Briefly: In our opinion no speculative positions in gold, silver and mining stocks are now justified from the risk/reward perspective.

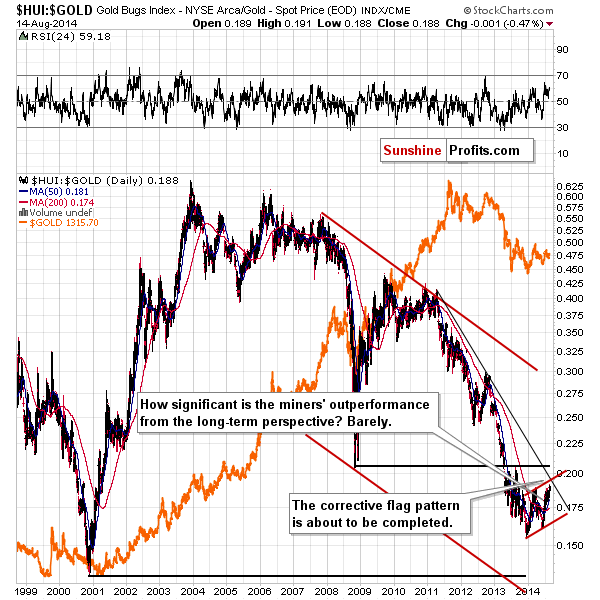

The ratio comparing gold stocks to gold has a special meaning to those who have been following the precious metals market for more than a few years. It was just a few years ago, when this ratio was one of the most reliable indicators of what’s to come. Mining stocks were the first to indicate in which direction the entire sector will move shortly. We have just seen a breakout in the gold stocks to gold ratio, so it’s no wonder that many investors and traders just got excited. What are the implications? Let’s take a closer look (charts courtesy of http://stockcharts.com.)

There are none so far. The above chart clearly shows what’s been going on since early 2011 – we’ve been seeing a downtrend, which still remains in place.

What’s more important is that the long-term resistance line is about to be touched – if the rally is to continue. This line is a strong one, which means that we can expect at least a pause, or – more likely – a turnaround.

The particularly interesting thing is that an additional situation fits in the above scenario. The rally that we saw in the first part of this year and the current one are very similar in terms of sharpness and (to some extent) size. To some extent, because these rallies will be alike when the ratio moves to the declining resistance line. This would create a corrective zigzag pattern, which is a quite common way for the mining stocks to correct previous trends. We have previously seen such patterns on a short- and medium-term basis, but since markets are fractal (self-similar) in nature, it’s quite likely that we will see this pattern also from the long-term perspective. This zigzag would be a form of a flag pattern, which is a continuation pattern. Either way, it seems that the pattern will be completed shortly and that we will see another decline shortly thereafter.

What are the implications for the precious metals sector? That we are likely to see some additional strength in the short term, which will be followed by a bigger decline in the following weeks. This is what we have been expecting previously, so overall what we see on the gold stocks to gold ratio chart serves as a confirmation.

Overall, once again we can summarize the current outlook in the same way as we did previously.

Summing up, it seems that even though the next big move in the precious metals sector is still likely to be to the downside (we have not yet seen actions that are usually seen at important bottoms, like huge underperformance of silver [what we saw this week was not huge enough], and gold is not actively hated in the mass media), the odds for a corrective rally are relatively high.

The USD Index is [still, but less with each passing day] likely to decline at least a little, which is likely to cause a rally in the precious metals sector. However, let’s not forget that the USD Index is after long-, medium-, and short-term breakouts, so this corrective downswing could be small and temporary – the next big move is likely to be to the upside. The opposite seems likely for the precious metals sector.

We plan to re-enter short positions when we see either a small rally an some kind of confirmation that the next local top is in. At this time, we prefer to say out of the market. The situation simply seems too unclear and risky to open a speculative position.

To summarize:

Trading capital (our opinion): No positions

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts