Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Tuesday, crude oil rebounded and gained 2.06% on hopes that weekly inventory reports would show shrinking supplies. In this way, light crude approached the May high and the short-term resistance line, but will they stop oil bulls in the coming days?

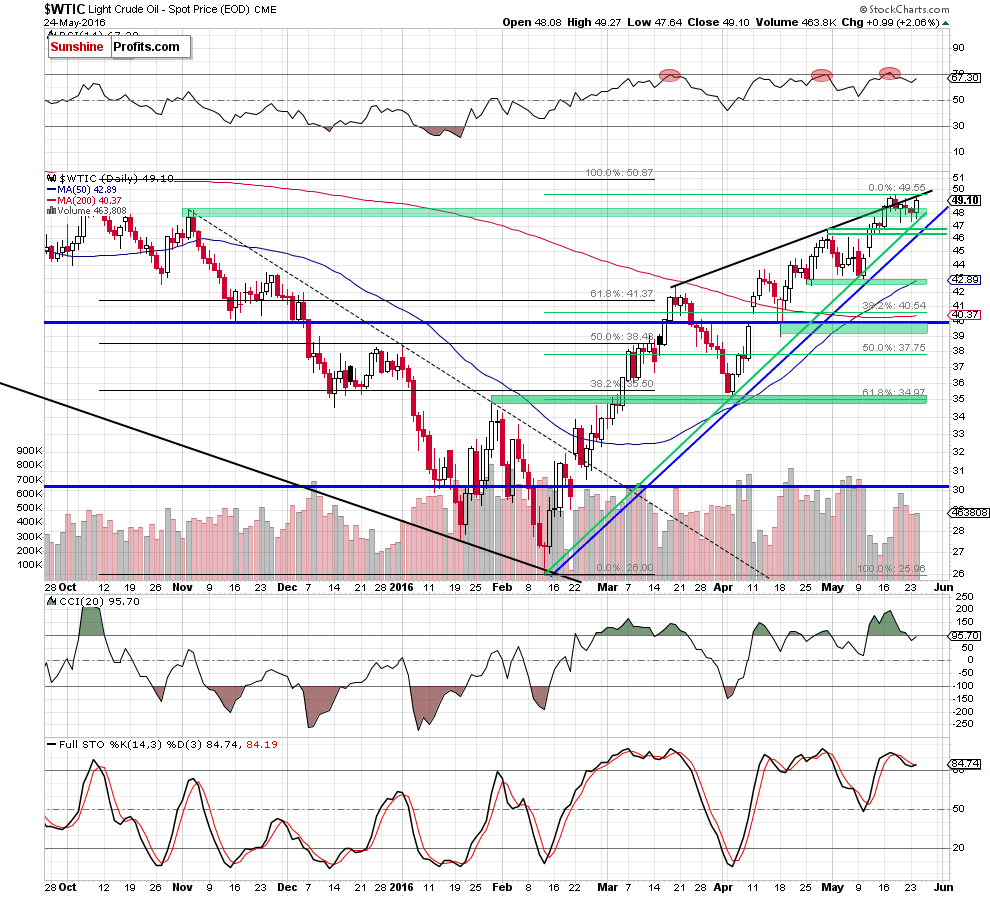

Let’s examine the daily chart and find out what can we infer from it (charts courtesy of http://stockcharts.com).

Although crude oil moved lower after the market’s open, the proximity to the medium-term green rising line based on the Feb and Apr lows encouraged oil bulls to act, which resulted in a rebound. With yesterday’s increase, the commodity came back above the Nov highs, which is a positive signal at the first sight. Nevertheless, Tuesday’s move took light crude to the black resistance line based on the Mar and Apr highs and approached it to the May peak (hitting an intraday high of $49.27), which may be good reason for oil bears to join the action and push the price of the commodity lower in the coming days.

At this point it is also worth noting that the size of volume that accompanied yesterday’s upswing was smaller than the previous days, which raises some doubts about further rises - especially when we factor in the current position of all our indicators (sell signals generated by the RSI and CCI remain in play, suggesting lower values of black gold).

Nevertheless, in our opinion, acceleration of declines will be more likely and reliable if crude oil extends losses once again and drops under the medium-term green support line (based on the Feb and Apr lows), invalidating earlier breakout above the Apr highs (in this case, we’ll consider opening short positions).

Summing up, crude oil rebounded, reaching the resistance area created by the black resistance line (based on the Mar and Apr highs) and the May peak, which may encourage oil bears to act in the coming days – especially when we take into account the size of yesterday’s volume and the current position of daily indicators. Nevertheless, as long as there won’t be breakdown below the Apr high and the medium-term support line (based on the Feb and Apr lows) a bigger decline is not likely to be seen.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts