Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Wednesday, crude oil moved little higher as a continuing drop in domestic inventories in combination with a weaker greenback supported the price. As a result, light crude gained 0.14% and closed another day above the support line. What’s next?

Yesterday, the U.S. Energy Information Administration reported that U.S. crude inventories for the week ending August 7 dropped by 1.7 million barrels, in line with forecasts for a 1.6 million decline. This positive news, in combination with a weaker U.S. dollar supported the price and light crude closed another day above the support line. Will it withstand the pressure? (charts courtesy of http://stockcharts.com).

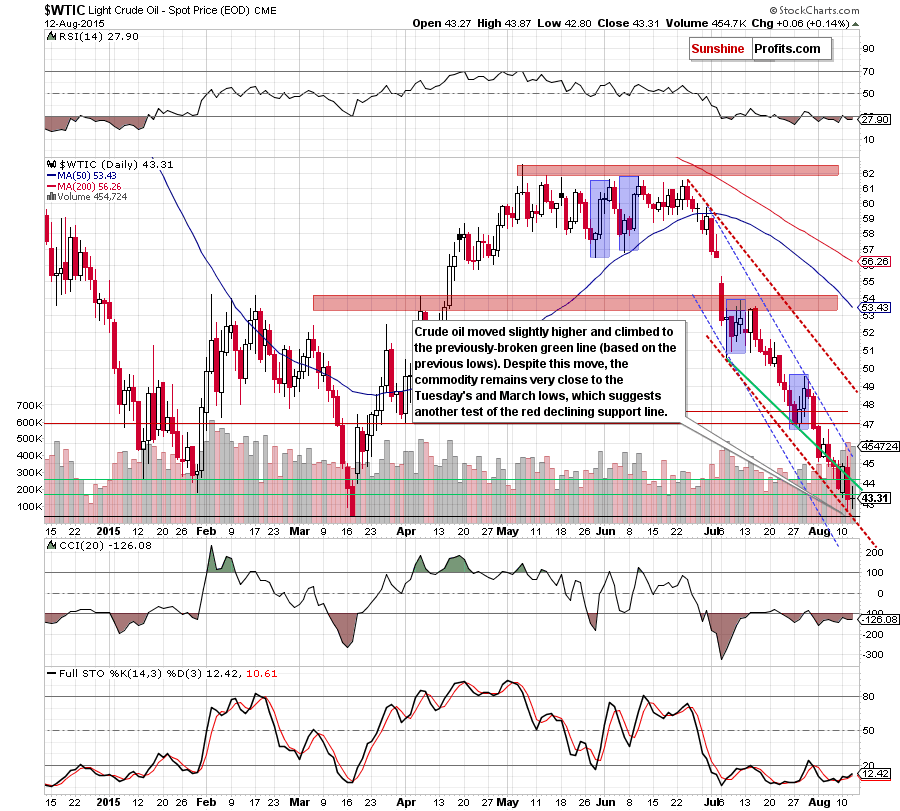

Looking at the daily chart we see that although crude oil moved little higher yesterday, oil bulls didn’t manage to push the commodity above the green line based on the previous lows (which serves as resistance at the moment). This suggests that yesterday’s increase could be nothing more than a verification of earlier breakdown. If this is the case, we’ll see another test of the red declining support line (the lower border of the trend channel) in the coming day.

At this point, it is worth noting that the above-mentioned support intersects the support level based on the March low, which together could pause (or even stop) oil bears and further declines.

Summing up, crude oil verified the breakdown under the green support line, which suggests a test of the red declining support line. Nevertheless, in our opinion, the outlook for crude oil is not bearish enough to justify opening another short positions. We will continue to monitor the market, look for another profitable trading opportunity and report to you accordingly.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed with bearish bias

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts