Trading position (short-term; our opinion): Short positions (with a stop-loss order at $53.22 and initial price target at $46) are justified from the risk/reward perspective.

On Wednesday, crude oil extended gains as a combination of a bullish EIA weekly report (which showed that crude oil inventories dropped by 5.2 million barrels last week, beating expectations) and Saudi Arabia oil minister’s commentary weighed on investors’ sentiment. As a result, light crude gained 2.37% and hit a fresh 2016 high, but will we see further rally in the coming days?

Let’s examine charts and find out (charts courtesy of http://stockcharts.com).

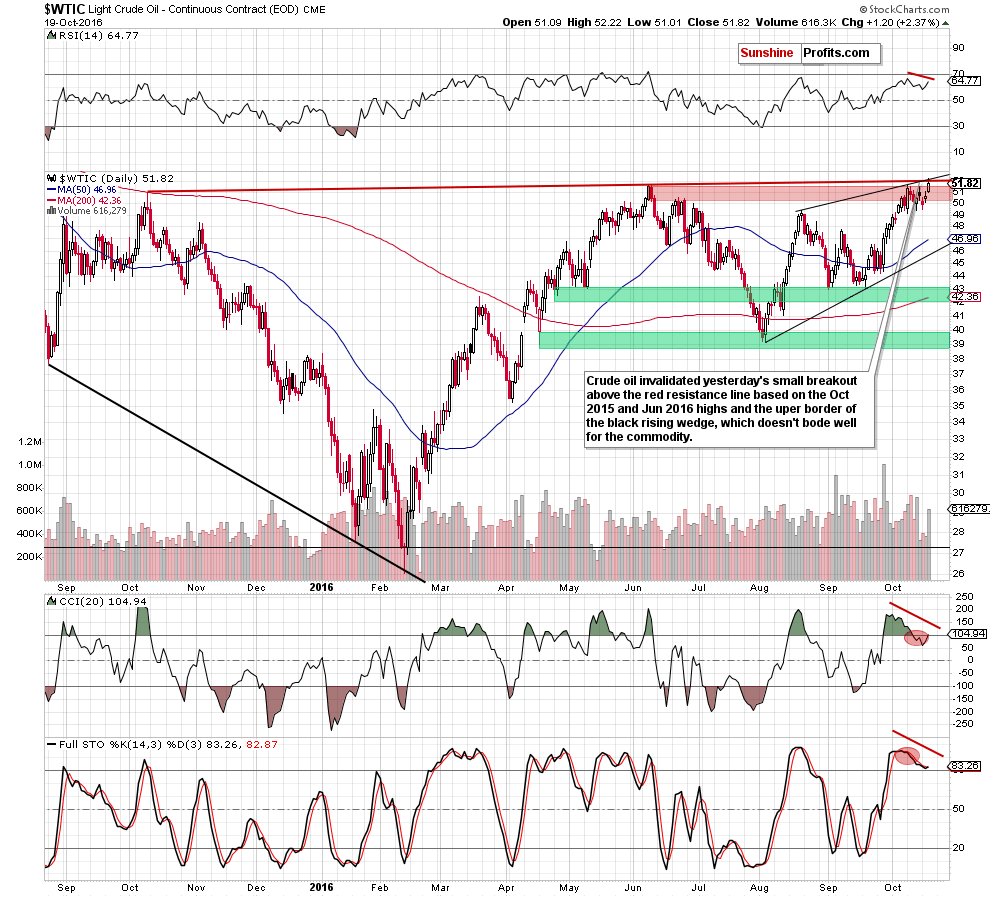

The first thing that catches the eye on the above chart is a breakout above the Jun high and a fresh 2016 high of $52.22. But is this event as bullish as it seems at the first sight? In our opinion, it‘s not. Why?

Firstly, although crude oil broke above the previous high and climbed above the red resistance line (based on the Oct 2015 and Jun 2016 highs), this improvement was very temporary and light crude reversed very quickly, invalidating earlier small (barely visible from the daily perspective) breakout.

Secondly, with yesterday’s downswing, the commodity also invalidated a tiny breakout above the black resistance line based on the Aug and Oct 10 highs, which is an upper border of the black rising wedge (another negative sign).

Thirdly, the size of volume that accompanied yesterday’s increase wasn’t huge (compared to what we saw at the end of Sep and on Oct 13), which raises doubts about oil bulls’ strength.

Fourthly, there are clearly visible negative divergences between the RSI, CCI, Stochastic Oscillator and the price of the commodity, which doesn’t bode well for further rally. At this point, it is also worth noting that although the CCI and Stochastic Oscillator invalidated earlier sell signals, it seems to us that they generate them once again in the very near future (maybe even later today).

On top of that, there are also other negative signals on the chart below, which could encourage oil bears to act in the following days.

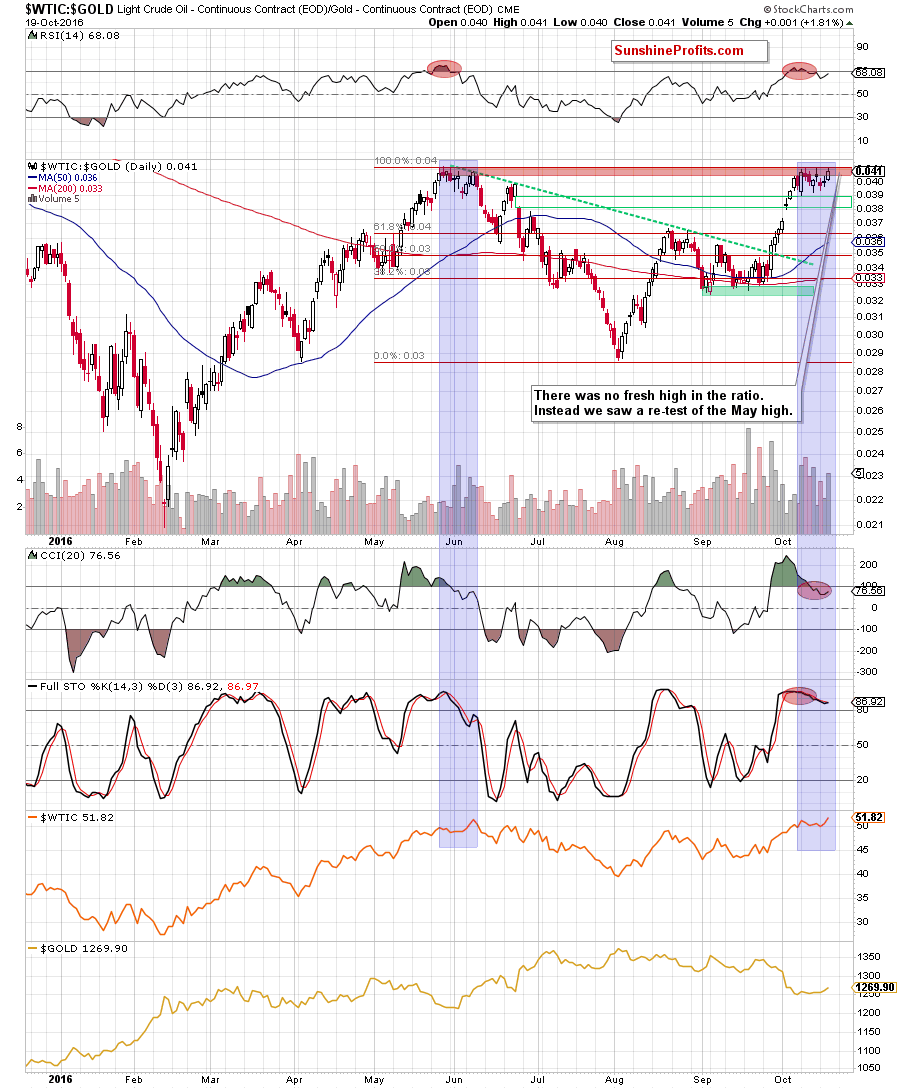

Looking at the oil-to-gold ratio, we see that although crude oil hit a fresh 2016 high, we didn’t see a similar price action in the case of the ratio. Instead, we saw a re-test of the May high, which means that we have a negative divegence between the commodity and the ratio.

What does it mean for crude oil’s future moves? As you see on the chart, we had a similar situation in May and Jun. Back then the ratio didn’t manage to hit a fresh high in line with crude oil, which translated into declines in both cases – crude oil and tthe ratio. Additionally, sell signals generated by the indicators remain in place, suggesting further deterioration in the ratio and lower prices of light crude as a strong negative correlation remains in place.

Taking all the above into account, we believe that crude oil will extend losses in the coming days and opening short positions is justified from the risk/reward perspective. Finishing today’s alert, please note that if we see further declines, the intial downside target would be the barrier of $50 and recent lows (around $49.15-$49.47).

Summing up, crude oil moved lower and invalidated earlier breakouts above the red resistance line based on the OCT 2015 and Jun 2016 highs and the upper border of the black rising wedge marked on the daily chart. Taking these facts into account and combining them with all negative signals that we noticed on the above charts, we believe that opening short positions justified from the risk/reward perspective.

Very short-term outlook: berish

Short-term outlook: bearish

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at $53.22 and initial downside target at $46) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts