Trading position (short-term; our opinion): Short positions with a stop-loss order at $54.12 and initial (!) target price at $35.72 are justified from the risk/reward perspective.

On Tuesday, crude oil moved higher after the market’s open supported by hopes for a decline in U.S. stockpiles. Thanks to these circumstances, light crude bounced off the key support zone once again, but did this increase change anything in the short-term picture of the commodity?

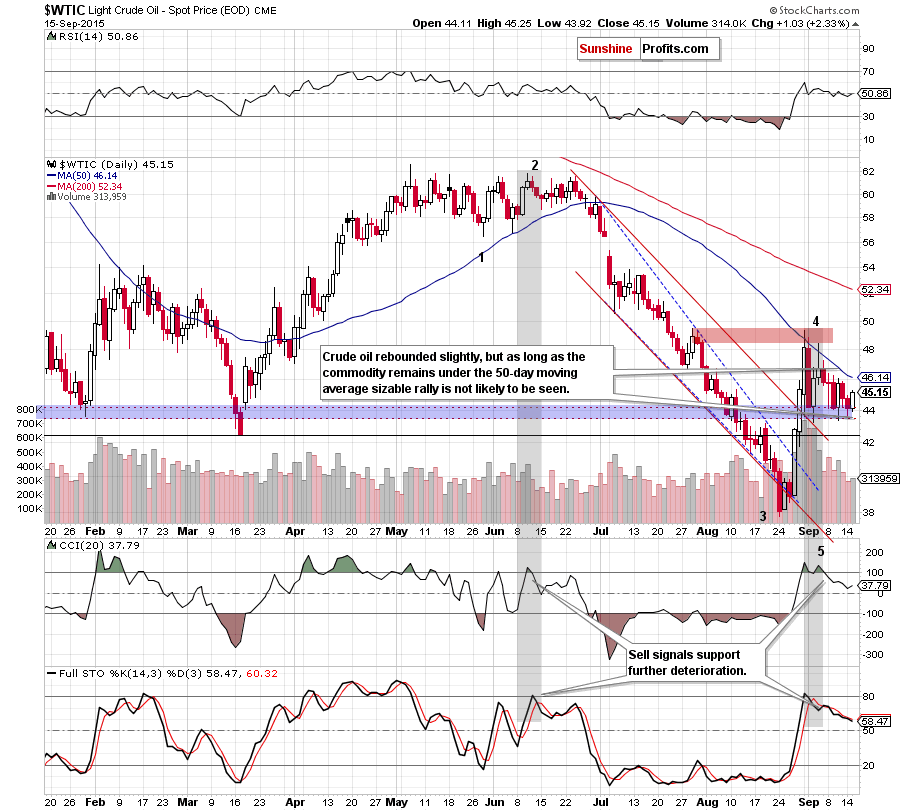

On Friday, Baker Hughes report showed that U.S. oil rigs dropped by 16 in the week ending on Sept. 4, which fuelled expectations that the API and EIA reports would show a decline in domestic crude oil inventories. As a result, crude oil reversed and bounced off the key support area, closing the session slightly above $45. What impact did this move have on the short-term picture of crude oil? (charts courtesy of http://stockcharts.com).

Quoting our previous commentary:

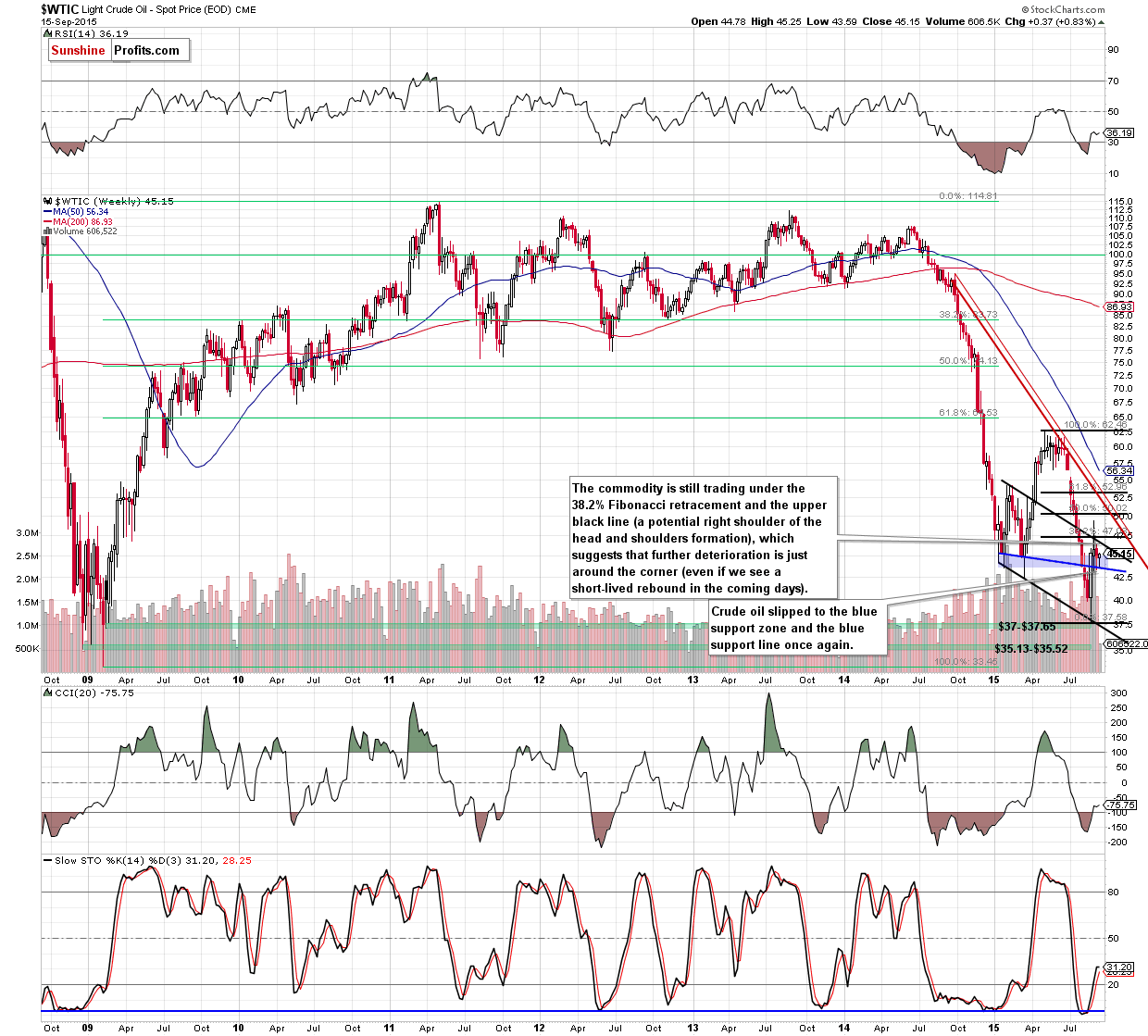

(…) crude oil moved lower and slipped to the key suport area created by the blue support zone (based on the Jan lows) and the previously-broken black support line (based on Jan and Mar weekly closing prices), which suggestes another rebound from here – similarly to what we saw in the previous weeks.

As you see on the daily chart, the situation developed in line with the above scenario and crude oil increased after the market’s open. But did this upswing change anything in the short-term picture of the commodity? Not really. Why? Firstly, despite yesterday’s move, crude oil remains under the 50-day moving average, which is the key short-term resistance at the moment. Secondly, sell signals generated by the CCI and Stochastic Oscillator are still in play, suggesting lower prices in the coming days (even if we see another daily increase). Thirdly, the volume during yesterday’s move was only slightly higher than during Monday’s decline, but we saw similar situation in the previous week. Back then, the commodity reversed and re-tested the blue support zone, which suggest that we may see such price action once again. At this point it is also worth noting that the same thing happened in early June, mid-July and late July and in all these cases no strong rallies followed. Conversely, in the first case crude oil continued to trade sideways after which it declined and in the last 2 cases it declined shortly. On top of that, the medium-term picture remains bearish. The reason? Let’s take a look at the chart below and find out.

From this perspective, we clearly see that although light crude moved higher, the commodity is trading under the 38.2% Fibonacci retracement and the upper black resistance line (marked on the weekly chart). Therefore, we believe that as long as there is no breakout above these lines further improvement is not likely to be seen and further deterioration is just a matter of time.

Summing up, the outlook for crude oil remains bearish (even if we see another upswing from the current level) and it will most likely remain the case at least as long as crude oil remains below the August high. Therefore, we believe that short positions (which are already profitable as we entered them when crude oil was at about $46.68) continue to be justified from the risk/reward point of view.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: bearish

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): Short positions with a stop-loss order at $54.12 (yes, that far as the medium-term outlook is unlikely to change as long as crude oil stays below the declining medium-term resistance line) and initial (!) target price at $35.72 are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts