Trading position (short-term; our opinion): Short positions with a stop-loss order at $54.12 and initial (!) target price at $35.72 are justified from the risk/reward perspective.

On Monday, crude oil lost 1.90% as worries over strength in the U.S. dollar and global growth concerns weighed on the commodity. In this environment, light crude slipped to its key support zone once again and closed the day below $45. What’s next?

On Friday, the Commerce Department showed that gross domestic product expanded at an annual rate of 3.9% in the second quarter, which supported the greenback and pushed the USD Index to a fresh monthly high. Although, the U.S. currency gave up some gains, Fed officials continue to send signals that an interest rate hike could be in play later this year, rising concerns that such action will likely translate to lower values of dollar-denominated commodities such as crude. On top of that, yesterday, the International Monetary Fund head Christine Lagarde said in an interview that the IMF is likely to revise downwards its estimates for global economic growth due to slower expansion in emerging economies. In these circumstances, light crude reversed and declined to its key support zone once again. What’s next? Let’s examine charts and find out (charts courtesy of http://stockcharts.com).

Quoting our previous commentary:

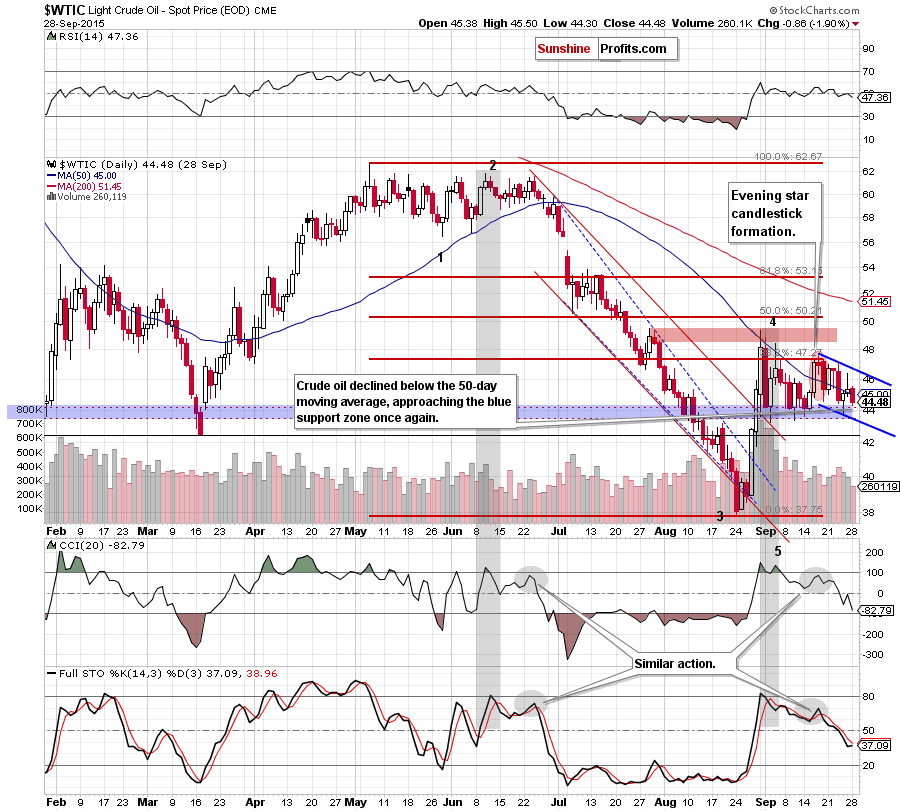

(…) light crude broke above the 50-day moving average and approached the upper border of the blue declining trend channel, which triggered a pullback. Taking this fact into account, and combining it with sell signals generated by the indicators, we believe that crude oil will move lower and re-test the blue support zone once again (in this area is also the lower border of the trend channel) in the coming day(s).

As you see on the daily chart, the situation developed in line with the above scenario and crude oil approached blue support zone once again. Looking at the price action in this area in the previous weeks, we think that another rebound from here is more likely than not. Nevertheless, even if light crude moves higher and climbs to around $46.40 (the upper border of the blue declining trend channel), the overall situation will remain bearish. Why? We believe that the best answer to this question will be the quote from our previous commentary:

(…) crude oil closed another week under the 38.2% Fibonacci retracement and the upper black line (a potential right shoulder of the head and shoulders formation), which suggests that further deterioration is just a matter of time.

(…) we still believe that an acceleration of declines will be more likely and reliable if we see a breakdown under the blue support zone and the blue support line. Until this time short-lived moves in both directions should not surprise us.

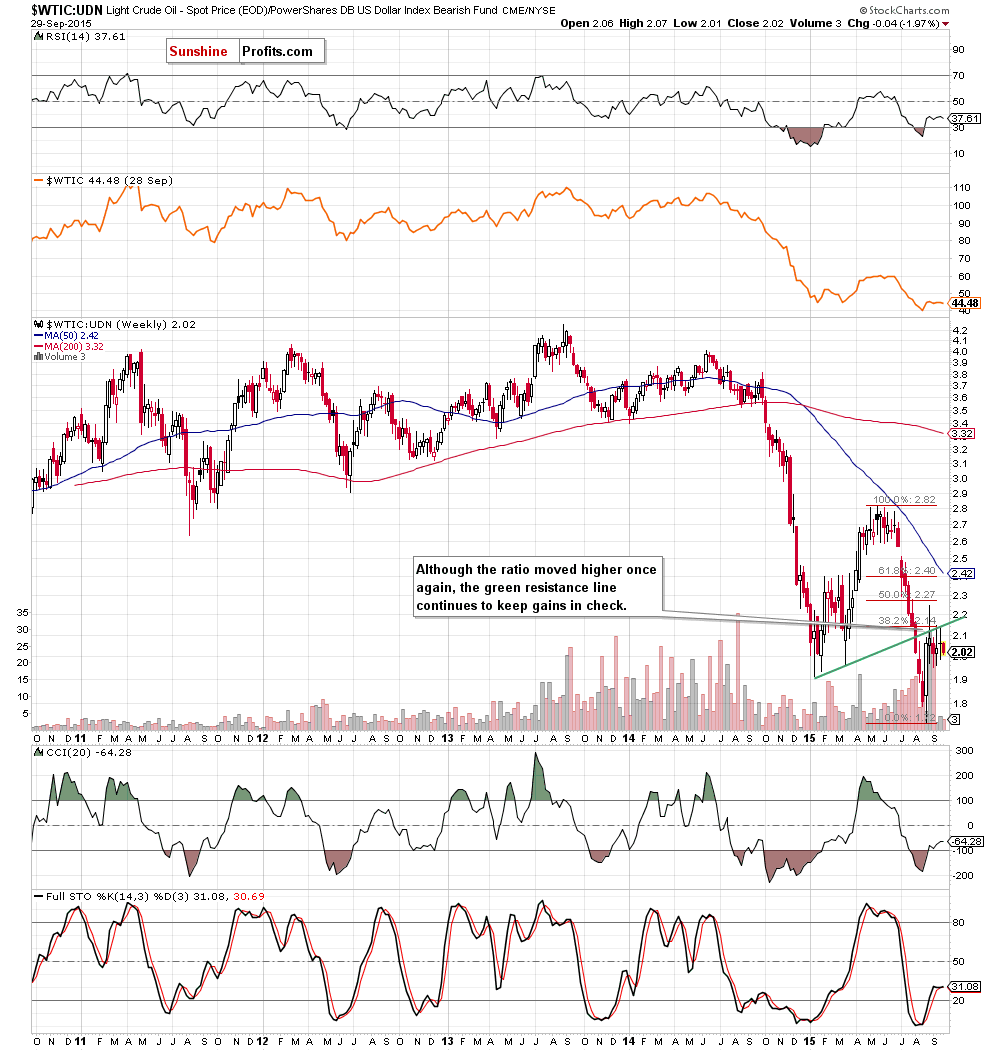

To have a more complete picture of the commodity, let’s take a closer look at crude oil priced in "other currencies" (as a reminder, UDN is the symbol for the PowerShares DB US Dollar Index Bearish Fund, which moves in the exact opposite direction to the USD Index. Since the USD Index is a weighted average of the dollar's exchange rates with world's most important currencies, the WTIC:UDN ratio displays the value of crude oil priced in "other currencies").

From today’s point of view, we see that the key resistance green line (which was strong enough to stop oil bulls several times in previous weeks) continues to keep gains in check. This means that as long as there is no weekly close above this important resistance line another attempt to move lower is more likely than not (even if oil bulls try to re-test it once again in the coming days). If we see such price action, it will translate to lower values of light crude in the coming week(s).

Summing up, crude oil slipped to its key support zone once again, which suggests another rebound – similarly to what we saw in previous weeks. Nevertheless, as long as the medium-term resistance levels and sell signals generated by the indictors remain in place, lower values of the commodity are more likely than not. Therefore, short positions (which are already profitable as we entered them when crude oil was at about $46.68) continue to be justified from the risk/reward point of view.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: bearish

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): Short positions with a stop-loss order at $54.12 (yes, that far as the medium-term outlook is unlikely to change as long as crude oil stays below the declining medium-term resistance line) and initial (!) target price at $35.72 are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts