Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Friday, light crude lost 0.59% as signals that supply disruptions in Nigeria, Canada and Libya are coming to an end weighed on investors’ sentiment. Thanks to these circumstances, light crude slipped to the previously-broken Nov highs. Will we see further deterioration in the coming week?

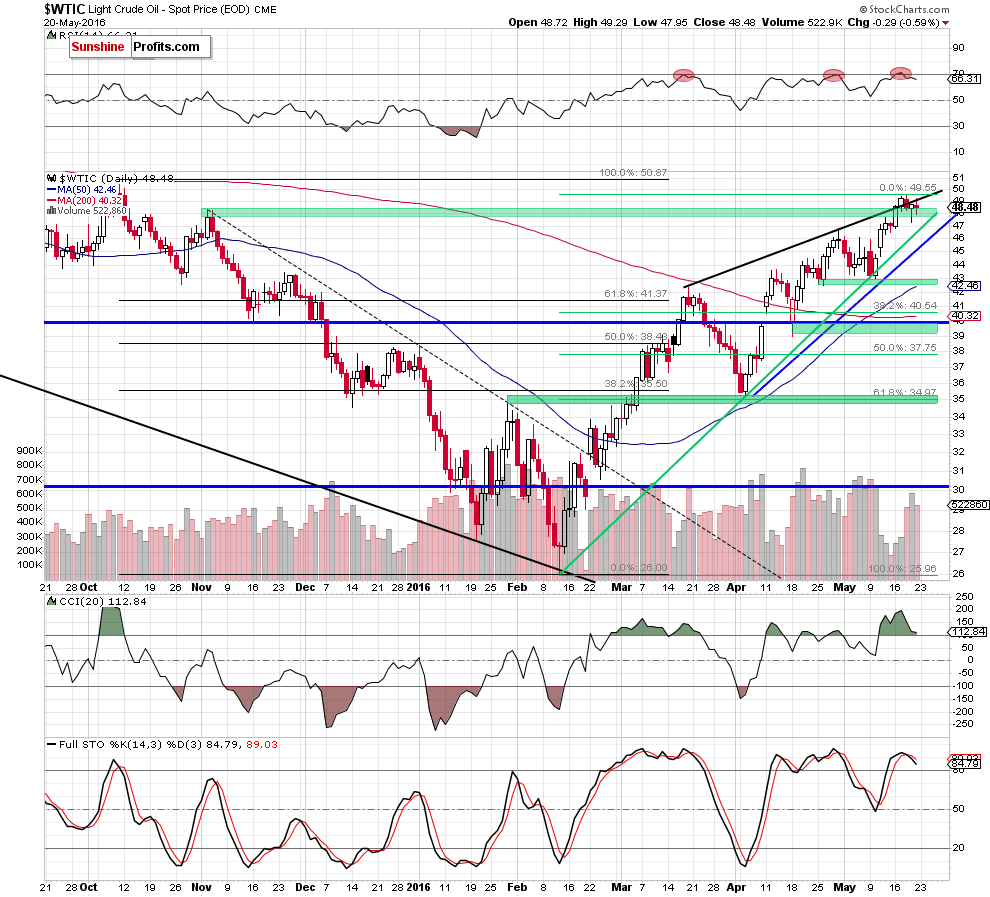

Let’s examine the daily chart and look for more clues about future moves (charts courtesy of http://stockcharts.com).

The first thing that catches the eye on the daily chart is invalidation of the breakout above the black rising line based on the previous highs. Although crude oil increased on Thursday, the commodity gave up the gains on the following day, which looks like a verification of earlier breakdown. Additionally, Friday’s move materialized on bigger volume compared to what we saw in mid-May, which increases the probability of further declines – especially when we factor in the fact that the RSI and Stochastic Oscillator generated sell signals (while the CCI is very close to doing the same).

Nevertheless, the size of the move is currently too small to say with full conviction that the recent rally is over – especially when we take into account the fact that the commodity closed all last week’s sessions above the Nov highs. Therefore, if crude oil extends losses and declines under the medium-term green support line (based on the Feb and Apr lows), invalidating earlier breakout above the Nov and Apr highs, we’ll consider opening short positions.

Finishing Monday’s alert, we would like to emphasize that today's analysis is based solely on the above chart and differences in data in case of data providers still take place, making the overall picture of the commodity a bit unclear.

Summing up, although crude oil gave up some gains and indicators generated sell signals, the commodity remains above the Nov, Apr highs and the medium-term support line (based on the Feb and Apr lows), which all together continue to keep declines in check. Therefore, as long as there won’t be breakdown below them short-lived moves in both directions can’t be ruled out.

Very short-term outlook: mixed

Short-term outlook: mixd

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts