Briefly: In our opinion no speculative positions are now justified from the risk/reward perspective.

Yesterday’s session and today’s pre-market trading changed quite a lot in the precious metals market on a short-term basis. Gold (yesterday and today), silver (today) and mining stocks (yesterday, perhaps today as well) rallied significantly and the million-dollar question is how much has just changed. Is the rally indeed bullish or has the situation simply become more overbought? Let’s take a closer look (charts courtesy of http://stockcharts.com).

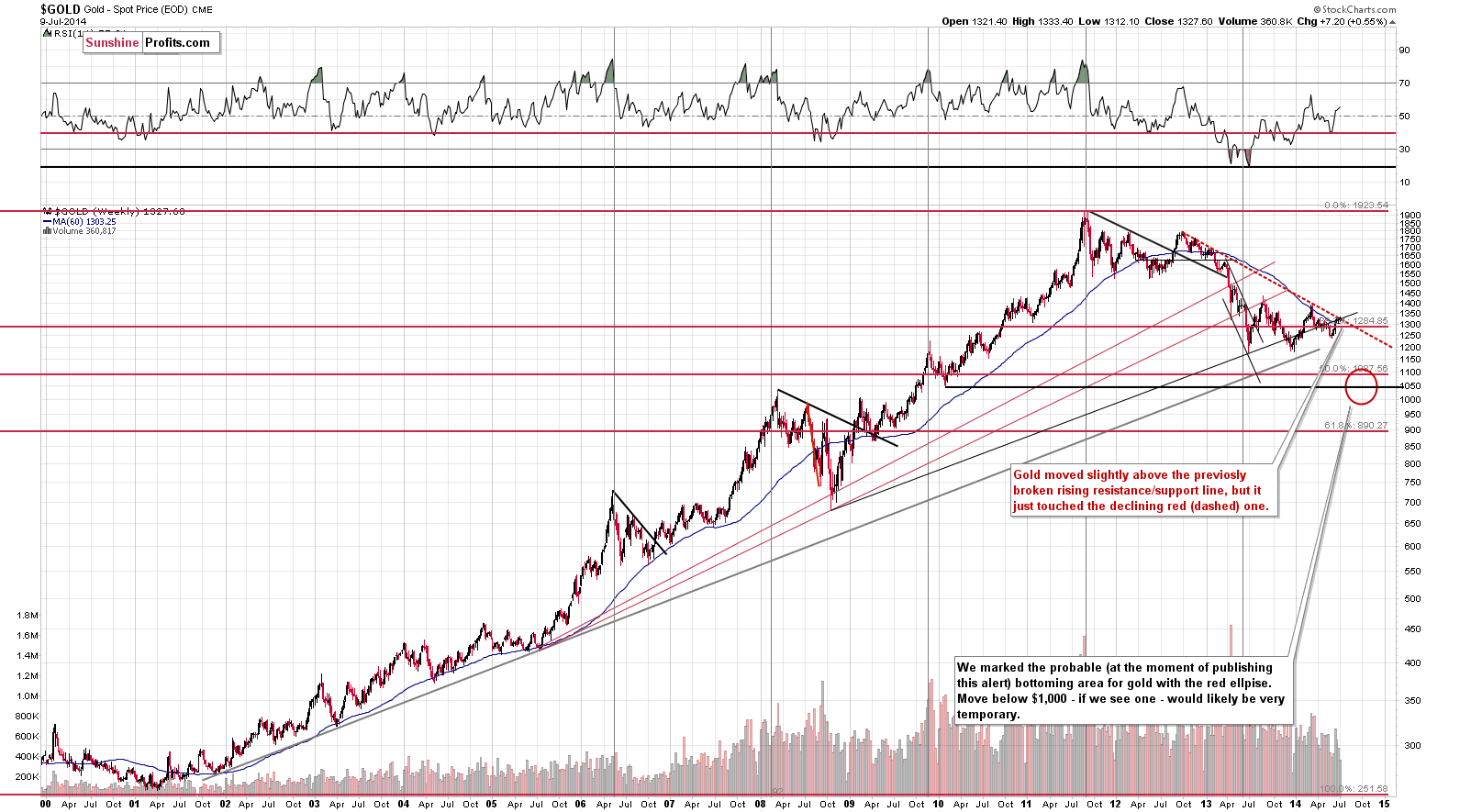

The above chart doesn’t show any changes as it doesn’t include today’s ($17 at the moment of writing these words) move higher. We previously commented on the above chart in the following way:

On the long-term chart we see that even though gold moved higher – slightly above the rising resistance line – it remained below the declining red (dashed) resistance line. From this perspective, not much changed yesterday. We still think that the medium-term trend remains down.

The above remains up-to-date, because of two points. Firstly, today’s pre-market rally is a bit to small to make a meaningful change on the very long-term chart. Secondly, the breakout would need to be confirmed before we can draw meaningful conclusions. Those who have been with us for years know that this skeptical approach toward breakouts has saved & made quite a lot of money on numerous occasions. It’s not “missing the boat” – it’s “waiting for the captain to set the final direction before you jump on the deck”.

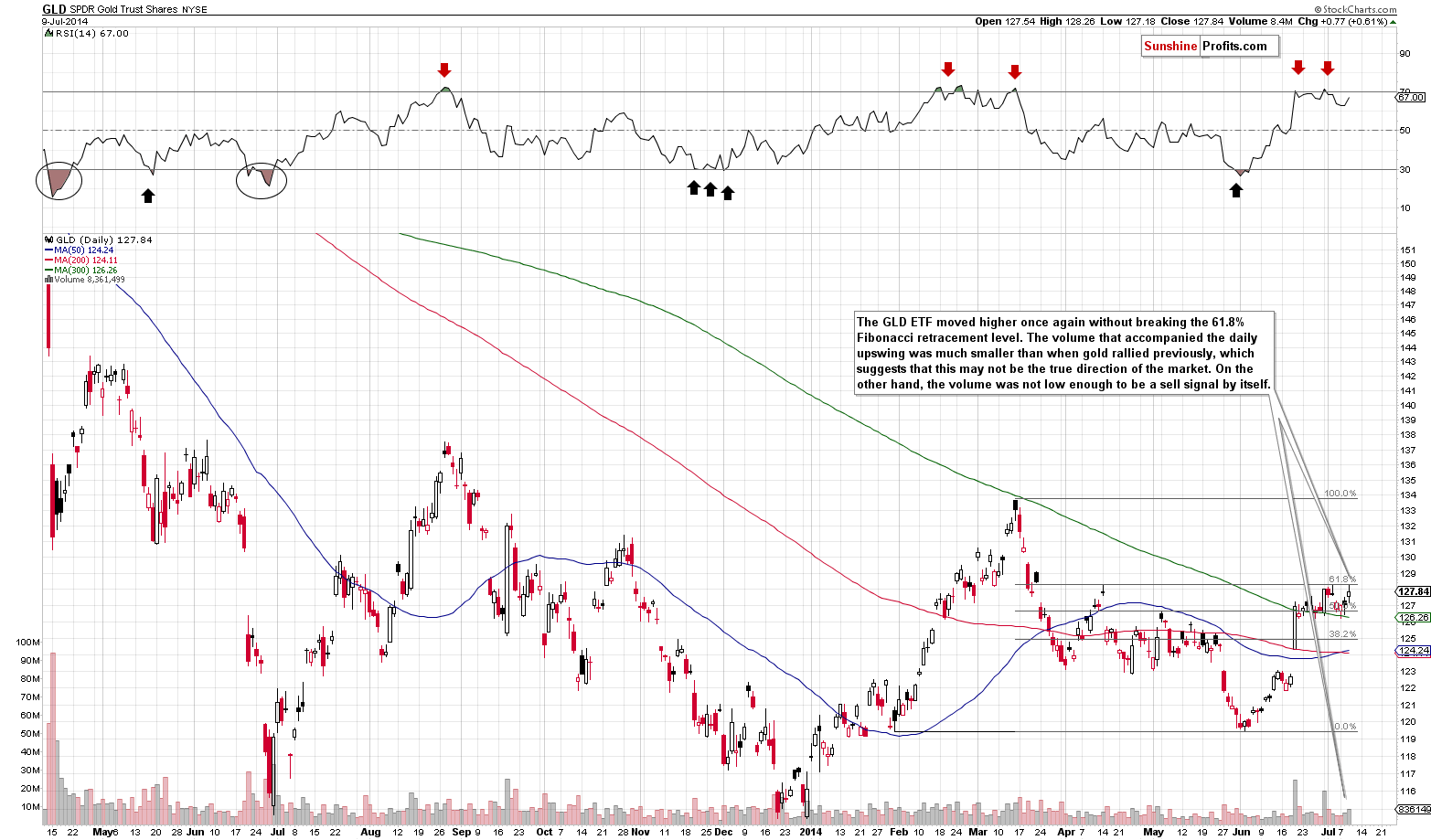

On the above short-term chart we don’t see much changes either – gold moved to the 61.8% Fibonacci retracement level once again without breaking it and the volume was not big enough to really confirm the rally. It was not small enough to be a sell signal, either. Of course, today’s pre-market action is not visible on the above chart. The breakout above the 61.8% retracement is quite likely to materialize after the markets open in the U.S., but the question is if gold will also manage to close above this level and if so, on what volume. “Confirmation” is the key word here.

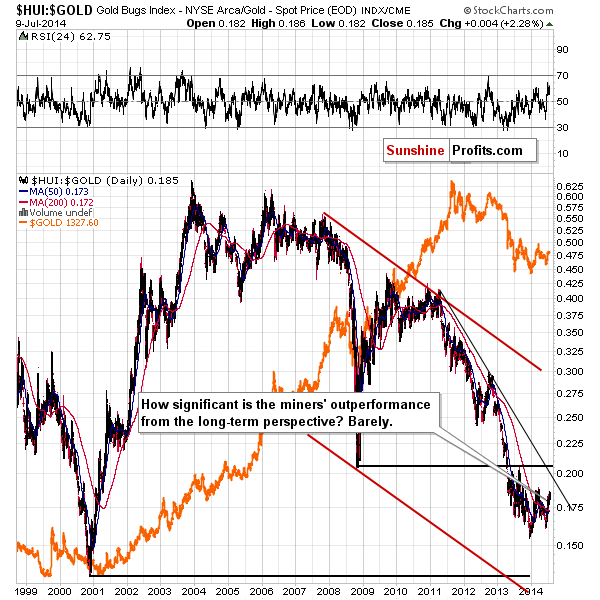

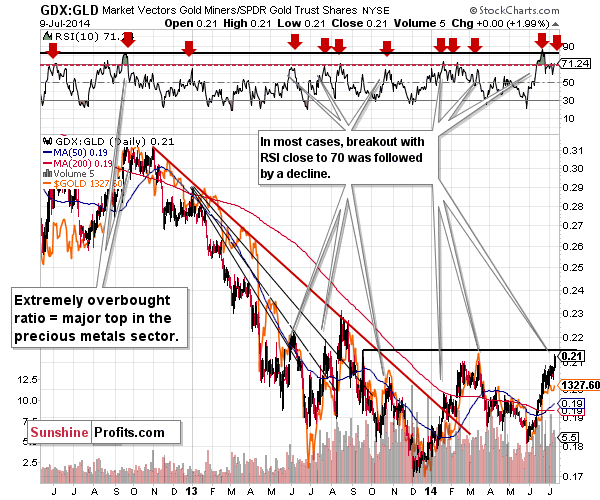

Mining stocks rallied significantly yesterday, also relative to gold. Let’s see how much does this change for the long- and short-term pictures.

The most recent rally is still small and bounce-like. It doesn’t look like a beginning of a new uptrend just yet – the medium-term resistance line based on the 2011 and late-2012 highs was not touched, let alone broken. From this perspective, the outlook remains bearish.

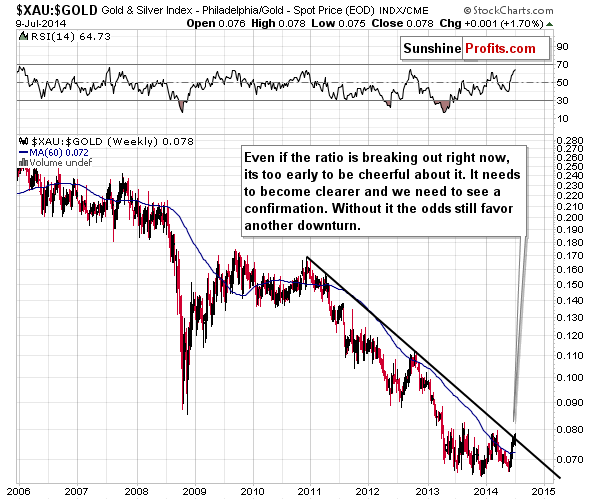

If we use a different proxy for the mining stock sector – the XAU Index – we’ll get the same results. The most recent rally was significant, but there was no visible breakout above the declining resistance line. On the above chart we see a small, insignificant move above this line, but it’s too small to be viewed as a real breakout. In our opinion, this situation actually shows that the miners to gold ratios might be ready to move lower once again, since at least one of the resistance lines has been reached (it hasn’t been reached in the case of the HUI to gold ratio).

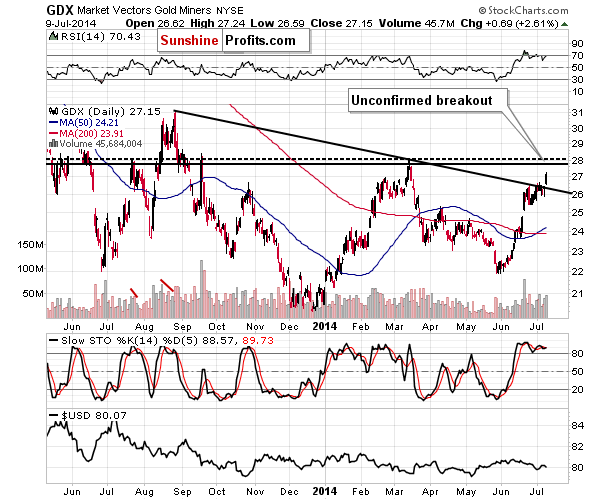

On a short-term basis, we saw a sharp daily move higher, but the next short-term resistance is just around the corner. A further one – the August 2013 high – is also quite close. All in all, it will take more strength from the mining stock sector to truly break out and prove that we are seeing a major improvement.

Mining stocks themselves have broken above the declining resistance line. The volume does not provide confirmation just now, but based on today’s pre-market upswing in gold it seems that this might change shortly. The “problem” with this rally is that it could end as soon as this week as the resistance levels based on September 2013 high and the March 2014 high are quite close. That’s one of the reasons why we’re not going long with the short term in mind.

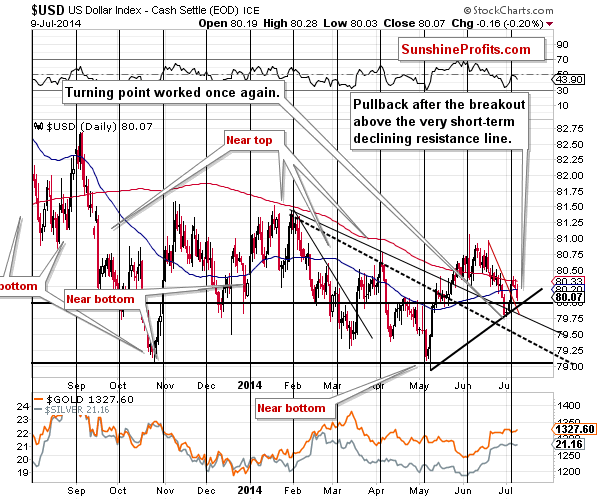

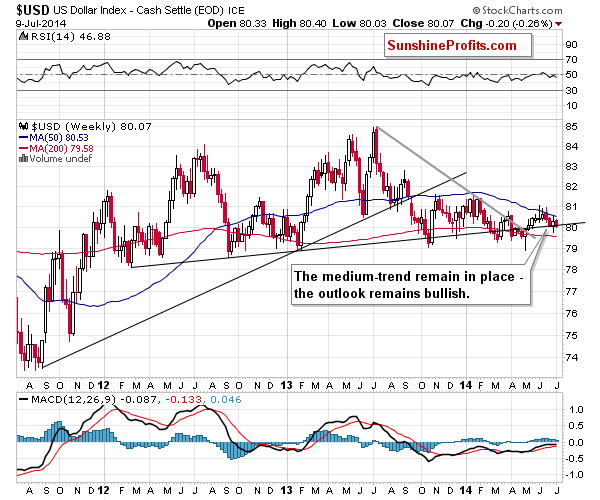

Another reason is the situation in the USD Index. It’s still looks like it’s about to rally substantially in the coming weeks / months.

On the short-term chart we see that the most recent daily downswing was just a pullback after a sharp, short rally. The support lines remain unbroken. The USD Index could very well rally from here. It’s likely to do so not only because of the cyclical turning point, but, more importantly, based on the medium-term picture.

The medium-term trend remains up and the USD Index is right at an important support line – it’s set to rally, which is a major threat for the precious metals market.

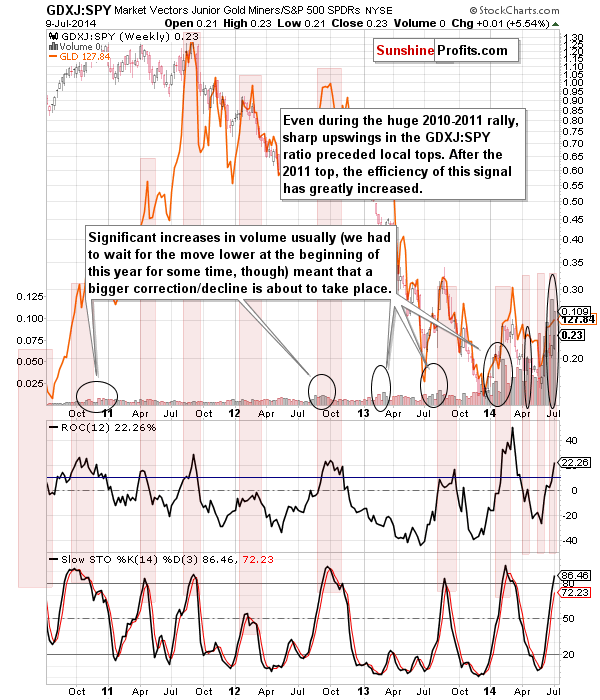

Meanwhile, the bearish indirect signal from the juniors market remains in place.

Our previous comments about the above chart remain up-to-date:

The spike in the ratio of volumes (juniors vs. other stocks) has been usually seen when the precious metals sector was at a local top, or slightly before the top. In other words, when the volume accompanying the move in the GDXJ ETF, which serves as a proxy for the juniors, was high on a relative basis, it suggested an extreme situation in terms of the precious metals investors’ sentiment, and this is something that accompanies local extremes. At this time, we’ve seen a huge spike and the implications are bearish.

Summing up, the situation in the precious metals market remains bearish, but since the sector is showing unexpected strength on a short-term basis it seems better to stay on the sidelines and wait for a more decisive sell signal. The last position didn’t work out as expected, but overall we think the approach and methodologies used were correct. The position was in tune with the medium-term trend, so it was less risky than a long position, and we correctly used only a small portion of capital for this trade, as the situation was rather unclear. On a side note, the last trade for which we used a full portion of capital was very profitable. The effects in trading come over time - it’s not a one-time shot. Opportunities are not always present (and sometimes they appear in other markets) and the key to success is to bend the odds in your favor by entering trades at the most favorable moments and keeping one’s head cool and sticking to this approach regardless of the profitability of one single trade. That’s what we’ll continue to assist you in.

Moving back to the precious metals market, the medium-term trend remains bearish, and even though we’ve seen some bullish signs, there are too many bearish ones and the possible rally here might end relatively soon, so it doesn’t seem that opening speculative long positions is justified here.

To summarize:

Trading capital (our opinion): No positions

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts