Trading position (short-term; our opinion): Short positions with a stop-loss order at $54.12 and initial (!) target price at $35.72 are justified from the risk/reward perspective.

On Thursday, crude oil reversed once again and re-approached the resistance zone as a weaker greenback and bullish comments from OPEC Secretary-General continued to weigh positively on investors’ sentiment and supported the price. Will this resistance area withstand the buying pressure in the coming days.

Although the Department of Labor reported that the number of initial jobless claims in the week ending October 3 declined by 13,000, beating analysts’ expectations for a 2,000 drop, yesterday’s minutes from the U.S. Federal Reserve's Sept. 16-17 meeting weakened the greenback, pushing the USD Index to its lowest level since Sep 21 and making crude oil more attractive for investors holding other currencies. Additionally, oil investors continued to digest bullish comments from OPEC Secretary-General (El-Badri predicted that global demand will increase this year by 1.5 million barrels per day), which together triggered another increase in the commodity and resulted in a re-test of the resistance zone. Will it withstand the buying pressure in the coming day? Let’s check what charts are saying about future moves (charts courtesy of http://stockcharts.com).

Yesterday, we wrote the following:

(…) taking into account the current position of the indicators, we think that another test of the red resistance zone (marked with circle on the charts) should not surprise.

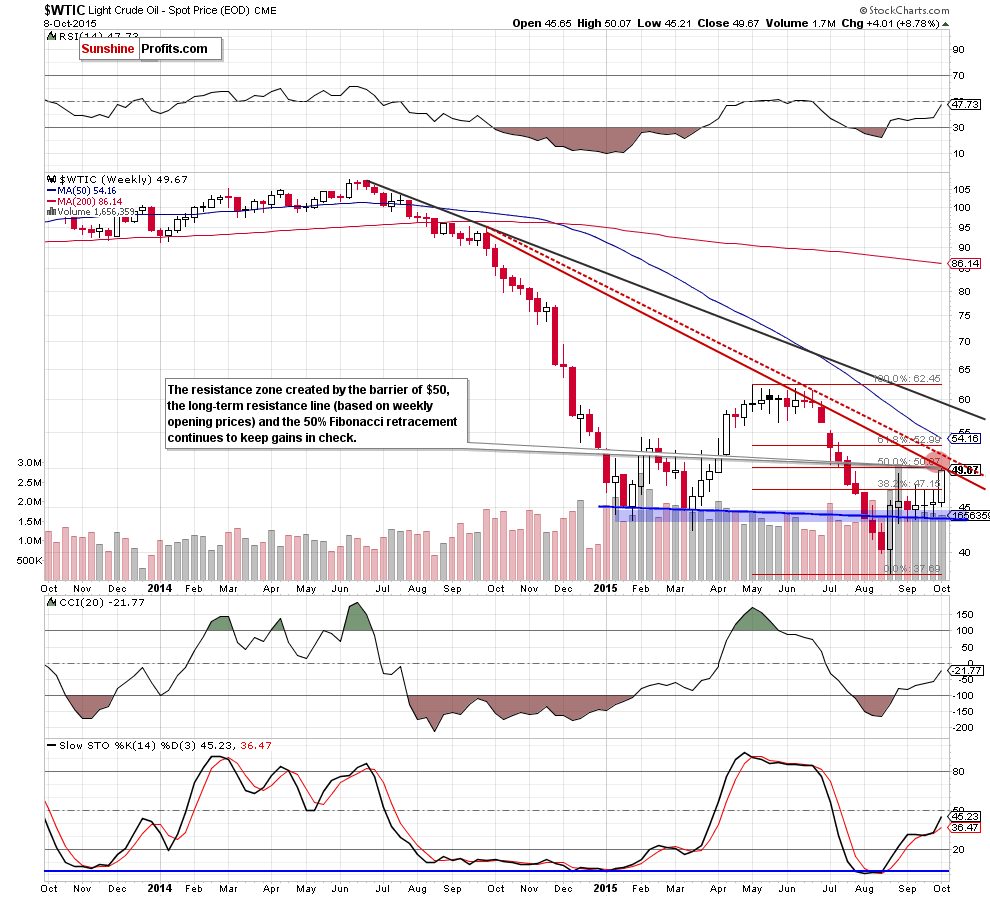

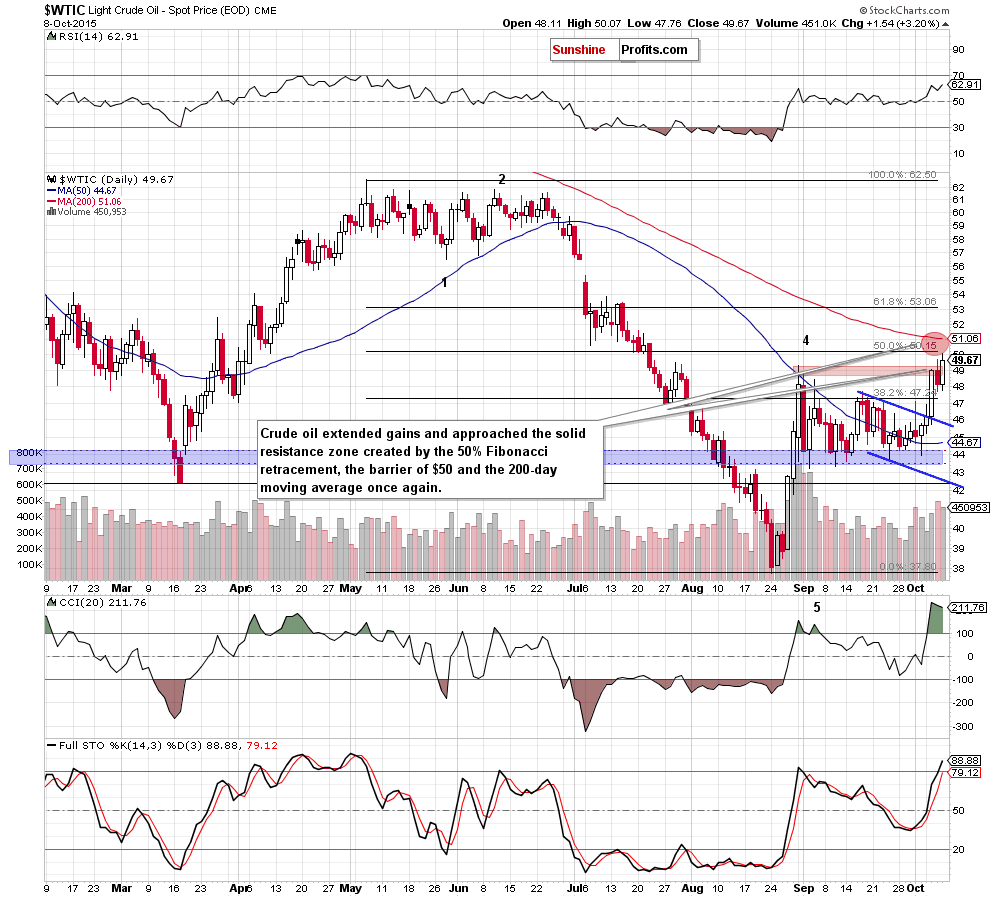

Looking at the charts, we see that the situation developed in line with the above scenario and crude oil moved higher once again, re-approaching the solid resistance zone (marked with red circle) created by the long-term resistance line (based on the weekly opening prices), the 50% Fibonacci retracement, the psychologically important barrier of $50 and the 200-day moving average. Although the commodity came back above the Aug high, we still believe that the above-mentioned resistance area (currently around $50-$51.06) will be strong enough to stop oil bulls in the coming week(s).

Nevertheless, it seems that the key factor, which will have a significant impact on crude oil, will be the weekly closing price. If oil bulls manage to push the commodity above the barrier of $50 and close the week above it, we may see further improvement and a rally to around $53, where the 61.8% Fibonacci retracement is. On the other hand, if they fail, and light crude finishes this week under the Aug high, we’ll see further deterioration in near future and the initial downside target would be around $46, where the previously-broken upper border of the declining blue trend channel is.

Finishing today’s Oil Trading Alert, please note that the size of yesterday’s volume was smaller than day before, which is not a bullish sign. Additionally, the daily CCI is overbought, while the Stochastic Oscillator climbed to the barrier of 80, which could encourage oil bears to act in the coming days.

Summing up, crude oil reversed and re-approached the solid resistance zone (created by the long-term red resistance line based on the weekly opening prices, the 50% Fibonacci retracement, the psychologically important barrier of $50 and the 200-day moving average) once again. Despite this move, the space for further gains seems limited and we believe that short positions continue to be justified from the risk/reward point of view.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: bearish

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): Short positions with a stop-loss order at $54.12 (yes, that far as the medium-term outlook is unlikely to change as long as crude oil stays below the declining medium-term resistance line) and initial (!) target price at $35.72 are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts