Briefly: In our opinion speculative short positions (half) are justified from the risk/reward perspective in gold, silver, and mining stocks.

The USD Index pulled back a bit yesterday, while precious metals moved higher. Is the situation bullish yet? Let’s see (charts courtesy of http://stockcharts.com.)

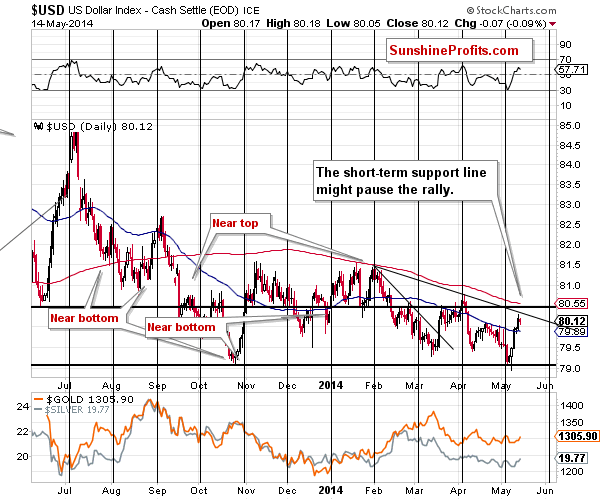

The USD Index paused after moving very close to the declining short-term resistance line. That’s not really surprising – the previous move up had been quite sharp, so it’s no wonder that we saw a breather. No market can move up or down without any corrections. However, the USD Index is after long- and medium-term breakouts and thus the continuation of the rally is to be expected.

What we wrote yesterday remains up-to-date:

The short-term USD Index chart reveals that there is one additional resistance level that needs to be taken out before the USD can rally much higher – the declining line based on the February and April highs. Once we have the USD Index above this line and the breakout is confirmed, traders should become convinced that the next move in the U.S. dollar is up, and that’s when we might see metals and miners finally respond to the USD Index’ strength (by declining).

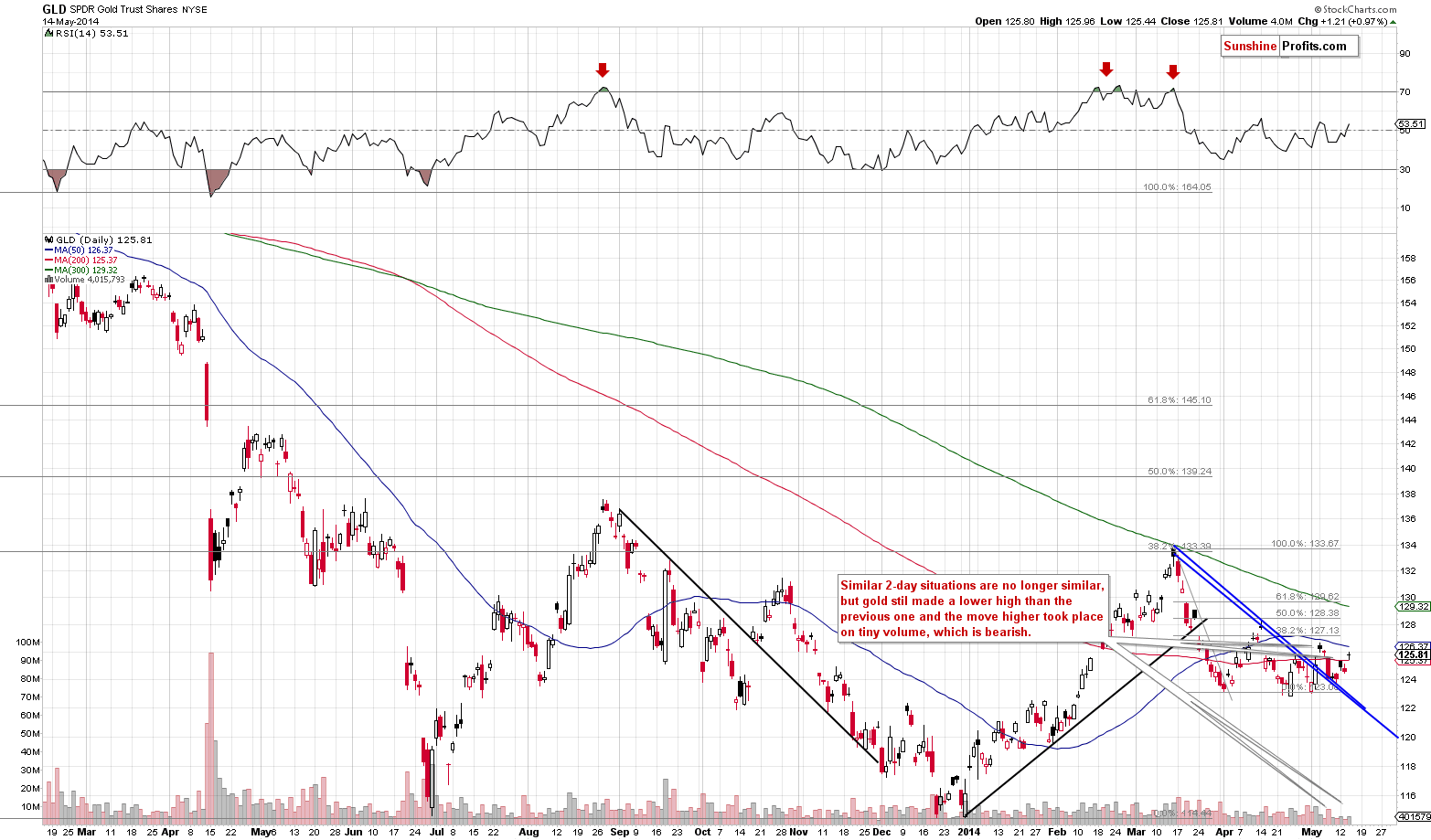

As far as gold is concerned, the 2-session analogy that we wrote about yesterday was already invalidated yesterday (the implications were not strongly bearish, anyway), but that hasn’t changed much. The GLD ETF moved higher on tiny volume yesterday, which is a bearish sign. Another bearish sign (or more precisely: not a bullish one) is that we don’t have gold above the previous local high. In fact we are seeing a series of lower highs – something that is an indirect suggestion that the next move will be lower.

Moreover, please note that this week’s small upswing didn’t make gold move above the 50-day moving average and the same goes for spot gold price. All in all, the current small move higher still seems to be a counter-trend move.

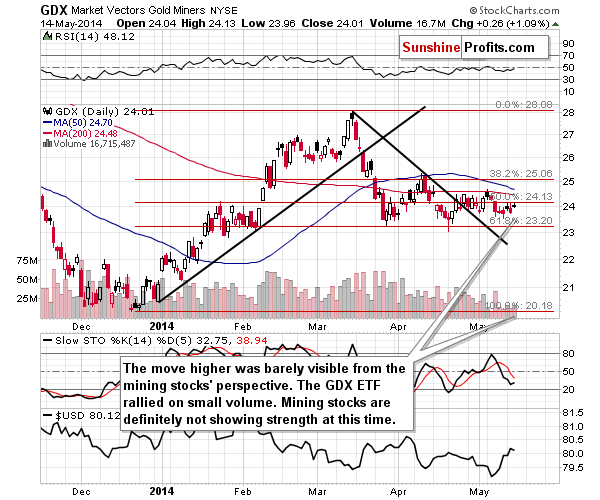

We can draw the same conclusions based on the mining stocks’ performance. What we wrote yesterday remains up-to-date:

The mining stock sector is close to the March and April lows, and with each local high being lower than the previous one, it seems that we might finally see a breakdown this month.

The precious metals sector usually declines in the middle of May, so we have bearish implications also from this perspective.

Additionally, please note that yesterday’s move higher took place on relatively low volume and was small compared to the one seen in gold. Miners are not strong at this time, and that – by itself – is also a bearish factor.

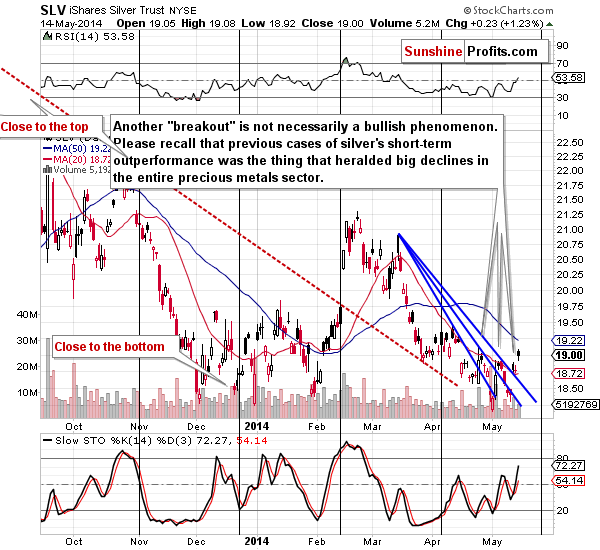

Silver, on the other hand, has moved visibly higher this week. Is this a bullish factor? Not necessarily. Silver’s outperformance used to be a very bullish signal in the past years, but that was not the case in the more recent past. Since March all cases of silver’s outperformance (and many cases before that) have been the final sell signals for the precious metals sector.

Summing up, the outlook for gold, silver, and mining stocks remains bearish, but not extremely bearish, which means that we don’t increase the size of the short position just yet. Precious metals are not responding strongly to the dollar’s rallies so far, but it seems that investors and traders are simply waiting for the confirmation of the breakout in the USD Index (there have been cases when the metals’ reaction was delayed in the past). Plus, silver’s strong performance and lack thereof in case of mining stocks, plus lower highs in gold and mining stocks are a bearish combination.

To summarize:

Trading capital (our opinion): Short positions (half) in: gold, silver, and mining stocks with the following stop-loss orders:

- Gold: $1,326

- Silver: $20.30

- GDX ETF: $25.20

Long-term capital: No positions.

Insurance capital: Full position.

Please note that a full speculative position doesn’t mean using all of the speculative capital for this trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts