Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Thursday, light crude lost 0.54% after the EIA report showed that crude oil supplies in the U.S. increased once again. As a result, the commodity slipped below $54 and closed the day under the last week’s highs. What does it mean for crude oil?

Although the EIA showed that gasoline inventories decreased by 1.593 million barrels, and distillate stockpiles fell by 1.811 million barrels, the report also showed that crude oil inventories rose by 0.614 million barrels in the week ended December 23, missing analysts’ forecasts and disappointing market participants. Additionally, supplies at Cushing, Oklahoma, increased by 0.172 million barrels last week, which affected negatively investors’ sentiments. Thanks to these circumstances, light crude slipped below $54 and closed the day under the last week’s highs. What does it mean for crude oil?

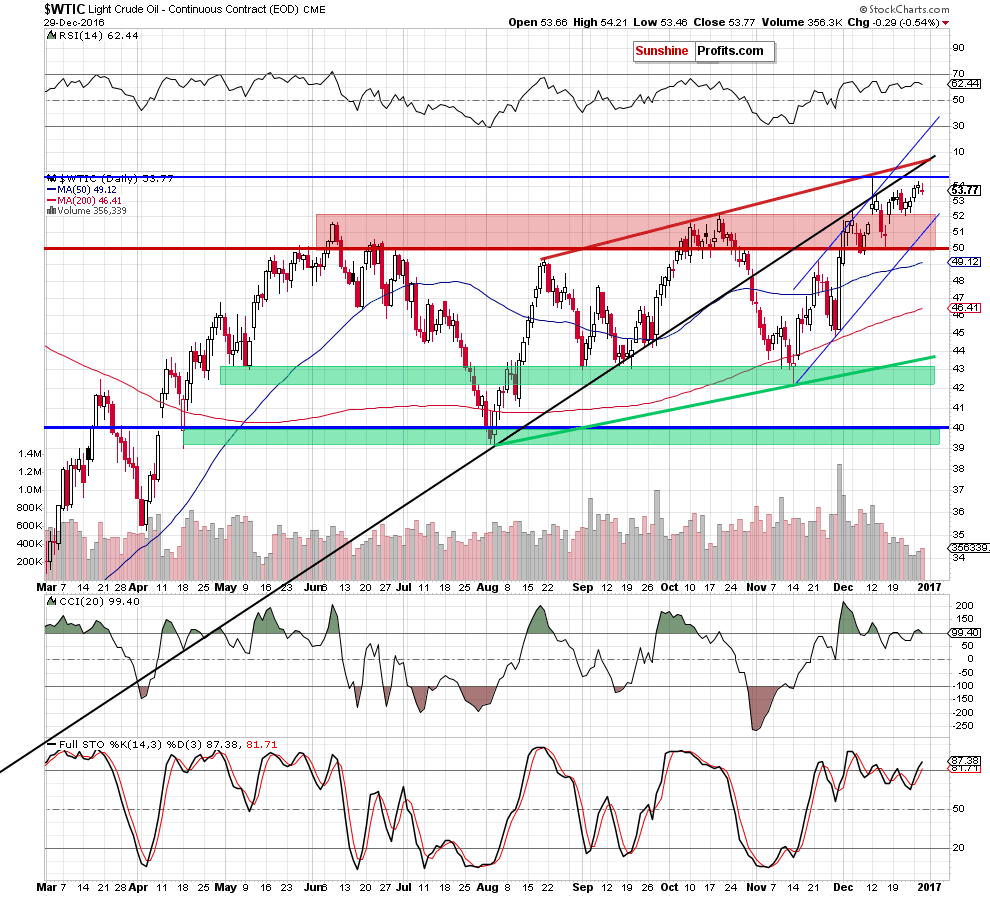

Let’s take a closer look at the chart below to find out (charts courtesy of http://stockcharts.com).

Quoting our yesterday’s alert:

(…) we should keep in mind that the American Petroleum Institute reported yesterday that crude oil inventories in U.S. rose by a 4.2 million barrel in the week to Dec. 23. Therefore, in our opinion, if today’s government data shows another increase in crude oil, gasoline or distillates inventories, oil bulls may have a problem to keep prices at current levels, which could translate into reversal in near future.

As you see on the daily chart, the situation developed in line with the above scenario and oil bears pushed the commodity lower after disappointing inventories news. With yesterday’s decline light crude not only moved slightly away from the 2016 peak, but also closed the day under the last week’s highs, invalidating earlier breakout.

This is a negative signal, which in combination with an increase in the size of volume yesterday increases the probability of reversal in near future (probably early next week) – especially when we factor in the fact that the commodity is still trading well below the medium-term black resistance line and the red resistance line based on the previous highs.

Nevertheless, in our opinion, as long as there won’t be a breakdown under the previously-broken Oct high (and an invalidation of earlier breakout) another sizable move to the downside is not likely to be seen and short-lived moves in both directions (between the Oct high and 2016 peak) should not surprise us.

Summing up, the outlook for the commodity remains mixed at the moment as the commodity is trading in a narrow range (between the previously-broken Oct high and the 2016 peak) and we can’t say whether a rally or a decline will be seen next. As always, we will keep you – our subscribers – updated.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts