Trading position (short-term; our opinion): Short positions (with a stop-loss order at $54.21 and initial downside target at $43.37) are justified from the risk/reward perspective.

Crude oil attempted to move higher yesterday, but failed to do so and closed the day almost 1% lower – it’s also moving lower in today’s pre-market trading. What’s likely to happen next?

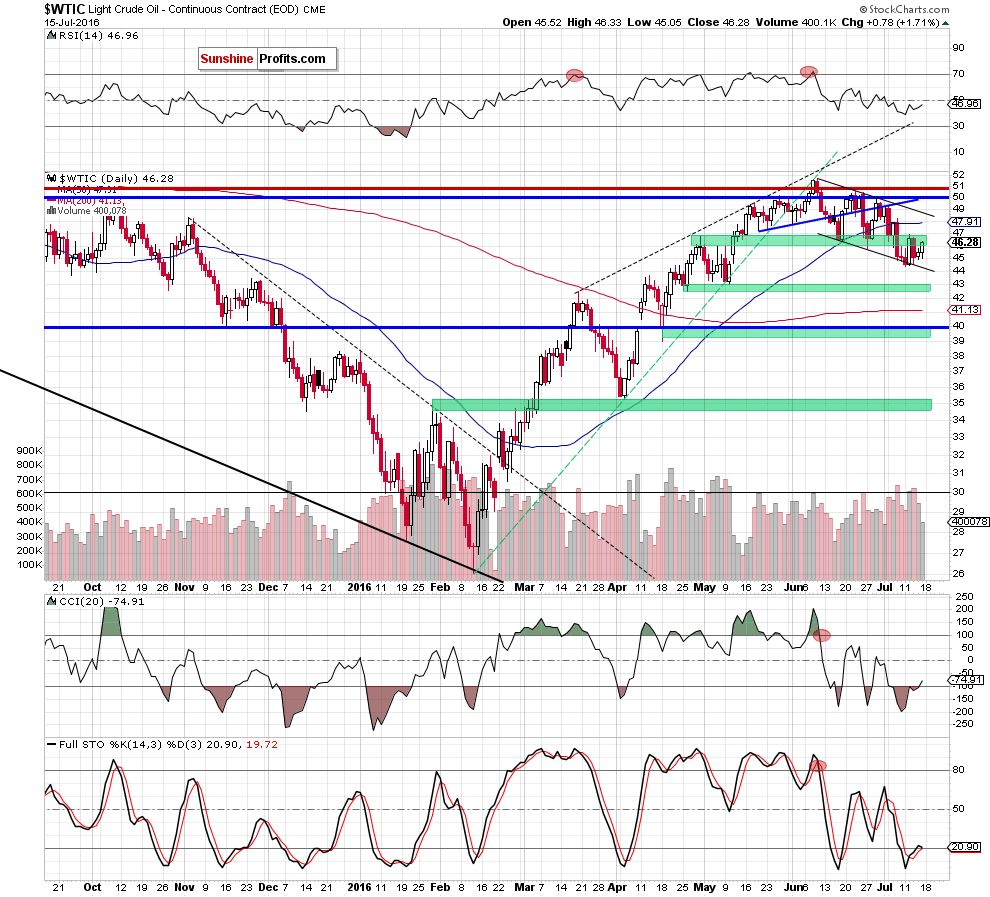

Let’s take a closer look at the chart (charts courtesy of http://stockcharts.com).

In short, the decline that’s in place is likely to continue and yesterday’s failed attempt to move higher simply confirms the bearish outlook. In other words, our yesterday’s comments remain up-to-date just as our short position remains profitable:

The volume that accompanied yesterday’s upswing was indeed significant compared to what we saw in the previous few days, but please note that we saw similar spikes in volume close to local tops during both: this year’s move higher and last year’s decline. For instance, in late November 2015, crude oil topped right after the big-volume session.

As far as the price move itself is concerned, crude oil moved to the green resistance area that it broke just a few days ago. There was no breakout above it, so technically nothing changed. More importantly, even if crude oil moves higher, the declining resistance line (currently at about $49) and the previous 2016 high are likely to stop the rally. Naturally, the above rally higher does not have to happen and today’s pre-market decline seems to confirm it.

The above remains up-to-date, but we would like to add that we saw an additional bearish confirmation in the final part of the week. Wednesday’s session was a decline on volume that was even bigger than the one that we saw on Tuesday and the 2 daily upswings that we saw on Thursday and Friday took place on even lower – and declining – volume. This kind of price-volume link has bearish implications and it’s in tune with the previous outlook.

The additional bearish (and of medium-term significance) confirmation comes from the fact that while crude oil rallied along with the general stock market for most of this year, it is currently no longer the case – even the breakout in the general stock market above the previous highs didn’t manage to trigger a bigger rally in crude oil. This is a sign of weakness and an indication that lower crude oil prices are to be expected.

Summing up, in the final part of last week, we saw additional bearish confirmations and thus the outlook remains bearish.

We will keep you – our subscribers – informed should anything change.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts