Trading position (short-term; our opinion): Short positions with a stop-loss order at $54.12 and initial (!) target price at $35.72 are justified from the risk/reward perspective.

On Monday, crude oil moved higher after the market’s open as news from Genscape, Inc. supported the price of the commodity. As a result, light crude came back above the 50-day moving average, despite rising U.S. dollar. But is this “show of strength” as positive as it seems at first sight?

A week ago, the U.S. Energy Department said that crude oil stockpiles at Cushing dropped by 2 million barrels, which was the biggest weekly draw since February, 2014. Additionally, yesterday, Genscape, Inc. said that crude oil inventories at the Cushing Oil Hub in Oklahoma, declined by 810,000 barrels for the week ending on Sept. 15.These signs of declining stockpiles fuelled hopes that future output could reduce and pushed the price of the commodity to an intraday high of $47.02. What’s interesting, this move materialized despite rising U.S. dollar. What does this “show of strength” suggest? (charts courtesy of http://stockcharts.com).

In our yesterday’s commentary, we wrote:

(…) the greenback bounced off the solid support zone, invalidating earlier breakdown under the 50% Fibonacci retracement. This is a positive signal, which suggests further improvement in the U.S. currency (and lower values of light crude) in the coming days.

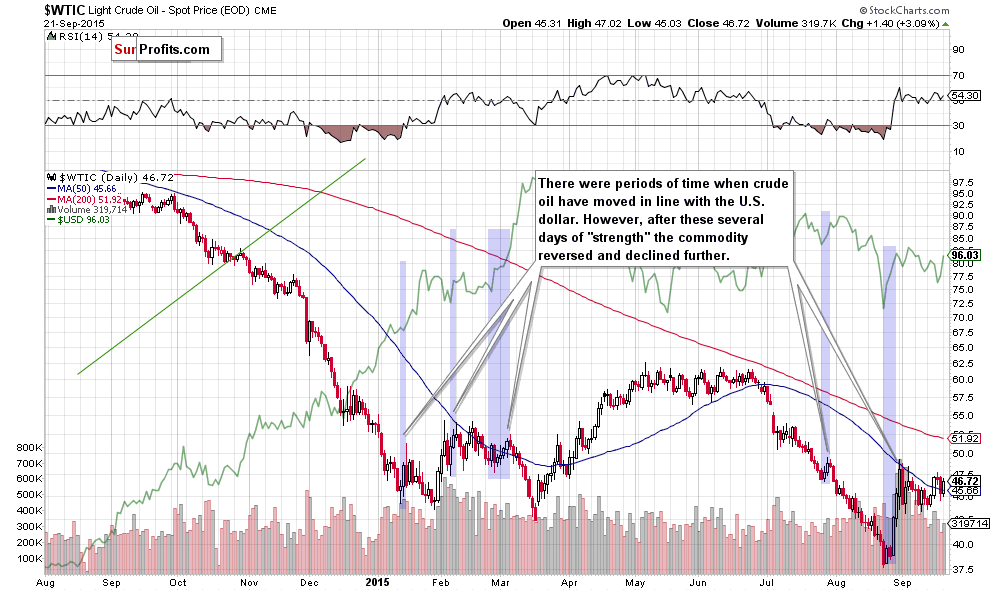

Looking at the above chart, we see that currency bulls managed to push the USD Index higher (marked with green) as we had expected. However, at the same time, we didn’t notice a decline in crude oil, which could raise some concerns among investors.

So, the key question here is this: is the rising price of crude oil along with increasing greenback a sign of strength of the commodity? In our opinion, it’s not. Why? When we take a closer look at the above chart, we clearly see that there periods of time when crude oil has moved in line with the U.S. dollar. However, after these several days of “strength” the commodity reversed and declined to fresh lows. Taking this fact into account, we can conclude that such signs of strength are only a short-term anomaly - not a sign of a trend reversal. Therefore, we believe that lower values of the commodity are only a matter of time.

Will the technical picture of the commodity confirm this assumption? Let’s examine the charts below and find out.

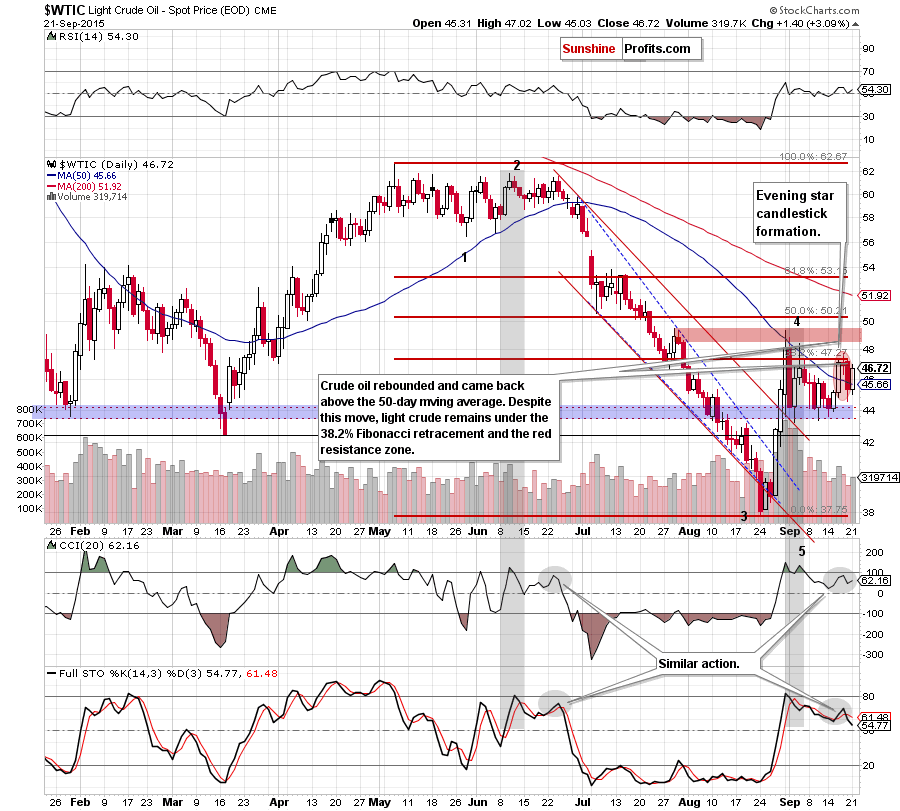

Looking at the daily chart, we see that although crude oil rebounded and came back above the previously-broken 50-day moving average, the commodity remains under the 38.2% Fibonacci retracement, which serves as solid resistance. Why? As you see, although there were several attempts to move higher, they all failed and we didn’t see a daily closure above this resistance level since Aug 31. Additionally, the bearish evening star candlestick formation (marked with the red ellipse) is still in play, reinforcing this resistance area.

It is also worth noting that the size of the volume that accompanied yesterday’s increase wasn’t huge (compared to what we saw at the turn of Aug and Sept), which raises doubts about oil bulls’ strength.

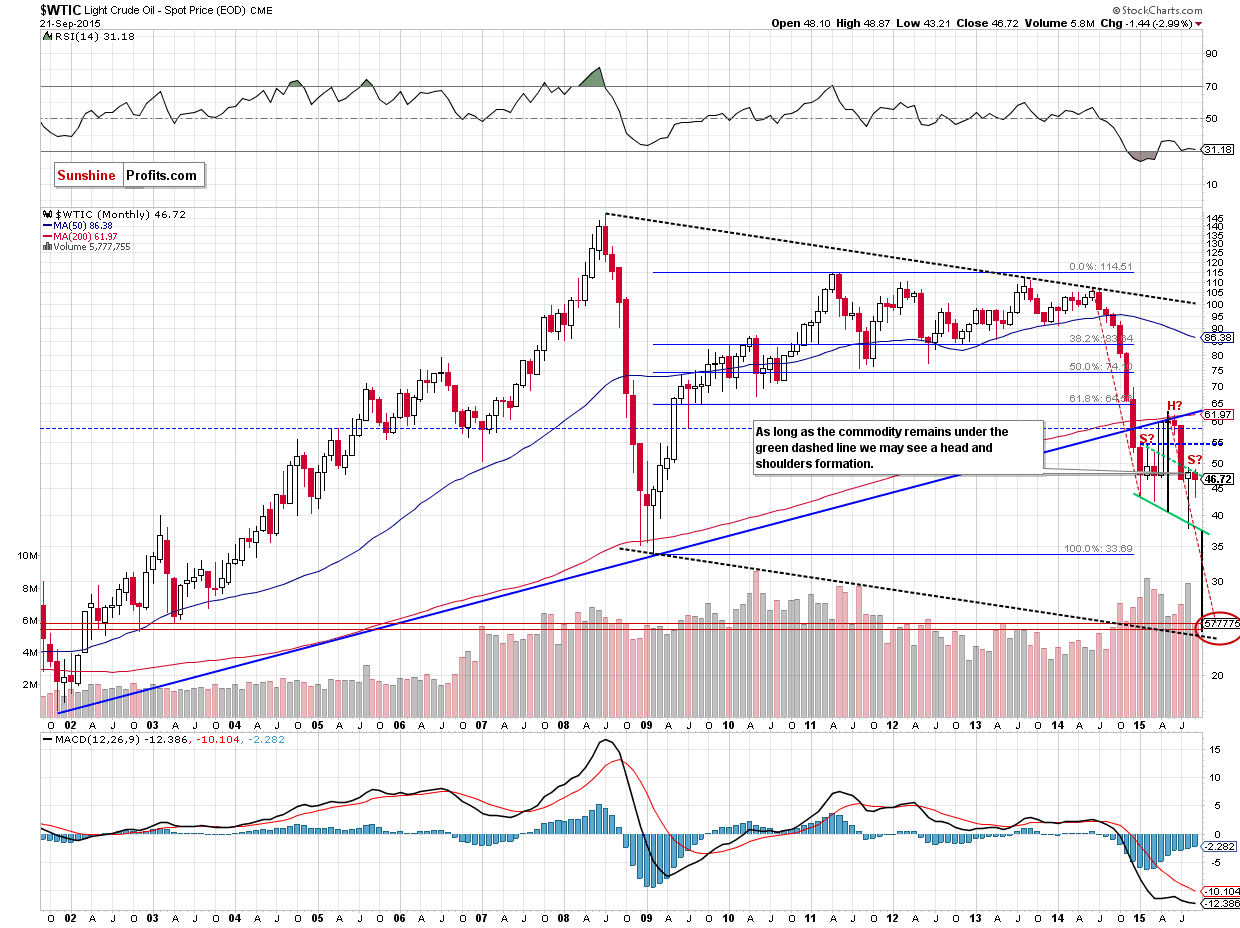

On top of that, the commodity remains under the green dashed line (marked on the monthly chart), which means that the probability of the bearish head and shoulders formation (and a significant profit potential on the current trade) is still very high – especially when we factor in sell signals generated by the daily CCI and Stochastic Oscillator.

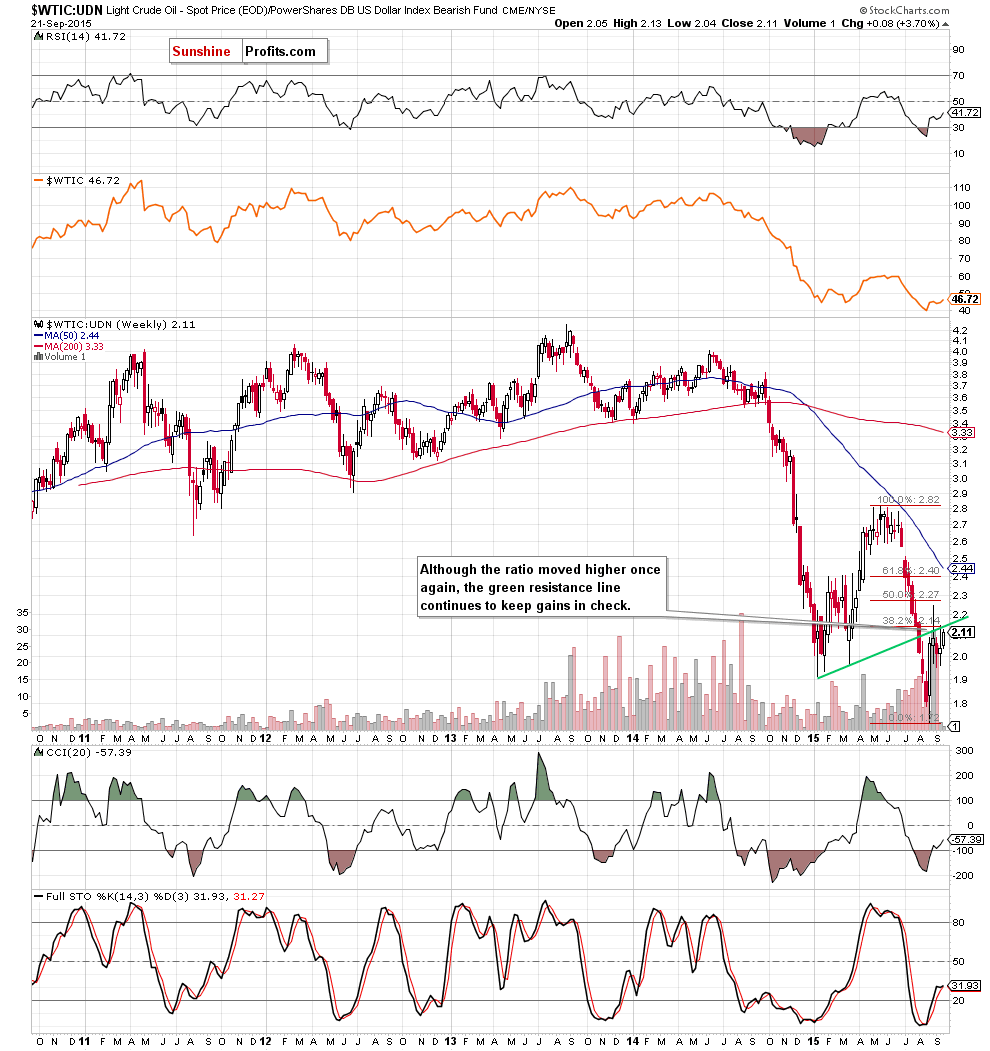

To have a more complete picture of the commodity, we would like to draw your attention to the non-USD (WTIC:UDN ratio) chart of crude oil. As a reminder, UDN is the symbol for the PowerShares DB US Dollar Index Bearish Fund, which moves in the exact opposite direction to the USD Index. Since the USD Index is a weighted average of the dollar's exchange rates with world's most important currencies, the WTIC:UDN ratio displays the value of crude oil priced in "other currencies".

From this perspective, we see that the ratio bounced off the last week’s low and approached the previously-broken green support/resistance line (based on the Jan and Mar lows) once again. As you see on the weekly chart, this key resistance was strong enough to stop oil bulls several times in previous weeks, which suggests that as long as there is no weekly close above this important resistance line another attempt to move lower is more likely than not (even if oil bulls try to re-test it once again in the coming days). If we see such price action, it will translate to lower values of light crude in the coming week(s).

Summing up, although crude oil broke above the 50-day moving average, the size of volume doesn’t confirm oil bulls’ strength (especially when we take into account the fact that the commodity remains under the 38.2% Fibonacci retracement, which serves as solid resistance), which means that the outlook for crude oil remains bearish and it will most likely remain the case at least as long as crude oil remains below the August high. Therefore, we believe that short positions continue to be justified from the risk/reward point of view.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: bearish

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): Short positions with a stop-loss order at $54.12 (yes, that far as the medium-term outlook is unlikely to change as long as crude oil stays below the declining medium-term resistance line) and initial (!) target price at $35.72 are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts