Trading position (short-term; our opinion): Short positions with a stop-loss order at $54.12 and initial (!) target price at $35.72 are justified from the risk/reward perspective.

On Tuesday, light crude extended gains and climbed above $47 ahead of the release of the American Petroleum Institutes' weekly crude oil inventory report. As a result, the commodity increased to important long- and medium-term resistance lines. Will they manage to stop oil bulls in the coming days?

On Friday, Baker Hughes report showed that the U.S. oil rig count dropped by 16 over the previous week to 578. This ninth consecutive weekly decline indicated that production could fall sharply and fuelled hopes that this week inventory reports would show a smaller-than-expected build in crude oil inventories. Thanks to these circumstances, light crude climbed above $47 and reached important long- and medium-term resistance lines. Will they manage to stop oil bulls in the coming days? Let’s examine charts and find out what are they saying abut future moves (charts courtesy of http://stockcharts.com).

Quoting our Oil Trading Alert posted on Thursday:

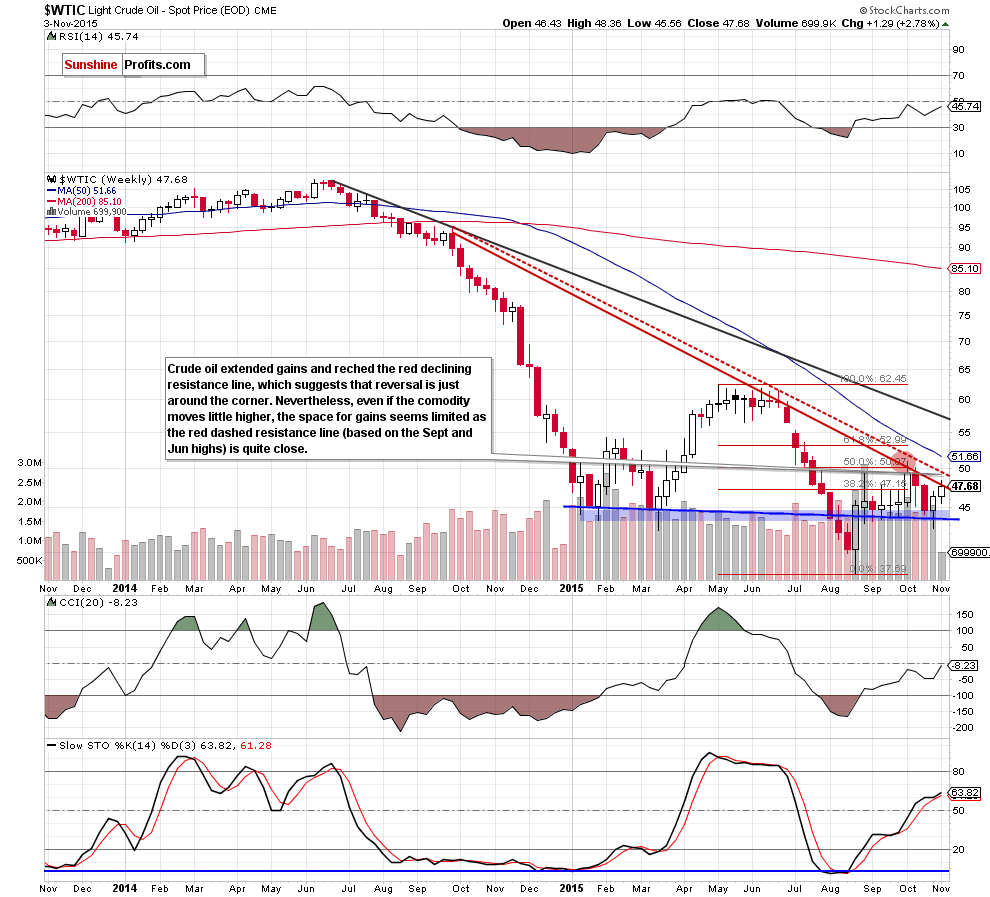

(…) the commodity reversed and invalidated the breakdown under the blue support line, which triggered a sharp rebound. This is a positive signal, which suggests that we may see further improvement and an increase even to the red declining resistance line (…) in the coming days.

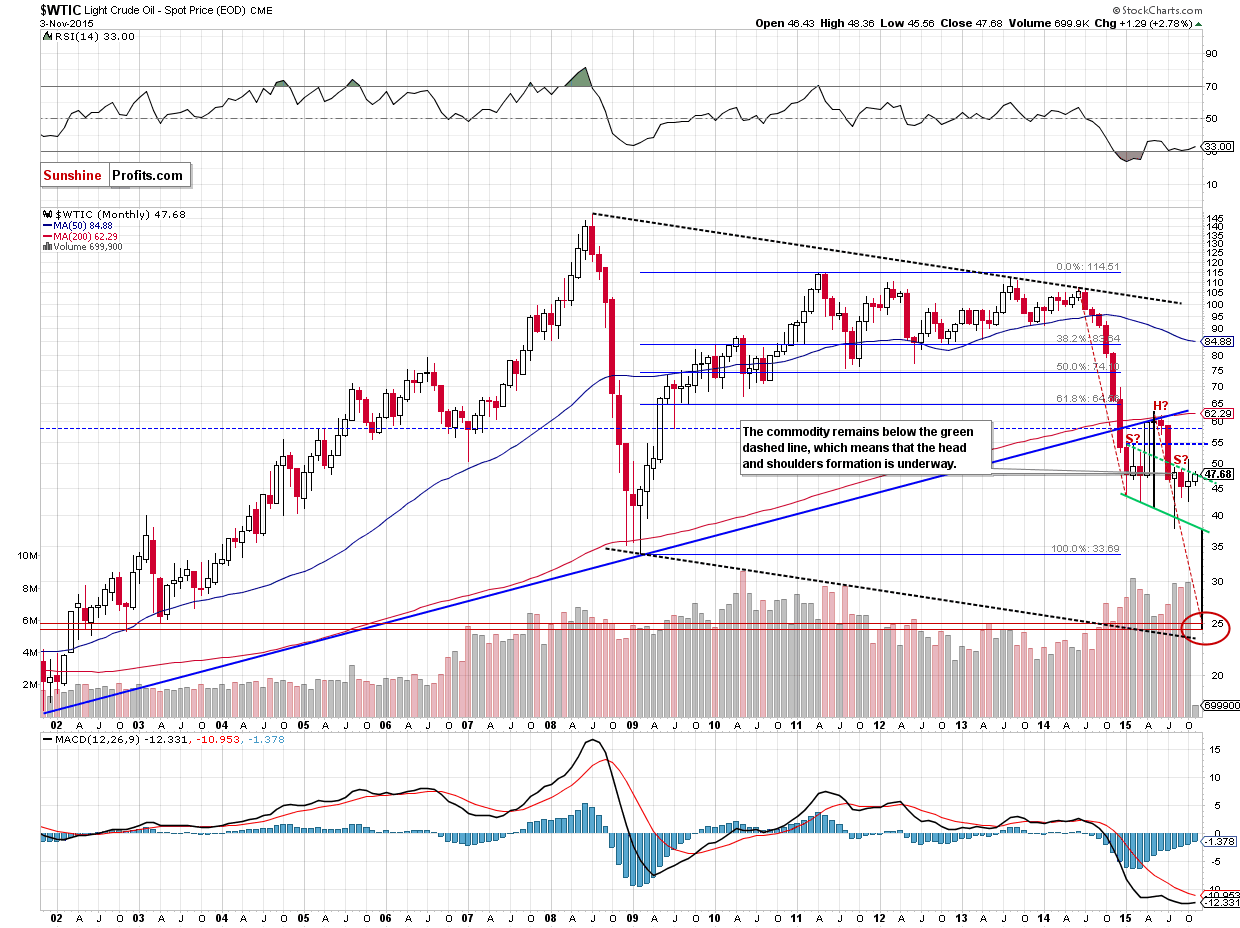

Looking at the weekly chart from today’s point of view, we see that the situation developed in line with the above scenario and oil bulls managed to push the commodity to our upside target. At this point it is worth noting that the red declining resistance line was strong enough to stop further improvement in the previous month, which resulted in a drop to the blue support area. Taking this fact into account and combining it with the long-term picture, we believe that reversal is just around the corner.

Nevertheless, even if the commodity moves higher from here, the space for further improvement seems limited as the next solid resistance zone (created by the red dashed resistance line based on the Sept 2014 and Jun highs and the 76.4% and 78.6% Fibonacci retracement levels based on the Oct decline) is quite close to the current levels (around $48.95-$49.52).

Summing up, although crude oil moved higher once again, the key long- and medium-term resistance lines continue to keep gains in check. This means that reversal in the coming day(s) is more likely than not and short positions continue to be justified from the risk/reward point of view.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: bearish

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): Short positions with a stop-loss order at $54.12 and initial (!) target price at $35.72 are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts