Trading position (short-term; our opinion): Short positions with a stop-loss order at $54.12 and initial (!) target price at $35.72 are justified from the risk/reward perspective.

On Tuesday, crude oil surged above $49 as investors continued to react positively to a weaker U.S. dollar and news that Russia and Saudi Arabia have met recently to discuss the downturn in global oil prices. In this environment, light crude broke above resistance levels and approached the Aug high. Will we see a breakout and a test of the psychologically important barrier of $50 in the coming days?

Yesterday’s official data showed that the U.S. trade deficit widened more than expected in August (to $48.33 billion, while analysts had expected that the trade deficit would widen to $47.40 billion), fuelling further concerns over the strength of the U.S. economy. As a result, the USD Index declined sharply below 96, making crude oil more attractive for investors holding other currencies. Additionally, investors continued to react positively to news that Russia will continue to consult with Saudi Arabia to help stabilize crude oil prices. On top of that, the U.S. Energy Information Administration forecasted that global supply will rise to 95.98 million bpd in the coming year, which together pushed the price of the commodity sharply higher. As a result, light crude closed the day above $49. What impact did this rally have on the technical picture of crude oil? Let’s examine charts and find out (charts courtesy of http://stockcharts.com).

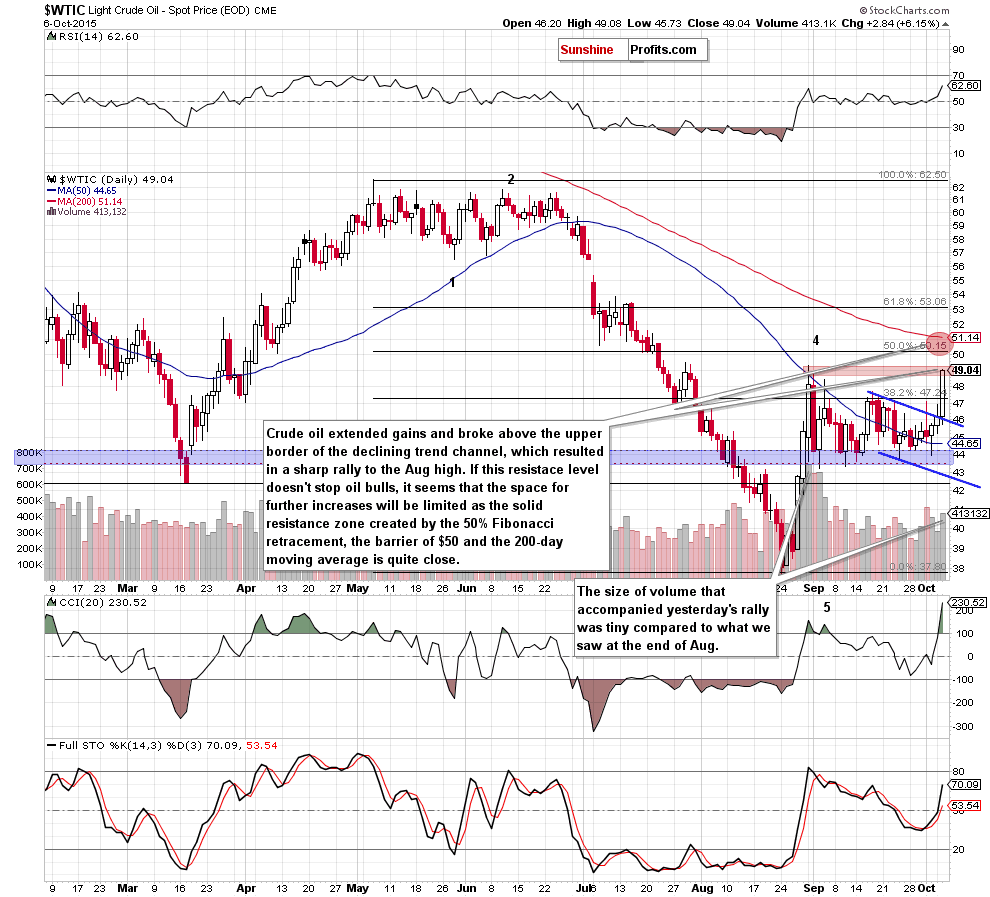

Yesterday, crude oil extended gains and broke above the upper border of the declining blue trend channel, which triggered an increase above the 38.2% Fibonacci retracement. This positive signal encouraged oil bulls to act, which resulted in a sharp rally to the Aug high.

In our opinion, even if this resistance level doesn’t stop oil bulls, we think that the space for further gains is limited. What is the reason? When we take a closer look at the daily chart, we clearly see that only $2 above the current levels is a solid resistance zone (marked with red circle) created by the 50% Fibonacci retracement, the psychologically important barrier of $50 and the 200-day moving average, which could stop further improvement.

Additionally, the size of volume that accompanied yesterday’s rally was tiny compared to what we saw at the end of Aug, which suggests that oil bulls may not be as strong as it seems at the first glance.

On top of that, the medium-term picture may also encourage oil bears to act. Why? Let’s take a closer look at the weekly chart and find out.

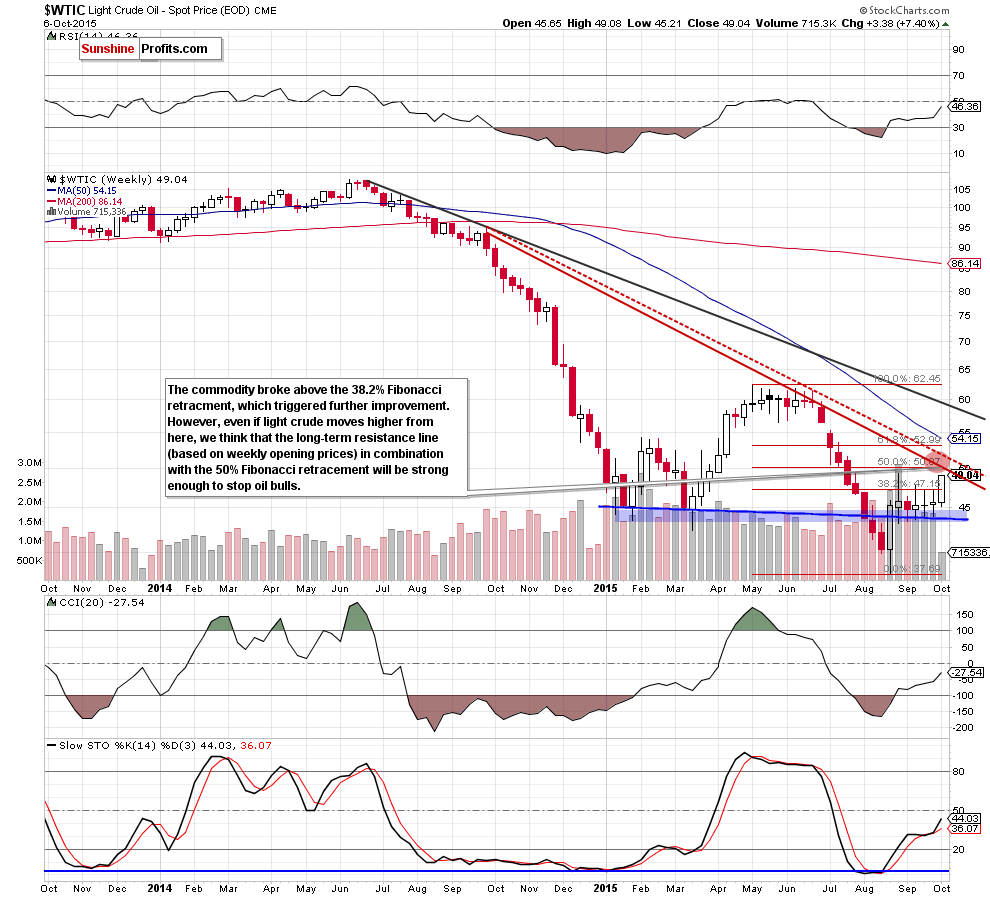

From this perspective, we see that the commodity broke above the 38.2% Fibonacci retracement, which triggered further improvement. However, if crude oil moves higher from here, we think that the long-term resistance line (based on the weekly opening prices) in combination with the 50% Fibonacci retracement will be strong enough to stop oil bulls in the coming week(s).

Summing up, although crude oil shoot up and broke above the 38.2% Fibonacci retracement, the space for further gains seems limited as the solid resistance zone created by the long-term resistance line (based on the weekly opening prices), the 50% Fibonacci retracement, the psychologically important barrier of $50 and the 200-day moving average is quite close. Therefore, we believe that short positions continue to be justified from the risk/reward point of view.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: bearish

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): Short positions with a stop-loss order at $54.12 (yes, that far as the medium-term outlook is unlikely to change as long as crude oil stays below the declining medium-term resistance line) and initial (!) target price at $35.72 are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts