Trading position (short-term; our opinion): Short positions with a stop-loss order at $54.12 and initial (!) target price at $35.72 are justified from the risk/reward perspective.

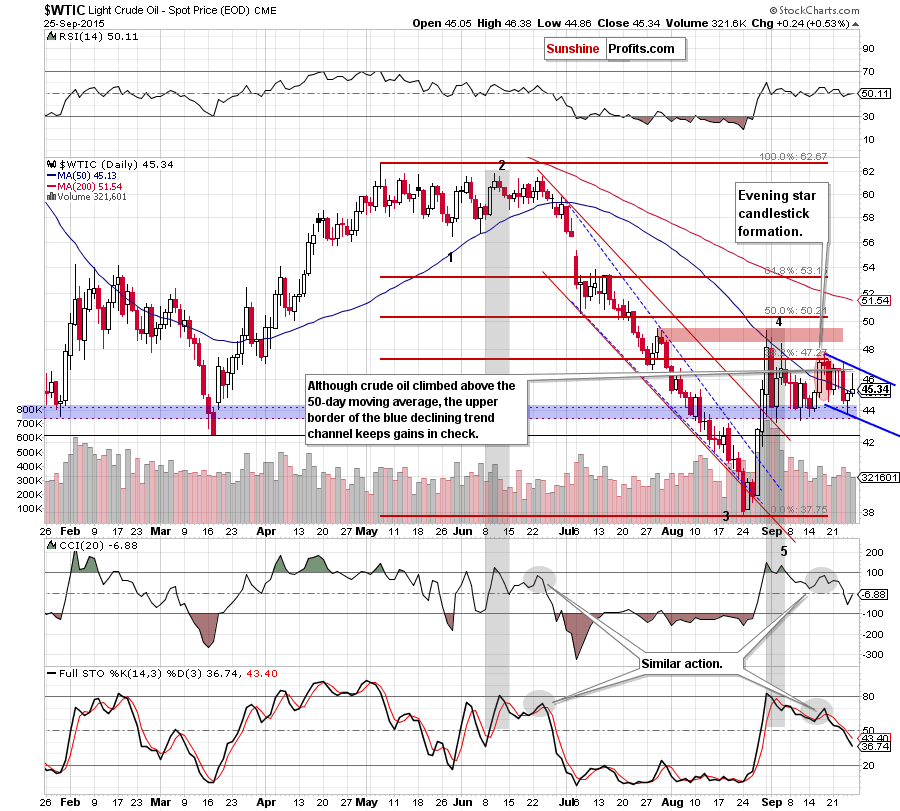

On Friday, crude oil gained 0.53% after Baker Hughes report showed 4th straight decline in weekly rig counts. As a result, light crude climbed above the 50-day moving average and closed the day above $45. What impact did this move have on the short-term picture of the commodity?

On Friday, news from Genscape, Inc. on another decline in crude oil inventories at Cushing (which dropped by 625,000 barrels for the week ending on Sept. 22) continued to weigh on investors’ sentiment. Additionally, Friday’s Baker Hughes report showed that U.S. oil rigs fell by 4 to 640 in the week ending September 18. Thanks to these circumstances, light crude climbed above the 50-day moving average and closed the day above $45. What does it mean for the commodity? Let’s check (charts courtesy of http://stockcharts.com).

Quoting our previous commentary:

(…) the commodity re-tested the blue support zone (based on Jan lows) and rebounded once again – similarly to what we saw in previous cases. As you see, oil bulls managed to push light crude to the previously-broken 50-day moving average, but the commodity closed the day below it.

What’s interesting, the size of volume that accompanied yesterday’s rebound was smaller than day before, which raises some doubts over their strength. Nevertheless, taking into account price action that we saw after similar drops to the blue support zone, it seems to us that light crude will likely move little higher in the coming day(s).

From today’s point of view we see that oil bulls pushed the commodity little higher as we had expected. With this upswing, light crude broke above the 50-day moving average and approached the upper border of the blue declining trend channel, which triggered a pullback. Taking this fact into account, and combining it with sell signals generated by the indicators, we believe that crude oil will move lower and re-test the blue support zone once again (in this area is also the lower border of the trend channel) in the coming day(s).

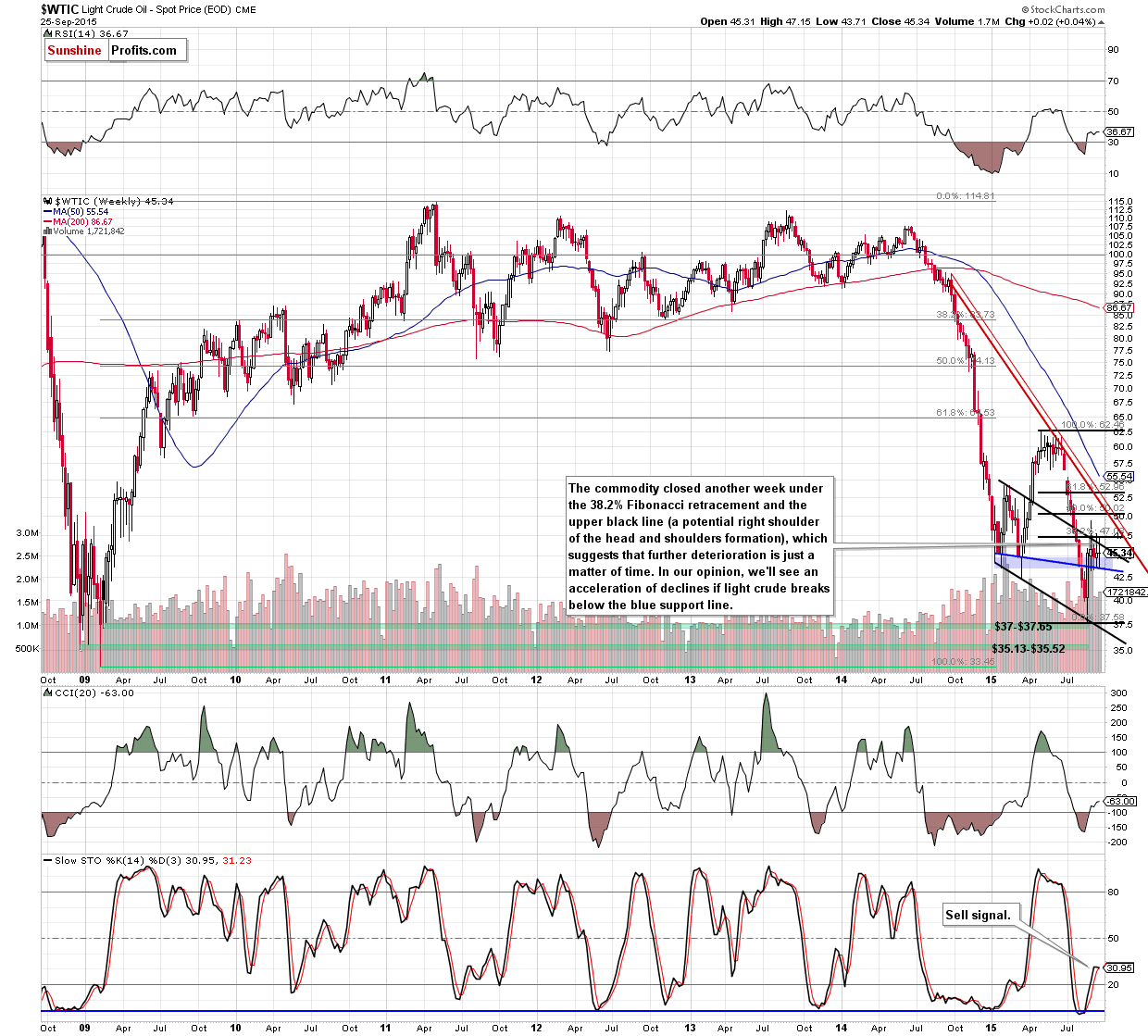

Having said that, let’s zoom out our picture of the commodity and examine the weekly chart.

From this perspective, we see that crude oil closed another week under the 38.2% Fibonacci retracement and the upper black line (a potential right shoulder of the head and shoulders formation), which suggests that further deterioration is just a matter of time.

Finishing today’s alert, please note that, we still believe that an acceleration of declines will be more likely and reliable if we see a breakdown under the blue support zone and the blue support line. Until this time short-lived moves in both directions should not surprise us.

Summing up, although crude oil increased above the 50-day moving average once again, the upper border of the declining trend channel keeps gains in check. Additionally, light crude closed another week under important medium-term resistance levels, which in combination with sell signals generated by the indictors suggests lower values of the commodity in the coming week. This means that the outlook for crude oil remains bearish and short positions (which are already profitable as we entered them when crude oil was at about $46.68) continue to be justified from the risk/reward point of view.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: bearish

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): Short positions with a stop-loss order at $54.12 (yes, that far as the medium-term outlook is unlikely to change as long as crude oil stays below the declining medium-term resistance line) and initial (!) target price at $35.72 are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts