Trading position (short-term; our opinion): Short positions (with a stop-loss order at $56.45 and an initial downside target at $45.81) are justified from the risk/reward perspective.

On Tuesday, crude oil moved higher and re-tested the strength of the key resistance area, but did this increase change anything in the overall picture of the commodity?

Let’s examine the charts below to find out (charts courtesy of http://stockcharts.com).

Yesterday, we wrote the following:

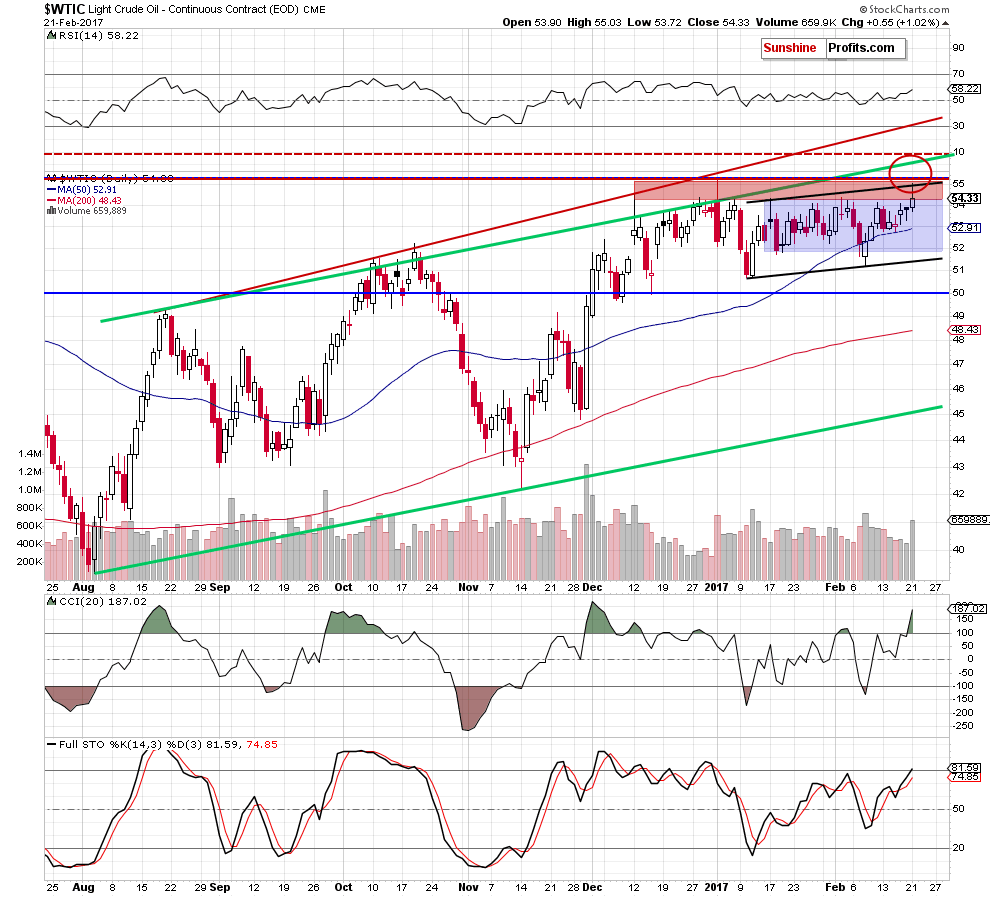

(…) earlier today, cure oil futures extended gains and hit an intraday high of $54.95, which suggests that the commodity will likely follow them and re-test the strength of the red resistance zone once again. (…) crude oil is currently trading not only in the blue consolidation, but it also remains inside the black rising trend channel. Therefore, taking into account today’s price action before the market’s open, it seems that light crude could climb to the upper border of the formation, which is slightly below the January high.

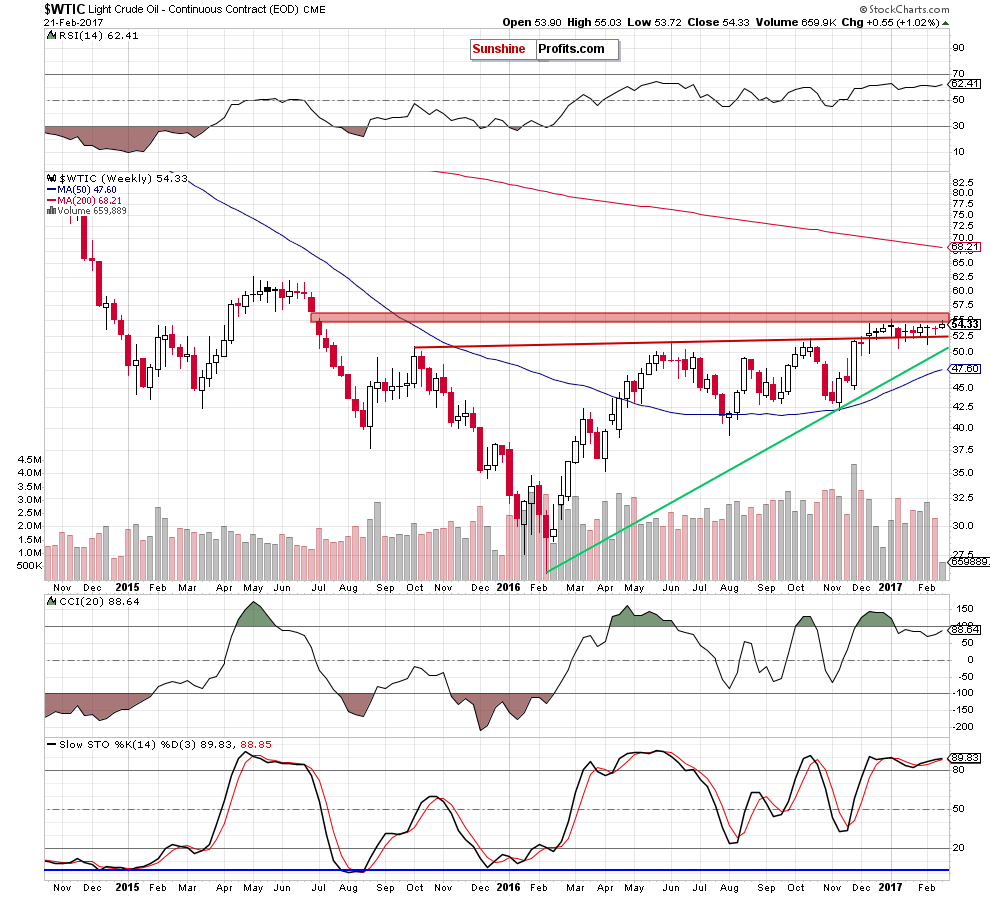

From today’s point of view, we see that the situation developed in line with the above scenario and crude oil moved to our upside target. Despite this improvement, the key resistance area encouraged oil bears to act, which resulted in an invalidation of the small breakout above the upper border of the black rising trend channel.

This suggests that further deterioration is very likely – especially when we take into account a potential double top formation and the proximity to the red gap marked on the weekly chart.

Finishing today’s alert, please keep in mind what we wrote yesterday:

(…) above this area (around $56) is also the upper border of the medium-term green rising trend channel, which successfully stopped oil bulls in October, December and January. This means that even if crude oil moves higher once again, the strong resistance is very close, suggesting that lower prices are just around the corner and short positions are justified from the risk/reward perspective.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at $56.45 and an initial downside target at $45.81) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts