Briefly: In our opinion (full) speculative short positions in gold, silver and mining stocks are now justified from the risk/reward perspective.

Gold and the rest of the precious metals market (especially silver) declined yesterday, as they were supposed to. They will eventually shine and rally significantly, but it is definitely not the case at this time. Let’s see what changed based on yesterday’s price moves (charts courtesy of http://stockcharts.com.)

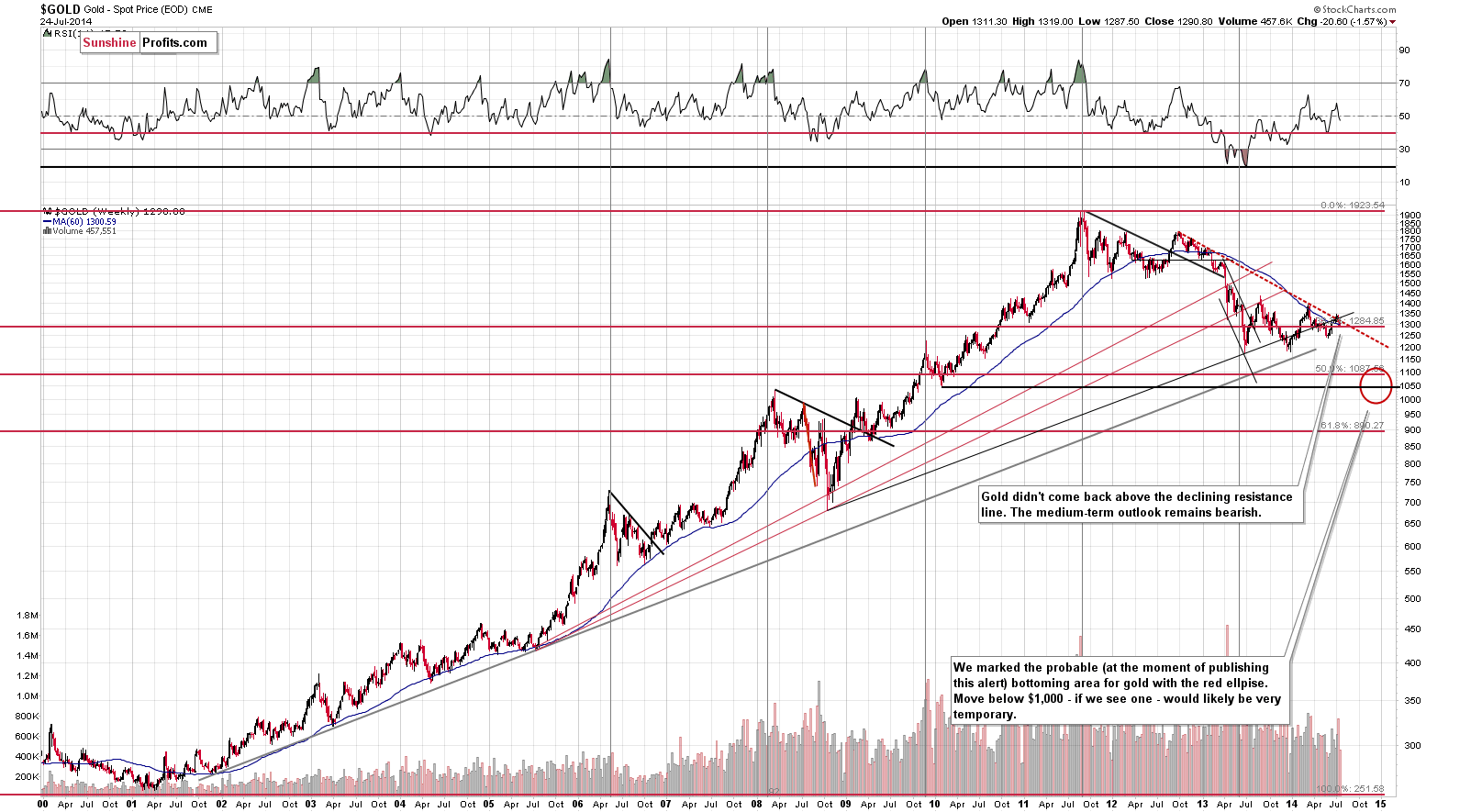

From the long-term perspective, not much changed. We see that gold declined once again after failing to move above the declining resistance line. The downtrend remains in place and we continue to expect the next big move to be to the downside.

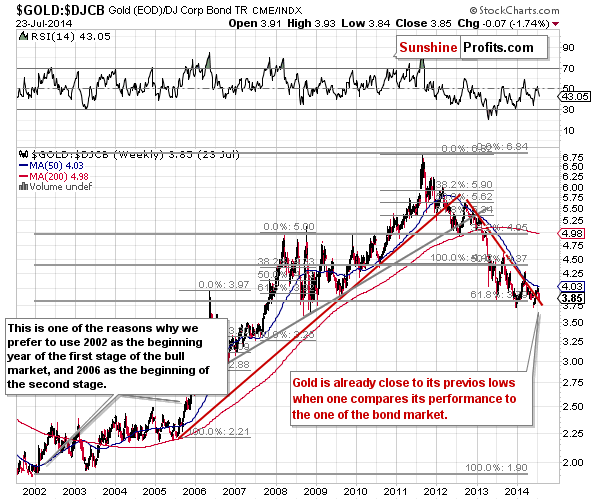

The long-term outlook has deteriorated more visibly in case of gold’s performance relative to corporate bonds. The reason is that from this perspective gold is already very close to its previous lows. It now takes only a little more weakness for gold to break below them.

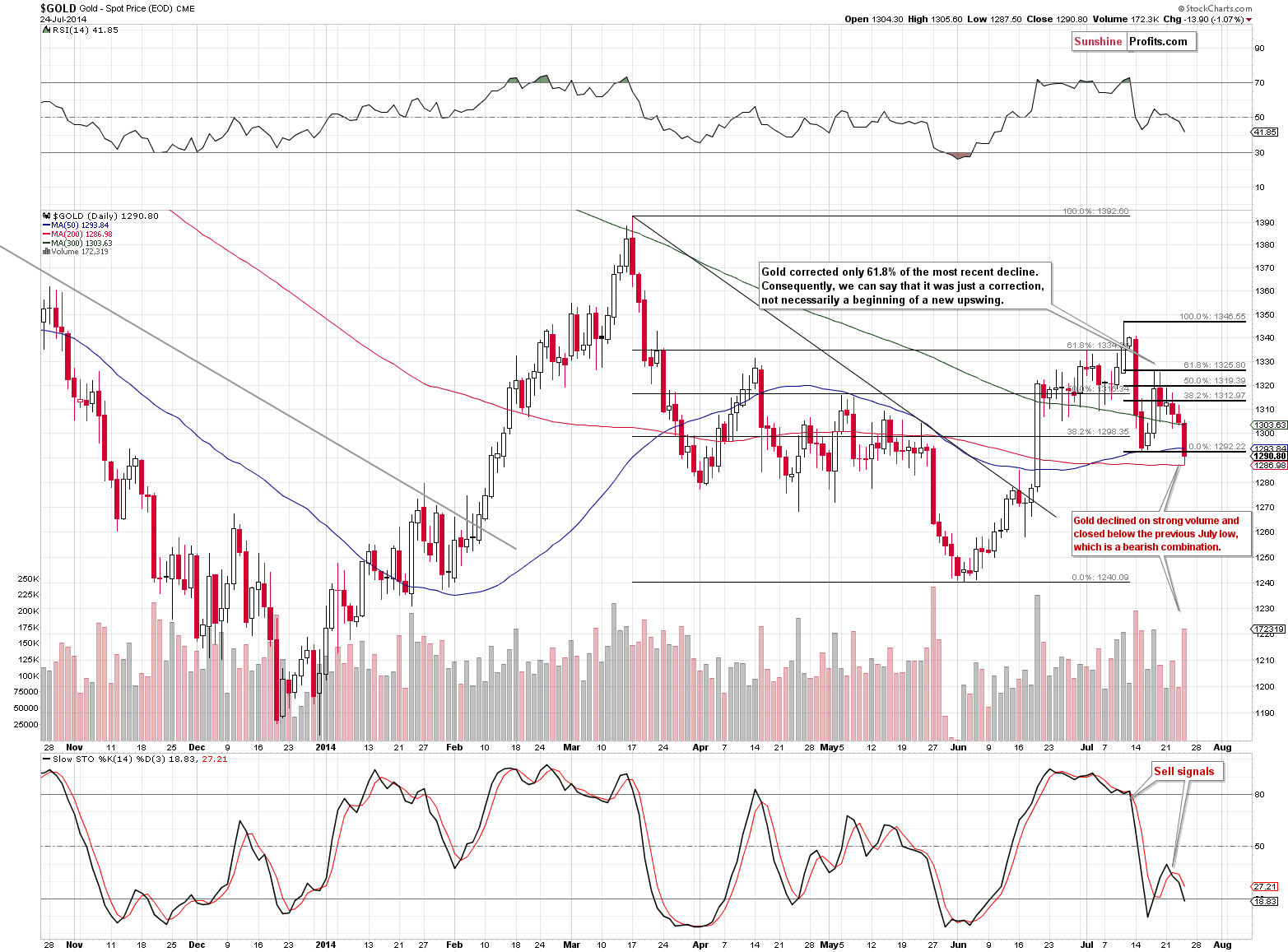

We have already seen a short-term breakdown. It was very small – gold is only a few dollars below the previous July low, but still, that’s a breakdown. Moreover, the move lower materialized on low volume, which is another bearish sign.

Overall, the situation in the gold market deteriorated based on yesterday’s decline.

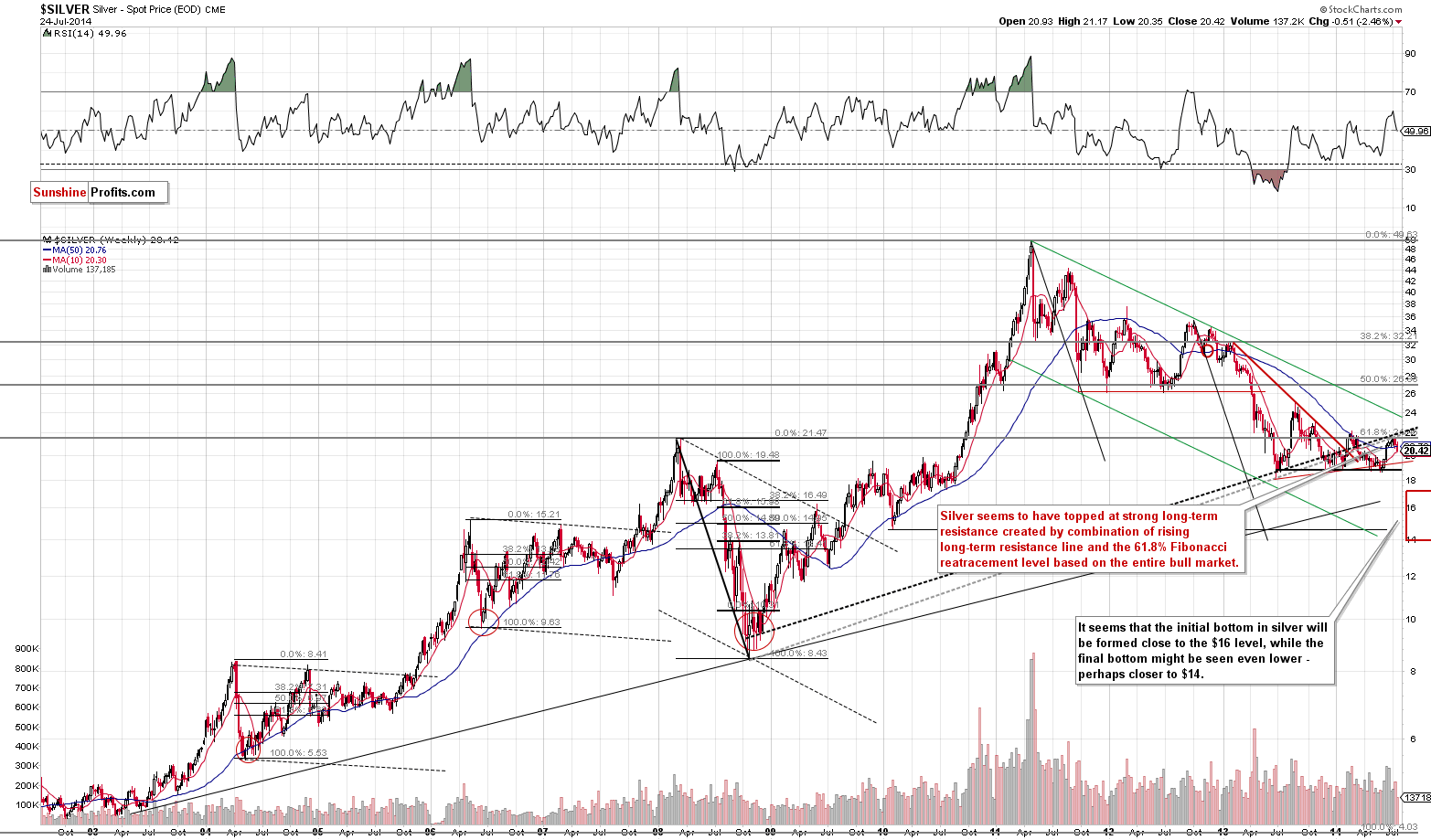

The more visible decline was seen in the silver market and this is where our short positions caused most gains. The most recent rally was clearly stopped by a combination of the 61.8% Fibonacci retracement level based on the entire bull market and the rising long-term resistance line.

Silver has been in the consolidation pattern for almost about a year now and once it moves below the previous lows (close to the $19 level), we can expect the following move to be substantial. The silver lining of this bearish cloud is that it seems that this big move lower will be the final one and that silver will truly bottom at its end.

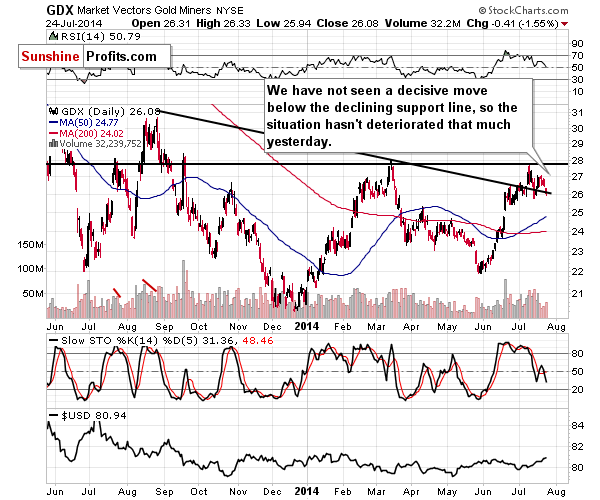

In the case of mining stocks, the situation hasn’t deteriorated much, as miners haven’t moved below the declining support/resistance line. We expect it to be broken sooner rather than later and we expect that the move following the breakdown will be quite sharp. Consequently, it seems to be a good idea to be holding a position at this time instead of waiting to open it after the breakdown.

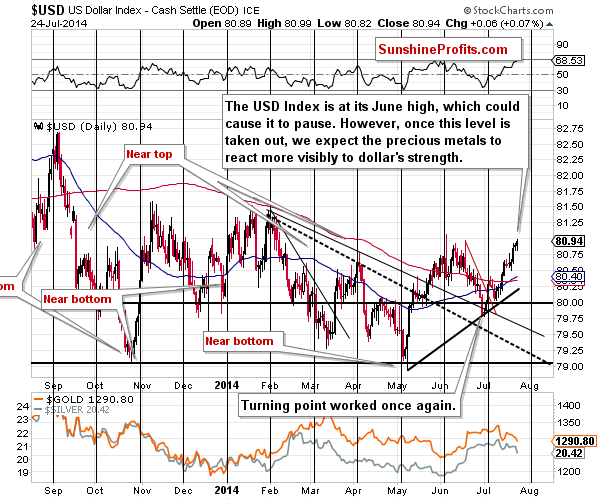

The situation on the USD Index chart is bullish, but we see some caution signs as well. The RSI indicator is getting close to the 70 level, which previously meant that a local top would be seen shortly. At the same time we have the USD Index itself very close to the June high. We could see a pause here, but we could also see another visible move higher followed by a correction close to the cyclical turning point (meaning in a week or so).

Summing up, it seems to us that the precious metals traders are mostly waiting to see how the situation in the USD Index develops before deciding to sell / short. As we have explained in previous alerts, the long-term breakdown in the Euro Index is something that will likely put great pressure on both currency indices and the precious metals market. With the Euro Index likely to decline significantly (even if that doesn’t happen in the next few days or even weeks), the USD Index is likely to appreciate significantly, even though we could see a pause within the next week. Once the rally in the USD Index picks up, we expect the precious metals market to accelerate its decline.

Consequently, even though we like precious metals as a long-term investment, we think that the decline that started in 2011 is not completely over yet.

To summarize:

Trading capital (our opinion): Short (full) position in gold, silver and mining stocks with the following stop-loss levels:

- Gold: $1,353

- Silver: $21.73

- GDX ETF: $28.30

Long-term capital: No positions

Insurance capital: Full position

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts