Trading position (short-term; our opinion): Short positions (with a stop-loss order at $54.21 and initial downside target at $43.37) are justified from the risk/reward perspective.

On Friday, crude oil moved lower once again as a combination of a stronger greenback and disappointing Baker Hughes’ report affected negatively investors’ sentiment. As a result, light crude closed another day under the short-term support zone. Is it enough to encourage oil bears to act in the coming week?

Although the U.S. Department of Labor reported that the unemployment rate increased to 4.9% last month from 4.7% in May, the data also showed that the economy added 287,000 jobs in June, beating analysts’ expectations for a 175,000 increase. Thanks to these solid numbers, the USD Index rebounded, making crude oil less attractive for buyers holding other currencies. Additionally, later in the day, the Baker Hughes’ report showed that the number of rigs drilling for oil in the U.S. increased by 10 to 351. This fifth increase (in recent six weeks) fueled speculation that domestic production could rebound in the coming weeks, increasing worries over a supply glut. As a result, light crude moved lower once again and closed another day under the short-term support zone. Is it enough to encourage oil bears to act in the coming week? Let’s examine the charts below and find out (charts courtesy of http://stockcharts.com).

On Friday, we wrote the following:

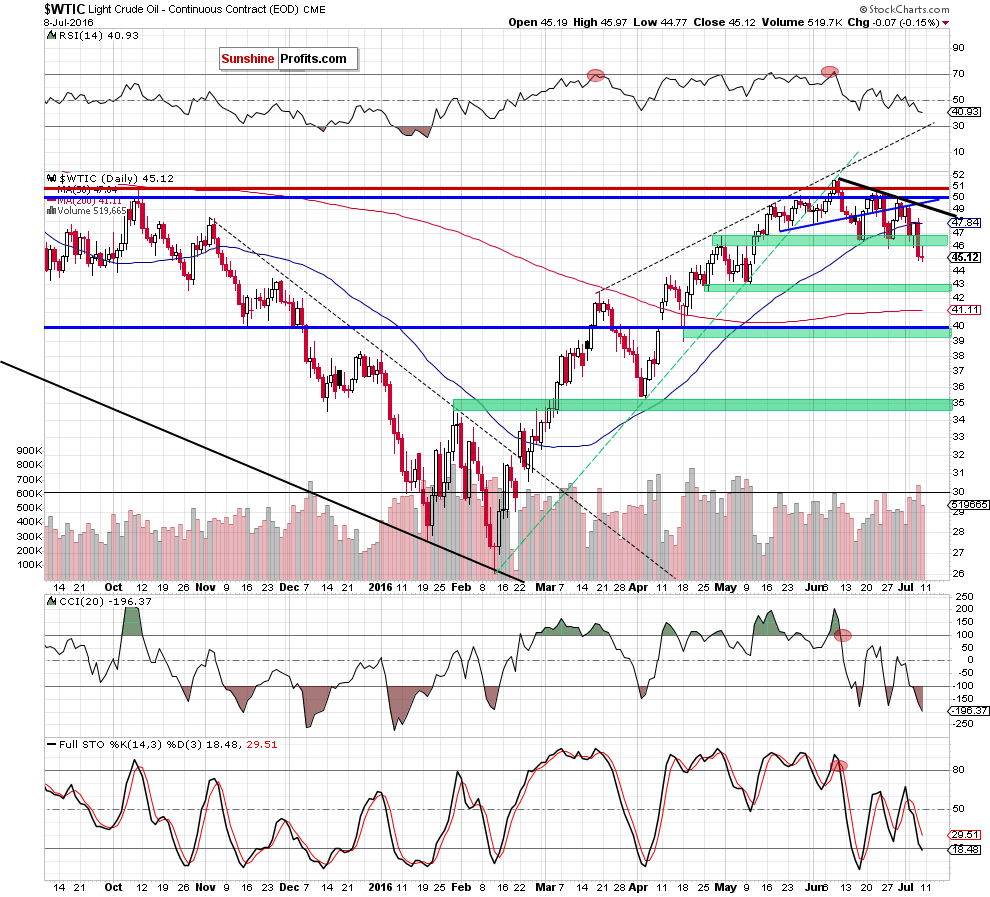

(…) light crude not only dropped to the Jun low, but oil bears managed to push the commodity below it. With this downswing crude oil also declined under the Apr high, invalidating earlier breakout, which is another negative signal. Thanks to yesterday’s decline, light crude closed the session under the green support zone, which suggests further deterioration in the coming day(s) – especially when we factor in a sell signal generated by the Stochastic Oscillator and the size of volume that accompanied Thursday’s move

Looking at the daily chart, we see that the overall situation hasn’t changed much as crude oil is still trading under the previously-broken green zone, which serves now as resistance. Additionally, a sell signal generated by the Stochastic Oscillator continues to support oil bears and lower prices of the commodity.

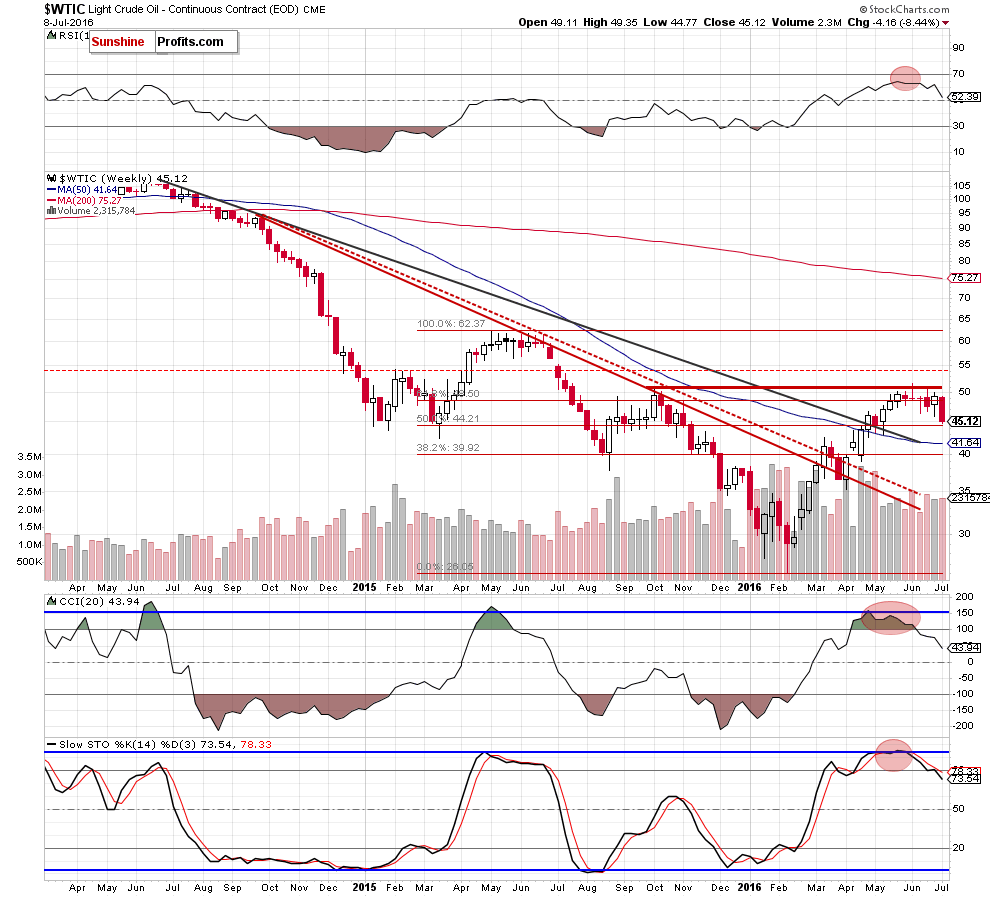

Having said the above, let’s examine the weekly chart.

From the weekly perspective, we see that invalidation of the breakout above the 61.8% Fibonacci retracement triggered further deterioration, which in combination with sell signals generated by the indicators suggests lower values of light crude in the coming week(s).

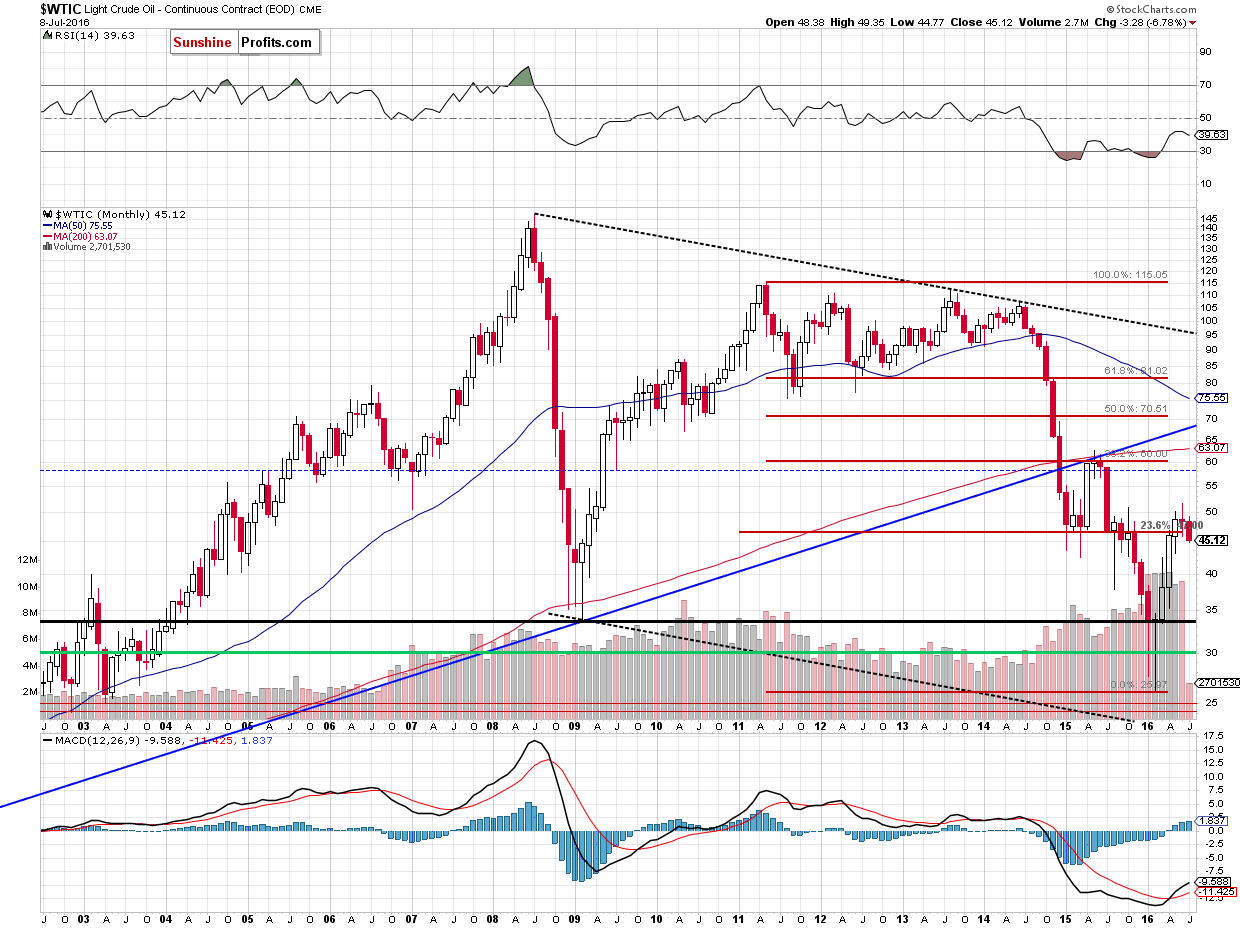

Are there any other factors, which could support the above pro bearish scenario? Let’s check the monthly chart and find out.

On the long-term chart, we see that although crude oil extended gains in the previous month, oil bulls didn’t manage to hold gained levels, which resulted in a decline earlier this month. As a result, crude oil dropped under the previously-broken 23.6% Fibonacci retracement, invalidating earlier breakout, which is an additional negative signal that could encourage oil bears to push the commodity lower.

Taking all the above into account, we think that the commodity will extend losses and test the strength of the next green support zone (around $42.50-$43.25) in the coming week.

Summing up, short positions continue to be justified from the risk/reward perspective as crude oil closed another day under the Jun low, the Apr high and the green zone (they serve now as resistance), which increases the probability of further declines and suggests a test of the strength of the next green support zone (around $42.50-$43.25) in the coming week.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: bearish

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): Short positions (with a stop-loss order at $54.21 and initial downside target at $43.37) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

On an administrative note, due to my travel plans, there will be no Oil Trading Alerts on Thursday and Friday (the next Oil Trading Alert is scheduled for Monday, Jul 18). Nevertheless, if the situation changes significantly, we will send you a quick note with our latest analysis and thoughts on that matter.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts