to correct as described previously and still likely to trigger a reversal in the precious metals market – little has changed on Friday regarding this link. Consequently, today we’ll focus on the precious metals market.

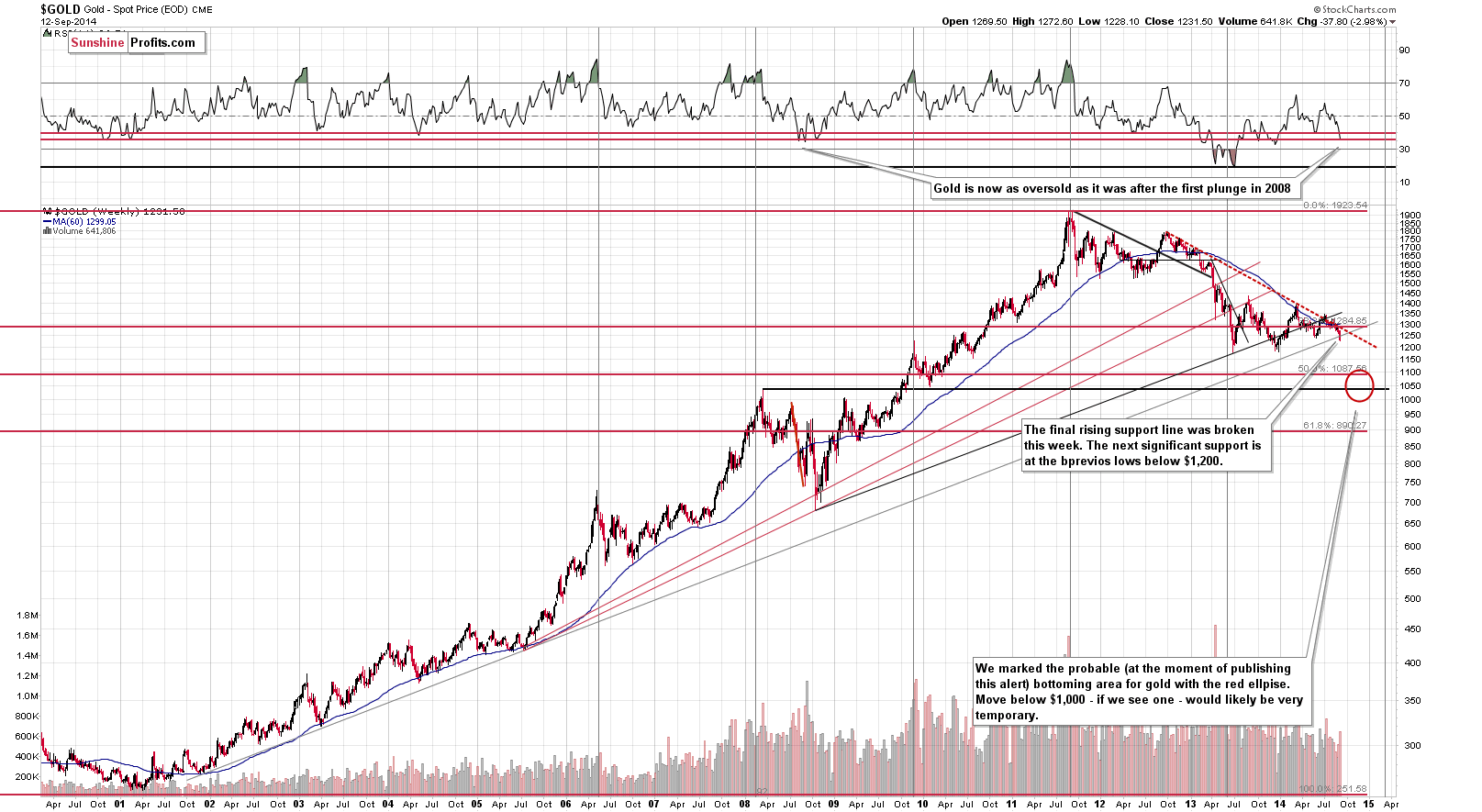

From the long-term perspective, we saw a breakdown below the final rising support line. Since we still have the secular bull market in the precious metals sector, and we expect their prices to move higher over time, it seems that in a way gold is already “lower” than it was in 2013. The price, of course, is not lower in nominal terms, but compared to the rising support line based on the 2001 and 2005 lows it’s “lower” – back in mid-2013 gold bottomed about $100 above this line, whereas it has just broken it last week. While this is not a breakdown below the 2013 lows in a strict sense, it is definitely a bearish sign for the coming weeks.

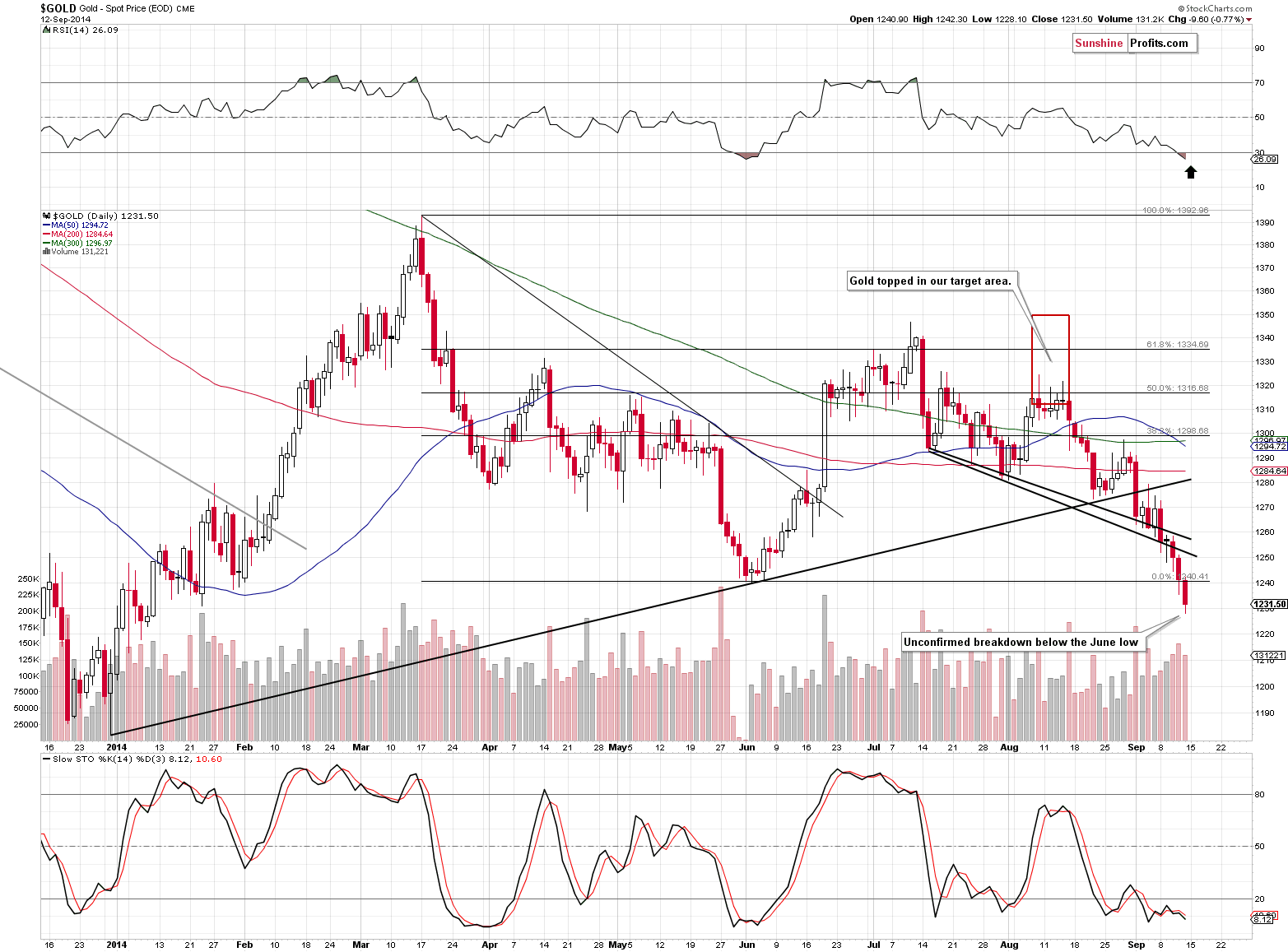

On a short-term basis, however, we see something quite different. Gold moved only $10 below the June 2014 low and the RSI is just as oversold as it was when gold bottomed at that time. It seems that a corrective upswing is just around the corner, quite possibly to the rising long-term support-resistance line visible on the long-term chart.

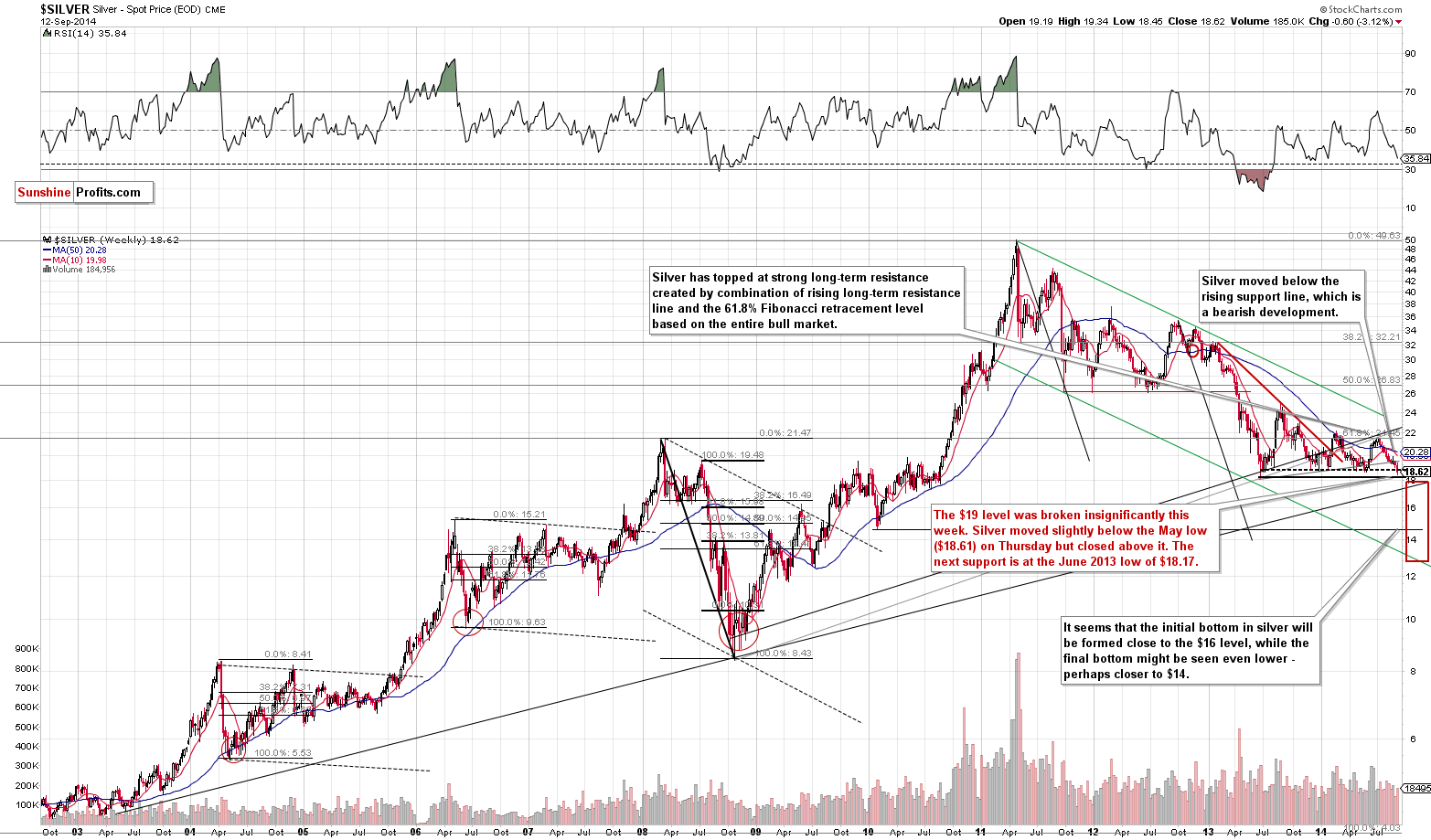

The situation on the silver market, however, is the most important thing that precious metals investors and traders need to look at. It is the white metal that is about to (or almost about to) break into new lows. There were many cheers when silver rallied in May, but we have been consequently emphasizing the corrective nature of that upswing. It turned out that silver formed another lower top in July and started to decline.

The interesting thing about the silver market is that it has already broken into new lows – if we take the weekly closing prices into account. That’s right – silver closed the week at the lowest level since 2010 – and that’s a significant medium-term sign. The white metal is likely to move lower in the coming weeks.

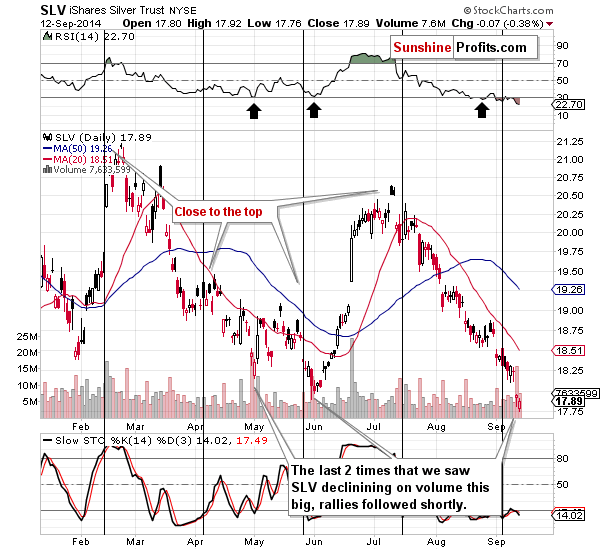

The big plunge doesn’t have to happen immediately, though. On the short-term basis, silver is very oversold and the outlook here is similar to the one seen in gold. The RSI points to a very oversold condition, and the last 2 trading days were very similar to what we saw right before the June rally – decline on huge volume (+intra-day reversal) followed by a smaller decline on relatively low volume.

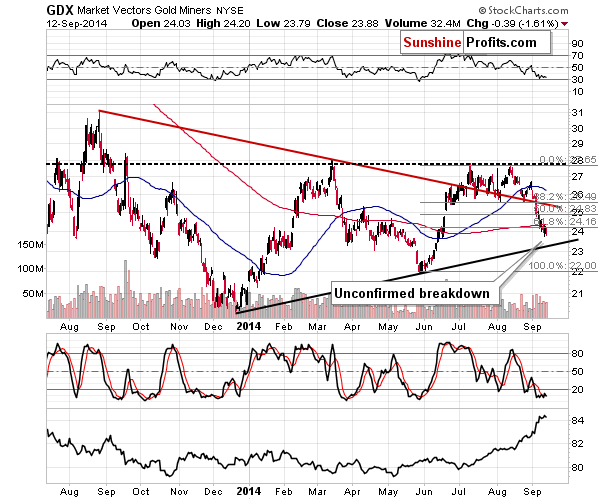

The mining stocks have finally shown some strength in the last few days. Taking the last 2 trading days into account they declined by about 1%, whereas gold declined more than 1.5%. Keeping in mind that miners usually magnify gold’s moves in the short term, the above can be viewed as a sign of strength. In fact, the mining stocks are the part of the precious metals market where the long positions that we suggested are already profitable. If one had entered longs in the first part of Thursday’s session – which is when we saw intra-day lows, the position is profitable at this time.

The RSI indicator is still very close to the 30 level, which suggests that we should expect a short-term rally – and we do.

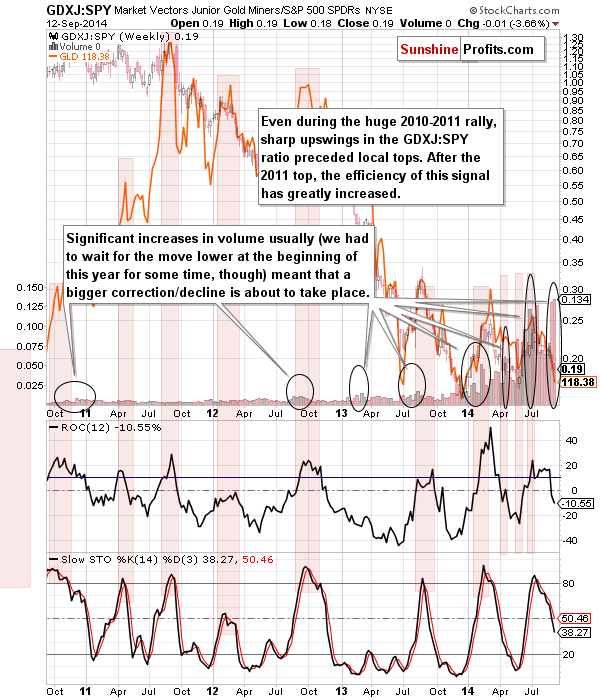

Before summarizing we would like to point out two additional signals that we have just seen.

The first one is extremely high ratio of volumes in case of juniors and the general stock market. In short that’s another medium-term sell signal and a repetition of what we had seen last week. In the alert that we posted a week ago, we wrote the following:

We have previously emphasized that when we compare the performance of the junior mining stocks to performance of other stocks (the general stock market) and focus on the ratio of volumes, we can get very useful medium-term signs. These signs are not useful in the short term, but have been effective when one focuses on performance of the precious metals sector in terms of weeks.

The volume on which juniors moved last week was extremely high when compared to the volume on which the SPY ETF moved (proxy for the general stock market), which is a bearish sign. We are likely to see another sizable move lower in the coming weeks, but not necessarily right away. This sign is in tune with what we can infer based on other charts.

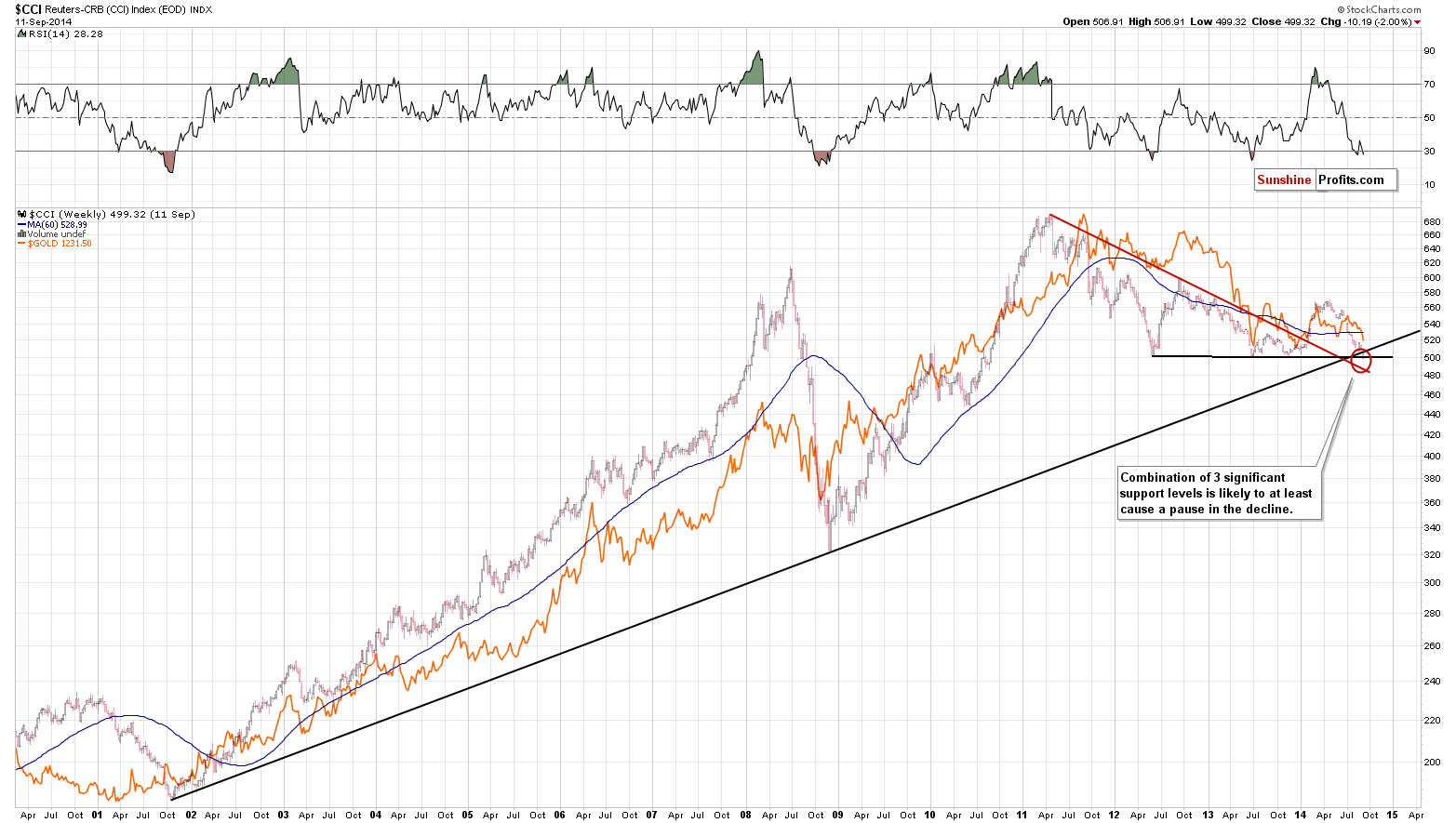

The final chart for today features the CCI Index – a proxy for the commodity sector.

The index has just moved slightly below the major, long-term support and stopped at the previous lows. That’s more or less in the middle of our target area for this index – the one that we featured weeks ago. The commodity sector is likely to at least take a breather before declining once again, and this is a short-term bullish sign for gold (and oil) as well.

Summing up, the odds for the corrective upswing in the precious metals sector have increased in the final part of last week and so has the size of the potential rally. While we had been suggesting staying out of the precious metals market with the long-term investment capital (long-term investments are usually the biggest part of one’s portfolio), it seems that the bounce in the market is now probable enough to push the risk/reward ratio in favor of having small speculative long positions (at the same time we don’t change our attitude toward long-term investments, as the medium-term trend is still down).

To summarize:

Trading capital (our opinion): Small (half of the regular position) long positions in gold, silver and mining stocks with the following stop-loss orders and (initial) target prices (we have lowered the ones for gold and silver slightly):

- Gold: Stop-loss: $1,222; Target price: $1,276

- Silver: Stop-loss: $18.33; Target price: $19.50

- GDX ETF: Stop-loss: $22.78; Target price: $25.30

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts