Briefly: In our opinion no speculative positions in gold, silver and mining stocks are now justified from the risk/reward perspective.

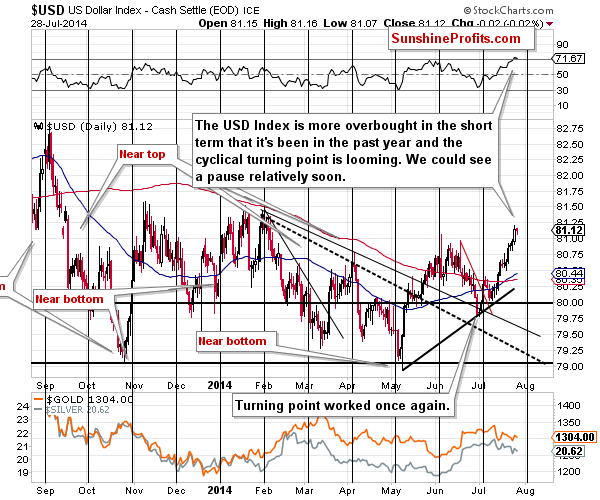

Not much happened yesterday in the precious metals market, but we adjusted our trading position nonetheless. The price is not the only factor that one needs to consider while making investment and trading decisions and it seems that at this time the thing happening “behind the scenes” is more important than the price moves themselves. Let’s take a look at the USD Index chart (charts courtesy of http://stockcharts.com.)

The thing that we described above is… Time. As another day has passed and the USD Index hasn’t declined yet, the move lower became slightly more probable. The reason is that now the USD Index is one day closer to the cyclical turning point.

Yesterday, we wrote the following:

The situation on the USD Index chart is bullish, but we see some caution signs as well. The RSI indicator is above the 70 level, which has previously meant that a local top would be seen shortly. In fact, it was the proximity of this level that was followed by declines, and at this time the U.S. currency is even more overbought – it’s more overbought than it’s been in a year. (…) We could see a pause here, but we could also see another visible move higher followed by a correction close to the cyclical turning point (meaning in a week or so).

The above remains up-to-date, and since the uncertainty caused by the situation in the USD Index has increased, it seems that our small short positions in the precious metals sector are becoming too risky. The risk/reward ratio does no longer favor keeping them open, even though we continue to think that the next big move in the precious metals market will be to the downside.

Consequently, it seems to us that closing the short position in the precious metals sector is justified from the risk/reward perspective. We will monitor the market for a good moment to re-enter this position (or perhaps open a long one) and report to you accordingly.

Changing the subject a bit, we have recently received a question from one of our subscribers and would like to use this occasion to answer it.

Q: On long gold & silver positions could you publish stop loss prices for UGLD & USLV ? Also, on short gold &silver Positions could you publish stop loss prices for DGLD & DSLV please.

A: The stop-losses for the assets you mentioned (given the stop-losses for gold and silver at $1,353 and $21.73, respectively) would be as follows:

UGLD: $17.54

DGLD: $55.62

USLV: $57.85

DSLV: $34.01

These have been computed using the following formula:

[(stop-loss for the base asset - base asset's close one day before the position is opened)÷(base asset's close one day before the position is opened)]×(leverage factor) +1]×(target asset's close one day before the position is opened]

where:

base asset - gold, silver, etc.

target asset - respective ETN

leverage factor - ETN-characteristic multiple (positive for long ETNs, negative for short ETNs)

Using the above formula you should be able to establish the respective stop-loss levels any time we suggest a possible position.

To summarize:

Trading capital (our opinion): No positions

Long-term capital: No positions

Insurance capital: Full position

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts