Briefly: In our opinion no speculative positions in gold, silver and mining stocks are now justified from the risk/reward perspective.

On Friday gold moved well into our target area and then reversed. Is the local top in? Let’s jump right into the charts (charts courtesy of http://stockcharts.com.)

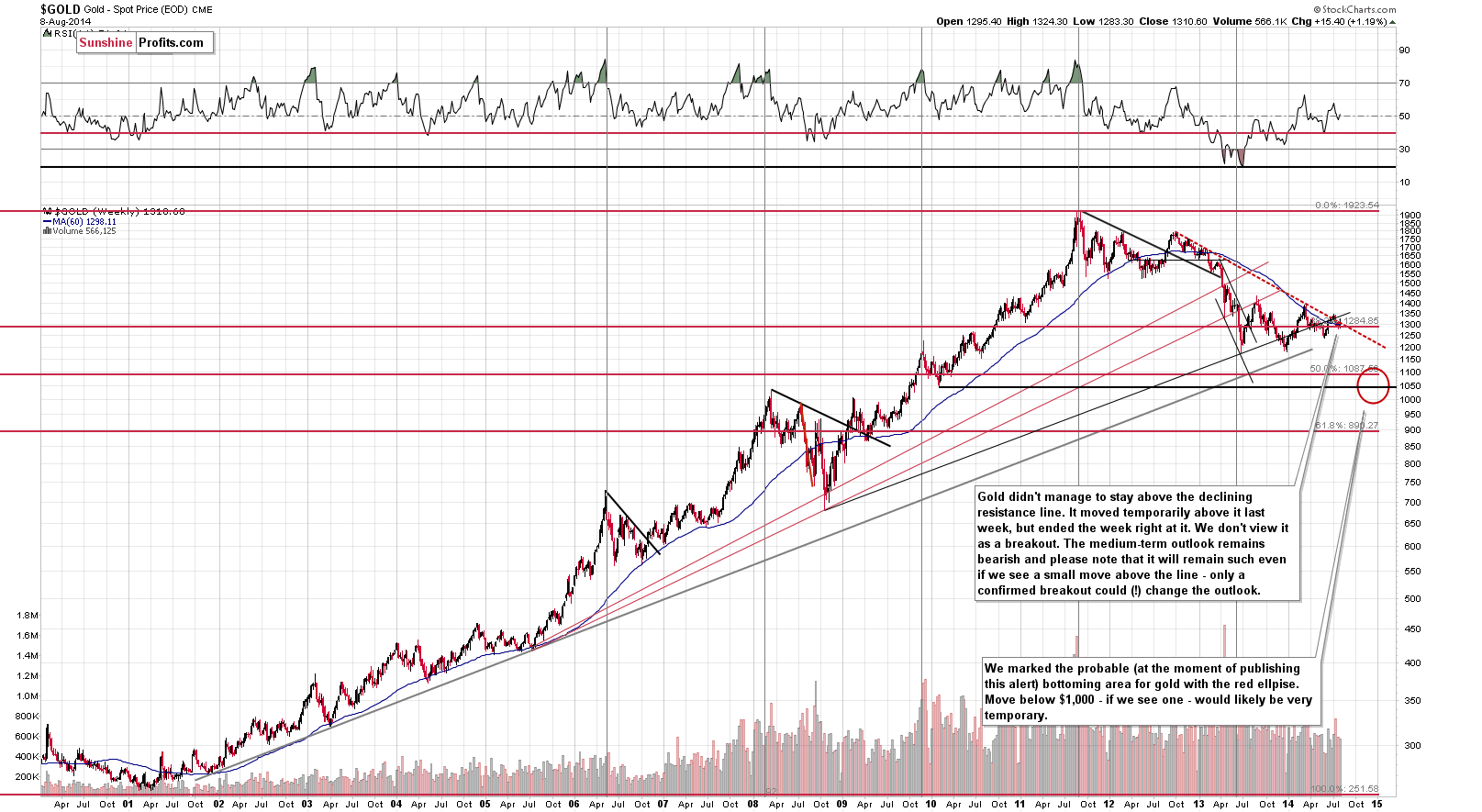

There was a move above the medium-term resistance line in the last week, but finally gold closed at this important line. We don’t view it as a breakout as there was none in terms of weekly closing prices.

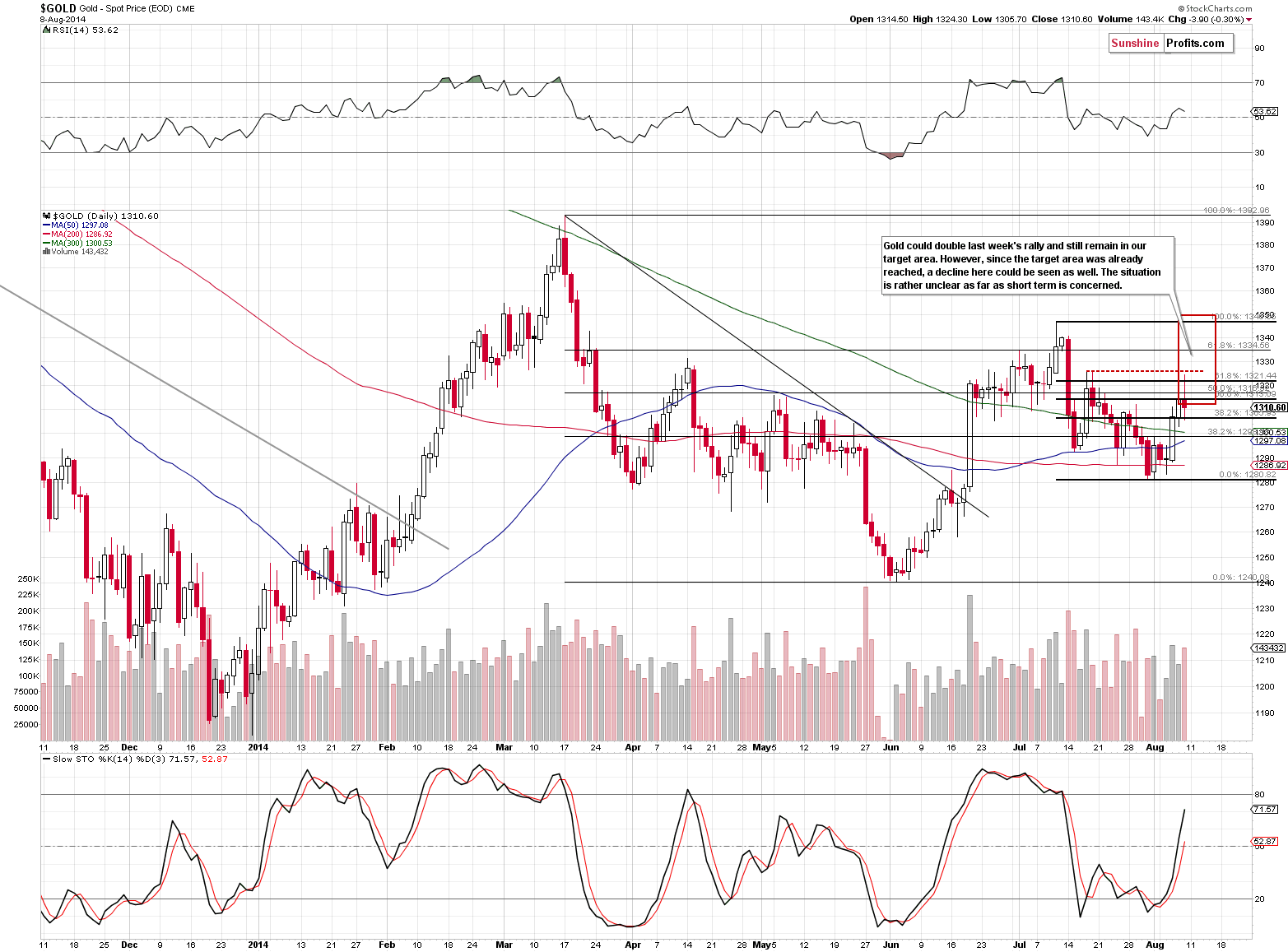

On a short-term basis, Friday’s price action was more visible. Our previous target area was reached, and the local top might already be in. That’s right – “might”. As you will see in the following part of this alert, the situation in the currency markets still suggests (with each day less and less, though) that another short-term rally will be seen soon. That’s why we enlarged the target area – if the USD Index corrects, then we could see some more strength in gold and the rest of the sector. At this time we don’t even rule out a move slightly above the July high.

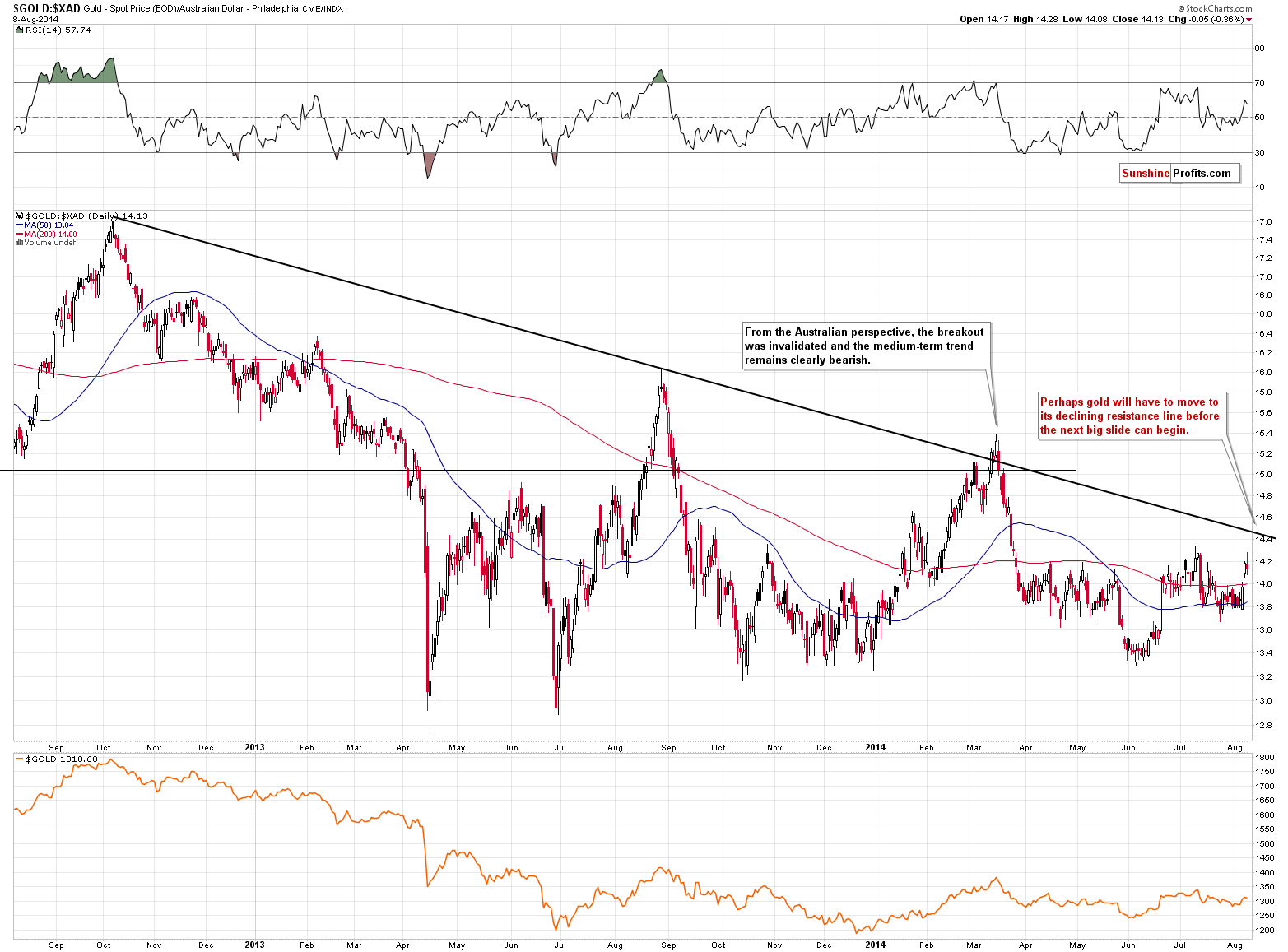

The chart featuring gold priced in the Australian dollar confirms the above:

The declining resistance line was almost reached. Key word – “almost”. Interestingly, it would take more or less a repeat of the most recent rally to get to this line. This line would then be likely to stop the decline, just like it did in March.

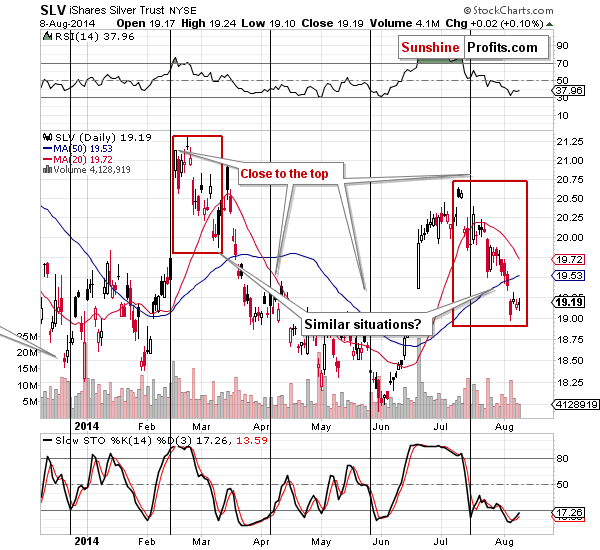

The situation hasn’t changed much for silver, so what we wrote previously about it remains up-to-date:

(…) silver is clearly not outperforming gold on a short-term basis, which means that we have yet to see this kind of confirmation that a top is likely in.

(…) the self-similar pattern remains in place. At this time the pattern is proportionately bigger, but remains similar in terms of shape. Big declines in the precious metals sector have been very often preceded by silver’s short-term outperformance, even if this outperformance was preceded by a visible downswing in the price of the white metal. What we saw in February and March serves as a perfect example.

Why has silver underperformed recently? As always, there is no clear explanation behind any price move (other than because someone pushed the “sell” button), but it seems to us that it can be in a large part attributed to the sharp decline in the general stock market.

If we are just seeing the beginning of another huge decline, then we are still quite likely to see a sharp rally in silver, just before the big drop.

The stock market is getting oversold on a short-term basis, but it doesn’t seem that it has bottomed yet. Perhaps we will see a sharp upswing in silver when stocks form their bottom. This could be something that aggressive market players might want to take advantage of, but a bet on such a volatile move is not suggested for most traders.

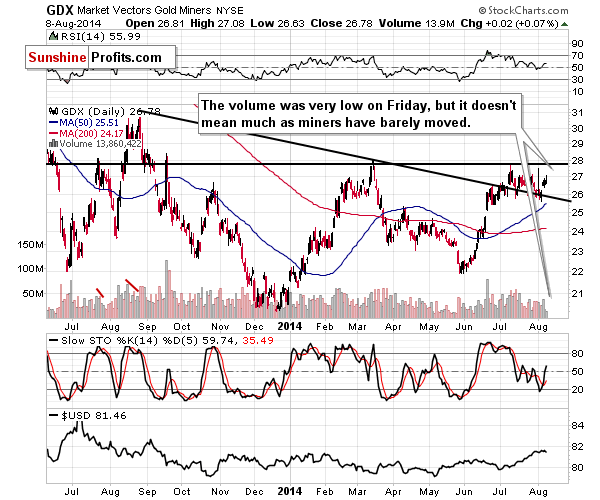

Once again mining stocks moved only a little higher, which has little or no consequences. Our previous comments remain up-to-date:

How far could miners rally if gold is to move to our target area? Quite likely to their March and July highs – close to the $28 level. Again, just like for gold, the situation in mining stocks is rather unclear, but the $28 level as the target is our best bet at this time.

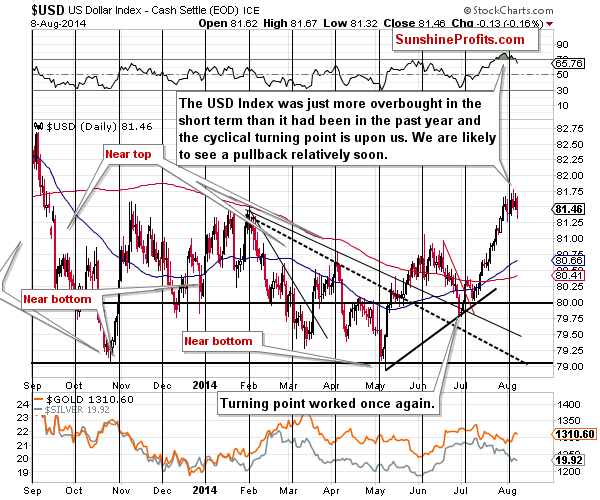

Finally, the situation on the USD Index chart is also similar to the one that we described based on the previous daily closing price, so what we wrote remains up-to-date also here:

The situation in the USD Index is still a bullish factor for the precious metals sector. The U.S. dollar is after a sizable rally and right after the turning point, which is likely to cause at least a small decline.

If the USD Index doesn’t decline in the next several days, it will prove the dollar’s strength. We saw a sizable rally in July and if the US dollar is able to hold these gains and only correct in a mild, horizontal way, then we will likely see another big upswing shortly. For now, the index is still close to the cyclical turning point, and thus prone to a corrective downswing.

Please note that with each passing day, the USD Index is getting further from the turning point, and the odds for a decline diminish. Another reason is that we are already seeing a consolidation pattern in the index – we are no longer “extremely likely” to see at least a pause, as we are already seeing it. The RSI indicator is once again below the 70 level, so the situation is no longer overbought on a short-term basis.

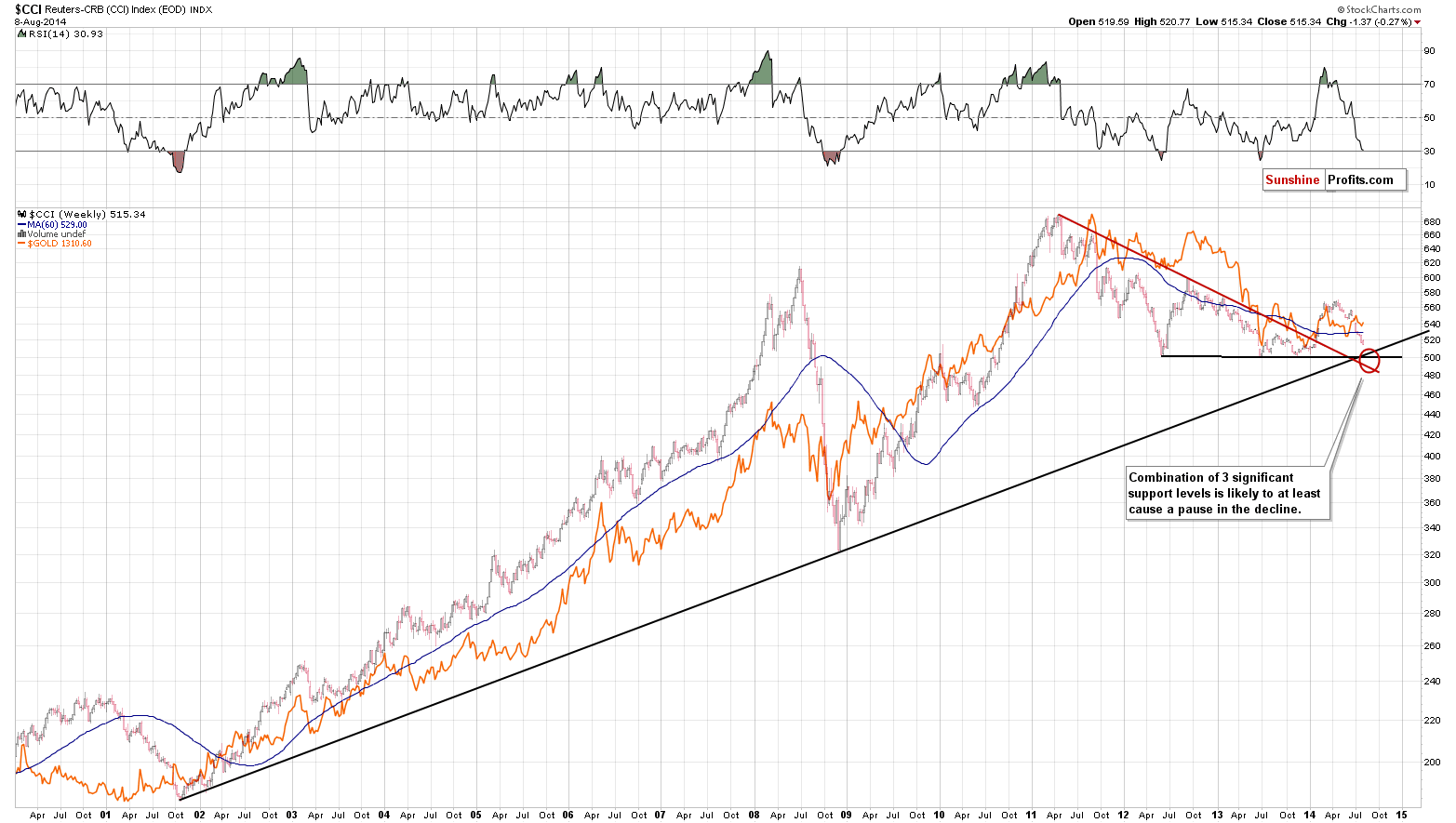

Before summarizing, let’s take a look at an interesting pattern somewhat outside of the precious metals sector – taking all commodities into account.

The RSI indicator is already oversold and the CCI Index (proxy for the commodity sector) is getting close to a triple support area. The very long-term support line coincides with the previous lows and the declining support line and the support that is created in this way is very strong. It seems that we could see a pause or a move higher in the commodities in a week or two. This has more important implications for crude oil than it does for gold, but still, once / if commodities break below these support levels, a big decline will likely follow also in gold.

Taking all the above into account, we can summarize the current outlook in the same way as we did on Friday.

Summing up, it seems that even though the next big move in the precious metals sector is still likely to be to the downside (we have not yet seen actions that are usually seen at important bottoms, like huge underperformance of silver [what we saw this week was not huge enough], and gold is not actively hated in the mass media), the odds for a corrective rally are relatively high.

The USD Index is [still, but less with each passing day] likely to decline at least a little, which is likely to cause a rally in the precious metals sector. However, let’s not forget that the USD Index is after long-, medium-, and short-term breakouts, so this corrective downswing could be small and temporary – the next big move is likely to be to the upside. The opposite seems likely for the precious metals sector.

We plan to re-enter short positions when we see either a small rally an some kind of confirmation that the next local top is in. At this time, we prefer to say out of the market. The situation simply seems too unclear and risky to open a speculative position.

To summarize:

Trading capital (our opinion): No positions

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts