Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Although crude oil invalidated yesterday’s breakdown under the barrier of $50, the key resistance zone continues to keep gains in check. What’s next?

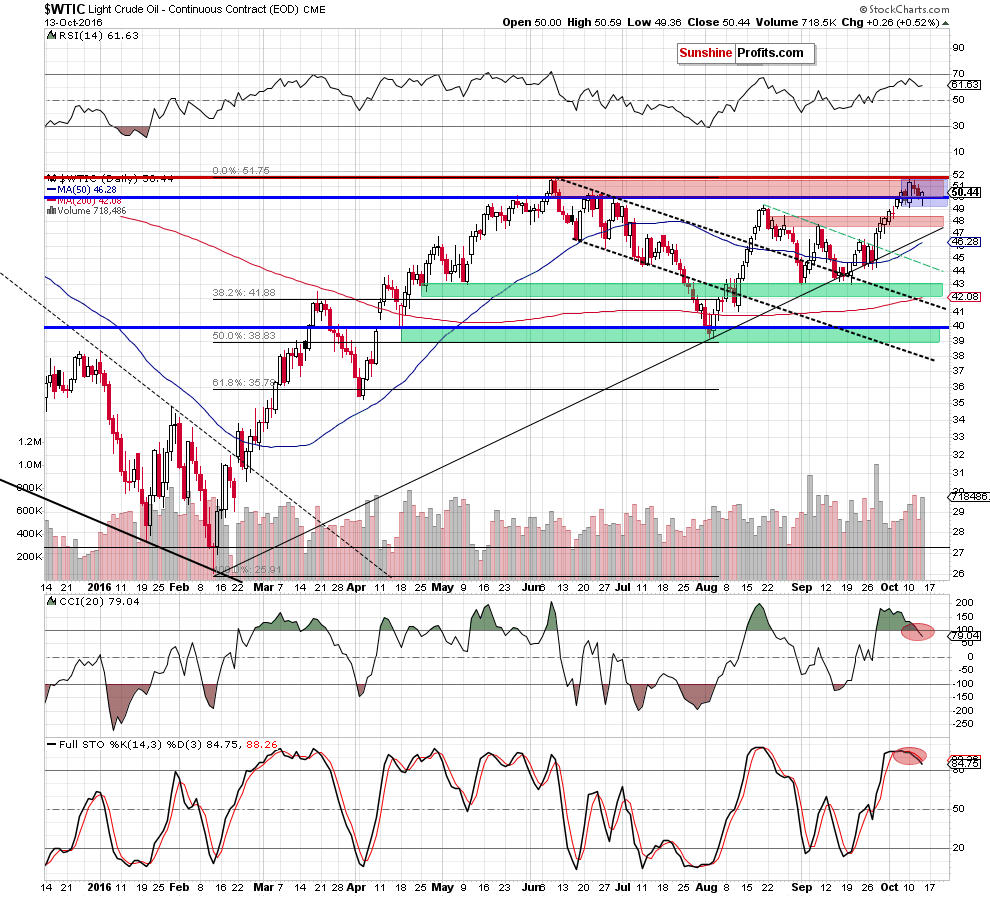

Let’s examine the daily chart and find out (charts courtesy of http://stockcharts.com).

From today’s point of view, we see that crude oil moved lower after the market’s ope and slipped under the barrier of $50. Despite this pullback, oil bulls managed to stop further deterioration and took the commodity to an intraday high of $50.59. In this way light crude invalidatd arlier breakdown, which is a positive signal.

But is it strong enoug to trigger fufrther rally? In our opinion, is not, because crude oil remains in the blue consolidation in the red (key) resistance zone. Additionally, sell signals generated by the CCI and Stochastic Oscillator remain in place, supporting oil bears and lower values of light crude.

On top of that, there are also other disturbing factors, which could trigger further deterioration in the coming days – more about them you could read in our Monday’s alert and Wednesday’s article based on our monthly Oil Investment Update.

We will provide you with a bigger update once we see more interesting developments on the crude oil market. As always, we’ll keep you - our subscribers - informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts