Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Thursday, crude oil gained 3.28% as the combination of an OPEC deal and another drop in U.S. crude oil inventories continued to weigh on investors’ sentiment. As a result light crude came back above the barrier of $50 and approached the Oct high. Where will the commodity head next?

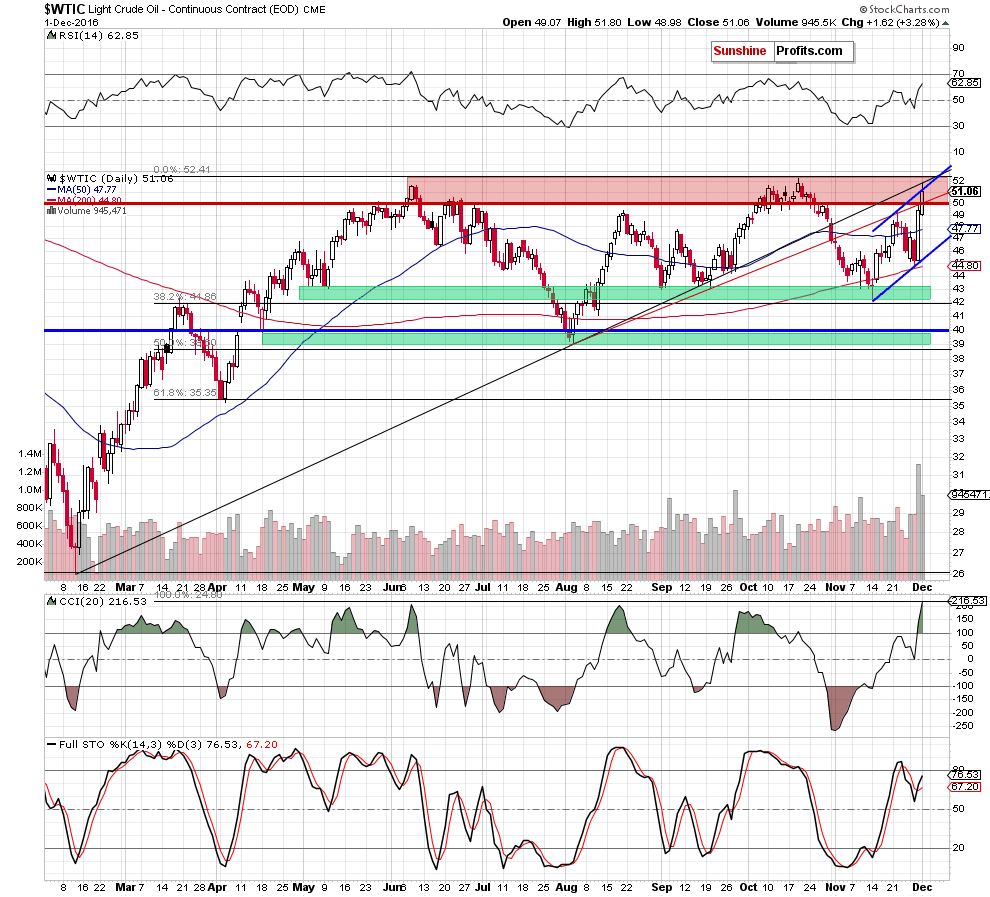

Let’s take a look at the daily chart to find out (charts courtesy of http://stockcharts.com).

Yesterday, we wrote the following:

(…) How high could the black gold go in the coming days? Taking into account the fact that the size of volume that accompanied yesterday’s increase was huge and a buy signal generated by the Stochastic Oscillator, it seems that the commodity may test the Jun and Oct highs in the coming day(s).

From today’s point of view, we see that the situation developed in line with the above scenario and oil bulls pushed the commodity higher. With yesterday’s increase light crude broke not only above the barrier of $50, but also the red resistance line (based on the Aug and Sep lows), which triggered further improvement and a rally above the upper border of the blue rising trend channel. Despite this move, the black resistance line (based on the Feb and Aug lows) in combination with the proximity to the Oct high encouraged oil bears to act, which resulted in a pullback and a daily closure below both resistance lines.

Such price action means that light crude invalidated the breakout above upper line of the blue trend channel and suggests a verification of the breakdown under the black resistance line which doesn’t bode well for oil bulls. If this is the case, we may see a correction of recent rally and a drop to the previously-broken red line based on the Aug and Sep lows (currently around $50.15) or even to the Nov 22 high of $49.20 in the coming week.

Nevertheless, as long as buy signal generated by the Stochastic Oscillator remain in place, another attempt to move higher and a test of the Oct high can’t be ruled out. Therefore, waiting at the sidelines is justified from the risk/reward perspective. In other words, we’ll let you know when the risk to reward ratio appears favorable for the next trade (a one likely to increase the profits that we made on the previous ones).

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts