Briefly: In our opinion no speculative positions are justified from the risk/reward perspective. Gold and silver are moving lower today and whether we decide to re-open the short positions depends to a large extent on the way mining stocks react. For now the outlook remains as outlined below.

The precious metals didn’t do much yesterday, but mining stocks showed strength once again. Today will examine their performance relative to gold more closely. However, first, let’s take a look at gold itself (charts courtesy of http://stockcharts.com.)

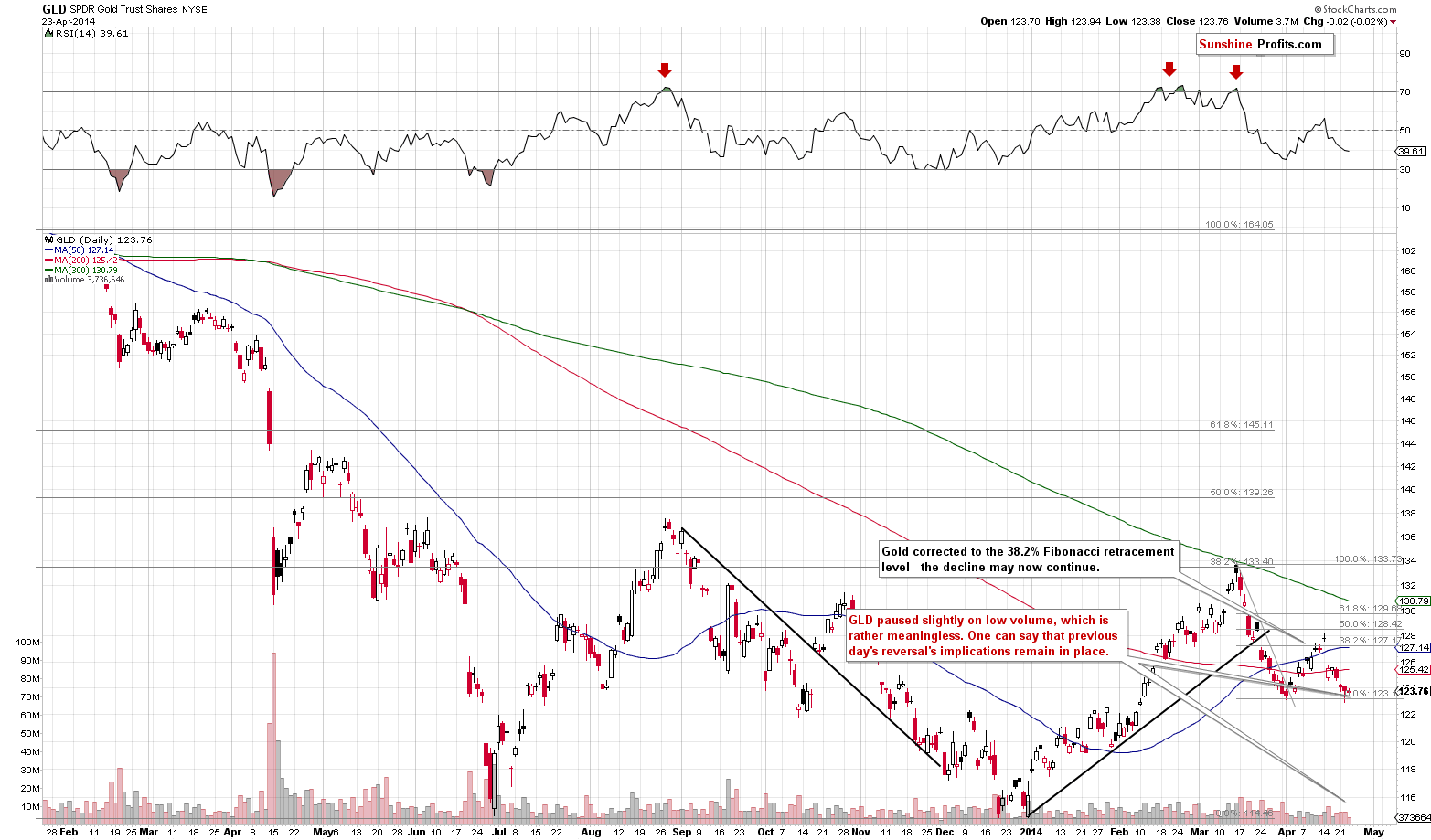

Gold closed very close to where it had closed on Tuesday, so what we wrote yesterday remains up-to-date:

We still haven’t seen any breakdown, but we saw an attempt to move below the recent lows – a failed attempt. The latter is a bullish sign for the short term, even though the medium-term trend remains unaffected and down.

Moreover, please note that GLD has just formed a reversal hammer candlestick.

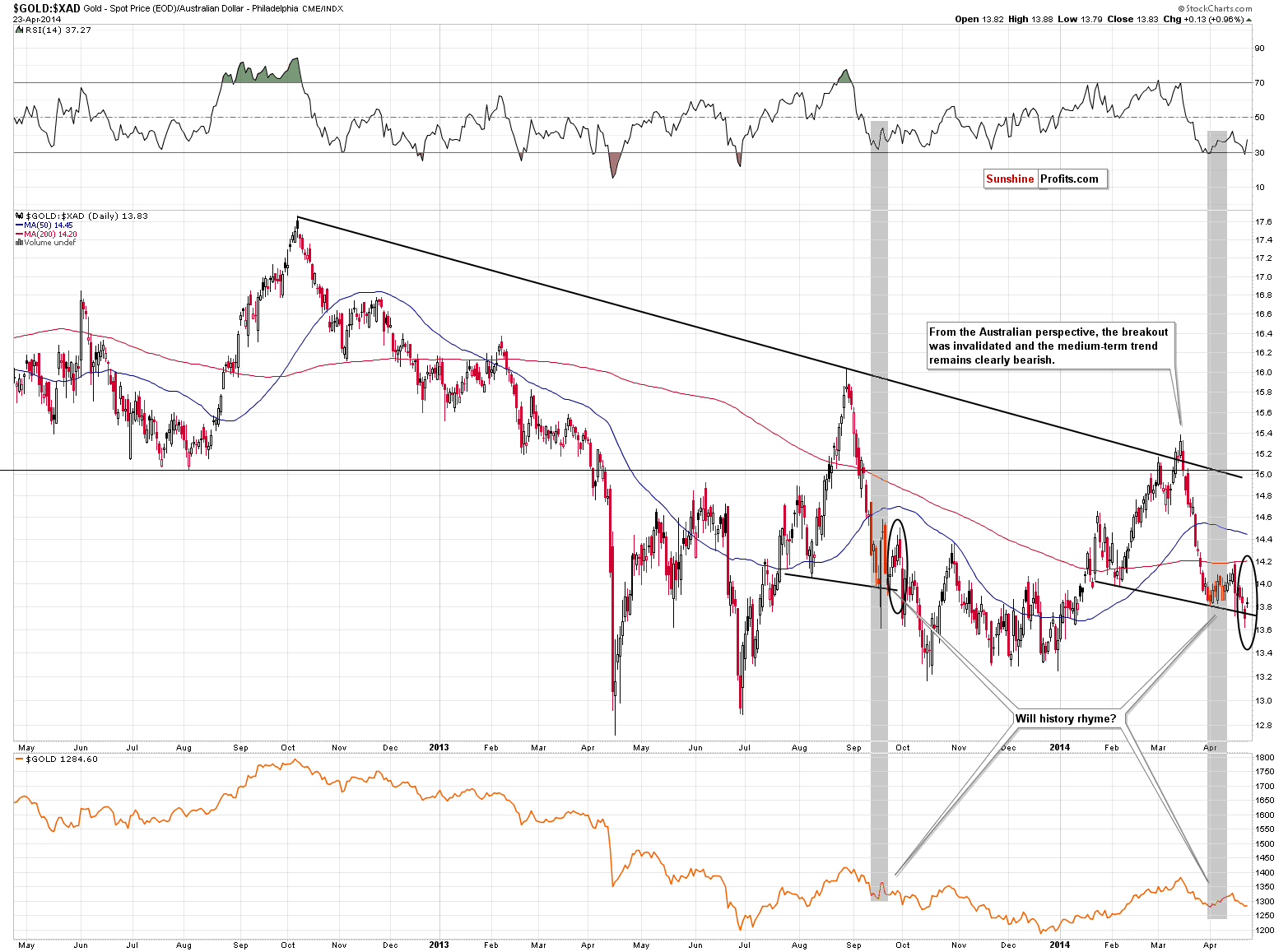

We also wrote about gold priced in the Australian dollar. We wrote:

(…) gold priced in the Australian dollar moved lower as well and in this case we saw a completion of the bearish head-and-shoulders formation. (…) The move below the neck level of the formation is not huge yet, so the breakdown is not yet confirmed, but the situation is still more bearish than not.

This breakdown was just invalidated, which makes the above picture bullish for the short term. Please note that at the same time the analogy between now and late September 2013 remains in place. Back then the first move below the neck level was also invalidated – there was some short-term strength, but nothing substantial.

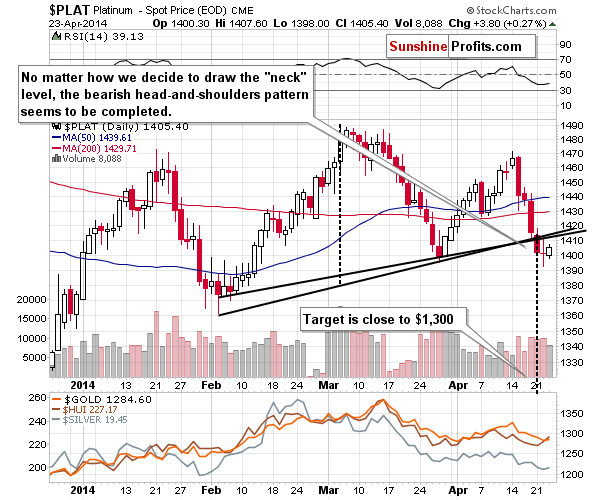

On the other hand, in the case of platinum, we saw the third consecutive daily close below the neck level and the outlook is clearly bearish in this case. It could be that we are in a situation similar to the first half of March – platinum declined but gold, silver and mining stocks moved higher for several days.

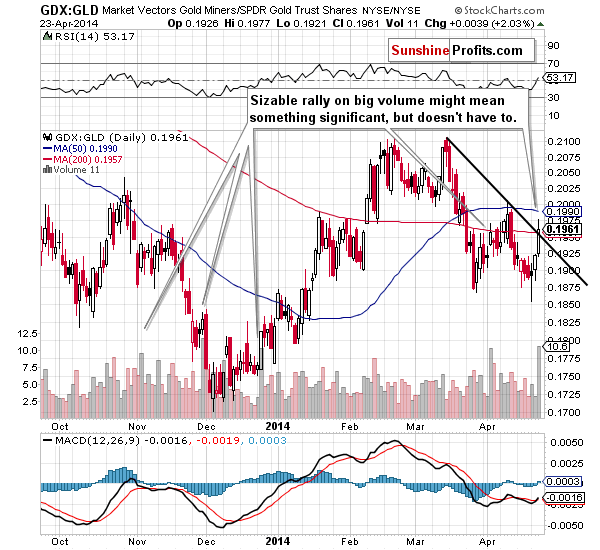

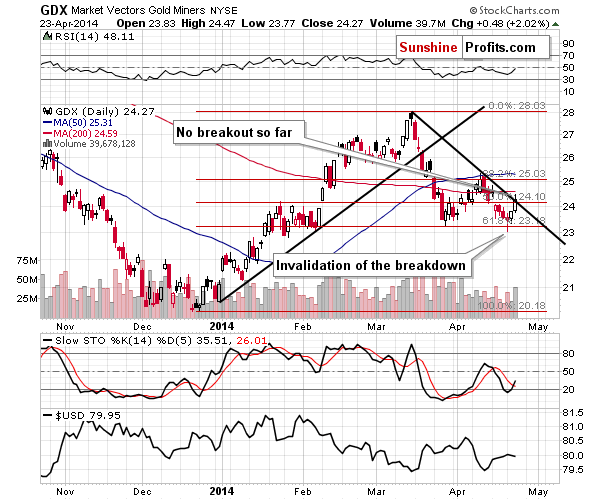

Earlier today we promised to discuss the miners to gold ratio. Let’s take a look at the substantial rally that just materialized in it.

The GDX to GLD ratio, meaning miners’ performance relative to gold, moved sharply higher in the past 2 days. Moreover, yesterday’s rally took place on big volume. That’s something that stands out and correctly catches the eye of gold and silver investors.

It looks very bullish at the first sight. Mining stocks are finally showing strength even though gold does not. That’s what had preceded the Dec. – Feb. rally. Is this enough to say that we’re seeing a bullish phenomenon? No. Prudent investors and traders will check what happened in each recent similar case instead of focusing on just one (since there have been many “similar” cases, that is). There have been a few cases in the previous months when miners rallied relative to gold and it happened on big volume (technically, we’re discussing the ratio of volumes, not the volume of the ratio – the ratio doesn’t have volume by itself) and there was only one time – in late December 2013 – when a significant rally followed. In other cases, the rallies were temporary and relatively small.

Moreover, please note that there was no breakout above the declining resistance line in terms of daily closing prices – only an intraday attempt.

Consequently, even though it seems that the situation has improved a lot – it hasn’t, at least not yet.

Mining stocks moved higher on sizable volume, but they also stopped at the declining resistance level. Without a confirmed breakout, the situation will not become much more bullish.

Overall, the situation is still rather unclear as far as short term is concerned and we think it’s best to follow the when in doubt – stay out saying. The situation for gold priced in the Australian dollar improved, but the environment deteriorated for platinum. The outlook in gold and silver remains unchanged and while the miners’ strong performance – especially relative to gold – looks promising, it’s not yet significant enough (particularly without a confirmed breakout above the declining resistance line) to change the outlook. It still seems that taking the profits off the table yesterday was a good idea.

To summarize:

Trading capital (our opinion): No positions.

Long-term capital: No positions.

Insurance capital: Full position.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts