Briefly: In our opinion no speculative positions in gold, silver and mining stocks are now justified from the risk/reward perspective.

Not much has changed since yesterday but we will take the opportunity to comment on what small changes there have been. Let’s look at the charts (charts courtesy of http://stockcharts.com).

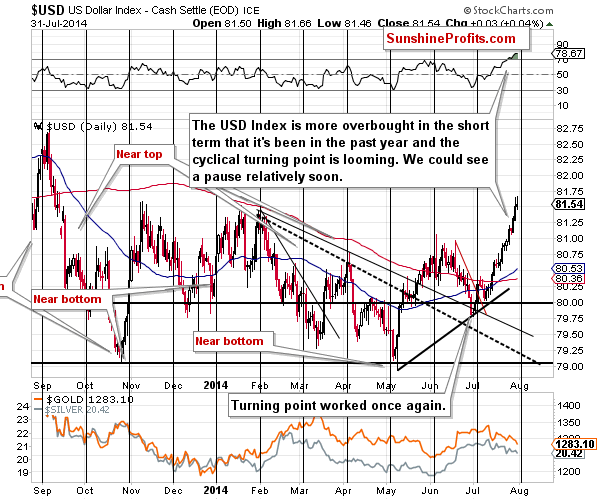

The USD Index moved higher again which makes the points we’ve recently touched upon even more important:

The USD Index moved higher once again (and the EUR/USD pair declined once again) and it is now even more extremely overbought in the short term. It is also another day closer to the turning point. Consequently, the risk of a decline in the following days that could push metals (probably temporarily) higher has once again increased.

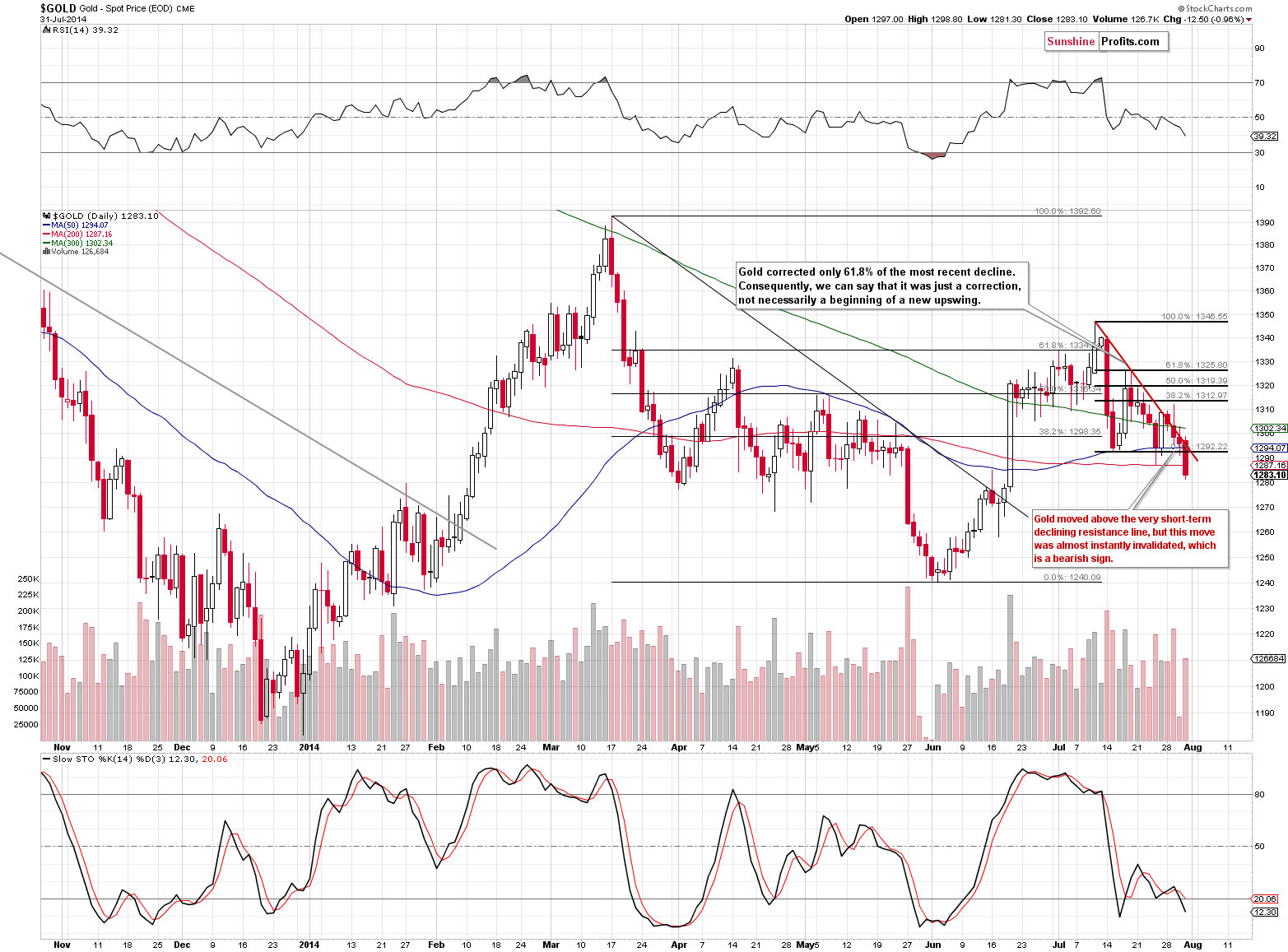

Two days ago, we analyzed gold’s reaction to the dollar’s strength:

[The yellow metal responded] just a little. Gold declined, but the move didn’t take the yellow metal below the previous highs, even though the USD Index moved to new highs. The implications are bullish for gold.

On the other hand, we just saw an attempt to move above the declining resistance line – which failed almost instantly. This is a bearish sign.

Overall, the short-term picture for gold is rather unclear at this time.

We saw a move below the previous low which looks promising but when we compare the situation in gold with the one in the USD Index, we see that gold has been indeed rather strong.

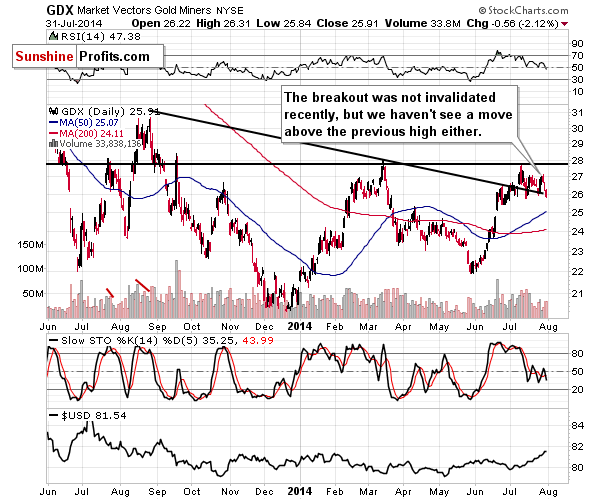

On the GDX ETF chart, we’ve just seen a move below the declining support line but the move has been very small and is currently unconfirmed. At this time, we only have moderate bearish implications here.

Gold has moved lower but the situation today isn’t actually much clearer than yesterday as the U.S. dollar might impact the precious metals market in the days to come. With no clean-cut signals, we apply “when in doubt, stay out” once again, waiting for more favorable conditions to enter another trade.

To summarize:

Trading capital (our opinion): No positions.

Long-term capital: No positions.

Insurance capital: Full position.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts