Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Monday, crude oil lost 7.60% as news about Iraq's output weighed on investors’ sentiment and renewed worries over a supply glut. As a result, light crude, declined sharply under the barrier of $30 and closed the day below it. Is it time for fresh lows?

Yesterday, Iraq's oil ministry informed that the country’s output hit a record high in the previous month (oil fields in the central and southern regions produce around 4.13 million barrels a day). Additionally, Iraqi oil official said that the country may raise output even further later this year, which together affected negatively the price of the commodity and pushed light crude under the barrier of $30 once again. What’s next? Let’s examine charts and find out (charts courtesy of http://stockcharts.com).

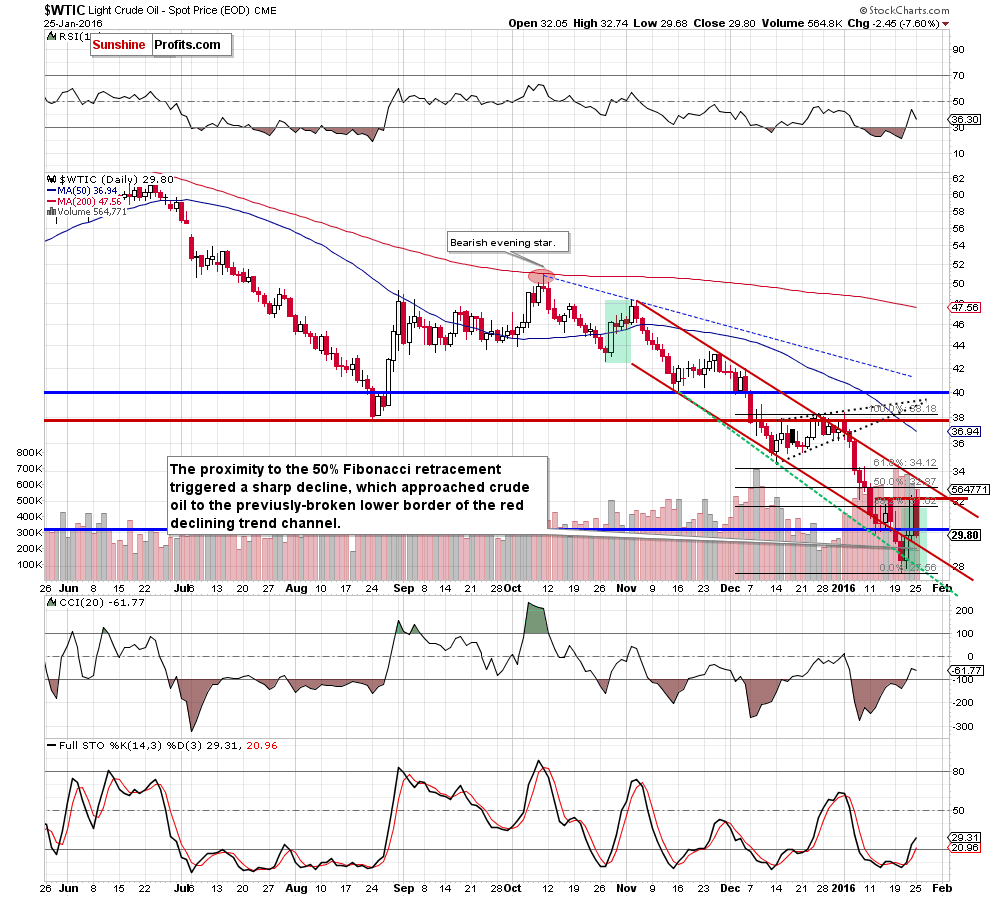

Looking at the daily chart, we see that the proximity to the 50% Fibonacci retracement (based on the Jan declines) encouraged oil bears to act, which resulted in a drop under the barrier of $30. Although this is a negative signal, which suggests further deterioration, we should keep in mind that yesterday’s downswing took the commodity to the support area created by the 76.4% and 78.6% Fibonacci retracement levels (around $28.66-$28.78), which in combination with buy signals generated by the indicators (all signals remain in place, supporting oil bulls) could trigger a rebound from here and a comeback above $30 in the coming days.

Summing up, crude oil declined sharply and closed the day under $30 once again, which is a negative sign. Nevertheless, the support area created by the 76.4% and 78.6% Fibonacci retracement levels in combination with buy signals generated by the indicators could trigger a rebound above $30 in the coming days.

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts