Briefly: In our opinion no speculative positions in gold, silver and mining stocks are now justified from the risk/reward perspective.

In yesterday’s alert we commented on the specific relationship between the USD Index and the precious metals market. We wrote about the bearish pressure that the index would likely put on gold and silver if the strength continued and the breakout was verified. We didn’t have to wait long for more strength in the U.S. currency. Yet, metals have not declined. What’s going on?

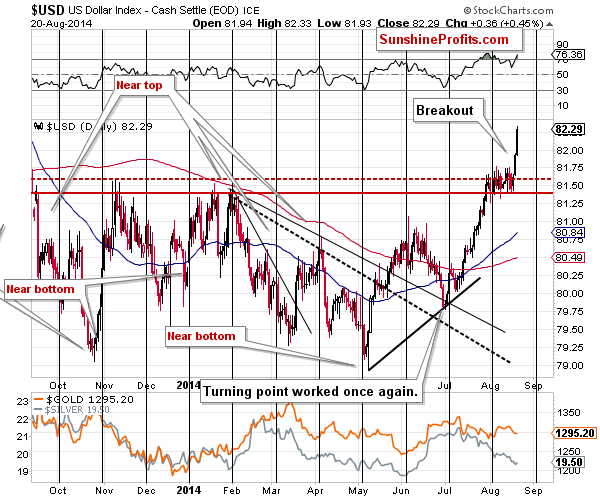

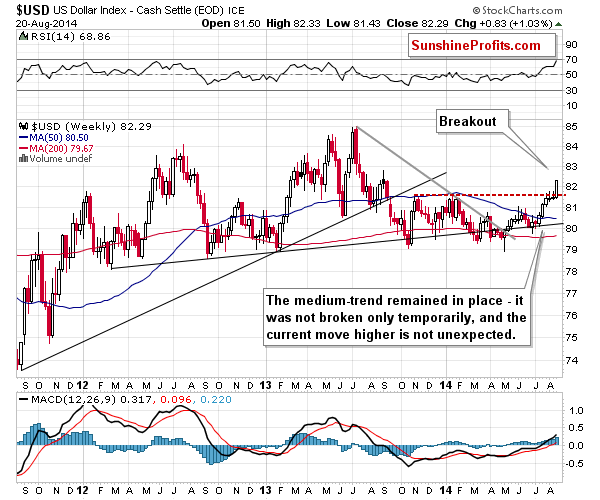

The situation in the precious metals market changed very little yesterday, so today we’ll focus on the currency movements and then discuss their relationship with gold and silver. Let’s take a look at the short- and medium-term USD charts (charts courtesy of http://stockcharts.com.)

Much of what we wrote yesterday remains up-to-date:

The above chart clearly shows that there was indeed a breakout. At the moment of writing these words, the USD Index is slightly above the 82 level. Is this the time to get excited about the strength of the U.S. dollar? Not really. The breakout will need to be confirmed first. We would like to see 2 additional closes above the broken resistance before we think that the continuation of the rally is very probable. It’s already probable, but the odds will increase once we see a confirmation.

Please note that the U.S. currency was strong enough not to really decline at the most recent cyclical turning point. Instead, we saw only a small local top that was followed by a consolidation. This type of flat correction is something that characterizes strong uptrends, so it seems quite likely to us that the rally will be continued. The odds will further increase if yesterday’s breakout becomes confirmed.

Consequently, the USD Index will likely put bearish pressure on the precious metals sector and once the breakout is confirmed, this will become very likely. Gold and silver are currently at a critical juncture and this pressure might be the thing that “helps metals to decide in which way to go”.

Now, the important thing that we just saw was that the USD Index continued its rally and, given the size of the post-breakout rally, we think that we can already view the breakout as being confirmed at this time. The breakout is significant even from the medium-term perspective. This means that even if we see a move lower in the currency, it will likely be relatively small and short-lived.

Is it likely that we will see one? Yes, breakouts are often followed by some kind of verification and the metals’ and miners’ strength (there was no huge decline in the past 2 days) suggests that they may react to a temporary weakness in the USD quite visibly and rally - despite that gold has moved about $10 lower in pre-market trading so far today.

Still, since the USD is after a breakout and likely to continue its decline, we can expect more weakness to be followed in gold, silver and mining stocks. It seems quite likely to us that this short-term move higher in metals will provide us with some kind of bearish confirmation that would make the risk/reward ratio favorable enough to open a speculative short position.

In other words, what we wrote yesterday remains up-to-date:

The above-mentioned corrective upswing in metals could provide a confirmation that the big decline is about to start – for instance if we see silver’s outperformance and/or miners move higher on tiny volume.

Summing up, the situation in the precious metals market still remains too unclear to open any positions in our view, but it seems that we won’t have to wait too long before things clarify and the risk/reward ratio becomes favorable enough to open a trading position.

To summarize:

Trading capital (our opinion): No positions

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts