Briefly: In our opinion no speculative positions in gold, silver and mining stocks are now justified from the risk/reward perspective. However, day-traders might consider a small speculative long position in silver.

The precious metals market moved lower last week, while the USD Index rallied, and what a rally that was! In just 2 days, the Dollar Index moved more than it had in the previous month. How significant is that? For the index itself - very. But how important is this major move for precious metals investors? Let’s take a closer look (charts courtesy of http://stockcharts.com.)

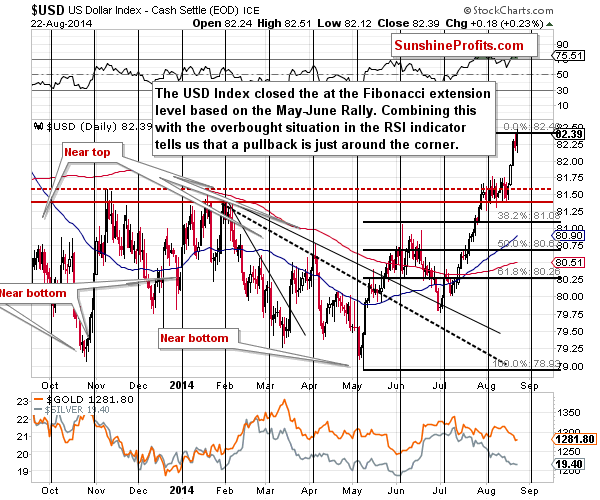

The USD Index reversed on Thursday and created a bearish shooting star candlestick. Despite this bearish sign, it managed to move higher once again, but closed at the previous day’s high – and at the Fibonacci extension of the previous rally. Since last week’s move was quite sharp, it seems that the local top could be very close, especially that the RSI indicates a very overbought condition.

It seems that quoting the previous comments is appropriate at this time:

Why only a corrective downswing, and not a new big decline? Because [last] week’s breakout has been confirmed and it’s a move above important resistance levels. The rally that is likely to follow such a breakout is something that might be much bigger than what we’ve seen this week. In fact, this week’s price action looks just like a start of a bigger move when we look at it from the medium-term perspective.

How low can the USD Index go? There are no certainties in any market, but it seems to us that the USD could move back to the previously broken level. In other words, a move to 81.5 – 81.7 range would not surprise us.

Naturally, the very short-term implications for the precious metals market are bullish, but the medium-term ones are even more bearish than they had been before this week began.

As far as the gold charts are concerned, our previous comments remain up-to-date, as gold didn’t move much on Friday:

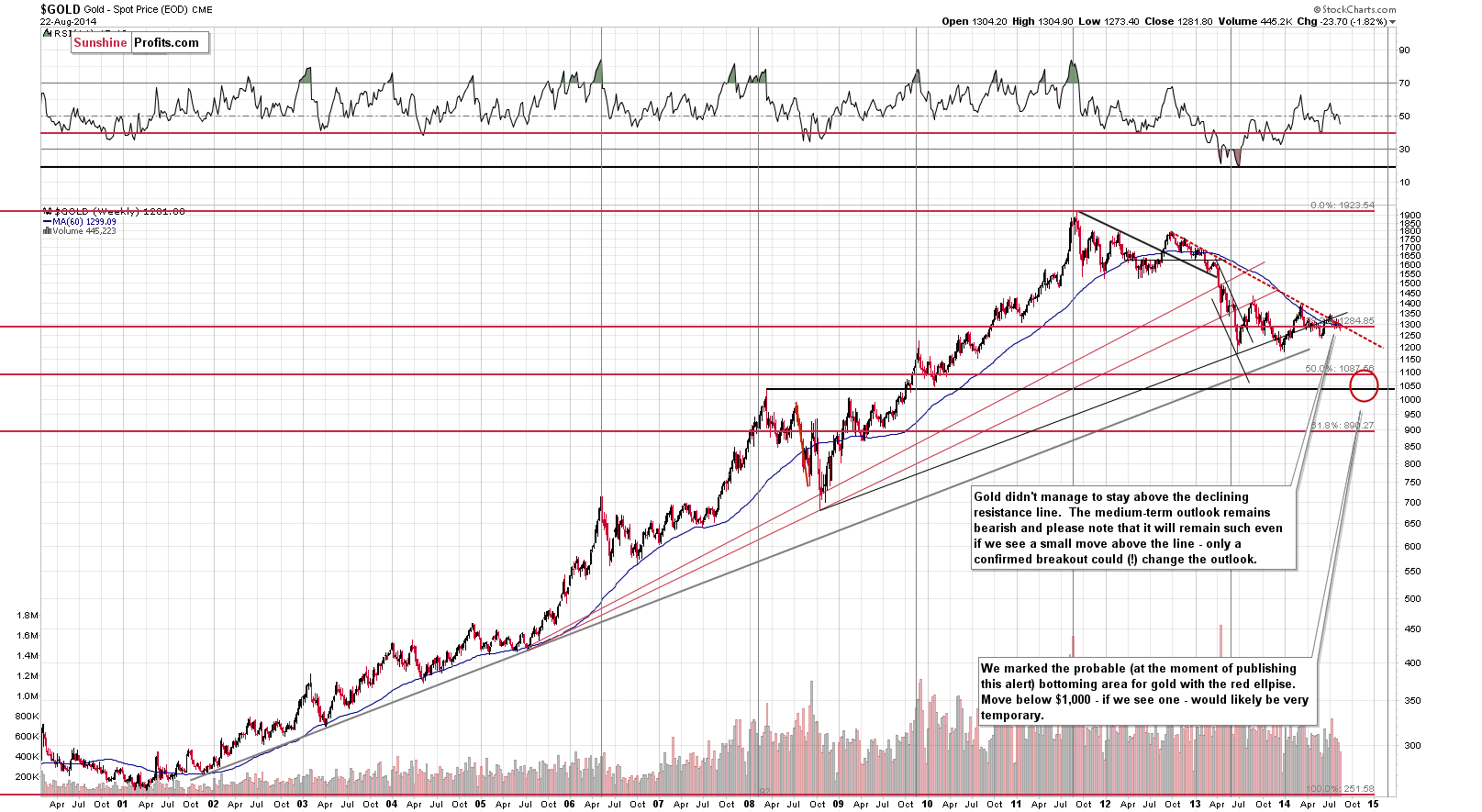

From the long-term perspective, we see that gold has invalidated the move above the declining resistance line, which is a bearish sign for the coming weeks. Gold is also below the 38.2% Fibonacci retracement level based on the entire bull market, which is another bearish sign for the medium term.

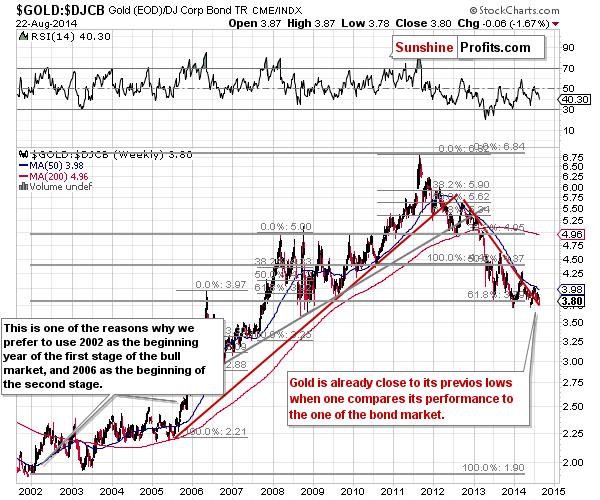

Interestingly, from the gold to bonds ratio perspective, gold is already at previous lows. Any further weakness will be a breakdown below the previous lows, so it’s not likely to happen before a correction. It is more likely than during previous attempts, though.

The silver market provides us with the same implications it did on Friday:

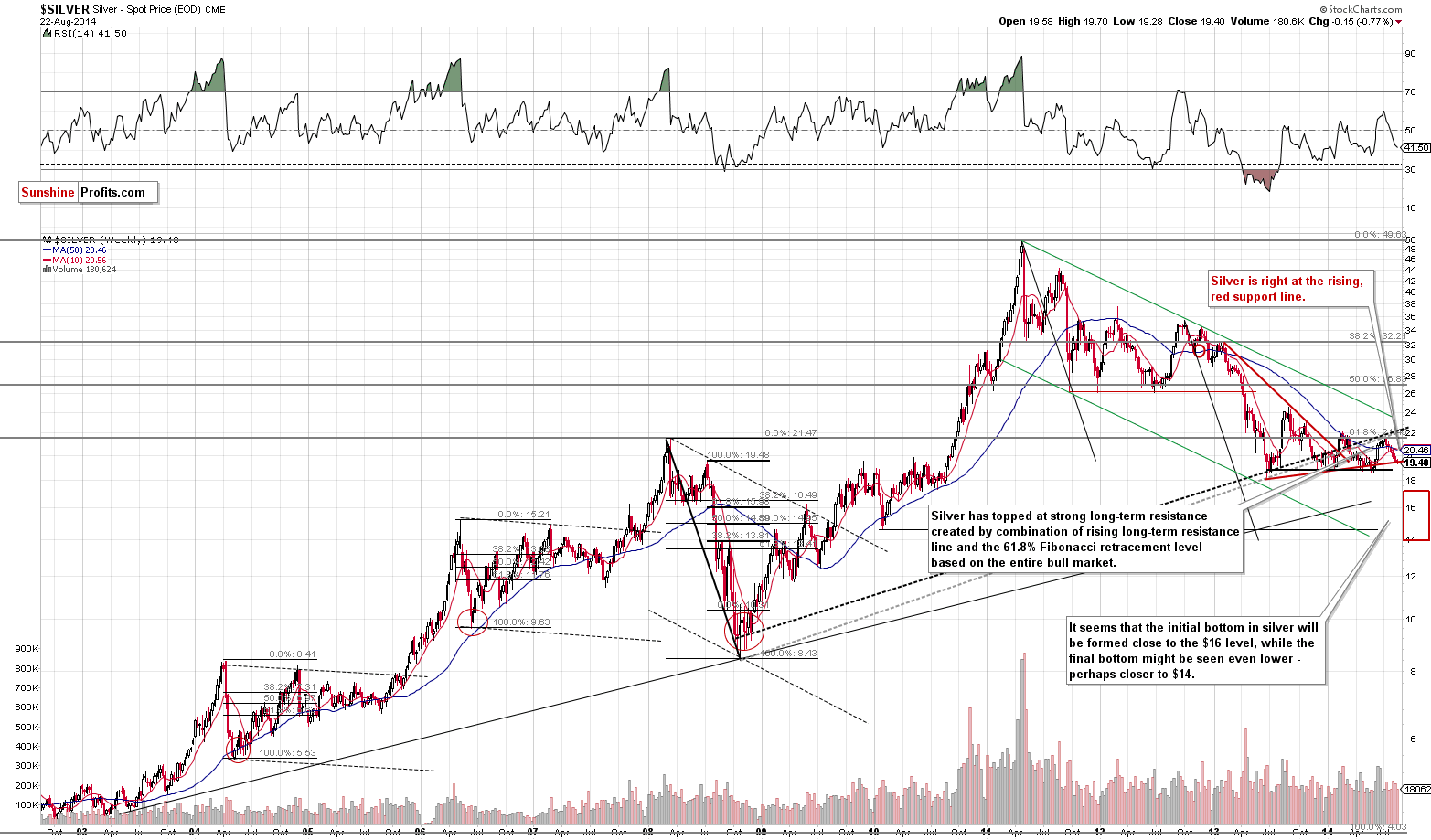

Silver, on the other hand, provides the support line. The white metal is not (yet) at its previous lows, but it’s already at the support line that is created by connecting these lows. Once this support is broken, the decline is likely to accelerate. If silver breaks below the previous lows, we could see a very sharp move into our target area. Will this happen soon? There are no certainties, but it’s becoming more and more likely that we will see this type of action in the following weeks or months.

What’s the most likely outcome for the following days? In our opinion we could see a verification of the breakout in the USD Index in the form of a pullback, which would cause a temporary upswing in gold and – especially – silver. Then the rally in the USD would continue and so would the decline in the precious metals sector. Of course, there are no guarantees, but the above is our best guesstimate at the moment.

The above-mentioned corrective upswing in metals could provide a confirmation that the big decline is about to start – for instance if we see silver’s outperformance and/or miners move higher on tiny volume.

All in all, what we wrote previously remains mostly up-to-date:

The above-mentioned corrective upswing in metals could provide a confirmation that the big decline is about to start – for instance if we see silver’s outperformance and/or miners move higher on tiny volume.

Summing up, the situation in the precious metals market still remains too unclear to open any positions in our view, but it seems that we won’t have to wait too long before things clarify and the risk/reward ratio becomes favorable enough to open a trading position. It seems that day-traders might want to take advantage of the specific way the silver market reacts during corrective upswings, but betting on silver’s bounce is not something that we can suggest to most traders.

To summarize:

Trading capital (our opinion): No positions

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts