Briefly: In our opinion no speculative positions in gold, silver and mining stocks are justified from the risk/reward perspective.

Little changed in the precious metals market on Monday and what we had written based on Thursday’s and Friday’s closing prices remains up-to-date.

The reasons for which we think the medium-term move is down were covered in the previous Monday’s alert, and if you haven’t had the chance to read it, we encourage you to do so today. We took profits on the short positions and are planning to re-enter these positions at more favorable – higher – prices. Are we at this point yet? Let’s take a closer look (charts courtesy of http://stockcharts.com.)

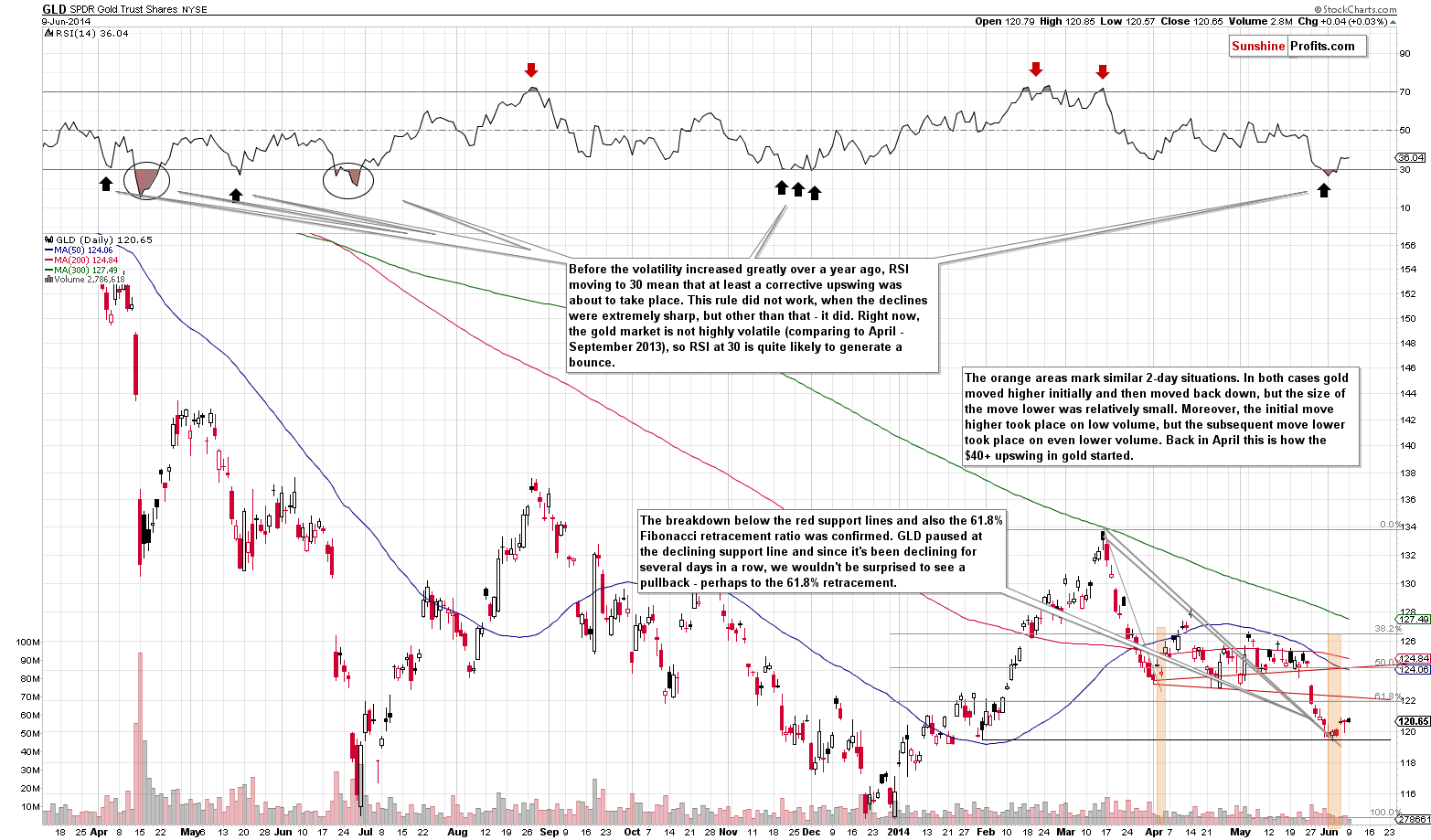

Gold stayed at the same level at which it had closed previously and the volume for yesterday’s session was low. It’s hard to interpret it on its own, so we will get back to this topic while discussing the moves in the USD Index.

Quoting our previous alert:

How high will gold rally before turning south again? There are no sure bets, but our best guess is that it will correct to the previously broken 61.8% or 50% Fibonacci retracement levels – which means a move to (or very close to) $122 or $124.50 or so in case of the GLD ETF and $1,260 or $1,290 in case of spot gold. We will be looking for bearish confirmations (signals from indicators, ratios, other markets, etc.) around these levels and we’ll probably re-enter short positions once we see them.

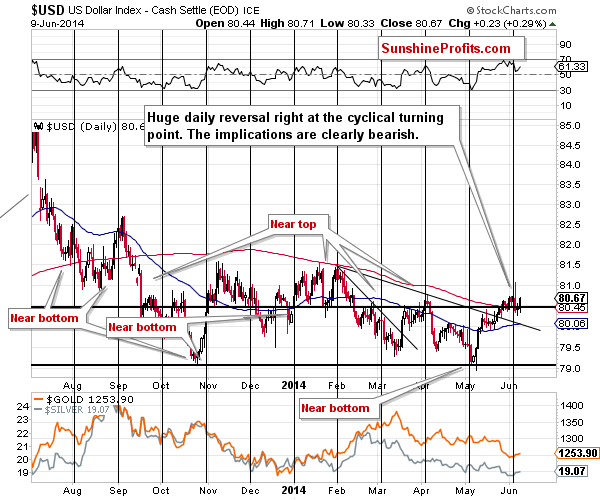

The USD Index closed higher than on the previous trading day. The precious metals haven’t reacted in a really negative way - which one might expect given the move in the USD Index. When a given market refuses to react in a certain way in spite of a visible factor for such a move, it usually means that a move in the opposite direction is likely. At this time, precious metals refused to decline given the move higher in the USD Index, which means that they “don’t want to” move lower and that they are not done rallying.

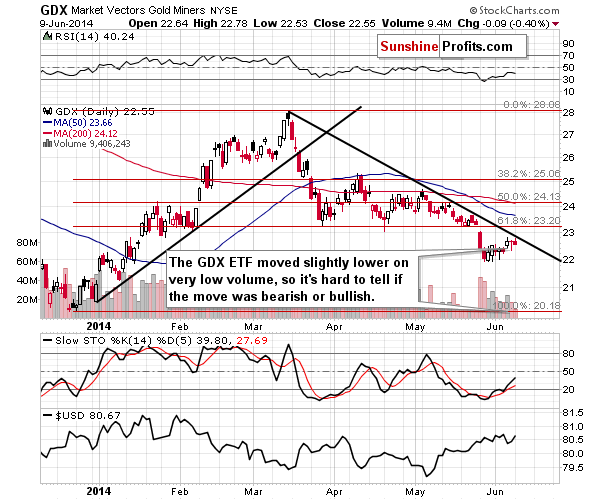

The situation in mining stocks is quite similar to the one seen in gold.

Mining stocks declined on Monday, but moved lower on low volume, which suggests that this might not have been the true direction of the move. The move lower was relatively small – compared to the size of the upswing in the USD Index, so the overall implications are overall bullish. What we wrote previously remains up-to-date:

In case of the GDX ETF, the price targets are relatively close as well. The first one is slightly below the $23 level, at the declining resistance line, and the second one is at the 61.8% Fibonacci retracement. The third one is at the 50% Fibonacci retracement slightly above the $24 level. Either way, the upside is rather limited and we don’t think that the GDX will move and stay above $24 for long – if it gets there, that is.

If gold is to double its recent move higher, then we could expect mining stocks to move at least to their 61.8% Fibonacci retracement, slightly above $23.

As it is the case with gold, we will be monitoring the markets for signs of weakness and bearish confirmations to estimate at which of these levels it’s best to re-enter short positions. The situation is much less clear in terms of price targets when it comes to silver, so we will focus on other markets to estimate the time when shorting the silver market seems justified from the risk/reward perspective once again.

Summing up, while the medium-term trend in the precious metals market is down, we are seeing a corrective upswing and it doesn’t seem that it’s over yet. It seems quite likely that the rally will be over relatively soon, perhaps when the USD Index reaches the 80 level.

To summarize:

Trading capital (our opinion): No positions

Long-term capital: No positions

Insurance capital: Full position

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts